Good morning!

EDIT: Apologies, I had technical problems with today's article, and some of it vanished, so I've recreated the lost bits as best I can remember!

Vislink (LON:VLK)

Share price: 45.25p

No. shares: 118.6m

Market Cap: £53.7m

There are two announcements today from Vislink, which is a maker of microwave cameras for outside broadcasting, and surveillance equipment. It has also expanded through acquisition into other related areas, such as broadcast software.

Strategic partnership - is announced today with Harmonic Inc. (NASDAQ:HLIT) which appears to have two elements - an order for £2m for product from Vislink, and a £2m injection of new share capital into Vislink, priced at 50p per share. I particularly like the second element, since it suggests the partnership is meaningful because the larger company is prepared to stump up equity funding, and of course it helps Vislink's balance sheet. Maybe it could even be a precursor to a takeover bid for Vislink at a later date, if the two companies work well together? Harmonic has a market cap of $602m, and a strong Balance Sheet.

Interim results - a complicating factor here is that Simon Thompson of Investors Chronicle wrote an article last week which caused a significant but short-lived spike in the share price, in which he seemed to suggest that the company was about to publish strong interim results. As it turns out, the results published today are not particularly good, so it's all rather perplexing. It's never a good idea to try to second guess what results will be like, as you usually end up with egg on your face, as has happened in this case.

Profitability - adjusted operating profit fell from £2.0m in H1 last year, to £1.7m in H1 this year (the six months to 30 Jun 2014), although the company says that currency movements are to blame, without with profit would have been up 3.4%.

Reading the narrative, it sounds as if the core broadcasting part of the group (which makes specialist cameras such as the ones fitted to Formula One cars) has struggled in H1, but has been bailed out by a good performance from the software part of the group. That's encouraging to my mind, as it suggests that the acquisition of Pebble Beach has been a success, and increases the predictability of earnings in future - a stated aim of management in the company's growth plans.

Outlook - whilst the headline interim figures look somewhat disappointing, the outlook for the full year sounds a lot more encouraging;

Whilst the broadcast market has been challenging for our hardware business, overall, we are encouraged with these results. We have taken timely action to reduce costs in our Hardware Division and we have seen an improved trading trend, the order book strengthened in Q2 and the orders to sales ratio is better than 1.

We are delivering on our software strategy with Pebble Beach Systems performing ahead of expectations. The Group's revenue has benefitted from the change in revenue balance, with software providing longer term visibility. The partnership with Harmonic Inc, which is being announced later today, represents further excellent opportunities for the Group.

2014 represents a transitional and transformational year for the Group and with the increasing focus on our software division, we believe that this will enhance the Group's overall quality of earnings in 2014 and beyond.

The Group continues to trade in line with market expectations and the Board remains confident for the future prospects for the Group.

Valuation - the all-important "in line with market expectations" comment above means that we should be able to rely on broker forecasts, which suggests normalised EPS of 4.13p this year, and 4.77p next year. So at 45.5p per share, that represents a PER of 11 this year, falling to 9.5 next year - which looks good value.

R&D spending - I note that the company is capitalising a hefty amount of development spend, of £2.0m in H1 (same as prior year H1), so that's worth bearing in mind.

Balance Sheet - looks alright to me. There is £8m of new debt in H1, but that is almost completely offset by cash of £7.7m. There doesn't seem to be a pension fund, which is good.

Dividends - as in prior years, there is no interim divi. The company has consistently paid a 1.25p divi for the last six years, giving a current yield of about 2.7%.

Director Buys - Note that both the Executive Chairman, and Finance Director, have announced personal share purchases today, of £45k, and £22.7k, which are meaningful amounts for a small cap, and certainly seem positive.

My opinion - Today's interim results are not particularly good, but the outlook for H2 sounds sufficiently positive that I'm happy to continue holding for another six months. Although ambitious management have not yet been able to deliver the sort of step change in profitability that they've been targeting. Still, Rome wasn't built in a day, and it is pleasing to see that the acquisitions they have made appear to have been successful.

Furthermore, the partnership with Harmonic Inc looks intriguing.

Johnson Service (LON:JSG)

Share price: 62.25p

No. shares: 299m

Market Cap: £186.1m

Interim results - these look good, although I'm not sure how much of the growth is organic, and how much due to the acquisition of Bourne Services in Mar 2014. Adjusted operating profit is up an impressive 25.3%, and with debt now under control, interest cost in H1 has halved against last year, thus boosting profit before tax up 54.5% to £8.5m, very impressive.

There seems to be an H2 weighting to the results, judging from the prior year comparatives.

Outlook - a nice clear, and positive statement today;

I am very pleased with the strong performance of the Group in the first half of the year and expect the result for 2014 to be slightly ahead of current market expectations. The Board is continuing to seek further acquisitions in Textile Rental and to invest in additional capacity at existing locations. The significant increase in the interim dividend reflects the Board's confidence in the business going forward.

Sounds good to me.

Balance Sheet - Although this has been greatly improved, it fails my testing, with a rather weak working capital position, somewhat inadequate net tangible assets of only £13.4m, and net debt still a little higher than I'm comfortable with, at £31.7m. Also note that there is a;

Pension Deficit - although not a huge figure on the Balance Sheet at £9.0m, I note from the narrative that the company is required to make cash payments of £1.9m in 2014, so that's a material factor in valuing the company - as that's cash which could otherwise be paid out in dividends. The cashflow statement shows that the divis cost £2.9m last year, so the pension deficit payments represent 65.5% of the total cost of the divis. Quite material then.

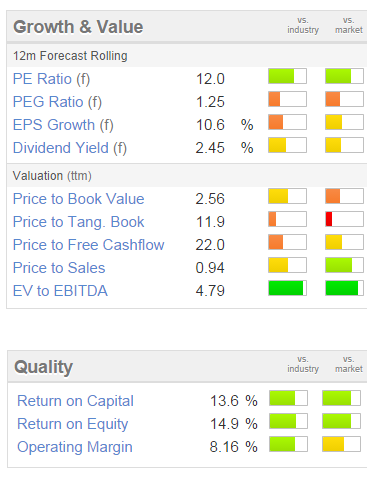

Valuation - looking at the usual Stockopedia graphics below, the price seems about right to me. Stripping out the net debt, and the pension deficit, would adjust the PER up to about 15-16 I reckon, which seems a sensible price. Note that the quality measures are upper medium, which is somewhat surprising, as I've always thought of this as being a low quality business, but actually it's quite good quality. It scores a very high StockRank of 95, so the algorithms on Stockopedia like this share!

My opinion - this seems a good company, and is probably priced about right in my opinion. Although the Balance Sheet puts me off from investing. It's not dire, but it's a tad too weak for my personal taste. Also it's worth bearing in mind that the company got into a mess before, with losses in 2008 and 2012, so I'd want to ask some tough questions about what they have done differently this time to prevent big problems recurring?

Regards, Paul.

(of the companies mentioned today, Paul has a long position in VLK)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.