Good morning! A jolly time was had by all at the usual monthly Mello investor evening in Beckenham last night, organised by my friend David Stredder. These are excellent evenings, and very friendly, as everyone has a common interest in shares.

The company presenting was HML Holdings (LON:HMLH) who provide professional services to blocks of flats. Management were the type of people that I like to invest in - straightforward, down to earth, hands-on management. They gave clear answers to questions, and seemed to present the business in a non-hyped way. Crucially also, I felt they were not trying to conceal anything about the business, it was an open book. So a firm thumbs up from me for this management team.

As for the shares, I think they are fairly priced at 37.5p, so it's one to go on my watch list, to possibly buy on any future dips, who knows? It's a bit too small & illiquid for my taste though, so I would only buy if the market throws me a bargain buying opportunity at say 30p or less.

Some investors don't like meeting management, which is a good idea if you're easily sucked in by a persuasive pitch. However I find meeting management very worthwhile - I can usually detect problems instinctively, and seem to have a sixth sense that rings alarm bells in my head when something is wrong. Maybe it's subconscious reading of body language, who knows?

dotDigital (LON:DOTD)

Share price: 33.5p

No. shares: 285.2m

Market Cap: £95.5m

Trading update - today's update reads very positively - it covers the six months to 31 Dec 2014. Revenue is up 31% to £10.9m, and I think this growth is all organic too.

Net cash has grown to £9.5m, so that's 10% of the market cap.

A final divi of 0.2p has been approved, which is an unnecessarily mean yield of only 0.6%. Come on DotDigital! You've got the cash in the bank, so pay a proper divi! To my mind they should be paying about 3-4 times that figure in divis.

Valuation - I like this business a lot, but the price is so high on the historic figures. That said, with 31% organic growth being achieved, you could argue a strong case for this stock deserving a premium rating - if that growth rate can be maintained. It might be safer to assume that it could slip back to say 15-20% growth perhaps?

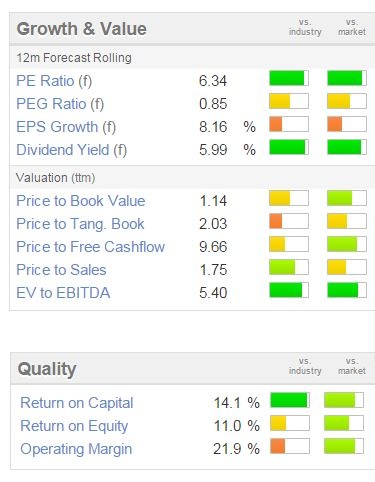

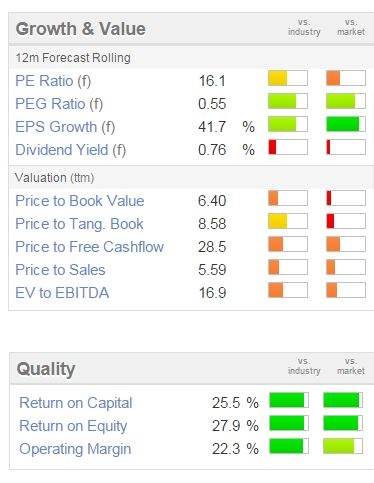

Stockopedia's computers look 12-months forward, so have calculated the forward PER as 16.1, as you can see below.

Look at the quality scores though - they're excellent.

My opinion - several things scare me about this share - the valuation is higher than I would normally consider. Also there has been heavy Director selling in recent years, although they must be kicking themselves for selling big tranches at only 7p in 2011.

On the other hand, the product looks fantastic - check out the product demo video on their website here. I get so much rubbish email from companies who churn out too much, and non-tailored emails, that I just unsubscribe from their email lists. So companies which take the time & effort to properly manage their email communications with customers, using software like DotDigital, will I think do well.

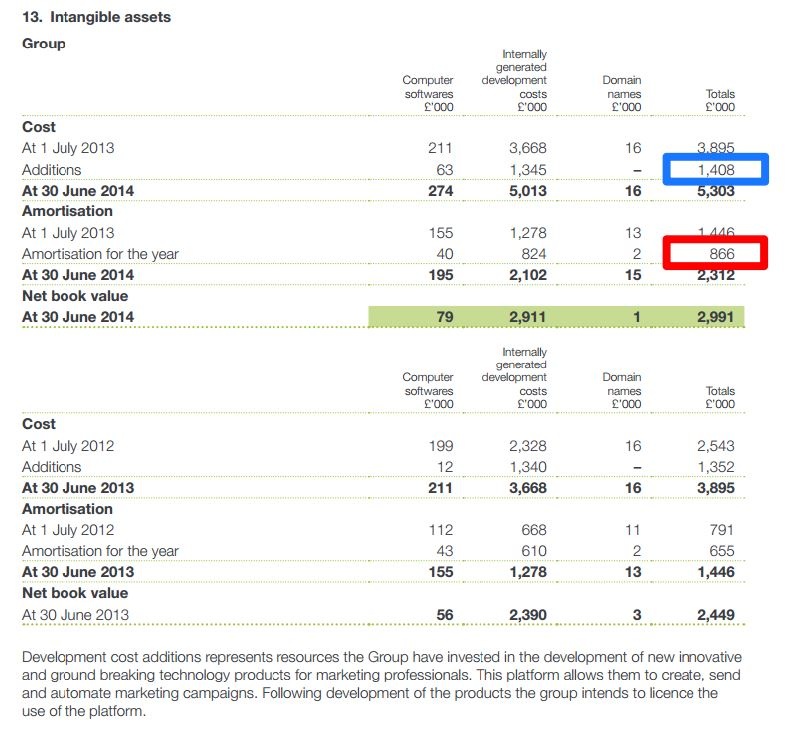

As I've previously mentioned, the company is capitalising some development spend. See note 13 from the last Annual Report below, where I have highlighted the key figures. As the amount capitalised of £1,408k is greater than the amortisation charge (which is £866k) by £542k, thus profit has been boosted by £542k from this accounting treatment.

EBITDA does of course over-state profitability, as it usually does with nearly all software companies, so the fashion for using EBITDA to value software companies is, in my view, misguided.

Hydrogen (LON:HYDG)

Share price: 72.5p

No. shares: 23.9m

Market Cap: £17.3m

I was fairly critical of this small recruiter when last reviewing it here on 22 Jul 2014. However, for people prepared to venture down into the illiquid micro cap space, it's starting to look interesting.

Trading update - this is the key part of today's announcement;

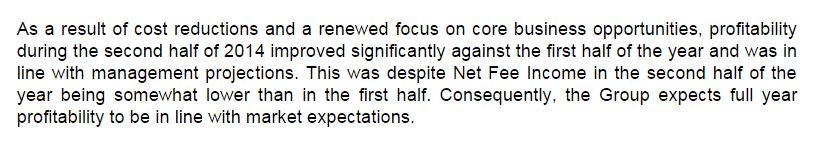

This is good news, because H1 was poor - the company reported an operating profit of £451k (down about two thirds from the prior year H1), and exceptionals of £1,488k, so an overall loss before tax of about £1.1m.

There's been a fairly major restructuring of the business to strip out costs;

That's almost a 15% reduction in admin costs, so a material amount.

My opinion - a lot of costs have now been stripped out, so one assumes performance in 2015 should be considerably better. Therefore, with the shares at a 12-month low, this could perhaps be a buying opportunity?

I like the generous dividend yield here too, of 6.5%. The balance sheet is strong, much better than most small recruiters, with little debt.

It's effectively a private company with a listing - management own a large stake in the business (good and bad), and the free float is tiny. For that reason I won't be buying any, which is a pity because if it had been somewhat larger and more liquid, then I think this might turn out to be a good time & price to pick up some shares. Just in my opinion, as usual.

Fairpoint (LON:FRP)

Share price: 113.5p

No. shares: 43.8m

Market Cap: £49.7m

I'm not at all keen on this company's range of activities (e.g. debt restructuring for individuals, PPI claims, legal services, etc). However, the shares are now starting to look so cheap that I'm tempted to hold my nose and look more closely at it.

The group is morphing into something a bit more palatable actually. Looking at the acquisition of Simpson Millar LLP in Jul 2014, checking their website, it seems to be a fairly regular firm of solicitors. Legal services represented 40% of turnover in H2 of 2014, and more acquisitions are planned, so perhaps in time the market might view this company more favourably, and hence be willing to re-rate it onto a less bombed out PER?

Trading update - today the group says that it traded in line with expectations in 2014. This is at the adjusted profit level, stripping out goodwill amortisation and exceptionals, which sounds alright.

Net debt - was £7.6m at 31 Dec 2014, well within the £20m bank facility. There are possible deferred consideration payments that might fall due though.

My opinion - I'm not keen on the company's activities, but this is looking remarkable value at 113.5p.

Whilst income from its traditional activities is declining, Fairpoint seems to be doing a good job in bolting on new companies in the legal services area, thus not just maintaining, but growing profits. This is being done without issuing new shares either - I note from Stockopedia that the average number of shares in issue has hardly changed in the last six years. Shareholders have been collecting rising dividends since 2010 too.

It has a very high StockRank of 96, so the computer algorithms like it. I don't like the company, but I do like these numbers.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in DOTD and FRP, and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.