Good morning! Running late again today, after the first decent night's sleep in weeks. I'm back to civilisation in Hove thank goodness, after a fortnight in North London - where everything stinks of cigarettes, dogs bark constantly, and people shouting - there always seems to be someone shouting incoherently out on the street, 24 hours a day. Ghastly. Still it's convenient for getting into the City.

Fairpoint (LON:FRP)

(at the time of writing, I hold a long position in this share)

Webinar - click this link to view the recent results webinar from Fairpoint. I haven't watched it yet, but results webinars are an excellent way for investors to get a similar experience to attending an analyst presentation in the City.

Regenersis (LON:RGS)

In a similar vein, Equity Development are doing a webinar with management TODAY at 2:45pm for recent results from Regenersis. Link to participate is here. I'm always happy to provide links to information & events that will be useful to investors, for proper companies (not speculative junior resources sector stuff though), whoever is running them.

FW Thorpe (LON:TFW)

Share price: 150p

No. shares: 115.7m

Market Cap: £173.6m

Interim results - for the six months to 31 Dec 2014 are published today.

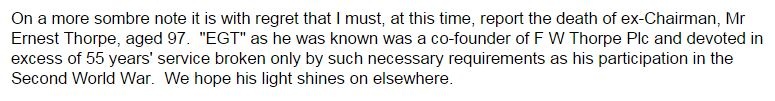

This is a conservatively-run family business, which also has a listing. This is emphasised by the touching tribute to one of the co-founders in today's report;

The figures are absolutely clean - there are no adjustments, or invented accounting definitions such as HOPS or adjusted EBITDA. Just straightforward EPS of 3.92p for continuing operations, which is up 9% against H1 last year. Note there is an H2 seasonal bias to trading, so it looks as if the full year (ending 30 Jun 2015) might come in around 9p to 9.5p. I can't find any broker forecasts on the company. You get the feeling this company would probably regard broker research as a waste of time & money!

An under-performing subsidiary called Sugg Lighting was disposed of on 6 Feb 2015, so that is positive, in getting its losses out of the group accounts.

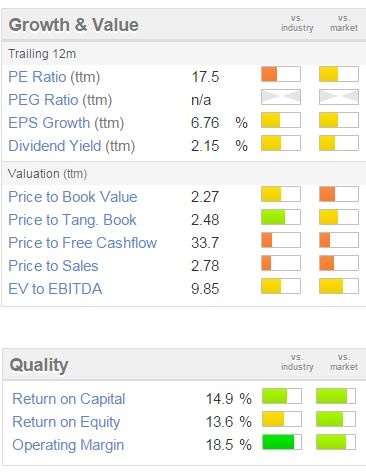

I like the strong operating profit margin at this company, which stood at 16.9% in these interim accounts, slightly down on the 17.2% achieved in H1 of last year, but still a very respectable number that demonstrates the products must be good quality, and in demand.

Dividends - the interim divi is up 5% to 1.1p, and continues the perplexing policy of paying out small dividends, when they have scope to pay out far more, given the strong finances. The full year divi looks to be heading for about 3.4p, a yield of 2.3%, although it is comforting to know that the company has the capacity to pay a lot more. So you'll get the divi, even in a bad year, in future, I would guess - there are probably quite a few elderly Aunts in the Thorpe family that rely on the divis!

Balance sheet - always a joy to behold! Net assets are £77.3m, of which £6.7m are intangible, so that's an NTAV of £70.6m. The current ratio is spectacularly good, at 5.61! This includes £33.9m in cash & on deposit. I wonder what they will eventually do with all the surplus cash? There's plenty of scope for a big special dividend, or a sizeable acquisition, so sooner or later they might create some value with all that cash.

My opinion - nearly all the profit comes from the main subsidiary, Thorlux. So the main risk is that competitors start to eat their lunch, and force them to lower prices & hence profit margins. At the current valuation, and given pedestrian growth rates in recent years, I would say these shares look priced about right. Even allowing for the cash pile, I wouldn't be chasing this valuation any higher personally. Smashing company though!

On the upside, I suppose the things to look out for, would be new product launches. Plus acquisitions - if a really strong acquisition was announced, using cash, then that would enhance earnings considerably, and could make the shares look a bargain. Sitting on a pile of cash, doing nothing with it, isn't a great strategy in my view.

Cello (LON:CLL)

Share price: 89p

No. shares: 84.9m

Market Cap: £75.6m

Final results - for calendar 2014 are out today. This is a marketing group, which has a particular focus on pharmaceuticals (that division makes most of the profits).

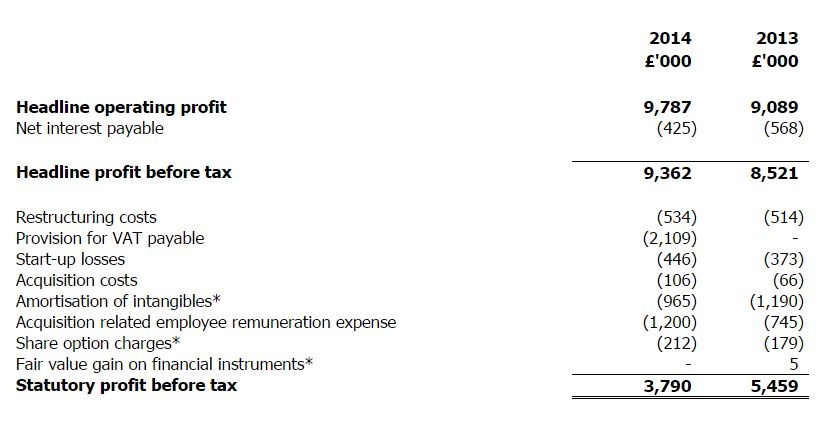

The headlines look reasonably good - turnover up 6.4% to £169.9m, and adjusted profit before tax is up 9.9% to £9.4m. My reservation here is that there are a lot of adjustments to profit, and note how some of them are not one-offs, but happened in both 2014 and 2013. Note also the scale of the adjustments, which materially improve profit in both years;

Several of those items look questionable to me. It all creates a sense of unease - am I being steered in the direction of inflated profits, and hence over-valuing the shares? I'm not sure, but it feels a bit like that.

If you do accept the adjustments, then EPS came in at 8.14p, which looks to be a bit ahead of consensus (7.8p). With the shares at 89p currently, that works out at a PER of about 11.

Dividends - the company has a good track record of steady dividend growth over the last seven years. The forward yield is reasonable, at about 3%.

Balance sheet - not great.

Once you take off the £74.9m intangible assets, NTAV drops out slightly negative, at -£5.4m.

The current ratio is 1.12, which is just about OK, given that this is a services business, and therefore does not hold any inventories.

Given the fairly weak current ratio, having another £12.4m in long term borrowings doesn't help.

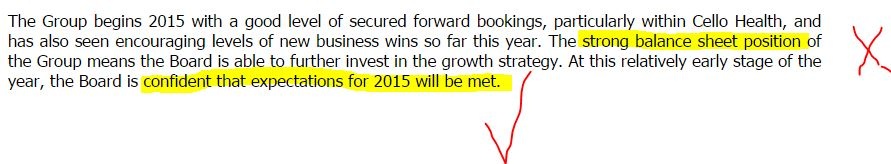

Outlook - memo to Mr Allan Rich, Non-Exec Chairman: you haven't got a strong balance sheet! However, I am taking his confidence about 2015 at face value, even if he needs a few lessons in balance sheet analysis (my rates are very reasonable!).

My opinion - it looks priced about right, on balance. This type of business generally doesn't attract a high rating, and with its weak balance sheet, and a PER of 11, I think the price is probably about right.

Gotta dash. See you in the morning!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in FRP, and no short positions. A fund management company with which Paul is associated may also hold positions in companies discussed)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.