Good morning! There are four companies which have caught my eye this morning, so I shall report on them. Then I'm taking the afternoon off, having a long lunch in Brighton with a friend who is visiting for the day. So expect more gibberish than usual on Twitter this evening!

May I just make another point. Reading a bulletin board elsewhere, people were slagging me off, saying that my "share recommendations" were rubbish. This is odd, as I categorically NEVER recommend any shares to anyone! All these reports are doing is to give one investor's opinions on shares that look potentially interesting to me. The ethos of this site is for everyone to do their own research. Sorry this has to be repeated yet again, but it STILL doesn't seem to be getting through to some people!

Also, we've had some fascinating discussions in the comments section this week, about various strategies, etc. I'm perfectly happy to accept that my more speculative share ideas have done pretty badly of late! (but I do get the occasional multibagger). So there is certainly a lesson in there, that maybe I should just stick to the boring old value situations, and high StockRank stuff (which is where I tend to make good money) and not flirt with the more speculative stuff (which is where I tend to lose money!)? All food for thought, and all up for discussion!

Digital Globe Services (LON:DGS)

Share price: 65p (down 51% today)

No. shares: 29.9m

Market Cap: £19.4m

Interim results - for the six months ended 31 Dec 2014, which have clearly gone down like a lead balloon, with the shares having halved in price today.

This is what the company does - "a leading provider of online customer, lead, and inquiry acquisition and digital marketing solutions for large, consumer-facing organisations". Reading a bit more of the blurb with today's results, it seems to recruit customers for American cable TV companies.

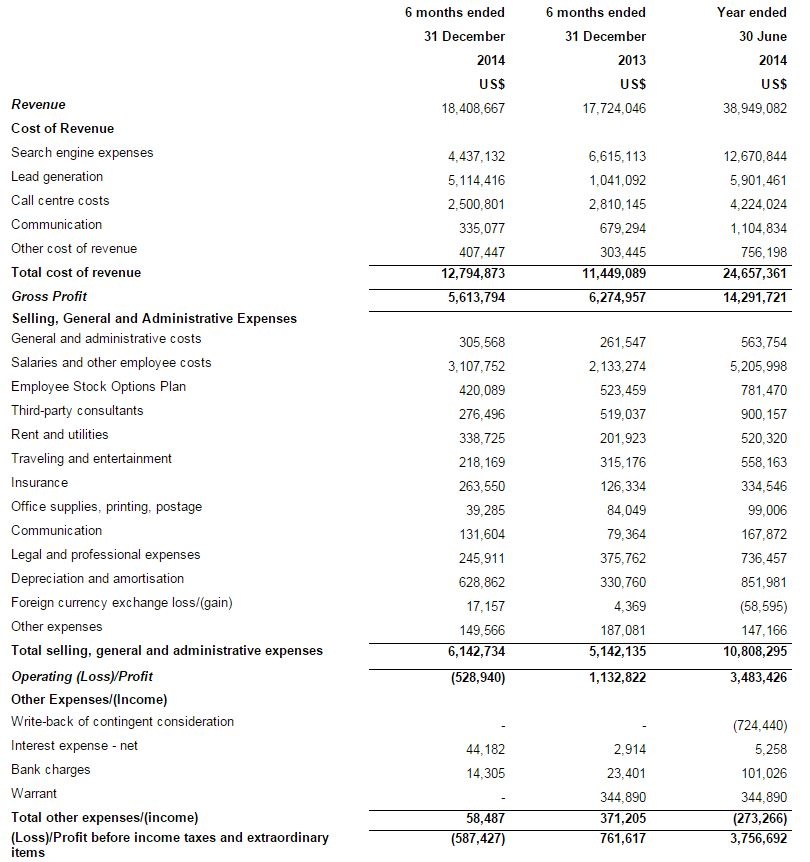

The business has been reasonably profitable in the past, but now seems to have had a poor first half. An operating profit of $1.1m last year H1, has turned into a £529k loss in H1 this year. I very much like the presentation of the P&L (see below), where individual costs are itemised. I wish UK companies would do this too, as you can really understand the moving parts in the cost base properly, in a way you can't when they are lumped into broad headings like distribution or admin costs.

Wouldn't it be great if all companies reported figures like this? It's more like a set of management accounts, than published accounts - far more useful.

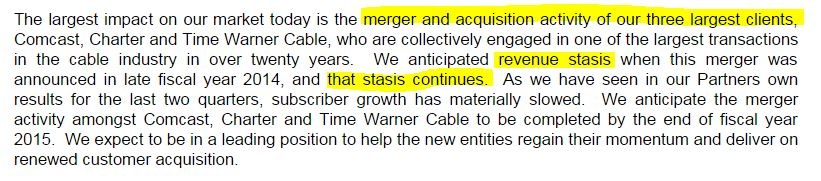

The reasons given for this poor performance seem quite straightforward, and hopefully temporary;

Although that does reinforce the perhaps rather flaky nature of revenue (and hence profit) at this company.

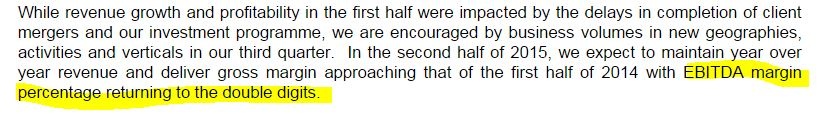

Outlook - the company mentioned having done some cost-cutting, and the outlook sounds more positive, of a return to previous levels of profitability;

Balance Sheet - this looks alright. Net assets are $10.3m, less intangibles of $3.7m, gives NTAV of $6.6m. The current ratio is good at 1.74, and there is no long term debt. Cash is tight, at $386k, but there is a revolving credit facility of $584k, so net debt of $198k, negligible really.

My opinion - I try not to invest in any company which has either of the words "digital", or "cloud" in its name, or any subsequent buzzwords., as they often seem to do badly.

That said, I wouldn't dismiss this one out of hand. Its finances look stable, and the 50% drop in share price today could be a buying opportunity, if (as they expect) profits recover in H2. I note that a maiden dividend was paid in Jun 2013, but nothing since, so there has to be a question mark over divis.

It's probably not for me, but for the more adventurous readers, it might be worth a look, as potential turnaround situation.

Bond International Software (LON:BDI)

Share price: 122.5p (up 20% today)

No. shares: 37.8m

Market Cap: £46.3m

(at the time of writing I hold a long position in this share)

Preliminary results & strategic review - annoyingly, this payroll & HR software company issued its calendar 2014 results today at 9:52am. Why?! How can it possibly make sense to put your results out at some random point during trading hours, so that people have the stress of trying to read & interpret the statement whilst the shares are trading live?

I have to say though, these results look good. Adjusted EPS is up 38% to 9.11p, usefully ahead of consensus at 8.56p. There was quite a big acquisition during the year, of Eurowage, in May 2014, for a consideration of £13.6m.

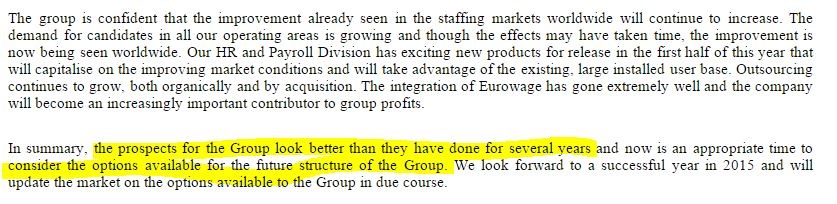

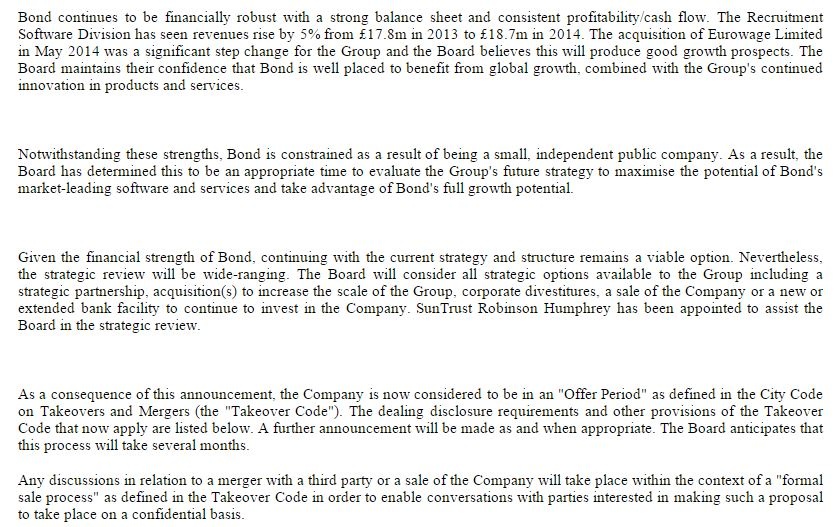

Outlook - this sounds promising;

Sale process - the company is very much up for sale now, so hopefully there might be a knockout takeover bid coming?!

My opinion - I like this company, is still looks reasonably priced, is performing well, and so it seems to be conducting this strategic review from a position of strength. So I will be keeping my beady eye (geddit?!!!) on this one very closely.

Brainjuicer (LON:BJU)

Share price: 391.5p

No. shares: 12.6m

Market Cap: £49.3m

Results for calendar 2014 are out today. This company has been on my "potentially interesting" list for a while.

Things I like;

- Innovative activities - applying behavioural science to marketing

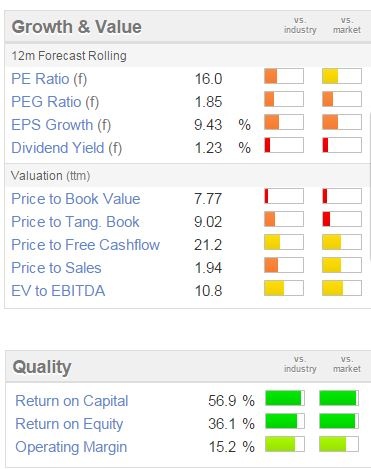

- High margins, and very high quality scores (see Stockopedia graphic below)

- Strong balance sheet with plenty of net cash (10.8% of market cap)

- Likes returning cash to shareholders

- Very clean accounts - no funnies

Things I don't like;

- Performance has been uneven

- "Limited revenue visibility", as the company openly admits today

- Growth slowing

- Cautious outlook statement

- Valuation looks fully priced for now

My opinion - interesting company, but it's difficult to see any reason for the shares to go up, for the time being.

CVS (LON:CVSG)

Interim results - the market likes these results, with the shares up 10% today to 515p.

It's a roll-out, with the company buying up vets practices. The P&L is impressive, but the balance sheet is looking weak now. Whether that matters? Not necessarily, as the business is strongly cash generative, and likely to remain so.

It's expensive, on a PER of about 20, but is one of those shares where it would have been sensible to just overpay initially, and hold long term. I can't bring myself to buy now, at this toppy valuation. How much more upside is there, that's the trouble with so many shares that have performed brilliantly in recent years. They can't keep going up forever, at some point the multiples need to come back down to earth.

Essenden (LON:ESS)

Share price: 72p

No. shares: 50.1m

Market Cap: £36.1m

(at the time of writing I hold a long position in this company)

Preliminary approach - the company reported late on Fri afternoon that it has received a "highly preliminary" approach from Harwood Capital LLP about a possible acquisition of Essenden by Harwood. Note that Harwood Capital already owns 34.1% of the company, so

The company effectively put itself up for sale on 12 Mar 2015, as I reported in my morning report on that day.

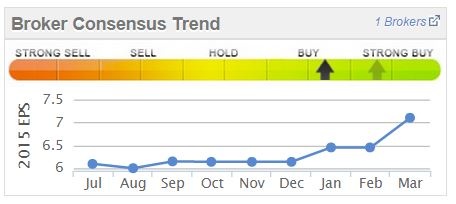

My opinion - as you can see from the Stockopedia graphic below, broker forecasts for Essenden have been steadily rising in the last year - nearly always a good sign. So with 7.1p EPS forecast for this year, the shares look modestly priced at the moment on a PER of 10.1.

Therefore I would only be happy to agree to a takeover bid if there was a significant premium. The figure would have to be 100p+ to interest me. Otherwise I'd rather hold, and put pressure on management to start paying decent divis.

Or the other option would be for management to do a fundraising, and buy up some complementary private companies, to build a bigger leisure group. Now seems to be the right time, with consumer discretionary spending set to rise, as real wage growth has begun to return.

Above all, it is important that smaller shareholders (and management) are not bullied into accepting a lowball takeover bid. After all, shareholders have supported the company through a difficult restructuring period, so it would not be right for the upside to be taken away through an opportunistic takeover bid. Obviously the potential bidder sees value in the group, or they wouldn't be interested in bidding for it.

Let's see what develops.

Right, got to dash. Have a lovely weekend everyone!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in BDI & ESS, and no short positions. A fund management company with which Paul is associated may also hold positions in companies written about here).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.