Good morning. Or rather bad morning for me, as I've been hit by a nasty profit warning - an occupational hazard for small caps investors I'm afraid, but still painful every time it happens.

Xaar (LON:XAR)

Share price: 262p

No. shares: 76.4m

Market Cap: £200.2m

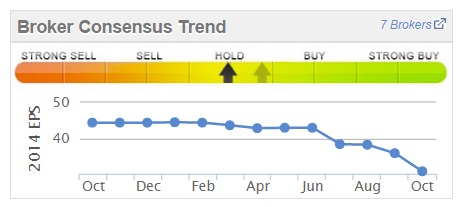

A maker of innovative industrial inkjet print heads, Xaar is having a very bad year - this is the third profit warning from the company, and at 262p the shares are now down 77% from their peak of 1162p in Dec 2013. The problem is that it has looked good value after each profit warning, but unfortunately business appears to be spiralling down more quickly than management expected, as demonstrated by this graph of broker consensus - which will take another lurch down after today's warning.

Profit warning - the key sentences are below;

As stated in the Interim Results announcement on 28 August 2014, demand for Xaar's products from the ceramic tile market softened during the third quarter of the year as a result of a slowdown in construction activity in China. The Company's exposure to China is significant, as almost half of the world's ceramic tile output is reported as manufactured and consumed in China. Revenue into the global ceramic tile market represented around two thirds of the Group's sales in 2013.

Monitoring of the ceramic tile market in China has indicated a further decline in activity resulting in excess manufacturing capacity being idled. As a consequence, forecast orders from Xaar's OEMs in this market for the remainder of the year have further reduced, such that the Board now expects total revenue for 2014 to be 5%-10% below the bottom of the previously announced range of £115-125 million.

A 5-10% further reduction in 2014 turnover doesn't sound too bad on its own, but my concern is that an industry with excess capacity being idled is probably going to pretty much switch off capex. The market has known for a while that 2013 was a one-off good year for Xaar, with exceptionally strong demand from Chinese tile makers, so it's not the fact that business is now declining that is the issue - it's more that the downturn is far more severe than the market, or indeed the company, expected it to be.

That removes one of the key planks supporting the company's valuation - i.e. decent earnings from legacy products, whilst we wait for the new product ranges to be launched in 2015 for e.g. printing directly onto bottles.

The outlook for 2015 has also been lowered;

Although visibility into 2015 remains low, based on all of the information currently available to the Group concerning the ceramic tile market in China, the Group is now planning to take action to reduce costs in anticipation of total Group revenue for 2015 being below £100 million.

Action will be taken immediately to reduce costs in line with the reduced expectation for sales in 2015. This is expected to result in a 15% reduction in operating expenditures, and potentially a total reduction in headcount (subject to consultation) of approximately 20% of the current global workforce of around 800 employees.

The cost reductions aim to achieve a reasonable level of financial operating performance in 2015, whilst ensuring that Xaar can fulfil its key strategic objectives.

Forecasts - N+1 Singer has reduced its 2015 and 2016 profit forecasts by a whopping 47% and 45% respectively. The trouble is, I don't think we can now rely on forecasts at all - because two thirds of the company's business is concentrated in a sector which appears to now be in serious trouble.

As well as declining sales, I am now a lot more worried about declining margins - since you can't maintain pricing power in a sector which is rapidly declining. So previous levels of profitability could now be impossible to regain?

Valuation - if we can't estimate profitability with any degree of reliability, then we can't really value the business on a conventional basis.

Director buying - one of the key reasons for my previous optimism about Xaar was that I place considerable weight on Directors buying in large quantities. Token Director buys are not of interest, indeed can actually be a bear signal (since their motivation is to boost the share price). However, in this case Directors spent about £440k buying shares at between 420-500p in Jun-Sep of this year. This is also important because it reversed the trend of them being sellers at higher prices earlier this year.

So the fact that the Directors also mis-timed their purchases, suggests that the downturn in business has been a lot worse than they expected too.

My opinion - In my view this is more than a bump in the road, this is a serious change in the company's outlook. For that reason I have changed my view on the company, and am now uncertain/negative on the short term outlook - I think this probably won't be the last profit warning.

On the other hand, the market cap is now greatly reduced, so at some point the bad news is in the price, and the upside is a bargain. We just don't yet know what that price will be.

How to value it? I'm not relying on earnings forecasts at all now. In my view this company is probably best seen as a declining legacy business (hence worth very little), with a fully funded blue sky business attached - for the new product ranges to be launched soon. If they take off in another of the "waves of adoption" of digital printing which Xaar refer to in their Annual Report, then it could once again be re-rated as a growth stock.

For the time being I've decided to take the loss, painful though it is, and sit on the sidelines to monitor the company's progress. It hasn't worked out as I anticipated, and the outlook is currently too uncertain. Reader comments are welcomed, as usual. How do you view today's profit warning? Is it a buying opportunity, or is there more bad news to come?

Ideagen (LON:IDEA)

Share price: 34p

No. shares: 122.9m

Market Cap: £41.8m

This is a niche software group, providing software for highly regulated sectors, such as the NHS.

Trading update - the company has a 30 April year end, so they are half way through the current financial year. The key parts say;

Group trading in line with expectations

Revenue and adjusted EBITDA* for the half year expected to show significant growth against the prior period.

£1m NHS Trust contract won - largest single NHS contract to date

The Group is pleased to announce that trading in the financial year to date has been robust in all areas of the business with both revenues and adjusted EBITDA for the first half expected to show significant growth over the same period last year. This is due to both strong organic growth and the acquisition of EIBS Ltd ("EIBS") in April this year. EIBS is now successfully integrated and performing in line with expectations.

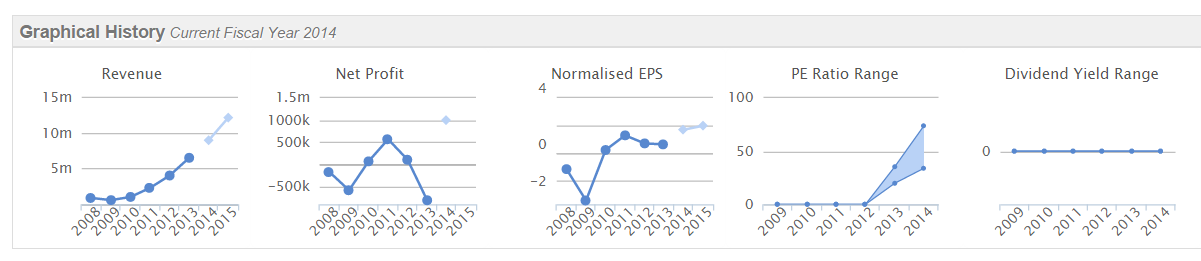

So that all sounds pretty positive. Although bear in mind that the company has issued a lot of shares to finance acquisitions, so the EPS growth rate has been fairly modest, as demonstrated from the Stockopedia graphics below;

My opinion - I've had issues about the valuation here for a while - it just looks too expensive for a tiny software group. You also wonder how much of revenue are one-off licence wins, versus how much is repeatable? (checking back my notes from 22 Jul 2014, the company said that recurring revenues cover 86% of fixed costs, so it looks quite good on that basis).

On the other hand, software companies have considerable power once they are embedded into large organisations. You also have to watch out for how much they are capitalising onto the Balance Sheet.

Overall, it doesn't excite me at this price, but good to see the company is having a decent year.

It's extremely quiet for news today, so nothing else has caught my eye.

Just a quick reminder that these reports are only ever personal opinion, and ideas for readers to research further. I never, ever, give recommendations either to buy or sell - since the whole ethos of Stockopedia is to provide information & tools to empower people in making their own investment decisions.

See you tomorrow, and let's hope we can get through this week without any more profit warnings.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company that Paul is associated with may have holdings in any shares mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.