Morning folks,

I'm planning to look at Headlam (LON:HEAD), Spectra Systems (LON:SPSY) and DX (Group) (LON:DX.) today.

Graham

DX (Group) (LON:DX.)

- Share price: 8.65p (-9%)

- No. of shares: 200.5 million

- Market cap: £17 million

Resumption of trading in DX Shares

Lots of drama on the open here as this logistics/parcel distribution outfit finally returned to trading.

The shares had been suspended since March, leaving shareholders to chew over dribs and drabs of news from the company as it negotiated the terms of a potential reverse takeover with John Menzies.

In a July trading update, covered here, trading was reportedly in line with expectations, and the bank was supportive of the £19 million net debt position. The CEO and the CFO simultaneously stepped down from their positions after presiding over huge percentage declines in the share price.

That brings us up to last week, when the John Menzies deal fell through (link) over a failure to agree terms, leaving DX to work on its business transformation alone:

This approach has the support of both DX's major shareholder and its bankers, with discussions on new financing options for DX already underway.

The "major shareholder" in this case is Gatemore, who were previously shareholder activists in French Connection (LON:FCCN) (looks like they've sold up and moved on from that now).

"New financing options": does this mean an equity raise? Maybe the bank is supportive in the short-term, but needs DX to raise more capital for it to remain supportive? That's pure speculation on my part, but is how I'd interpret that paragraph.

With the takeover not happening, the shares are back trading. They plunged >30% on the open but are only c. 10% lower now.

Full-year results "will include the aborted costs of the Transaction and certain other expected non-recurring exceptional items, principally a non-cash goodwill impairment".

Lots of red ink then. More losses on the way.

I probably shouldn't spend any more time on this, because in my opinion this is uninvestable, and is only worth gambling money at this stage.

If you are Gatemore, you can at least get high-quality information from the Board and can negotiate on the terms of a refinancing. Small shareholders, on the other hand, have access to very limited information and won't have any say in the negotiation of a deal.

DX already had negative tangible assets and its intangibles are about to take another big hit. It's a crowded logistics market and while I've been reliably informed that DX's document delivery service, DX Exchange, is valuable, I can't see any good reason for private investors to put any more money into this.

Headlam (LON:HEAD)

- Share price: 575.25p

- No. of shares: 84.8 million

- Market cap: £488 million

My first time looking at this, "Europe's largest distributor of floorcoverings".

I like boring companies. They are the most exciting investments, sometimes. And this sounds pretty damn boring!

The results are pleasing - decent results in their own right, and explained in a very clear way.

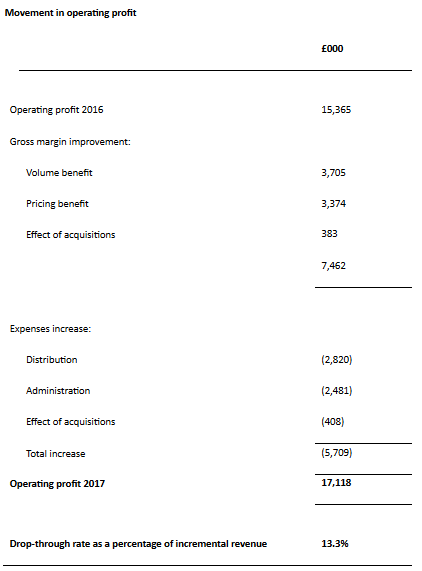

For example, how many companies break down their operating leverage like this:

We can instantly see that volume was the biggest contributor to the gross profit increase, though pricing power also played a role.

Distribution costs didn't increase by as much as either of these effects, so total operating profit increased by 11.4%, or by 13.3% of the increase in revenue.

That's a handy statistic to have. Operating margin for Headlam is actually 5%, but was 13% of the revenue increase during this H1 period.

So to the extent it can make further gains in volume and pricing while controlling distribution and administration expenses in the manner it just did, those gains are highly valuable.

The improvement in gross margin during the period is attributed to "efficiency initiatives and more effective organisation and streamlining of the Company's businesses' practices". More of the same please!

I don't see any balance sheet issues: £72 million in gross cash and £50 million in net funds, after subtracting the value of the debt. There are large committed bank facilities, too. Such a large value of net funds probably means that the "fair" PE ratio should be reduced!

The interim dividend increases by 13% to 7.55p.

Trading is in line with expectations for the full year.

My opinion

I'm really impressed with this, so far.

The business model is simple: a big distribution network connecting floorcovering manufacturers with independent retailers/flooring contractors.

The dividend yield is 4.8% and I note that it has paid dividends every year since 1992!

Payouts have risen every year except for some significant cuts during the crash in 2009/2010.

And for the last two years running, it's been paying out big special dividends (rather than going on an expensive acquisition spree, as some companies would). Pretty much a dividend champion in my book, then!

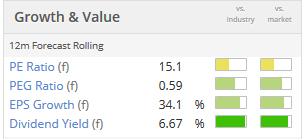

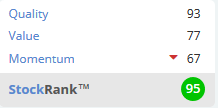

Stockopedia likes it too, and at a 14x PE ratio it seems to be offering a good deal to potential investors:

Spectra Systems (LON:SPSY)

- Share price: 91.5p (+22%)

- No. of shares: 45.4 million

- Market cap: £42 million

Trading update and interim results date

Another first time for me, Spectra makes products for authenticating high-value goods (banknotes, passports and others).

Spectra "is incorporated in, and its main country of operation is, the United States of America" - so we can have that old debate about investing in foreign stocks (albeit USA, i.e. developed market).

Strong update:

...trading in the current year has been strong. Unexpectedly high sales of our phosphour products along with a full year of higher margin in-house manufacturing have combined to produce a strong year todate.

As a result the Board now expects the Company to significantly exceed market expectations for PBTA and cash flow for the full year ending 31 December 2017.

Checking the annual report, I see that it started manufacturing "covert materials" for a G7 central bank in-house. Gross profits rose 35% as a result.

PBTA means Profit before Tax and Amortisation (Amortisation has been a large entry in Spectra's accounts).It recently paid its maiden dividend, having been listed since 2011.

The stock has multi-bagged this year as investors figured out performance was improving.

Despite the surge that's taken place in the share price already, this looks like one of those that could just run and run. Phosphour sales were up 211% in 2016, which was approximately half due to an acquisition and half due to a "new sales channel".

It's all rather mysterious.

I note that Spectra itself doesn't seem to know for sure who its end customers are. From the 2016 report, its important near term opportunities were said to include:

The continued sale of our specialty phosphour materials to a security thread manufacturer providing product to what we believe is a large Asian central bankHow interesting! I guess there are other industries where you don't know where your products wind up in the end, but not quite like this!

Since it doesn't know who its end-customers are, it also doesn't really know how long the demand will remain high:

Although we cannot be assured of the continued sales levels of the phosphour materials, we are confident that our proven ability to deliver large quantities of material in 2016 to a new customer will have lasting value which will translate into sustainable increases in our sales of these materials.

Seems likely to be worth a punt, but difficult to verify its claims and customers for yourself. Difficult to verify its products, too!

The valuation looks potentially attractive for a niche business with growth opportunities. It also has $8.8 million in cash and no debt.

Before today's share price rise, the value numbers were as follows:

I think that's it from me today.

Paul should be back tomorrow!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.