Good morning!

A very quick run through this morning, as I have to set off as soon as possible after 10am, for a regular investor lunch in Reading.

Paddington station is tricky to get to, from Islington. However, I do enjoy the free WiFi on the GWR trains from there to Reading. It makes the journey so much more productive, as you can do useful things on the way.

I do wish the Government would prioritise free WiFi on all trains, as I think that would be a good boost to economic activity - allowing people to work on trains more effectively.

Vislink (LON:VLK)

Share price: 13.27p

No. shares: 124.6m

Market cap: £16.5m

Trading update - the company reassures on current trading;

The Company continues to trade in line with the Board's expectations for the full year, with Q4 expected to mirror the usual trading seasonality uplift.

The original core business is being sold for $16m, which will clear most of the group's bank debt. This sale was expected to close by end 2016, but looks as if it's slipped into early 2017. If this disposal falls through, then the company is in big trouble, with way too much debt, and a loss-making business in aggregate.

Therefore I wouldn't even consider an investment here until the sale has gone through.

John Hawkins' disastrous, self-serving (in terms of excessive remuneration) stewardship here has resulted in the original business being sold off in a fire sale, to repay the debt he ran up making acquisitions. He's got form on this - a series of acquisitions ended badly when he ran Anite.

However, that's water under the bridge now. The only question is whether the remaining software business - Pebble Beach - is worth more or less than the market cap?

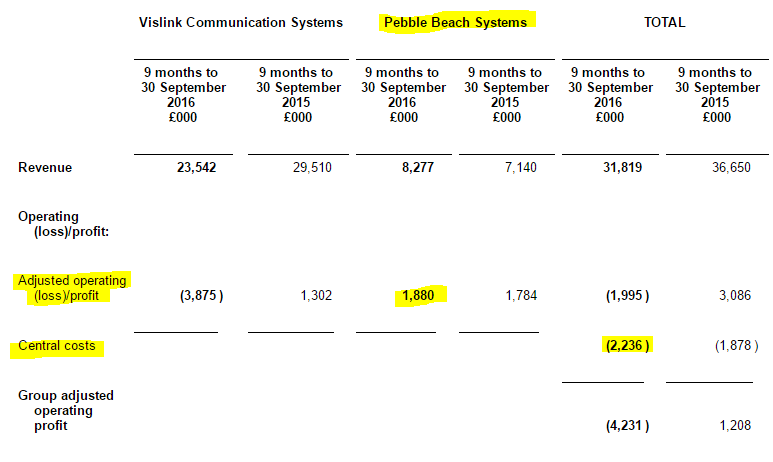

A table is provided today, which shows that Pebble Beach (i.e. future Vislink) is profitable. However, I've also flagged up the hefty central costs. So the key question is how much of the central costs will depart along with the main business that's being sold?

At a guess, it looks to me as if new Vislink (i.e. Pebble Beach) may make a profit of c.£1m after reduced central costs. As such, the market cap of £16.5m doesn't look particularly attractive to me.

I'd want to look very closely at the accounting procedures too, as I've always suspected that the figures might have been buffed up a bit, to give a nice shine.

Overall, Vislink has been a complete dog under Hawkins' tenure - just look at the share price chart. Therefore I wouldn't invest in it unless & until he's been sacked. Of course then you'd have the cost of a 12-month severance payment - a ridiculous and unjustified perk for rubbish Directors.

I feel that notice periods should be no more than 3 months for Directors. The existing 12-month norm is just another way in which Directors deplete the funds at companies they work for. All the more galling for shareholders, in that it's a reward for failure, for departing Directors.

1Spatial (LON:SPA)

Share price: 2p (down 27% today)

No. shares: 734.9m

Market cap: £14.7m

Trading update (profit warning) - oh dear, it's contracts slipping into 2017 that has triggered this warning;

While 1Spatial's sales pipeline and order book remain robust, due to a number of factors, including transitioning the business model to one of annualised revenues and the extension of the industry sales cycles, timing of certain key contracts are now expected to fall into 2017.

As a consequence, the Company now expects to deliver a marginal Adjusted EBITDA loss for the full year ending 31 January 2017.

The Company anticipates ending the financial year comfortably within its current banking facilities.

1Spatial has taken a proactive approach to the short term challenge it faces, assessing both the cost base and assets of the Company, as management seek to preserve cash and maintain its core focus.

It goes on to say that one business has been sold for an insignificant amount, and another has is being closed down.

My opinion - I've never properly looked at this company before, and on this update can't see any particular reason to change that approach today. I just wanted to flag it here, so that the profit warning is recorded in the archive here.

Avanti Communications (LON:AVN)

Share price: 22.9p (up 9.2% today)

No. shares: 147.4m

Market cap: £33.8m

(at the time of writing, I hold a small short position in this share)

Refinancing & completion of strategic review - the bondholders are in control here. They have allowed the company to continue operating, and have provided more cash for it to launch another satellite

However it seems very obvious to me that the equity (shares) are probably worth nothing. This is because debt ranks ahead of equity. So the poorly performing business (which struggles to get into the black even at the EBITDA level) stands no chance of generating enough cash to even service the (very high) interest on the debt, let alone repay the capital.

Today's refinancing sees the debt pile grow even greater, to a staggering $856m after this refinancing transaction. Bear in mind that the business only generated $7.8m EBITDA in the year ended 30 Jun 2016, and you can see what a complete pickle the company is in.

They tried to sell the business, but got unsatisfactory offers, so a sale is no longer on the cards.

My opinion - clearly the bondholders see more overall value in the business if the new satellite is funded, and the launch goes ahead. However, it's very difficult to see how new business is likely to generate enough value to make the business viable again.

However, as a friend pointed out to me last week, the bonds are actually trading not far off par value. So maybe the situation isn't quite as bad as it at first appears?

I remain of the view that the eventual outcome here is likely to be a big debt for equity swap, that is likely to essentially dilute existing shareholders down to virtually nothing.

The big problem with satellite capacity is that the selling price is constantly reducing. Existing satellites quite rapidly become obsolete, yet they cost a fortune to put in orbit. It seems a very unattractive business model.

Avanti has been a serial disappointer, so why is that going to change? I doubt it will.

There's nothing else of interest in my universe today, so I'll leave it there.

See you tomorrow!

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.