Good morning!

It was interesting visiting Canary Wharf on Friday afternoon, especially at 5pm onwards, when vast streams of people were spilling out of every building, and congregating for drinks in the various bars. Makes you realise just how many people now work there - it must be an important financial centre in its own right.

I met a lawyer friend, whose office is based there. She mentioned how one client arrived to see her, and as he looked around Cabot Square, he commented, "You can just smell the money here, can't you?". She replied, "No dear, I think that's falafel you can smell, there's a little shop selling it just over there!".

Michelmersh Brick Holdings (LON:MBH)

Share price: 94.7p (down 6.7% today)

No. shares: 81.2m

Market cap: £76.9m

Trading update - I had to read this several times, to make sure I understood it properly;

Michelmersh Brick Holdings Plc (AIM: MBH), the specialist brick manufacturer and landfill company, today reports to the market on a better than expected trading performance in the second half of the year to 31 December 2015, achieved through operating efficiencies, continued low energy costs and aided by the additional capacity from Freshfield Lane.

Delivery volumes are below previous expectations as a result of a softening of the market, however average selling prices are ahead of those budgeted. As a consequence, the Group is likely to exceed the market expectations of profit before taxation for the year. The results for the full year are scheduled for release on 21 March 2016.

That's quite a strange combination of positives and negatives - which seems to be summarise as: costs down, selling prices up, but demand softening = profit ahead of expectations.

The trouble is, when demand for anything softens, then usually selling prices start falling, as manufacturers compete harder on price, in order to achieve the required sales volumes.

I vaguely recall, from a presentation by Michelmersh a couple of years ago, that supply of bricks is semi-fixed - i.e. production capacity can be increased, but it takes quite a while to set up the increased manufacturing capacity. So in the short term, prices can rise a lot, if increased demand occurs.

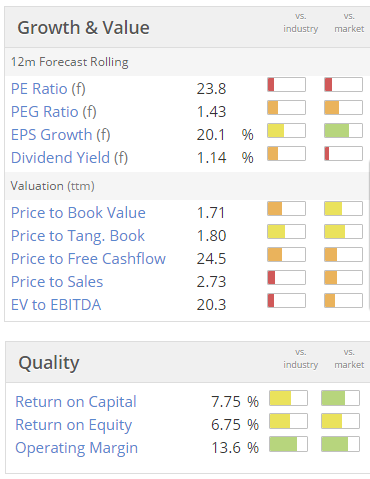

Valuation - as you can see, this stock looks aggressively priced right now, even allowing for it exceeding market expectations;

Housebuilding in the UK still seems buoyant, and with demand out-stripping supply, that's likely to remain the case for some time to come. So it would be necessary to find out which builders buy Michelmersh's bricks, and why. Are they substituting with someone else's bricks perhaps? I seem to recall that this company's bricks are a premium product.

Based on the statement today, it's difficult to see many new buyers for the shares taking an interest, at this valuation. Time to bank the profits, possibly?

Tribal (LON:TRB)

Share price: 76.8p (down 37% today)

No. shares: 94.8m

Market cap: £72.8m

Profit warning - no big surprise here. This is yet another situation to add to the long list of companies which say they are expecting an H2-weighted year, but subsequently go on to issue a profit warning. It's a big warning sign usually.

Today, Tribal says;

In light of these trading conditions, we now expect our revenues for the current year to be lower than the prior year, and we expect our operating profits to be significantly below our previous expectations.

The reasons given are various, but from what I can make out, it seems to basically hinge on competitive pressures, and a failure to convince enough potential customers to sign contracts.

So what are they doing to sort things out?

The Board initiated a review of the Group's operations in the summer. Despite implementing initiatives to drive sales and increase our operating efficiency, we have been impacted by the more difficult trading environment. We are strengthening our sales leadership, fundamentally reviewing of our sales priorities and processes, and better aligning our cost base with our ongoing activities.

My opinion - I don't like this share. The balance sheet is too weak, and that means there's no support to the valuation when things go wrong, as they have done. If we don't know what profits are going to be delivered, then how do we value the shares?

Although software companies are nice things to invest in, if there is a high proportion of recurring revenue. So at some point, once the dust has settled, this might be worth a closer look perhaps? Not yet though - I'd want to see all the sellers flushed out first, and the share price stabilise. It's nearly always a mistake to steam in and buy immediately after a serious profit warning.

I see a new CEO is being sought, so perhaps that might be a catalyst for a recovery? Although new CEOs often kitchen-sink the accounts, to give themselves a favourable starting point.

Note that the StockRank of 25 was extremely low here, so nicely done Stockopedia computers.

Vianet (LON:VNET)

Share price: 99.75p (up 2.3%)

No. shares: 27.9m

Market cap: £27.8m

Trading update - this sounds reasonably good, in the context of a slowly declining core business (the Brulines beer flow monitoring subsidiary);

Trading for the first half of the current financial year was ahead of the same period last year achieving good growth in line with the Board's expectations. Against that background the Board intends to declare a maintained interim dividend of 1.7 pence per share. Encouraging commercial and operational progress has been made across the Group's businesses, notwithstanding the continued pressure on trading in the pub sector, with the focused approach to exploiting growth opportunities, such as in vending telemetry, set to underpin the Group's return to growth.

My opinion - I no longer hold this share, as I decided that the headwind from the declining pubs sector was likely to limit the potential upside on these shares. That said, the divi yield is almost 6%, and the company has consistently paid out in recent years - although it has looked a struggle at times.

So the total shareholder return has actually been quite reasonable, if you add divis onto the chart. It's not one I plan on revisiting, due to the probably quite limited growth prospects.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.