Good morning!

Trading volumes are extremely light again this morning - about a third of the companies I monitor haven't had any trades at all yet this morning (at 9:10 am). Thin markets mean more pricing anomalies occur, so I like this time of year!

I've had some excellent results recently, from reacting quickly to positive trading updates (e.g. accesso Technology (LON:ACSO) and MySale (LON:MYSL) ), as there is often a delayed response at this time of year, because so many people are away on holiday. Or, the share price may not move much initially, because the buying might be offset by a stale bull selling. All of which can create an opportunity to load up at a favourable price immediately after good news.

On that point, the key thing is to separate genuinely good news from spurious RNSs. Jam tomorrow companies are notorious for this - they put out repeated good news announcements, designed to push up the share price primarily (in advance of the next Placing), so investors develop an impression that everything is going brilliantly. Then the results come out, and they're diabolical!

So when I read RNSs, I always try to think how the news might affect the company's profitability. Above all else, the key phrase to look for, is "exceed market expectations", or similar. If that phrase is missing, then the news being announced is probably not material to trading, and should largely be ignored. Maybe a contract win has just replaced another contract lost? Isn't it funny the way companies only tend to announce the contract wins, but usually keep quiet about losing customers?! (unless it's a catastrophic loss, in which case they have to announce it).

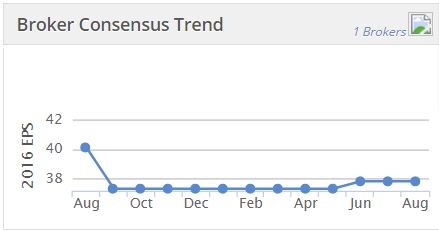

Equally, the little graph on Stockopedia which shows changes to broker consensus EPS forecast over the last 12 months is invaluable. Most companies work quite closely with brokers, and will give them a lot more information than PIs have. So if you see earnings forecasts being guided down gradually, then it could mean something is going wrong, and is often a precursor to a profit warning.

An AIM CEO once told us at a presentation, that with small caps, the house broker forecasts are effectively the company's forecasts. Usually, the FD will have been through the numbers in detail with the analyst, and will have guided the analyst to a number that he/she is comfortable with.

Mind you, having said that, I've also seen plenty of broker research which is complete nonsense - where obviously unachievable forecasts have been put out, and missed by a mile. So everything needs double-checking for reasonableness.

Castings (LON:CGS)

Share price: 445p (up 2.3% today)

No. shares: 43.6m

Market cap: £194.0m

AGM statement - annoyingly, Castings issues these during market hours - at 9am today. This is very bad practice, as the convention is that trading updates and results should be published at 7am, so that investors have an hour to digest the news before the market opens.

It's not even because the news is issued at 9am to coincide with the AGM starting. The AGM actually starts this afternoon, so I cannot fathom why the trading update was issued at 9am today. This is distinctly unhelpful for shareholders & potential investors, to release price sensitive information whilst the market is open.

On a more positive note, my experience of Castings announcements in the past, is very positive. They have a track record of being completely open & honest about current trading. One announcement in particular sticks in my mind, where the company said a while ago that it simply didn't know what the outlook was like, as it was too unpredictable at the time. Things turned out OK in the end, which again impresses, because it suggests management err on the side of caution, rather than blagging it.

This prudent mindset also comes across from their balance sheet - which is fantastic - one of the best out there. It's bulletproof, with plenty of cash, no debt, and lots of other assets. People might say it's inefficient, or that ROCE is too low, but personally I'll happily take a balance sheet stuffed full of surplus assets, over a higher ROCE any day.

Actually, I think the whole concept of ROCE is badly flawed. I can see the value of calculating what return can be made from new capex, and obviously we want that to be as high as possible, but I would much rather a company held surplus assets so that it can survive & prosper during recessions, rather than strip its balance sheet bare in the good times, in order to increase ROCE, but have nothing to fall back on in the hard times. What use is a high ROCE if you go bust in the next economic downturn?

The ideal situation (for me anyway) is to strike a balance of reasonably good, but not necessarily sector-leading ROCE, combined with a strong balance sheet that enables everyone to sleep soundly at night. Feel free to disagree on this point, it's only a matter of opinion.

Sorry, I'm rambling around the point here. This is the trading update today;

Following the statement in the Chairman`s report in June, it is pleasing to report sales volumes are still improving in particular in the commercial vehicle sector. We see no change in the foreseeable future and provided there is no adverse economic and world news it is expected profits will improve on last year's level.

That sounds fine, but a comment about performance compared with market expectations would have been more useful & relevant, but was not provided.

Valuation - it's important to note that the market is already anticipating an improvement in profits on last year's level, so today's update is consistent with that, as far as we can tell.

Going back to what I was on about earlier (re broker forecasts), note that the consensus edged up in Jun 2015 (see graph below), which indicates that things are probably going well:

Broker consensus is for 37.8p EPS this year, up from 31.8p last year (which was a bad year). So the PER at 445p per share is 11.8 times this year's forecast EPS.

Once you adjust for the very strong balance sheet, the PER would be a good bit lower. By my reckoning, the balance sheet contains about £60m (maybe more) in surplus net asset value - i.e. you could strip out the whole £30m cash pile, and put in another £30m of debt, and the business would be able to function absolutely fine, and would be comparable at that level with many other companies.

My assessment of £60m surplus capital is equivalent to 138p per share, so if we take that off the share price of 445p, it arrives at an adjusted share price (for valuation purposes) of 307p. Using my adjusted share price, gives a PER of only 8.1. I've ignored interest costs on the theoretical debt, so it's not exactly right, but a reasonable estimate.

Therefore, when buying or holding these shares, you're really getting a nice business on a PER of 8.1, plus a big pile of surplus assets. As the company may well not do anything with the surplus assets, there's an argument for discounting the £60m I mentioned above, maybe by a quarter, or a half, in your valuation.

On the other hand, the company has plenty of scope to do acquisitions, so that could be a catalyst for a re-rating, were Castings to make a decent acquisition or two, which it could fund from its own cash pile, and maybe a bit of bank debt on top.

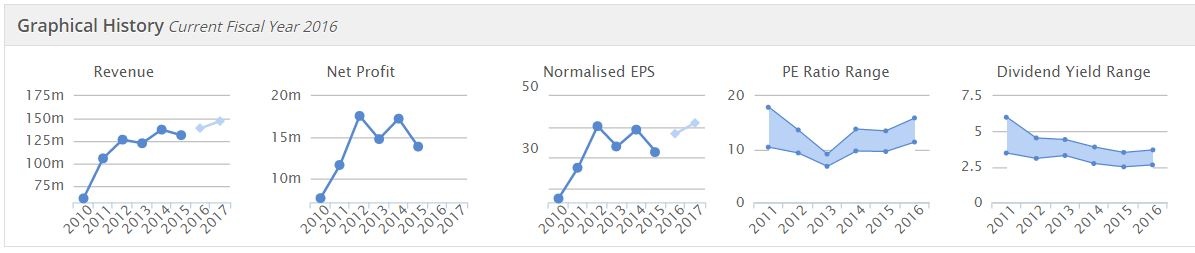

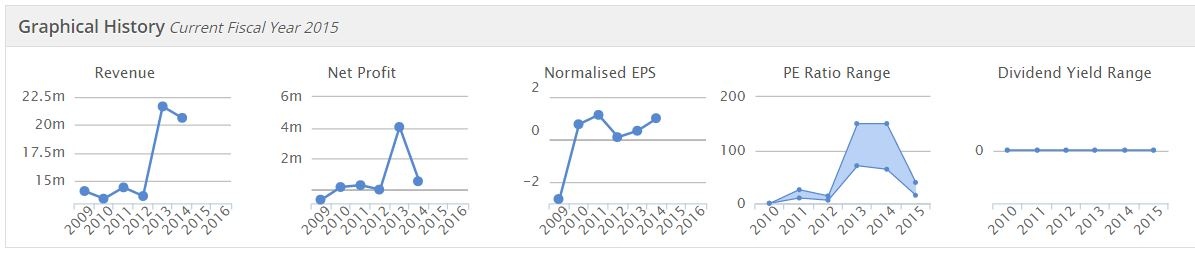

Outlook - no further comments are made, other than the above. Uncertain outlook has been the Achilles Heel for Castings in recent years, but it's still churned out excellent profits, at a good margin, and is forecast to continue to do so:

Although note the sideways trend of EPS, so it's not likely to attain a high PER, as it's currently a solid, mature business, rather than an exciting growth company.

My opinion - this looks an excellent business, with a fantastic balance sheet, and pays a useful divi of about 3.3%. It has a high StockRank of 92, which reassures.

I think there is a clear opportunity here for Castings to step up a gear, and expand through sensible acquisitions. It has the financial clout to do that, so maybe management have been too cautious?

They don't seem to be suffering from the strong pound/weak Euro so far, at least no mention is made about currencies today. How sustainable are the profits? That I don't know, but it must be a competitive sector - so will competitors erode their high margins over time?

Based on the historic figures, and the update today, it strikes me as a quality, but mature business, that looks very reasonably-priced. The shares are surprisingly illiquid though, so must be tightly held. It's the illiquidity, and wide bid/offer spread which has put me off buying shares in this company in the past, but I can see a good case for buying some and tucking them away for the long-term.

H & T (LON:HAT)

Share price: 194.9p (down 0.6% today)

No. shares: 36.9m

Market cap: £71.9m

Interims to 30 Jun 2015 - I wasn't going to look at this company today, as pawnbroking is not something I personally find acceptable as an investment. However, a reader has asked me to look at it, and it's not for me to impose my moral judgments on readers, so I'll review the figures anyway and try not to go off on a rant!

Competition - the background is that this sector has suffered (good!) in recent years due to the big fall in the price of gold, which has reduced the size of loans where gold jewellery is pledged as collateral, and also reduced their retail sales of gold items. Remember that stock market listed competitor, Albemarle & Bond, went bust in Mar 2014. Doing a bit of quick googling reveals that A&B was rescued by Promethean Investments in Apr 2014 with a pre-pack administration. 128 branches were rescued, and 59 branches ditched - so a nice way to get rid of all your loss-making shops in one go, thus arguably achieving an unfair competitive advantage. Original shareholders were wiped out completely of course.

Note that H&T's CEO, John Nichols, mentions competition in his opening remarks with today's interim results;

The trading environment remains challenging although the competitive landscape is now easing with the continued closure of competitors' stores.

So if not the last man standing, then at least H&T seems to be the largest, and strongest man still standing, by the sounds of it, with 190 trading units currently, and a very strong balance sheet.

H1 profit (before tax) rose from £2.0m last time, to £2.6m in H1 this year;

This improvement is principally the result of growth in the Retail, Personal Loan and Other Services revenues.

So this looks a solid performance, in a tough market, achieved by diversifying their services into new areas such as personal loans, FX, etc.

Outlook - they're slightly below expectations ("broadly in line"), but overall this sounds fairly encouraging;

The Group believes that the demand for small sum, short term cash loans remains strong and by increasing the range of assets it accepts, by expanding Personal Loans and Other Services both in-store and online we will be ideally positioned to grow as the market adjusts in the next year.

Current trading is in line with management's expectations for 2015. Allowing for the recent reduction in gold price, we currently expect the full year results to be broadly in line with current market expectations.

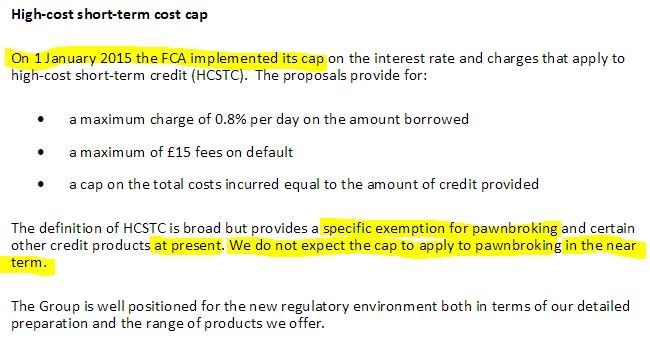

Regulatory risks - reading between the lines, it sounds as if there is a potential medium to longer term threat here, so I have included this whole section below;

Their use of the phrases "at present", and "in the near term" seem to be signalling that there is a risk of the FCA cap being extended, or other measures perhaps being brought in to curb the charges that pawnbrokers levy. This is a major threat to their business model I would say - any punitive measures introduced by the FCA could kill this business stone dead. OK, that may not be likely, but it's a big, and ever-present risk that would make me nervous about holding these shares. At the very least, more regulation could reduce profits and increase admin costs.

Balance sheet - this is tremendously strong.

Net assets - £91.9m, reducing to £73.3m after writing off goodwill & "other intangible assets". Note that this is slightly more than the market cap of £71.9m, so very good asset backing.

Current ratio - amazingly strong, at 10.8 - that's one of the highest scores I've ever seen. Even if we move long term bank debt into short term creditors, then the current ratio would still be fantastic, at 9.0.

Debt - there is £14.8m in long term debt, plus £1.4m in provisions, but these are dwarfed by net current assets of £80.0m (which includes cash of £7.9m), so the modest level of bank debt (relative to assets) is not a concern at all. Net debt works out at £8.7m, which is fine.

Dividends - there's a big percentage increase in the interim divi from 2.1p last time to 3.5p this time. Looking at the previous payouts, it looks as if the total divis for this year may exceed broker forecast of 5.83p. It looks to me as if they're limbering up to paying perhaps 7-8p divis this year, which (if I'm right) would give a decent yield of about 3.8%, versus current forecasts of about a 3% yield. So there's upside on future divis I reckon.

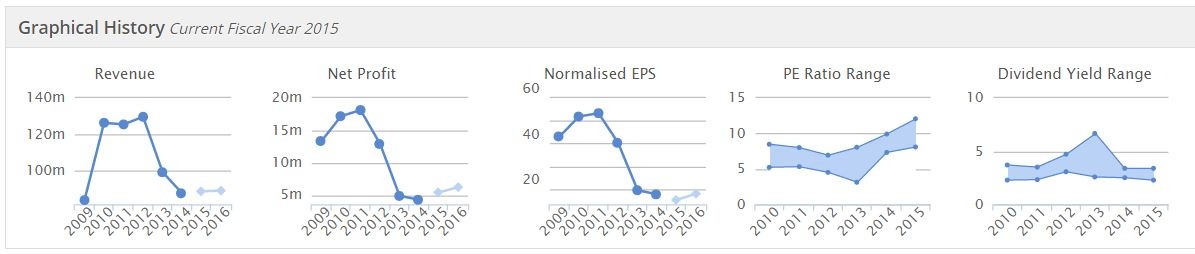

Valuation - broker consensus is for 15.1p EPS this year, so they look to be heading slightly below that, say 14p. At 195p per share that gives a PER of 13.9, which looks about right to me.

My opinion - the shares look priced about right to me, on a current PER of 13.9, and with a divi yield that looks to be heading for nearer 4% than 3%, if the final divi is increased.

These shares could go higher, as the company seems to be on a modestly improving trend in profitability now, after several tough years, as you can see from the Stockopedia graphics below. It looks as if profitability has stabilised at around £5m p.a. anyway.

Shareholders have a fantastic balance sheet to rely on here, so this company won't be following A&B into Administration in my view. However, there's the ever-present risk of some regulatory bombshell being imposed by politicians & regulators, keen to demonstrate to the electorate that they are punishing companies that exploit the poor. There again, it can be argued that pawnbrokers are more ethical than the alternatives (loan sharks, Wonga, etc).

It's a tough one. It's not for me, but if I had to guess, I'd say these shares are probably more likely to go up than down from here, providing the regulatory position doesn't worsen. I say this because the valuation is fairly reasonable, and it sounds like a business where management have taken effective steps to improve performance.

The Stockopedia algorithms like H&T too, with a StockRank of 99.

APC Technology (LON:APC)

Share price: 11.88p (down 27% today)

No. shares: 90.6m

Market cap: £10.8m

Profit warning - the company put out an "in line with market expectations" trading update less than three weeks ago, on 31 Jul 2015. So it is worrying that today, just 18 days later, they're issuing a profit warning. That does make me wonder if management are in full control of the business? Possibly not, by the sounds of it.

For such a low market cap, there seem to be a lot of moving parts, with three separate divisions, and the balance sheet is dominated by intangibles, which looks like goodwill on acquisitions, and similar.

Interim results to 28 Feb 2015 (which I didn't review here) were poor, with a pre-exceptional operating profit of only £249k (down from £815k), and after exceptionals the profit before tax was a loss of -£732k.

The balance sheet is starting to look a little stretched too, with the previously ungeared balance sheet now showing £2.9m of gross bank debt, and £831k of long term "financial liabilities", although those were partially offset by £2.4m of cash on the latest balance sheet date of 28 Feb 2015. I worry when companies with bank debt start getting into trading difficulties - that type of situation is best avoided in my view, although banks are being extraordinarily lenient with listed companies at the moment.

Profit warning - various details are given on the reasons for the profit shortfall (cost over-runs on recent contracts, a delayed contract, etc), but the upshot is this;

Due to the above the Board expects that while the Group will be in-line with market expectations at the revenue line, underlying operating profit for 2015 will be below market expectations.

In light of this, Leonard Seelig, the Group Chairman, is leading an operational review of the business with the Board. This review will further focus Group attention and effort on the markets in which the Group currently operates that will deliver greatest profitable growth in the near term.

The Board is mindful of working capital and has already taken action in order to address the impact of the Group's recent financial performance. The Board believes that its current facilities are more than sufficient to support the business.

I can't find any forecasts, so have no idea what market expectations actually were. Given that H1 was only a small profit, I presume that the full year figures would not have been forecasting that much of a profit. Nothing is quantified today, so who knows what the full year will now look like?

Operational review - uh-oh, that's usually bad news in the pipeline - so expect redundancies, factory closures, and lots more exceptional costs.

Working capital - that worries me more. Whilst existing bank facilities might be adequate, will the bank be happy to continue extending those facillities? Are any bank covenants likely to be breached?

My opinion - I've never understood why these shares were so highly rated. Indeed, my comments on 9 Dec 2013 were almost correct, as the shares have since lost 82% of their value - "So I'm very much at a loss as to understand why this stock is valued at £38m (at 65p per share), when on the back of today's figures I'd struggle to get much above £5m valuation."

Things don't look bad enough for this share to go on my bargepole list, but that was a close call. I would certainly not consider investing here until the strategic review is complete. I suspect this company will need to raise some fresh equity, so a Placing is looking fairly likely at some point, in my view, which could exert further downward pressure on the shares.

It's difficult to see much positive at this company, due to its erratic, and unimpressive track record of profitability (see below), with what looks like a one-off bonanza year in 2012/13, but very little profit either side of that year. No divis either. It's not for me. It might be an interesting one to watch for a future turnaround, but that seems some way off.

John Menzies (LON:MNZS)

Share price: 469p (down 4.8% today)

No. shares: 61.4m

Market cap: £288.0m

Interim results - a very quick review of the figures. They're not very good;

- Turnover up 0.9% to £1,001.4m for the six months

- Underlying profit before tax down 18% to £17.0m (note the wafer thin profit margin there)

- Underlying EPS 18.8p (down 24%)

- More exceptional "non-recurring" costs, which seem to happen every year - funny definition of non-recurring then!

- Interim divi reduced from 8.1p to 5.0p (forecast yield about 3.5% - not bad, if sustainable)

- H2 weighting for this year's profits reiterated;

As we previously highlighted, profits will have a greater second half weighting this year as we continue to transition the business. There is a great deal of potential across the business and we remain on track.

Balance sheet - remains weak;

- Net tangible assets are negative, at -£32.3m

- Current ratio is fairly weak, at 1.09

- Too much bank debt - gross debt of £161.3m, partially offset by cash of £37.2m = net debt £124.1m

- Pension deficit has come down to £40.1m. After tax this is £32.1m, which is about 10% of the scheme assets, which looks manageable given the size of the company & level of profitability.

My opinion - the fwd PER might look superficially good value at 10.3, but it's not such good value once you factor in the considerable bank debt, and pension deficit.

The shares have recovered nicely from the Nov 2014 profit warning, but to my mind the price looks fully up with events now. The Directorspeak is positive concerning their turnaround strategy, but this is a large, sprawling business, with lots of complex contracts, only eking out a modest profit margin. So a turnaround might take a long time, and there will always be the risk of more things going wrong. Plus no doubt more non-recurring exceptional costs every year!

As such, it doesn't float my boat, but that's based on only a superficial review of the figures.

All done for today! See you in the morning.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned.

NB. These reports are Paul's personal opinions only, never financial advice or recommendations)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.