Good morning! I was busy last night, adding comments on Fairpoint, Regenersis, KBC Adv Tech, and Ubisense to yesterday's report. So that full report is here.

Budget Day today, so no doubt there will be pre-election bribes for various interest groups, and a last ditch attempt to create a feel-good factor to make us want to vote Tory! Mind you, it will take more than George Osborne tweaking tax rates to repair the damage to my pension fund after today's news from Synety...

Synety (LON:SNTY)

Share price: 92.5p (down 33% today)

No. shares: 8.4m before, 12.3m after fundraising

Market Cap: £7.8m before, £11.4m after fundraising

(at the time of writing, I hold a long position in this share)

There are three announcements today from this niche telecoms/software company.

New Non-Exec Director - good news in that a highly relevant new NED has been proposed for appointment, Peter Simmonds of dotDigital (LON:DOTD) - a company which has been very successful in selling a niche software product on a SaaS model.

Final results - for the calendar year 2014. Clearly the market got wind of there being something up, as the results announcement has been delayed almost three weeks. Delay is never good news, hence why the share price has been falling of late. I'll come back to the results later.

Placing & Open Offer - it's been obvious for a while that the cash position was going to be tight in the run up to breakeven (forecast for early 2016), you could work that out yourself from the interim accounts. However, that didn't bother me because I thought it would be a quick & easy matter to raise a couple of extra million quid, if needed, given that the KPIs have been showing strong growth.

Unfortunately not. There has clearly been little appetite with investors for another fundraising, just a year after the last one raised £4.5m (before expenses) at 250p per share. As a result, the company has been forced to price this latest fundraising at just 90p - half the price the shares were trading at just a month ago.

3.1m new shares are being issued at 90p, raising £2.8m in a Placing. Existing shareholders will have the opportunity, if they wish, to take part in an Open Offer, on the basis of 9 new shares for each existing 91 shares held, also at 90p. So if fully taken up, the Open Offer will raise a further £0.75m.

My opinion - to be brutally honest, this has been handled badly by the company. It didn't raise enough money last year, and you can't go back to investors saying, ooops sorry we're going to run out of money. Or rather you can do that, but they may well take a very dim view, as has happened here.

Bottom line for investors though, you have three options;

1. Cough up some fresh money to maintain your % holding in the company (which should be possible, as some investors will not take up their Open Offer shares, so you can apply for an excess amount), or just buy in the market to offset the dilution from the Placing.

2. Do nothing, and accept that you will be diluted.

3. Sell up and move on.

So it's up to each of us to decide what to do. Personally I've done number 1, because I like the company & the product, and think they are close enough to the original plan to mean that, with the additional money, it should reach breakeven next year.

Final results - coming back to these, the figures are slightly below broker forecast - an operating loss of £5.35m, versus the most recent house broker forecast of £5.1m loss. Turnover is up 198% to £1.63m. These figures may sound terrible, but the company is building a high quality recurring revenue stream (clients are charged monthly, and the churn rate is very low). So the business model involves the up-front fixed cost of providing the cloud-based service, plus employing a sales team to generate customers. That was always going to be loss-making at first.

The interesting part is when operational gearing kicks in & the business has the potential to become highly profitable (as the gross margin is c.70%).

There was £2.36m cash left at end Dec 2014, clearly not enough to take them to breakeven (forecast for mid to late 2016 now, although that does tend to keep slipping). The monthly cash burn rate is c.£300k I understand, at the moment.

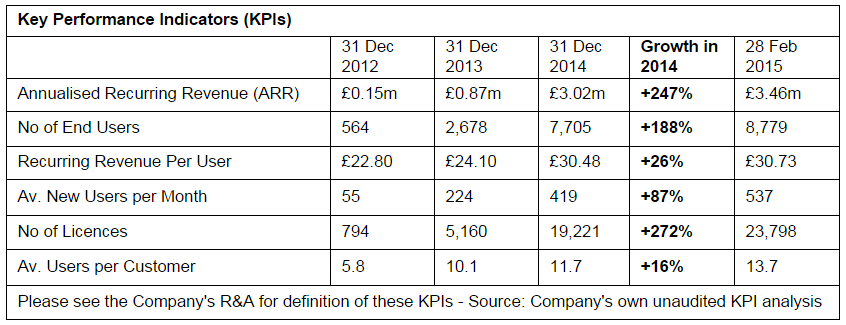

The key KPI is annualised recurring revenue (ARR). This is the current run rate of sales at any point in time. You can see ARR building nicely below - remember these are recurring revenues, so a reliable income stream;

My opinion - the growth is impressive, but isn't quite fast enough to get investors excited (clearly!), and I feel that the breakeven point is too high. So personally I would like to see the breakeven point lowered somewhat through a closer focus on costs.

It will take a while for the dust to settle over this latest fundraising, and let's hope the new NED brings a tighter focus on reaching breakeven sooner, and with more cash headroom. I think this has to be viewed as the last fundraising, given how brutal the discount demanded by Institutions was this time.

On the upside, all it would take is some decent KPIs later this year, and this share could end up looking a real bargain. The product is fantastic (I've used it), and there is encouraging growth happening. The company now needs a total focus on delivering sales growth.

Obviously there are a lot of hacked off shareholders today (including me), but in the long run that doesn't matter particularly, as if the company does well then the share price will go back up again. The shares will succeed or fail based on the delivery of strong growth this year, and achieving breakeven next year, or not as the case may be.

It's clearly high risk/high reward, so will not be suitable for most investors. So far the shares have been a big disappointment, but that's mainly because they were forced to do a fundraising sooner than expected. Remember that on the recent, strong KPIs, the shares recovered to about 200p. If they had raised a bit more money last year, then everyone would be looking at the KPIs today, and saying they're OK. So it's important to keep perspective.

Bloomsbury Publishing (LON:BMY)

Share price: 152.5

No. shares: 75.0m

Market Cap: £114.4m

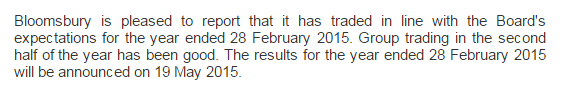

Trading update - there's a short and sweet update today from this book publisher;

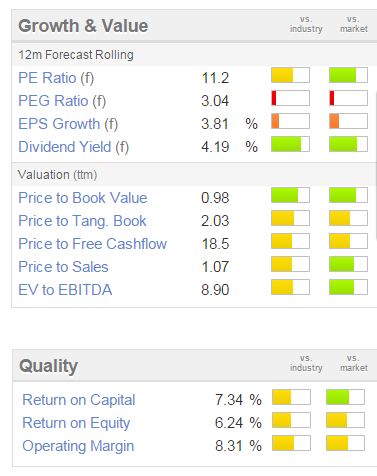

Valuation - it's a see of amber on the Stockopedia value & growth ratings;

Although, strangely the StockRank is extremely high, at 97.

My opinion - I've liked this company in the past, but am wary of anything to do with books - as surely such stocks are likely to be valued on low ratings, given the structurally declining nature of the sector?

accesso Technology (LON:ACSO)

Share price: 580p

No. shares: 21.9m

Market Cap: £127.0m

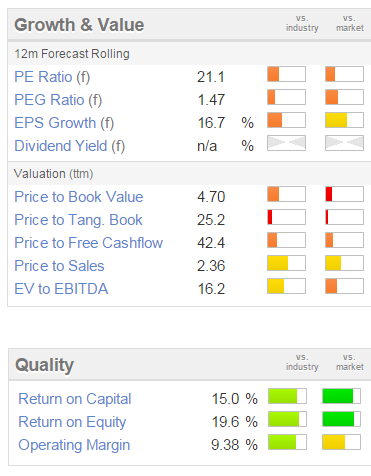

Preliminary results - for calendar 2014 are out. The company reports in US4. Turnover has risen 24.5% against 2013 proforma 12 month results, to $75.1m.

Adjusted operating profit rose from $7.2m to $8.7m, a rise of 20.8%. I'm not sure what amount of that is organic, and what has come from acquisitions.

Adjusted EPS came in a whisker ahead of forecast, at 30.81 US cents.

Balance sheet - this is looking quite weak now, following acquisitions funded by debt. Net assets are $56.9m, but take off $71.1m intangibles, and NTAV turns negative, to the tune of -$14.2m. Not disastrous, but not great either.

The current ratio is healthy at 1.78.

However, long term creditors includes a new $20m bank debt. That is partly offset by $5.7m in cash, but it's probably as far as the company should go with bank borrowings, to avoid stretching the balance sheet any further.

It would make a lot of sense for the company to do an equity fundraising, to strengthen the balance sheet, whilst the shares are valued highly, in my opinion.

My opinion - I don't know the company well enough to assess its future prospects, but based on broker forecasts it looks fully valued, or a tad expensive, but has done for a while. The valuation doesn't look extreme though, which it did a while back, but it doesn't appeal to me at this sort of level. Long term bulls like the company & its prospects though, I hear.

I'll leave it there for today, as have to cycle from Islington to Victoria station, and back to Hove, after a long stay in London. I've enjoyed the lively debate on Synety in the comments section below, so please feel free to add your comments. We welcome all intelligent comments, whether bull or bear, and it's absolutely fine to say you think I'm wrong, if you explain why. As I often say, investing is a team sport, and I think we reach better decisions by listening to a wide range of views on all shares.

Regards, Paul.

(as mentioned above, Paul has a long position in SNTY (unfortunately!!), and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.