Good morning, and welcome to the first SCVR of 2015. I hope you are suitably refreshed from the festive break, and raring to go!

Unfortunately it doesn't look like many companies are raring to go today, with only one set of results, and no trading statements coming up on the RNS. So whilst everyone else was singing Auld Lang Syne, only the Directors of ISDX-listed Hot Rocks Investments (OFEX:HRIP) were signing off their accounts, although the figures look poor.

It's a tiny investment company, in junior resource stocks. Net assets were only £1.06m at 30 Sep 2014, so presumably the value of their investments is likely to have fallen considerably since then, given the carnage in the sector.

With £49k operating expenses in six months, that means that administration costs in a full year would be just under 10% of funds under management. How can that possibly make sense? The market cap of £1.7m looks too high in comparison with net assets, unless the company has some hidden assets that are under-stated on the Balance Sheet?

I'm only really mentioning it because there's nothing else to write about today. Although talking about the ISDX market, I have been meaning for some time to review every stock on this market. The reason being that in the past I've spotted one or two interesting companies on ISDX (it's a very small market, formerly called Plus Markets, and OFEX). As very few investors look at ISDX stocks, you are more likely to find pricing anomalies - i.e. usually stocks which are completely overlooked. A good example some time ago was Sprue Aegis (LON:SPRP) - a friend flagged up that company to me when it was listed on ISDX and was about 92p. It was a stonking buy at that price, and the value was obvious, but hardly anyone knew it even existed. Those shares have since more than tripled, and the company has moved up to AIM.

As someone wisely mentioned on Twitter the other day, a good way to make money is to find an illiquid market, and then become an expert in it. To a large extent that sums up my approach, although you can still find plenty of pricing anomalies in fairly liquid small to mid caps too.

Afren (LON:AFR)

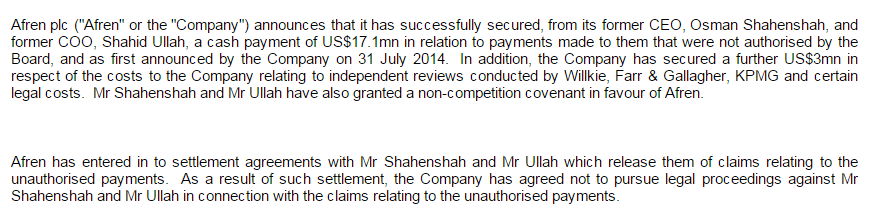

It's not a sector I follow (resources), but the very unusual nature of today's RNS from this oil producer is noteworthy;

So a good result for the company, but what a bizarre situation where Directors apparently helped themselves to a big wad of cash.

This stock looks cheap on a forward PER basis, but as with all oil producers, you have to wonder if analyst forecasts have been cut back enough to reflect the roughly halving of the oil price in recent months.

I'm very tempted to pick up some oil producers at current depressed prices, as surely the economic development in Asia and Africa, is bound to increase demand for oil, such that any short term over-supply issues are likely to reverse in the not-too-distant future. I'm not an expert on this area at all, but frankly that doesn't matter, as it's abundantly clear that experts haven't got a clue what the price of oil is going to do either! After all, how many experts predicted the recent collapse in the price of oil? It seems to have caught out almost everyone.

Restore (LON:RST)

Announces a very small acquisition (just £500k), for cash.

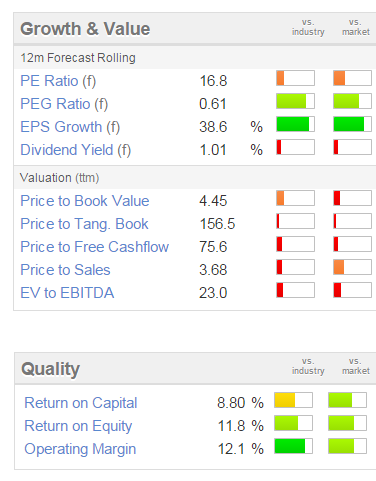

Looking at the Stockopedia graphics, this share looks rather expensive for what it is, on a forward PER of 16.8 times. I can't see how a document storage company is likely to be a growth area, as offices will be reducing the amount they print as things become gradually more electronic. It's surprising that the paperless office has been so slow in happening. I can remember ceasing to print out huge reports that nobody ever looked at, in about 1999, instead just copying the files onto a spare hard disc, just in case someone ever asked to view the reports (which never happened).

Also the 1% dividend yield is unexciting.

On the other hand, bulls such as Mark Slater point out that Restore has reliable recurring revenues, as once documents are stored with them by clients, in e.g. a disused nuclear bunker, or a salt mine, then a monthly fee rolls in reliably, for no additional work. I can see the attraction of that, but sooner or later the market is likely to start factoring in reducing earnings, and I can't see that supporting a high PER in the long term.

Rurelec (LON:RUR)

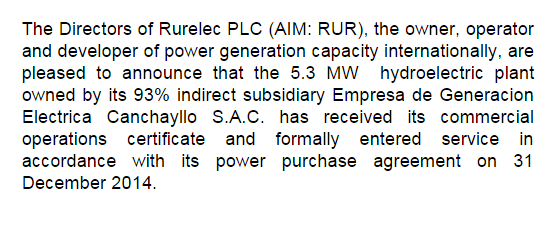

This is an AIM-Listed company focussed on electricity generation in South America. As you would expect, the shares have been very poor performers, it almost goes without saying - if it's overseas and listed on AIM, it's safest to keep well away, in my opinion.

The company announces today that a hydroelectric project it majority owns has come into service;

I suppose with oil now halved in price, alternative sources of power are looking less commercially attractive. Although looking at the chart here, something serious seems to have gone wrong in Jan 2014. Checking the last set of results, the issue in Jan 2014 was the devaluation of the Argentinian Peso.

Looking at the company's Balance Sheet, it isn't too bad actually, and at the operating profit level, it only made a small loss in the interims to 30 Jun 2014. Also, with net assets at £54.1m, and the market cap at about half that, the valuation seems quite modest.

On balance though, it's not something I'd be interested in buying.

I shall sign off for today & this week. Next week we'll start to get the trading statements from retailers. The John Lewis figures suggest that the push by retailers to promote Black Friday (yet another Americanism we seem to have forced on us!) may have blunted sales in the days immediately after Xmas. That's bound to happen really, as people only have a certain amount of money to spend.

Incidentally, for anyone interested in history, I've been reading a wonderful book on Churchill, by Boris Johnson, called "The Churchill Factor", and highly recommend it. As you would expect from this author, it's a fast-moving and entertaining read, which rather than following a dull, chronological format, instead dips in & out of key moments in Churchill's life - more like a collection of linked short stories, told with great flair.

See you back here on Monday.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.