Good morning. Let's start with AGA Rangemaster (LON:AGA), the maker of posh cookers. I like the company's turnaround potential as economies and the housing market recover, but the massive pension scheme deficit has put me off in the past. The recovery plan for their deficit stipulates that, having paid £20m into the scheme recently, they now have a breathing space until paying £4m in 2015. From 2016-2021 Aga must pay £10m p.a. into the pension scheme, with another £30m payable in 2020. So that is a total of £94m in payments due over the next few years! A huge amount considering the market cap is currently £74m at 103.5p per share.

I was amazed to read a short article on Aga in Shares magazine which didn't even mention the pension deficit here! So I suspect that some new investors are buying the shares unaware of the seriousness of the pension deficit, and that it could quite easily consume virtually all of the group's cashflow for the next eight years.

The narrative to the interim results (six months to 30 Jun 2013) published today do mention these overpayments, but interestingly they indicate that perhaps lower overpayments might be negotiated in the next couple of years:

As market conditions alter and as the increase in yields on government bonds has a positive impact on the actuarial valuation of liabilities, it remains the intention of the Group to rebalance the relationship in terms of scale and financial strength between the scheme and the Company before any new formal funding arrangements are to be put in place in relation to the next triennial actuarial valuation to be undertaken as at 31st December 2014.

The accounting deficit appears quite small, and the latest figures are scheme liabilities of an astonishing £828.9m (!!) and scheme assets of £813.3m, giving a deficit of only £15.6m. However, the nonsense of pensions accounting is such that a separate (and usually more conservative) valuation is agreed every three years, which drives the negotiated overpayments. So for the purposes of investors, we have to understand two completely different pension scheme valuations - one for the Balance Sheet, and a different (in this case much worse) valuation for overpayment calculations.

This is probably the biggest pension scheme relative to the market cap of the company that I can remember ever seeing. So it remains a huge issue, and realistically prevents me from investing in these shares at anything like a normal valuation. With that sort of risk overhanging the company, how on earth do you price the shares at all?

Looking at today's interims, turnover is essentially flat against last year's H1, at £119.5m, and operating profit is also flat at £1.5m. There seems to be an H2 weighting to profits, since they produced £6.5m operating profit last year for the full year.

With finance charges, and £1.4m in restructuring costs (same as H1 last year), the loss before tax for H1 is £1m worse than last year at £2.4m loss. So that is likely to deliver a roughly breakeven full year figure. Not very impressive.

However, the outlook is more positive, where they say that:

Taken overall the indicators from the order intake are that revenues will finally start to move forward in the second half bringing profitability improvements as the operational gearing impacts.

So at last, some signs of improvement, after years of restructuring. You would expect that, given that the UK housing market is coming back to life, albeit still on life support of ultra-low interest rates, and Govt policy which seems determined to reflate the housing bubble even more, instead of letting it gradually subside to allow prices in the South to become affordable again. So I think the Govt has simply deferred the inevitable house price crash that has to happen once interest rates normalise.

Therefore personally I wouldn't want to invest too heavily into anything that is dependent on a housing market recovery, given that the current housing market is an extremely wobbly structure, built on very weak foundations.

Another factor is that AGAs are very heavy on electricity, although the latest versions can be set to switch off overnight, and at quiet periods, instead of guzzling electricity all the time. So this could still be a factor in holding back sales possibly?

In summary therefore, AGA shares are only attractive if you take the view that their pension deficit will sort itself out in the fullness of time, which is possible, but the scale of the scheme is so enormous that it represents a gigantic risk that could easily pull down the company if the deficit were to get worse. It doesn't make enough profit to finance the existing overpayments from 2016 onwards at the moment, so it is also a gamble on profits increasing enough to make those agreed payments. Or a gamble on them being able to negotiate reduced pension deficit overpayments.

To get an idea for how volatile the pension deficit is, consider from the 2012 Annual Report, note 6, it says that for every 0.1% change in the discount rate, the pension scheme's liabilities rise or fall by £12.7m! That's 2 years' profit for each 0.1% change in the discount rate. So when interest rates do go up, this pension deficit will probably turn into a surplus. So for optimists, that could be a factor to consider.

There is also operational gearing to consider - i.e. if turnover were to rise say 10%, then profits would rise dramatically. The gross margin is not stated, so I can't gauge by how much profits would rise. Assuming a say 40% gross margin, then a 10% rise in turnover (based on last year's figure of £244.6m) would increase profits by £9.8m, or more than double last year's operating profit of £6.5m to £16.3m.

So actually, I'm starting to see that there could be some upside here if you think interest rates are likely to rise sooner than expected, which would then fix the pension deficit probably, and give shareholders an operationally geared recovery in earnings. It's too risky for me though, but I'm starting to see the potential if one looks forward rather than backwards.

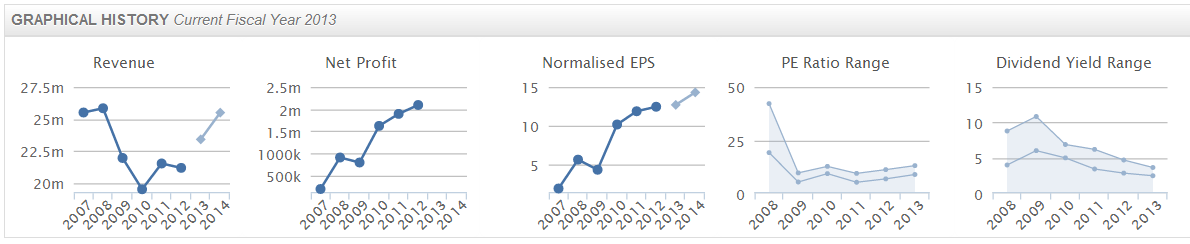

Normalised EPS is forecast at 8.1p for this year and 10.4p for next year, putting it on a PER of 12.8 and 10.0 respectively. There is no dividend, and none can be paid without the approval of the pension fund trustees, so again that pension fund is absolutely pivotal to everything here. Given the risks, I'd be looking for a much lower entry price, probably sub-50p, so at 103.75p per share currently, it's not of any interest to me.

Look how high the shares traded during the last housing boom though:

Next, I've had a quick look at the interim figures today from PPHE Hotel (LON:PPH), or Park Plaza Hotels. However, I don't like the Balance Sheet at all. Not only is there far too much debt, but also there are large advance payments from customers of their apart-hotel business. So the whole thing looks wobbly to me - what happens if the economy goes back into Recession, and they breach their banking covenants? Shareholders would get either wiped out in an insolvency, or would face a dilutive cash call. Definitely not for me.

I'm a great believer in only buying equity in companies with a solid Balance Sheet, having made too many mistakes in the past with over-geared companies which hit an unexpected bump in the road, and have no cash cushion to protect them, ending up at the whim of the Bank Manager. Investors have become deluded into thinking that debt is low risk, as the Banks have been so lenient in the past few years, under pressure from the Government. However in a recovering economy the Banks will be far more willing to pull the plug - so this is becoming a much greater risk, and vigilance is needed to avoid companies with weak Balance Sheets & too much debt, in my opinion. Why take such risks when you don't have to? There are plenty of good companies out there with net cash.

There's an interesting announcement from Renew Holdings (LON:RNWH) today, which has pushed the shares up 4% to 123p. It concerns "three material exceptional items" which have arisen, and will be accounted for in the current year (ending 30 Sep 2013). These are:

- Sale of 71 acres of land near Rugby, for £11m cash proceeds (£9.4m profit).

- Writing down the book value of property in the USA by £5.2m to £2.7m.

- Writing off £2.9m of unrecoverable costs (already expended).

Overall, these combine to produce an exceptional gain of £1.3m, and a boost of £11m in cash, which will eliminate the short term borrowings used to recently buy Lewis Civil Engineering. There will be a net cash position overall at the year-end date of 30 Sep 2013.

Renew also update on current trading, saying they are in line with market expectations.

Renew also update on current trading, saying they are in line with market expectations.

This is all pretty impressive stuff. I liked Renew on their improved performance, and added it to "Paul's Picks" on 30 Jan 2013, based on their solid Q1 Trading Statement, and a forecast PER of only 6.9 at the time. It's since risen 35%, so that was a good move. Pity I didn't buy any real shares in it, but never mind!

As you can see from the latest Stockopedia growth & value graphics on the right, the PER is still reasonable, and the dividend yield not bad.

Given today's statement realising significant cash (I didn't know they had property assets, as I hadn't read the Annual Report so that is a nice surprise), the shares still look reasonably attractive at 124p, a market cap of £74m, although it is a rather low margin business, and I'm not keen on the sector - sooner or later something goes wrong with a contract, and problems ensue. Although they are diversifying into higher margin areas, and of course they are likely to be a beneficiary of an improving UK economy.

As @EntrustTMF quipped on Twitter this morning:

"Nice announcement - stored up a few bits of bad news and got them out under the cover of some better news. Smart :-) In line too"

Let's review the interim results to 30 Jun 2013 from Robinson (LON:RBN) next.

Robinson is a Chesterfield-based packaging manufacturer (plastic & paperboard). However, the company also has substantial property assets (i.e. surplus land) which at some point is likely to provide upside for shareholders over & above the operating business.

The shares are up today to 162p, and with 16.19m in issue that gives a market cap of £26.2m.

Looking first at the operating business, revenues are up 14% and operating profit before exceptionals is up 10% to £1,030k. the EPS figure for the underlying business is 7.1p vs 7.4p for last year's H1. The diluted EPS figure drops to 5.0p, which seems strange, as that implies there must be large potential dilution from unexercised share options.

I have just queried this point about diluted EPS of 5.0p with the company, and they are looking into it, but it might possibly be an error and need restating? The full year EPS figures are correct though, so any issue with the interim EPS figures should not affect how people value the company.

The company's track record in recent years looks pretty good, although it's important to remember that rents from their extensive property portfolio flatter the profits, and are not separately shown on the P&L, so are difficult to gauge:

Let's try something new, with a picture of the Balance Sheet of Robinson (LON:RBN) next to my comments, and see if this works. I've had to cut off the prior year comparatives, as otherwise it won't leave enough room for my comments alongside.

The big attraction of Robinson (LON:RBN) is the strength of the Balance Sheet. So note that the £8.9m property is mainly land & buildings (it was 74% of this category at the last Annual Report date of 31 Dec 2012).

However, their substantial property assets in Chesterfield are probably undervalued by a considerable margin, as they are only recorded in the books at "cost or deemed cost". Hence open market value is probably considerably more than book value, so there is hidden value here.

Note that trade receivables includes the £4.25m sales proceeds from a recently disposed freehold called Portland Works, in Chesterfield. So that is or will shortly turn into cash. WH Ireland believe that Robinson will end the year with c.£6m in net cash, plus all the remaining property assets on top of that, which at some point are likely to be sold. The cash is likely to be deployed at some stage in further European expansion, maybe an acquisition?

So probably the best way of looking at this, is a growth business which will fund its growth from the cash realised from their property assets.

People sometimes ask how do I assess the strength of a Balance Sheet. Ideally I like to see net cash, as in this case you can see there is £1,055k in cash, and no interest-bearing borrowings at all. So that's a big plus. A certain amount of debt is acceptable, but only if it's relatively small (max 1.5 times) cashflow, and that cashflow is recurring.

Secondly, I love freehold property. The reason is that it's a hidden asset, although you have to be careful not to double-count it, as owning a property that you run the business from means that you are saving on rent that would otherwise be payable. In the case of Robinson they do say that the latest property disposal will mean the loss of £400k p.a. in rental income, which makes me wonder how many other rents they receive, and to a certain extent this does flatter the profits of the operating business.

Next one should look at working capital, i.e. current assets vs current liabilities. It depends on the dynamics of the sector, but normally I would expect to see current assets considerably higher than current liabilities, which is necessary to run a business in good order. As a rule of thumb, I like to see current assets above 150% of current liabilities.

In this case, current assets are £12.8m, and current liabilities are £4.0m, so the ratio is way over 150%, it's actually 320%. That shows a very strong liquidity position - this is a business that will not run out of cash, hence it is a safe investment.

Then one needs to look at long term liabilities, which are only £0.7m here, so insignificant. The smaller the liabilities, the better.

Finally, I consider Net Assets versus the market cap. I always write off Intangibles, and to be conservative one should also write off all fixed assets that don't have any resale value. So in practice that usually means retaining only property, and a small percentage of equipment value. In this case, the fixed assets are fine left as they are, as we know the freehold property is probably worth far more than book value, and a key consideration would be to find out how much it is actually worth, and increase fixed assets accordingly, to market value, since property is a readily saleable asset.

In this case the market cap is £26.2m, and the net tangible asset value (NTAV) is £24.1m, and in reality the NTAV is in reality substantially higher than that, if properties were revalued to open market value. Hence this Balance Sheet is just completely bullet-proof, and very much a sleep easily at night type of share for investors.

Broker consensus is for 12.7p EPS this year, and 14.3p next year, so at 162p the shares look pretty reasonable value at PERs of 12.8 and 11.3 respectively. Plus on top, there is all that cash & property, so this is all pointing towards the shares still looking good value, despite having had a very nice run in the last few years.

I had the opportunity to buy some RBN last year at 90p, and was impressed at meeting management at a Mello Central event last year, but like an idiot I dithered, and then forgot about it, so didn't pick up any shares myself, even though I knew it was cheap.

The dividend yield is reasonable too. The forecast is for a 4.5p payout this year (up from 4p last year), and the interim dividend has been increased from 1.75p to 2.0p, so that looks on track. That gives a yield of 2.7% at the 165p current share price, not to be sniffed at, especially as it's been consistently rising by 0.5p every year since 2009.

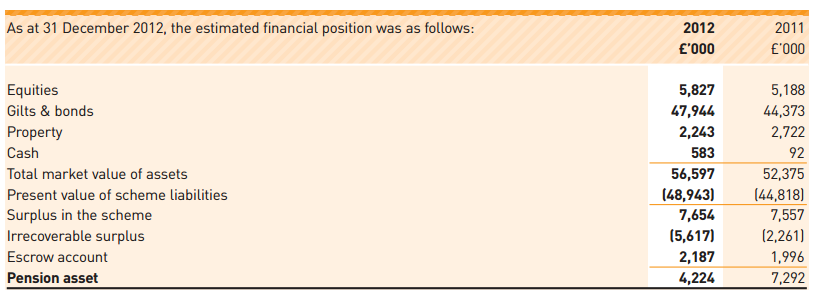

Finally, as the icing on the cake, Robinson has a pension surplus! I've checked the 2012 Annual Report, and it's a real pension surplus, not a phoney accounting surplus. Scheme assets were £56.6m at 31 Dec 2012, of which 85% was in Gilts & Bonds, and scheme liabilities were £48.9m, so a healthy surplus of £7.7m. Interestingly, the company has paid £2.2m into Escrow for pension contributions which were not necessary, so it is possible that this could be returned to the company at some point in the future. That is included within the £4.2m pension surplus shown on their Balance Sheet. Here is the relavent note from the 2012 Annual Report.

Finally, Robinson describe the outlook like this (my bolding):

Market conditions for the rest of this year are expected to remain subdued. The directors are nevertheless optimistic that the Group will show progress in the profitability of the trading business for the year.

So that gives comfort that the broker forecasts & hence valuation look achievable.

Run out of time, after that marathon write-up on Robinson! I was going to look at STV (LON:STVG) but just quickly the results look solid, and the key issue being that net debt has reduced sharply from £55.9m last year to £43.4m. Debt, and the pension fund deficit was the achilles heel at STV, but is now coming down well.

They indicate the dividend will be reinstated, with a 1.5p payment for 2013, which is obviously good news.

Their pension deficit has reduced from £23m to £15m in the last six months, due to the rise in Gilt yields, which is interesting - we should see a similar effect at other companies with pension deficits. The outlook sounds fairly positive.

The share price has risen strongly in recent months, so I wonder if it's now perhaps up with events? I made a nice turn on these shares a little while ago, but as usual sold out too early. Never mind!

Phew, I'm exhausted now! Signing off for today, see you from 8 a.m. tomorrow.

I'll run through again & insert the share prices & correct the typos.

Regards, Paul.

(of the shares mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.