It's hot and humid here in Spain (near Barcelona), where I shall be residing this week, in a modern but strangely sterile resort called Dolce Sitges. However, these reports carry on as usual, albeit with probably a few more typos than usual - my ancient Chromebook has latency on the keyboard, so misses out the occasional letter when it can't keep up with me! (one of the spin-off benefits of writing these reports every weekday, is that I've learned how to touch-type, quite fast, which is nice).

Mello Beckenham

David Stredder has just texted me to ask if I would remind regulars (many of whom read these reports) that there is no meeting tonight. The next one is on 21 Sep.

Brady (LON:BRY)

Share price: 105p (down 2.3% today)

No. shares: 83.3m

Market cap: £87.5m

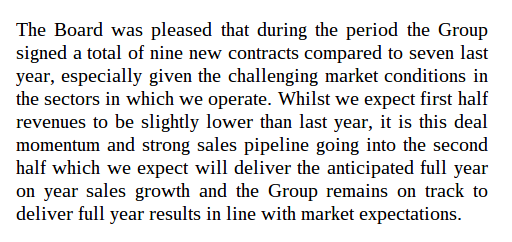

Trading update - the company says positive things about contract wins, but then reveals that H1 turnover will actually be slightly below last year;

Usually I'm very sceptical about companies which say they hope to achieve full year results after a soft H1, but in this case they do seem to have good grounds (contract wins & a strong pipeline) to justify confidence.

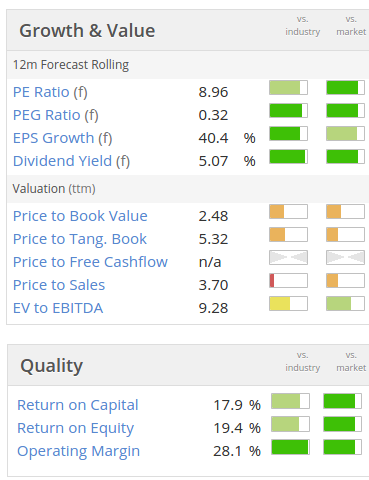

Valuation - given that valuations are quite high at the moment (PERs are much higher than 2-3 years ago on most stocks I follow) then this looks priced about right, relative to the rest of the market, in my opinion:

Another advantage that software companies have, is that if they're not paid (even disputed invoices), they can go nuclear by just switching off your business-critical systems. As you might have gathered, my experience of dealing with software companies as a customer, has not always been positive, but it has made me admire their business models, and hence it's a sector I like investing in.

Warren Buffett - I was reading Berkshire Hathaway's 2012 shareholder letter yesterday (essential holiday reading!) and I got a warm glow when Warren Buffett detailed his thinking on the treatment of amortisation of intangible assets - because I had accidentally stumbled on precisely the same approach. In a nutshell, he ignores amortisation charges if they are purely accounting book entries which have no basis in real business costs (e.g. amortising goodwill), but he treats the amortisation of software, and development costs, as real business costs which must not be ignored. As usual from the great man, that's straightforward common sense.

This is why, as I frequently point out, EBITDA is a completely false performance measure for software companies which capitalise a lot of development costs.

I reviewed Brady's 2014 results here, and came to the conclusion that the balance sheet is alright, and that the business does seem to generate decent, real cashflow.

As the company mentioned today, the markets it serves are struggling (commodities), so it's quite impressive that their business appears to be doing reasonably well.

Overall, it looks potentially interesting as an investment, but much more work would be needed to understand the products, market, and competitive position, etc.

Michelmersh Brick Holdings (LON:MBH)

Share price: 86p (down 8% today)

No. shares: 81.2m

Market cap: £69.8m

H1 results to 30 Jun 2015 - the figures look really good - turnover is up 13% to £15.3m for the half year, but operating profit nearly doubled, from £1.4m to £2.7m. The improved performance seems to have mainly come from higher selling prices, and hence a useful increase in gross profit, which has an operationally geared benefit to the bottom line.

The commentary mentions a 20% increase in industry prices, and it's an interesting sector because supply is fairly fixed in the short term, although imports can make up any shortfall, although it would be interesting to look at the economics of importing a low value, but bulky/heavy product, which obviously won't work as well as importing small, expensive items.

Outlook - the outlook comments have put a dampener on things, with the company saying, "more recently there are signs that the period of frenetic growth has ceased and competitive forces are strong... however the structural balance of supply and demand should ensure that brick manufacturing remains a busy and profitable sector".

The company expects H2 to be quieter than H1, but is comfortable with full year expectations. So it's a bit mixed, but overall sounds alright.

Broker forecast seems to be for 3.7p EPS this year, and 4.4p EPS next year. At 86p then the share price looks rather aggressive - that gives a PER of 23.2 and 19.5, which on the face of it seems too high.

Although I've not looked into the matter of surplus property - I seem to recall there might be some here, so am flagging it as an area where there could be additional hidden value, possibly?

The other angle is that people might believe broker forecasts can be exceeded, although today's statement rather puts a lid on expectations.

My opinion - I don't know the company that well, but it seems to me the shares have had a great run over the last 3 years, and are now looking a bit on the toppy side perhaps?

You also have to think about cyclicality - construction activity is high again now, but at some point in the future it will probably slow down again. So a share like this really needs to be priced at a level which makes reference to earnings over the whole cycle, and averages them out. Since it might now be enjoying above average earnings, then it might make sense to apply a modest PER, to reflect that.

Or, if you think the current buoyant construction activity has years left to run (which it probably does, in my opinion), then you might be comfortable paying a high PER for now, in the expectation that earnings could have a lot higher to go.

Investing is all about trying to predict the future, so depending on your view of the future, this share is either expensive, about right, or cheap! I'm leaning towards seeing it as possibly a little too expensive for now, but good market conditions might see earnings grow into the valuation? As with a lot of things, it was a great investment a couple of years ago, but maybe not so great now that the price has shot up so much?

I think a lot of investors are getting carried away with momentum right now, forgetting that things won't carry on going up forever! As a general point, once shares in fairly ordinary companies are aggressively priced, then I think the logical thing to do is to sell up, or at least top slice.

XLMedia (LON:XLM)

Share price: 65.75p (up 9.6%)

No. shares: 200.4m

Market cap: £131.8m

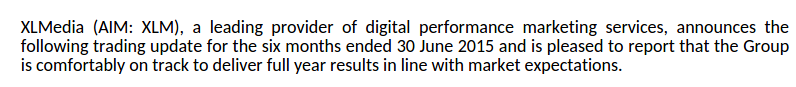

Trading update - this update sounds encouraging:

The company seems to be growing through acquisitions mainly.

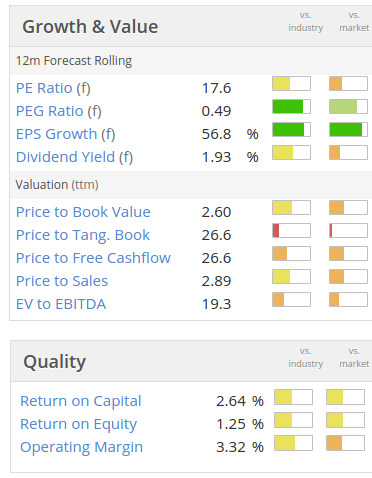

On the face of it, the shares look really cheap, as you can see from the usual Stockopedia graphics below. However, I'm extremely wary of this type of company (digital marketing), as their profits can be a flash in the pan.

My opinion - shares in Blinkx (LON:BLNX) and Matomy Media (LON:MTMY) have been disasters, when it became apparent that their bumper profits were not sustainable. You also have to question why there was a rash of these companies listing in the last few years - probably because the original owners realised they were in a sweet spot for profits, and wanted to cash out whilst the going was good!

The Directorspeak and outlook in today's update is all very positive, there's a nice 5% divi yield, so on paper it looks great.

However, I suspect this share is likely to join the list of fashionable digital marketing companies which goes horribly wrong sooner or later. It's based in Israel too, and as we've seen with Plus500 (LON:PLUS) and Matomy Media (LON:MTMY) these too-good-to-be-true Israli digital companies usually have something badly wrong with them, which is not always immediately apparent.

I can't see any reason to take the risk. On the other hand, if you're prepared to take it at face value, and believe that its profits are sustainable, then it might be a bargain, who knows?

Entu (UK) (LON:ENTU)

Share price: 109.5p (down 5.2% today)

No. shares: 65.6m

Market cap: £71.8m

(at the time of writing I hold a long position in this share)

Interim results to 30 Apr 2015 - the figures have been rushed out this afternoon (they were scheduled for Weds morning), presumably in response to the share price collapsing in recent days. We were discussing this morning what might be happening to trigger such a fall, in the comments below.

Revenues are down 6% to £52.9m, and profit before tax has dropped from £5.6m to £3.8m, so this looks like a relatively poor half year. However, the commentary says that results are "in line with management expectations, against unusually high prior year comparators".

Outlook - there's been a huge increase in the order book, from £10m to £30m, and on full year trading the company reassures, saying;

"We have seen and continue to see increased activity levels in the second half, and we remain on track to meet market expectations for the full year."

So taking that at face value, there's no reason for the shares to have fallen at all, let alone by such a large amount in recent days.

Although looking on Stockopedia, and another website, there don't seem to be any current broker forecasts out there. Someone has pointed me towards Edison's website, and they had a forecast of 13.3p EPS for this year, but that's an old forecast now, dating from the IPO in Oct 2014. So it's not clear how relevant that forecast still is.

The company clearly needs to clarify what market expectations actually are, and I have to say that they don't seem very good at managing market expectations, judging by the share price volatility in recent days/weeks.

Although the company's comments today that H2 is seeing increased activity levels seems encouraging.

EU VAT ruling - it's encouraging to see that the company says this has had minimal impact.

Dividends - this also sounds encouraging, and suggests the big dividend yield is intact (although note they've given themselves "subject to" wiggle room);

Cashflow - it's been pointed out to me that the cashflow in H1 was poor. I think that's an amber flag, but one half year of negative cashflow is not in itself an issue - because companies see, perfectly legitimately, working capital going up and down. It's only a problem if a company sees repeated negative cashflow over a number of years, which is not the case here.

My opinion - I need to read the figures and narrative again, to let it all sink in, but so far my feeling is that the most important point is that the company has confirmed performance is in line with expectations fro the full year. and that trading in H2 is busier than H1, so it appears that the market sell-off recently might have been a bit of a red herring perhaps?

Right that's me done for today. The pool area here is full of screaming kids unfortunately (memo to self: choose an adults only resort next time), but my friends have just texted to say they've found an enclave which is sunny, quiet, and has good wifi, so I will be able to relax and monitor the price of Entu (UK) (LON:ENTU) (although the two are mutually exclusive!) there this afternoon.

Have a good day, and don't break any more share prices whilst I'm away! ;-)

Regards, Paul.

(of the companies mentioned today, Paul has a long position in ENTU, and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned.

NB. These reports are just Paul's personal opinions. They are NEVER advice or recommendations).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.