Good morning!

Please note that Ed is doing a webinar this Thursday, at 12:30, to demonstrate the new international markets added to Stockopedia - with new regions added this week - Canada, Australasia, developed Asia, and India. More details are here. It's certainly exciting to see Stockopedia developing into a global site!

Europe and the USA are already available of course.

Vianet (LON:VNET)

Share price: 109p (up 2.3% today)

No. shares: 28.0m

Market cap: £30.5m

Trading update - for the year ended 31 Mar 2016. This has reassured the market, hence the shares being up just over 2% today.

Trading for the second half of the year has been as anticipated and, as a result, the Group's full year profits will be broadly in line with market expectations and ahead of last year's outturn of £3.18 million.

Broadly in line does of course actually mean slightly below.

The fuel business was sold a few months ago, so the group is now simplified, consisting of the core (but declining) brulines beer flow monitoring equipment, and a vending machines business.

Brulines has:

...strengthened its market position and maintained its contribution despite ongoing pub closures.

As regards vending, the company says:

Vending Telemetry is benefitting from the Group's increased investment in people and capability during the year which has resulted in good revenue growth during the second half, with the prospects for this business remaining excellent.

Outlook - it sounds as if the vending business is, at long last, making some progress:

James Dickson, Chairman, commented: "Against a backdrop of ongoing pub closures and increased investment, the Group has delivered year-on-year profit growth. Importantly, there has been solid overall progress across the core businesses and the sale of Fuel Solutions will allow full focus on our Leisure and Vending businesses where the medium to long term prospects are exciting, particularly for telemetry and payment solutions for the coffee vending market."

Dividend - a generous 4p final dividend is maintained.

My opinion - I became disillusioned with the limited growth prospects of this group some time ago. It's impressive that the big divis have been maintained - shareholders have received almost 23p in divis just in the last 4 years.

I feel that there is only limited scope for the share price to increase much from here. It's generally not a good idea to invest in companies where the core business is in structural decline.

Trifast (LON:TRI)

Share price: 137.7p (up 1.5% today)

No. shares: 116.7m

Market cap: £160.7m

Trading update - for the year ended 31 Mar 2016. Things seem to have gone well:

The Company is pleased to report a strong finish to the year, benefitting from the ongoing focus on driving operational efficiencies, continued organic growth and a positive contribution from acquisitions. Accordingly, the Board expects the results for the year ended 31 March 2016 to be towards the upper end of market expectations.

Sounds good, although note that the share price has risen quite a lot in the last few weeks, so arguably a strong performance is already baked into the valuation.

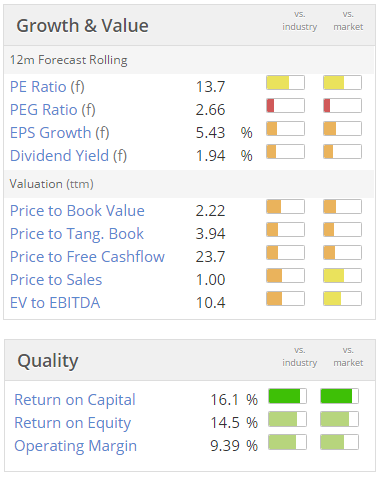

Looking at the graphics above, the valuation of the company looks about right to me.

Outlook comments sounds good, so the business seems on a roll. Perhaps the share price might have further to go?

Utilitywise (LON:UTW)

Share price: 188.4p (up 3.9% today)

No. shares: 77.8m

Market cap: £146.6m

Change to payment terms - good news - Utilitywise has successfully managed to persuade another energy supplier to pay it more quickly.

This has been the company's Achilles Heel in the past - a balance sheet groaning with debtors, and hence question marks over its revenue recognition policy.

...The supplier has agreed to amend its terms such that any future extension secured to a contract that has not expired receives the same cash payment terms as for a new contract, in this case 80% of the expected revenue from the contract falling due on the extension signing and the remainder at maturity subject to the normal reconciliation process. We have also agreed that this change of terms will apply to historic accrued revenue balances and we will therefore receive £2.251 million (inc VAT) in cash from the supplier prior to the Company's financial year end on 31 July 2016.

My opinion - this is clearly a step in the right direction, although I would like to see the next set of numbers before considering putting this back on my list of investable shares.

Interim results - for the 6 months to 31 Jan 2016.

The P&L figures look good, e.g. adj. diluted EPS is up 21% to 9.8p for the half year.

Net debt has risen to £10.2m.

Balance sheet - still looks mighty peculiar to me. There is a long term debtors figure of £25.7m. This hasn't fallen, it's actually still rising. I'm not comfortable with that.

My opinion - I have 2 worries with this company - firstly its revenue recognition policy, and associated extended debtors.

Secondly, I'm not convinced that profits are sustainable. After all, it's a rather unnecessary intermediary. What if the energy companies decide they don't want to keep giving away some of their profit margin to intermediaries such as Utilitywise? The business could be wiped out overnight. However unlikely that might seem, it's possible, and that puts me off this share.

A few snippets before I have to head off for a meeting.

Connect (LON:CNCT)

interim results to 29 Feb 2016 are out today. The P&L figures look OK, and the company says it's performing in line with expectations.

I still can't get comfortable with the balance sheet - NTAV is negative at a whopping -£158.4m. That deficit closely matches the net debt figure of £160.9m. So the business is relying entirely on bank financing - that's too risky for my liking. In the good times it isn't a problem, but what happens if we have another credit crunch, with banks seeking to shrink their lending?

Another worry is how much life remains in the core activity of distribution of newspapers & magazines?

On the upside, it pays a huge dividend of 6.4%. Personally I would rather see the balance sheet repaired, and dividends scrapped or reduced, but the trouble is that the group is expected to pay divis by its shareholders, as that's the core reason many hold the shares.

I did have a reassuring conversation with the CFO a while back, who seems comfortable with everything. For me personally though, I don't normally invest in any company with negative NTAV. Nor any company with an over-reliance on bank debt.

Lombard Risk Management (LON:LRM)

This trading update looks like a profit warning to me, so I'm surprised the shares are only down 4.7% today (at 11.2p). It says:

The year ended 31 March 2016 has been one of substantial change for the Company, with changes in the leadership team and a renewed focus on its core offerings of collateral management and regulatory reporting software. These changes have inevitably come at a price and Lombard Risk has incurred some significant non-recurring additional costs. These costs amount to approximately £2.5m, of which approximately £1.7m relate to non-cash items, including further impairment charges and other provisions. Other costs incurred relate to the transition of the executive leadership team; a full rebranding of the Company's products and corporate presence; and significant investment in hiring new talent for the sales and product development teams in particular.

The Company expects to report a year-end cash balance of £3.3m and a statutory loss, stated after the non-recurring items referred to above, in region of £2.1m to £2.3m.

I am becoming increasingly sceptical about supposedly non-recurring costs, as all too often companies which use this approach seem to have non-recurring items every year!

This reminds me of a conversation a while back with a new CEO, who told me a remarkable story. When he was reviewing budgets, he asked his FD what profit the company was expected to make this year. The FD replied, "whatever profit figure you want - the exceptionals take up the strain".

Of course, the new CEO was appalled at this, and immediately stopped this practice. However, it certainly opened my eyes to how manipulated a lot of company results really are. The more adjustments, exceptionals, highlighted items, etc, then the less reliable the profit figure really is, in my view.

Going back to LRM, I've never liked this company, because it is too aggressive with its capitalising of costs. There's no genuine profit at all in my view. That's why the dividend is so small.

The outlook comments are more jam tomorrow - there's always exciting stuff in the pipeline for this company, but it never comes through to genuine profit & cashflow. Today's outlook comments sound like a profit warning dressed up as positive news:

"The Board looks forward to strong revenue growth in the years ending 31 March 2017 and 31 March 2018 on the back of this targeted investment, but acknowledges that these investments will impact profitability in the short term."

Investment in this context actually means paying wages for staff & contractors. I would just call that cash burn.

My opinion - I think this is a lousy company, and the shares are unlikely to deliver a positive long-term return. That's just my personal opinion of course, which may turn out to be wrong, or right, time will tell.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.