Good morning!

It's very quiet for results & trading updates today.

ShareSoc seminar - Altrincham

As mentioned in yesterday's report, I think that networking with other investors is absolutely key to becoming a better investor, and also enjoyable. Most events for investors tend to be in London, so it's great to see ShareSoc and others arranging meetings further North.

This type of event simply won't continue to happen if people don't support them, so I strongly urge all readers within travelling distance of Altrincham (near Manchester, as I just found out from Google Maps, lol!) to attend this event - details here.

I would certainly be interested in meeting management of NWF Group, and 1PM, both are interesting companies. I'm not familiar with BKY.

Avingtrans (LON:AVG)

Share price: 123.2p

No. shares: 27.7m

Market cap: £34.1m

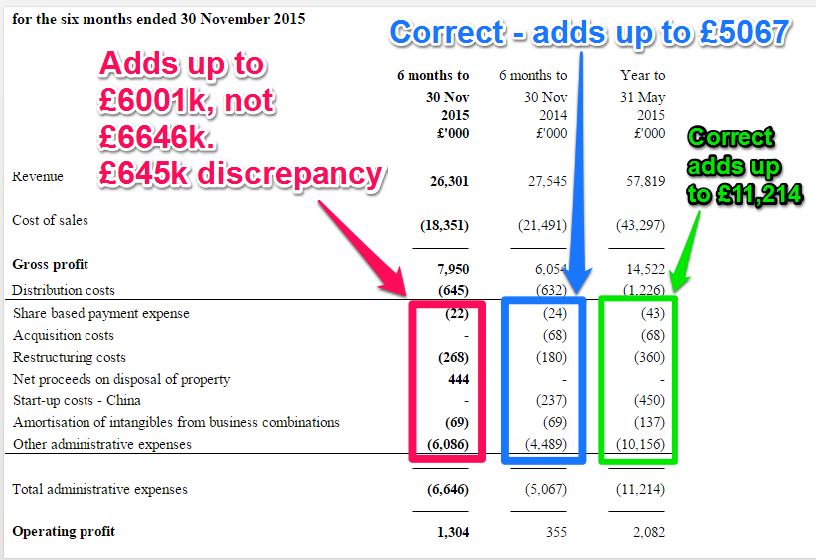

Interim results, 6m to 30 Nov 2015 - a reader was saying how marvellous these results were yesterday - I had a quick look, but something didn't look right in the numbers, so I had another look last night, and spotted an arithmetical error in the figures, as explained below.

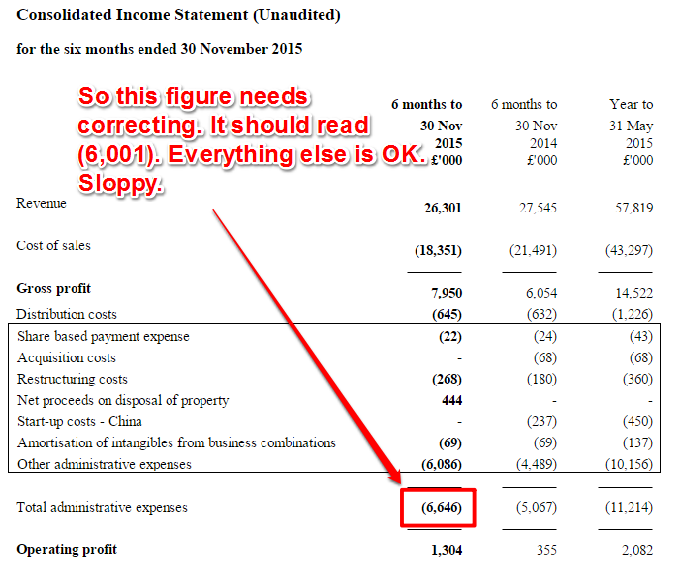

So basically someone didn't check the arithmetic properly. This figure needs to be corrected:

The profit figure isn't affected, so it's not a material error as such, just a sloppy addition error which should have been spotted and corrected when the figures were being reviewed prior to publication. It's really not good enough, getting a basic thing like this wrong. Investors have to be able to rely on the figures actually adding up correctly.

I spent many years producing & checking figures as a trainee auditor, and then an FD, so if a figure is wrong, it just jumps out of the page at me - your mind is doing calculations without you even being aware of it.

Operating profit - rose strongly (from a low base of £355k in H1 last year) to £1,304k this H1. Note that the operating profit margin is OK, but nothing to get excited about, at 5.0%.

If we double that, to make a full year, then operating profit would be £2.6m. I can't get particularly excited about that, given that the market cap is £34.1m. However, H2 is expected to be much stronger than H1.

Second-half weighting - results last year showed a bias towards H2 for profits, and it looks as if the same is likely this year;

Our full year revenues are expected to increase - due to second half weighting, especially in Energy and Medical. This confidence in the outlook for 2016 was boosted by the recent contract wins with Rapiscan and Bruker, thus underlining our continued dividend progression."

Finncap are forecasting adj. PBT to rise from £1.2m in H1 to £2.9m in H2, giving £4.1m for the full year. That's starting to look a bit more interesting.

Valuation - Finncap is forecasting adj. EPS of 12.6p this year, and 17.7p next year, so the PER based on a share price of 123.2p looks quite good value, at 9.8, and 7.0 respectively. The latter figure is of course dependent on the company achieving the considerable increase in profit forecast for next year, some of which is coming from acquisitions I believe.

Outlook - the narrative generally sounds pretty upbeat, although obviously an H2 weighting for profitability does hold potential risk that something might go wrong to trigger a profit warning in H2.

With good progression in the aerospace business and results for Energy and Medical anticipated to be skewed towards the second half, we remain optimistic about our prospects for the full year and beyond. Our strategy should lead to growing investor returns as stability is restored and with increasingly robust, long-term, blue-chip customer relationships, we remain confident about the future of Avingtrans and achieving the Board's expectations for the full year.

They've specifically confirmed full year expectations too, which is good.

Balance sheet - overall it looks alright, although I am concerned that debtors seems high, and there is some debt, although it's not worryingly high.

Overall, there is a good solid NTAV of £22.1m, which is 64.9% of the market cap - so there's decent asset backing to underpin the valuation. Although obviously the valuation is mainly based on a multiple of earnings.

My opinion - overall, I quite like it. So definitely one to do some more research on. I'm not terribly keen on investing in this sector - engineering/aerospace, as contracts can be lumpy, and problematic at times.

Having said that, it sounds from the narrative as if the company is on a roll, and the valuation looks modest, if they are indeed able to hit forecasts for next year.

Overall then, well worth a closer look.

North Midland Construction (LON:NMD)

Share price: 106.5p (down 4.9% today)

No. shares: 10.2m

Market cap: £10.9m

Trading update - I'm surprised this share hasn't fallen more than it has today, as the company announces fresh losses equivalent to 28% of its market cap!

The resolution of certain previously referred to legacy contracts across the Group has now been concluded and the settlement figures expected have not been achieved, resulting in additional total losses of £3.1 million. This leaves only one problematical legacy contract to conclude.

Mercifully, it only has one problem contract to conclude. I wonder what additional losses might crop up with that?

Other comments sound more upbeat;

Despite these negative settlements, due to strong underlying trading, management still expects an unadjusted profit for the full year, albeit significantly below previous management expectations.

The order book for completion this year currently stands at £195 million and the Board is confident about the outlook for the year.

That seems to suggest that the core business is doing alright, if it can mop up losses of £3.1m on problem contracts, and still report an overall profit.

My opinion - I've had a quick look at the historic figures, and this share doesn't interest me. It's a low margin business, with a not very strong balance sheet. Divis stopped in 2013, and wherever possible I try to avoid low margin building companies, as they often get into a mess with contracts that go wrong.

I suppose there might be an opportunity for the shares to be re-rated, once legacy problems are fully resolved, perhaps?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.