Good morning! It's Paul here.

I'm heading into London shortly for an investor seminar, so will rattle off a few comments on today's news, more briefly than usual.

De-listings - Interquest & Fusionex

This is becoming a big issue. Companies which decide to abandon their stock market listing are usually hopeless cases - tiny, loss-making, and strapped for cash. So they're pretty easy to avoid.

However, I'm becoming increasingly concerned at companies which are leaving the markets when they really shouldn't. A good example is Interquest (LON:ITQ) - a small staffing company. It previously had a good track record, but the shares crashed when it warned on profits last year.

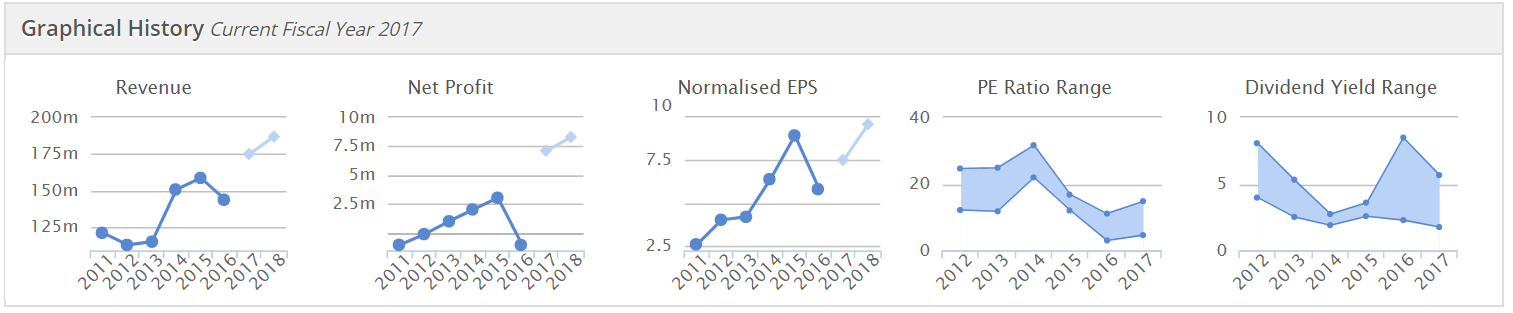

As you can see above, there was a nice progression of profit growth, until things went wrong last year. Obviously the share price has reflected this period of poor performance:

If a company performs badly, then management have a duty to rectify things. Over time, the market will reward improved performance with a recovery in the share price.

However, in this case, management has decided to stuff outside shareholders with a low-ball takeover bid. They're offering just 42p (a lousy 9.3% premium to the previous share price) to take the company private! In the relevant paperwork, management bemoan the low share price, whilst seemingly oblivious to the fact that it's their poor performance which is the root cause of the low share price. A ridiculous loan note alternative (redeemable in 2027!) only adds insult to injury.

In my view this takeover bid is unethical. It's also damaging to the reputation of the stock market, and undermines investor confidence. Why would any of us buy shares in any company, if we're going to be forcibly bought out, at a low price, if things go wrong?

The only independent Director at Interquest has urged investors to reject the offer, and has the support of shareholders with 20.1% of the company. Unfortunately, I don't think that will be enough to stop this shabby, opportunistic deal. A share can be de-listed once a takeover bid has the support of 75% of shareholders. In cases like this, where management have a large shareholding, the interests of outside shareholders can be seriously compromised.

The only hope is that the Directors who are trying to force through this low-ball offer can be shamed into withdrawing the proposal. I understand that the financing for the deal is being partly provided by Luke Johnson. I'm normally a fan of his, and am surprised that he's got involved in something like this, where private shareholders seem to be being treated unfairly.

Fusionex International (LON:FXI) is another case. It's a pretty awful Malaysian company, with dreadful accounts, so it's not something I would have gone near in the first place.

However, shareholders here have also been stuffed. The company announced out of the blue that it had decided to de-list. Again, management have large shareholdings, so have been able to force through proposals to de-list.

I see that Fusionex's NOMAD has resigned today, so the shares will be suspended tonight, and de-list on 27 Jun 2017. Therefore shareholders only have today to get out. Bizarrely, the share price has strongly rallied in the last few days. This seems inexplicable to me, as the shares will effectively be worthless when they de-list tonight. I doubt UK shareholders will ever see any value from their shares.

This shabby deal is effectively a cheap way to take the company private. Outside shareholders will have no say in the running of the company, and who knows what will happen once the scrutiny of being a listed company has been removed?

It seems to me that FXI simply used the UK stock market to extract money from gullible investors. Once that purpose has been completed, the company no longer needs the hassle & costs of a listing. Bear in mind that this company raised £14m in a Placing, in Oct 2015. So to announce a de-listing only 20 months later, seems very questionable.

Overall then how can we trust companies to maintain their listing? It's very difficult. In my view, it really does boil down to trust. Are the Directors ethical, and committed to a long-term stock market listing?

I think companies need to think long & hard before they decide to become stock market listed. It's a long-term commitment, and companies should not list at all, unless they are prepared to remain listed forever.

Certainly investors should make a note of the names of Directors who harm the interests of private shareholders in this way, and boycott any future share issues from companies connected to those Directors.

Above all, Directors need to recognise that the share price reflects market perception of how good a company & its management are. So if the share price is frustratingly low, then Directors need to look closer to home for the reasons why.

I think regulators need to look at tightening up the rules, to make it more difficult & expensive for companies to de-list on a whim. The Naked Fund Manager wrote a blog on this issue recently, which is worth a read. He suggests changes to the AIM rules, to make de-listings more difficult to do. Protecting minorities is important. At the moment all too often minorities can be squeezed out by unscrupulous management and major shareholders.

Accsys Technologies (LON:AXS)

Share price: 76.8p

No. shares: 111.0m

Market cap: £85.2m

Preliminary results - for the year ended 31 Mar 2017.

This company makes specially treated wood products, called Accoya and Tricoya.

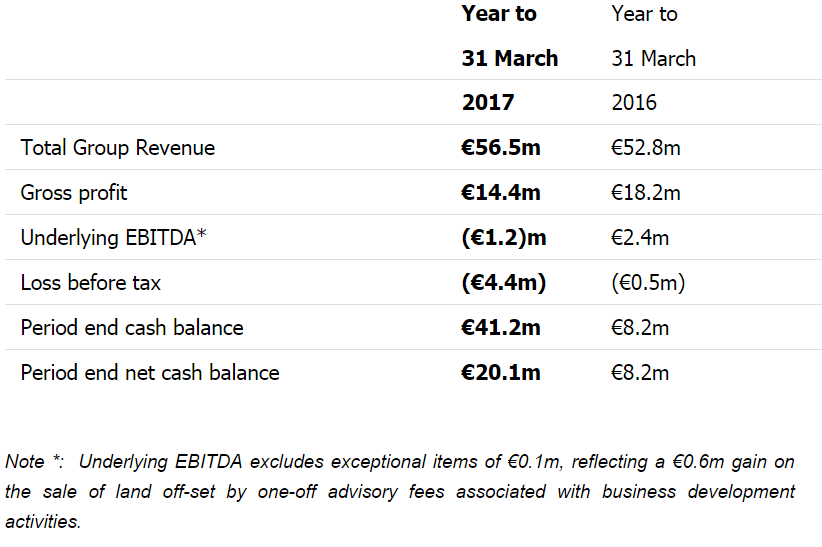

The highlights don't look very good - profitability has gone backwards, despite turnover being higher:

I'm not sure how relevant these numbers are though, because this company is best seen as work-in-progress. It's setting up new manufacturing facilities, so future production should be larger, and more profitable.

It's difficult to value this company, as it all hinges on how much increased production kicks in, and what level of demand there is for it. So getting hold of broker research is key, and assessing (if you can) whether those forecasts look achievable or better still, beatable.

Balance sheet - looks strong, with plenty of cash.

Additional funds were raised post period-end.

Outlook comments sound encouraging, although note that sales growth is restricted by capacity constraints this year;

The Firm Placing and Open Offer, which was launched successfully and completed in April, with the Open Offer having been four times oversubscribed has also put the Group in a firm financial position. I am confident that as we continue to invest in growth, and as we benefit from the additional manufacturing capacity, we will become cash-flow generative.

The new financial year has started well, with growth in Accoya sales being comparable to growth seen in the second half of last year. Sales growth will be temporarily restricted for the year as a whole until the new capacity becomes available in early 2018 calendar year.

Demand for Accoya continues to increase and we expect sales to grow further thereafter.

My opinion - I've always felt mildly positive about this company. Its products seem to be good, and in demand. So with capacity constraints set to be relieved in 2018 from new production, maybe this might be a good time to take a position here?

Overall, I think it'll probably have to go into my "too difficult" file. I'm generally not too keen on businesses that require massive capex to grow sales. Also I prefer companies that are already profitable, not stuff like this which promises more jam tomorrow.

NWF (LON:NWF)

Share price: 139.2p (up 2.7% today)

No. shares: 48.6m

Market cap: £67.7m

Trading statement - this company describes itself as;

the specialist agricultural and distribution business delivering feed, food and fuel across the UK

This update today sounds reassuring;

The Group is pleased to report that trading for the financial year ended 31 May 2017 was ahead of the prior year and in line with market expectations.

More detail is given, which I won't go into here.

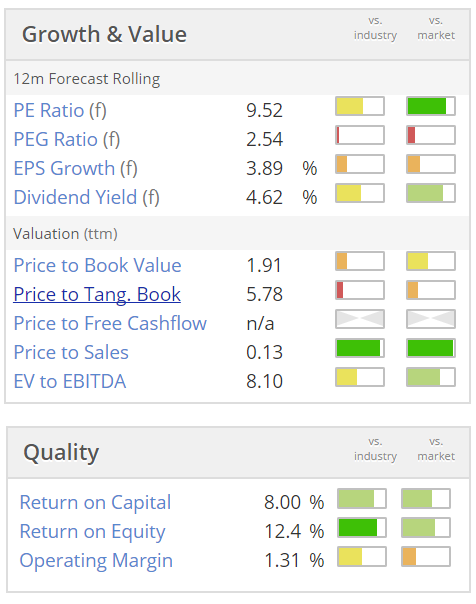

Valuation - this is starting to look quite good value;

My opinion - I rejected this share in Dec 2016, when it was 173.5p, concluding that a forward PER of about 13 was too expensive for a boring, low margin, ex-growth company.

As you can see above, the fwd PER has now fallen to 9.5, and the dividend yield is looking attractive at 4.6%.

It's not the type of business that I would usually invest in, but it might now be worth a closer look, by value investors.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.