Good morning! Did you see the Robert Peston documentary last night at 9pm on BBC2, about China's credit-fuelled investment boom since 2008? Fascinating. A number of key points struck me - that he sensed a general mood of impending doom amongst the Chinese people (which could explain why insiders are so keen to exit AIM Listed Chinese stocks at virtually any price)?

Also, that an estimated 15% of the housing stock in China has been bought by speculators and is lying empty - a clear sign of an overheated housing market. When the property crash happens, the banks will be hit hard with bad debts, although being a one party State the Government has the power to do whatever is required to prop up the Banks - although nobody knows the size and risks in the shadow banking sector.

It's the explosion in debt in the last five years that is the most remarkable thing - the Chinese banking system has apparently grown from 120% of GDP to 200% of GDP in just five years, if I recall the figures correctly. It was not clear whether that includes the large shadow banking system, but probably not, as nobody knows how big it is. So the true figure could be much larger. 200% doesn't strike me as a crisis level though, but the rampant growth in lending cannot possibly continue forever.

As Peston concluded, history demonstrates that a credit boom on this sort of scale has never ended well. So I suspect that worries about China could now become a key investor concern. We certainly need something to rein in bullish sentiments in our Stock Market, as it's really getting out of control as far as growth companies & some smaller caps are concerned, in my opinion.

I cannot remember equity markets feeling this frothy about growth companies since 1998-99. Valuations are becoming bonkers on many growth companies, often with lousy business models - but nobody cares (for now) if the share price keeps going up (Ocado, and others spring to mind). We're now firmly into the "euphoria" stage of this bull market in my view, so I reckon it could be maybe another year or two before the inflated prices of growth companies experience a crash?

I've shorted a few over-valued growth companies, but it's not going well so far. So perhaps it would have been better to sit on the sidelines and wait for bullish sentiment to reach a crescendo & then open some shorts?

Anyway, none of this matters to long term value investors. If you cast your mind back to when the TMT boom ended in Mar 2000, although the FTSE100 crashed by about half over the next couple of years, a lot of bombed out value shares did very well - indeed my investing returns from 2001-2003 were fantastic in percentage terms, despite it being a bear market - as sellers became irrational, throwing away good companies at far below what they were worth.

My main worry at the moment (or it's maybe an opportunity?), is that we could, remembering what happened in 1998-9, soon be going into the period where growth companines on crazy valuations begin sucking investor funds out of (and hence driving down the price of) other, sensibly priced companies? There's no sign of that yet, and I'm encouraged by how broad the bull market in small caps has been in the last couple of years.

OK, I'd better look at some trading statements & results, instead of waffling on about the timing of the growth companies bubble bursting (for it certainly will, the only question now is when?)

Monitise (LON:MONI)

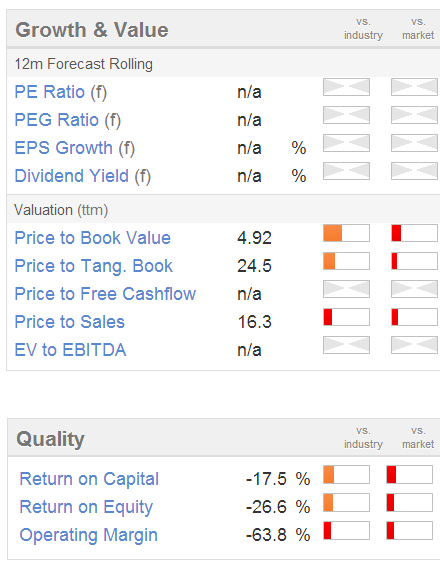

OK, it's not a small cap (but it probably should be), but I have to comment on interim results from Monitise. At a valuation of over £1.1bn, all built on hope value of future growth for their mobile banking software, interim results this morning for the six months ended 31 Dec 2013 look dreadful to me.

OK, it's not a small cap (but it probably should be), but I have to comment on interim results from Monitise. At a valuation of over £1.1bn, all built on hope value of future growth for their mobile banking software, interim results this morning for the six months ended 31 Dec 2013 look dreadful to me.

H1 revenue grew to £46.5m (up 67% on prior year H1), but it was still loss-making with an EBITDA loss of £10.2m (down from £14.7m). That appears to be a bad performance, but an improving trend. However, if you look at the cashflow statement, they also capitalised £8.1m of costs and put them onto the Balance Sheet (in intangible assets), which was up from the £4.8m capitalised in the prior H1 period.

Combining those figures, the cash loss was £18.3m this time round (in just six months remember), versus £19.5m loss in the prior H1 period. So despite 67% turnover growth, their cash loss remains stubbornly high. This appears to indicate an unviable business model. Turnover growth should be having an operationally geared improvement in losses, and a move into profit. That's not happening here with Monitise.

They are burning through about £20m cash every six months (which is consistent with my figures above, of EBITDA plus capitalised spending), so with £67m left in the pot, they will surely be back looking for another cash injection later in 2014, as cash is likely to run out by about mid-2015. They had better hope it's still a bull market by then.

It might be the best thing since sliced bread, but if they carry on making losses like this, despite rising turnover, eventually investors are going to run out of patience at financing the losses. So the shares are surely extremely high risk? Especially at a £1.1bn market cap.

Gaming Realms (LON:GMR)

Ever wondered what happened to that over-hyped pile of junk called Pursuit Dynamics (PDX), that was forever promising jam tomorrow, and sucking in gullible investors into wild fantasies about enormous profits that never materialised?

Its loss-making activities were hived off last year for virtually nothing, and the Listed shell has since been used as a vehicle for a reverse takeover, by an online gaming group. So it has been renamed Gaming Realms (LON:GMR).

Preliminary results from the new group look pretty grim. Its turnover in the four months of trading to 30 Sep 2013 was only £0.9m, whilst marketing and set-up costs resulted in a thumping loss before tax of £3.3m. There was however a cash buffer of £5.2m at 30 Sep 2013.

Their Q1 trading statement (to 31 Dec 2013) shows better turnover, at £1.43m for the three months, but not profit or loss figure is given. So it's probably safe to assume it was another loss.

I suppose the shares are really a punt on them successfully delivering some successful games, which are things like Bingo Apps, for mobile phones & Facebook. If they can come up with something like Candy Crush, which is being valued at about $5bn on IPO soon apparently, then shareholders will be laughing. How likely is that though?

The management at Gaming Realms are the team behind Cashcade, which created online bingo brand Foxy Bingo (I remember seeing a TV advert for them some time ago), which they sold for £96m in 2009. Hence the market cap here of about £35m at 21p per share seems to rest entirely on hope that management can repeat previous successes.

This sector (gaming companies) tends to be an investor graveyard, especially at the smaller, loss-making end, so it's not of any interest to me. Growth investors might want to have a look at it though, and try to assess whether it has a viable future.

24/7 Gaming Group (LON:247)

This company is a very good example of why the online gaming sector is an investors' graveyard. I last reported on it on 17 Jan 2014, where I awarded the shares my bargepole rating at 10.88p. That was a good (if pretty obvious) call, as the shares have now plunged further to just 3.55p.

The company today announces various debt for equity swaps at 5p per share, and a very small Placing to raise just £502k (before expenses) at 3p per share.

This one smells of terminal decline, so I retain my bargepole view of it.

Looking at the chart, and the timescale, it's really shocking that this could unravel so quickly. The same was true of something called Zattikka - there's an incredibly high incidence of failure with companies involved in computer games, gambling, Apps, etc., so it beats me why they command such high valuations, on the offchance that they might create something big.

Ab Dynamics (LON:ABDP)

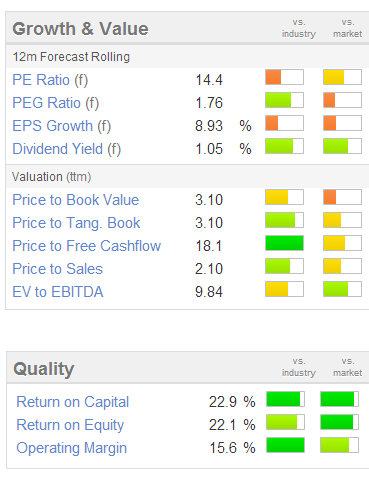

This is an automotive company, making equipment for testing of suspension. It was a (bargain) IPO in May 2013 at 86p, and has since roughly doubled. I reported briefly on its results for the year ended 31 Aug 2013 here in my report on 7 Nov 2013.

It looked a good company, but a bit pricey at 185p. The shares are 11% cheaper now, at 165p, so it might be worth another look, particularly after today's upbeat sounding trading statement.

Trading is in line with expectations, and it has net cash too - although it sounds as if some or all of the cash is likely to be spent on developing a new factory. Dividends are due to start this year, and they report a strong order book. So there's enough there to trigger my interest, and when time permits I'll do some more in-depth research on it.

Broker consensus is for 10.5p EPS this year, and 11.3p next year, so on that basis it's probably priced about right at 165p per share - the forward PER is 14.4.

Broker consensus is for 10.5p EPS this year, and 11.3p next year, so on that basis it's probably priced about right at 165p per share - the forward PER is 14.4.

So the key question is how likely it is to out-perform against forecasts, and how strong growth is likely to be? Also I'd want to find out the typical profile of sales - i.e. are they lumpy one-offs (bad), or predictable & recurring (good)? That's pretty key to the valuation.

The UK is a leader in motorsport companies, so if they are involved in that sector, then it could be an interesting one. Anyway, I'm just throwing the idea out there to readers to possibly DYOR if you like the sound of it, and of course please feel welcome to report back in the comments section below at any time in the future, as that will neatly keep comments on the company pegged to my article referencing it.

Note that the Stockopedia valuation graphic is flagging high quality scores (the bottom three green bars above left).

The outlook comments today sound positive;

The Group has performed well in the first half of the year with growth in product offering, customers and revenues. A strong order book gives the Board confidence in a successful outcome for the year as a whole.

Castings (LON:CGS)

This group is a maker of iron foundry products, e.g. for the automotive sector. It's surprisingly successful & profitable, so don't dismiss it because of the sector. Management have a track record of telling it like it is, and today's IMS is no exception.

Results for 2013 are in line with market expectations. However, the outlook is uncertain due to demand currently being stimulated by European emissions legislation, and the company today says;

Whilst we expect the current level of demand to continue to the end of this financial year, it is impossible to reliably predict any further ahead.

Refreshingly honest, but that then makes it very difficult to value the company.

It's curently on a forward PER of 11.7, and has a 2.9% dividend yield. Not bad figures for a company with decent net cash too. However, as earnings are now unpredictable, I can't really get any further with it. You would either have to get into the business model in detail, and try to estimate how demand might change, or just take a complete punt on it. I'm not really minded to do either, so will move on.

Time for lunch, so I'll stop there. Thank you for reading & see you tomorrow.

Oh just a short note about Twitter. I enjoy discussing investment matters with people on Twitter, but if people get abusive, then I just Block them. It's fine to disagree, but it's not fine to be abusive.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.