Good morning!

It's quiet for news today, so a fairly brief report.

I recorded another CEO interview yesterday afternoon, with Mark Cambridge of Zytronic (LON:ZYT) . He is one of my favourite CEOs, being a down-to-earth manager, who tells it like it is, and doesn't expect outrageous remuneration or options schemes.

It's a super little company I think, making excellent margins with niche products, and the shares still actually look quite good value in my opinion. Zytronic has a StockRank of 95, so it's well worth a look in my view, despite the shares having recently hit new highs (disclosure: I hold a long position in ZYT).

My next CEO interview is with Brady (LON:BRY) who I'll be talking to on Monday morning, re their recent profit warning, on a "right to reply" basis, and also to hopefully clarify what has gone wrong, and why they didn't see it coming. It's really good when companies engage, and respond to criticism, or clarify areas where there might be differing perspectives, so I'm looking forward to that interview. (disclosure: I recently picked up a few shares in Brady, after they stopped falling - as usual, I couldn't resist a falling knife!)

1pm (LON:OPM)

Share price: 70.5p (up 8.4% today)

No. shares: 52.5m

Market cap: £37.0m

Pre-close trading update - covering the 6 months to 30 Nov 2015. There's plenty of detail in this update, which I'll skip over, but the most important bit says;

The trading results for the half year ended 30th November 2015 will show further growth in revenue and profits compared with the corresponding period last year and are ahead of management expectations. The results include a first contribution from Academy Leasing Limited ("Academy") for the period from 25th August 2015 to 30thNovember 2015. Academy, a provider of equipment finance and an equipment and vehicles broker to the SME market, is the only trading company within the MH Holdings (UK) Limited group of companies ("MH Holdings"), which was acquired by 1pm plc on 25th August 2015 (the "Acquisition"). The trading results of Academy are also ahead of management expectations.

1PM seems to be doing very well, taking advantage of a gap in the market for asset financing for SMEs, which banks seem reluctant to return to.

My opinion - I'd want to see the interim figures before forming a view on this, and to be sure that the market cap isn't getting too far ahead of NTAV.

It's easy for financing companies to book profits in the good times, but this type of business often goes badly wrong in recessions, as a proportion of the loan book turns bad. There's also the risk that as credit conditions gradually normalise, then the big banks will probably return to financing for SMEs, thus under-cutting margins.

For the moment though, 1PM seems to be making hay whilst the sun shines.

United Carpets (LON:UCG)

Share price: 12.05p (up 2.5% today)

No. shares: 81.4m

Market cap: £9.8m

(at the time of writing, I hold a long position in this share)

Interim results to 30 Sep 2015 - this is a carpet retailer, which claims to be the UK's second-largest, after Carpetright presumably, operating from 61 stores. The company seems off the radar to investors, and it's rarely mentioned by anyone, but actually looks quite a nice little company, in my opinion.

Key points from today's interim results;

- Turnover rose 11% to £10.1m for H1

- LFL sales rose a creditable 5.0%

- Underlying operating profit rose 15% to £583k

- EPS rose 45.2% to 0.61p - note that this is a large percentage because the tax charge normalised this year, after being unusually high last year in H1.

The company seems to have an H2-weighting to trading, so full year broker forecast of 1.3p looks achievable to me.

Valuation - using 1.3p EPS forecast for this year (ending 31 Mar 2016), and a 12.05p share price, gives a reasonable PER of 9.3 - that looks good value, but bear in mind this is a small company, so it should be cheap, as it's higher risk.

Balance sheet - looks good. The business went through an insolvency process a few years ago, thus getting rid of onerous leases, etc, and cleaning up its balance sheet.

NTAV is £3.7m, and it has a healthy working capital position, including £2.1m in net cash.

Dividends - good. Note that it also paid a 1p special divi in Jun 2015 - not bad in the context of a 12p share price. I think there is scope of possibly more special divis, as the cash pile would permit this.

The normal divi yield is 3.4%, so that's not bad either.

Outlook - sounds cautiously optimistic to me. Tougher comparatives are noted.

Like for like sales since the period end remain positive against much tougher comparatives in the second half of last year and the Group appears well positioned to complete this financial year successfully. The business is transitioning from a period of retrenchment to the next phase of growth from a sustainable base. The Group has negligible borrowings, the network of stores continues to strengthen, the market is showing greater stability and there are opportunities, if carefully selected, to increase revenues be it through new stores or new marketing initiatives. Overall, the Board remains confident that the Group will continue to generate improving returns for shareholders.

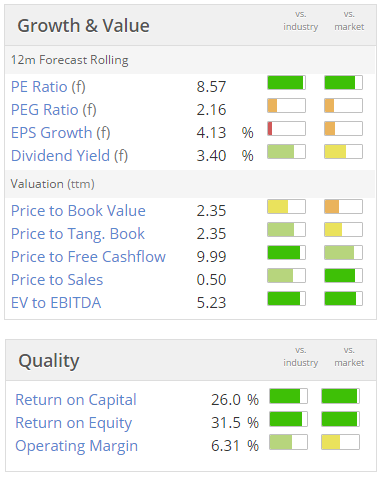

My opinion - the outlook comments suggest to me that increases in profit from here are likely to be fairly modest. Overall, this share strikes me as a good value on all the main metrics that I look at - PER, divi yield, P/NTAV, etc.

The Stockopedia computers like it lots too, with a StockRank of 99.

Note that there's plenty of green on the usual valuation & quality scores below.

I think caution is needed though, to take into account that this is a very small & illiquid share. So if something were to go wrong, you might have great difficulty selling, and it's extremely difficult to buy too. Therefore, for me, this is only a very small, long-term holding, that I've tucked away and largely forgotten about.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.