Good morning!

Somero Enterprises Inc (LON:SOM)

(at the time of writing, I hold a long position in this share)

I recorded a fascinating interview yesterday afternoon with the CEO & CFO of Somero Enterprises Inc., listed on AIM since 2006. This is a highly cyclical specialist maker of laser-guided concrete screeding machines, which claims to be (by far) the world leader in this niche. The company is based in the USA, where it does most of its business, but is also expanding into China, and has smaller sales in many other countries.

Why it was particularly interesting to interview this company's management, is for their insights on the economic outlook in USA & China in particular, which I focussed on. I was expecting to hear caution, but not a bit of it! They were very bullish about the economy in America right now, and the pipeline for the next 1-2 years.

With regard to China, their feeling is that the market opportunity there is enormous, and so far they have only scratched the surface, that even in more depressed conditions there is still plenty to go for.

This interview has added to my general sense that things are perhaps not as bad as the markets seem to be thinking. For that reason, I closed nearly all my large cap shorts yesterday, and went long of a basket of US large caps with Stockopedia StockRanks in the high 90's. I'm lucky enough to have the US subscription service here, and it's very helpful to see all the key numbers in a format with which I am familiar. Just one successful trade would easily cover the cost of a subscription - it amazes me how people will cheerfully punt on the markets and lose thousands without a qualm, yet baulk at paying a few hundred quid for quality information sources - false economy if ever I've seen it.

This sanguine view is confirmed by a deluge of trading updates in the UK in recent weeks, most of which seem to have been fine, both in terms of 2015 results, but also outlook. I'm seeing a generally fairly confident tone in the outlook comments that UK small caps are putting out at the moment, with obvious exceptions such as embattled sectors like resources & associated service providers.

Therefore, for what it's worth, I'm more a buyer than a seller at the moment, for reasonably-priced, financially sound UK small caps. There are some nice discounts on offer today, for things that have seen purely sentiment-driven selling in the last 3 weeks, but where fundamentals are fine.

EBITDA

I questioned mgt of Somero about this in my audiocast yesterday. Why did they quote adjusted EBITDA in their trading update? Investors generally want to know about real profit, not "bullsh** earnings", as Charlie Munger famously described EBITDA.

I know a lot of PR people & brokers read my articles, and are the people who often write, or at least edit trading updates for their clients. More and more updates are using EBITDA as the benchmark performance figure. I can't talk for everyone, but the overwhelming view in my investor network sees this extremely negatively! So you're not doing your clients any favours at all by quoting EBITDA in announcements, instead of what you should be quoting - profit before tax (it's fine to adjust out acquisition-related intangibles, and genuinely exceptional items).

By quoting EBITDA in a trading update, I immediately think they're trying to pull the wool over my eyes - since many companies (especially in tech) aggressively capitalise development spend, thus producing a wildly inflated EBITDA figure which bears no relation at all to the genuine profits (if any) being generated.

(Some people always point out at this stage that accounting standards require companies to capitalise development spend. That may be true in theory, but in practice, is untrue. Companies effectively have carte blanche to do whatever they want, within reason. Some companies write off everything, others capitalise as much as they can. It's a policy decision, and can get past the auditors either way, providing it is reasonable & defensible. There is no single correct profit figure - there is a sliding scale, often surprisingly wide, of available profit figures which management can choose from, by adjusting their accounting assumptions, levels of prudence with provisions, etc.).

So quoting EBITDA in announcements is extremely negative. Stop it! I want to know what the genuine profits are, not an inflated EBITDA figure.

Oil sector

Sometimes you hear something which you know makes sense, and will probably make you a lot of money. I got that feeling yesterday, when an analyst said that the current depressed oil price presents a "generational opportunity" to make money from oil company shares.

Obviously you have to be very selective, and balance sheet strength is key - more than that, cash is key - as we're likely to see a wave of insolvencies in the sector if low prices persist. The analyst went on to say that c.80% of the world's oil production is now below cost, therefore it's inevitable that supply will eventually contract, and demand increase, such that the imbalance will switch from a glut, to a shortage. That will inevitably lead to higher oil prices, and a geared effect on the share prices of oil producers which survive the downturn. Nobody knows when, mind you.

This very much struck a chord with me, so I've started building up positions in cash-rich, low cost oil producers. It's not my area of specialism, and it's a complex area to research and invest in, since there are many more factors to consider. Looking at historic and forecast data is fraught with risk. So I'm relying on sector experts with a proven long-term record of success to guide me. Don't ask me for any tips please, and I won't be including oil shares in these reports, unless something really exceptional crops up.

For now, I prefer to just pick up a basket of stable, financially strong, low cost oil producers, and am prepared for potentially large short term losses - nobody knows when or where the low will be, but I think we're getting close to the point where it's just a question of starting to buy, and then adding to positions as they drop further. I usually buy (and sell) too early, so it might be sensible to ignore me, and wait a bit longer.

All food for thought anyway!

MartinCo (LON:MCO)

Share price: 131p

No. shares: 22.0m

Market cap: £28.8m

Trading update - this announcement came out yesterday, but I missed it in the blizzard of things going on.

The summary is that 2015 was in line with expectations, and so is current trading. Unfortunately, I can't see any broker estimates, so can't quantify this.

It looks potentially interesting though, as group revenue rose 38% in 2015, and the balance sheet contained £2.3m of net cash. The business seems to be franchised property management, focussed mainly on residential lettings.

Note that the shares have drifted down heavily, from a peak of nearly 200p last autumn, to 131p today. Sentiment has probably been hit by the declining attractions of buy to let for private investors, due to impending tax changes. Also the property sector seems to be attracting new entrants online, with much lower overheads than traditional agents. Therefore it looks a sector which is set to suffer from disintermediation (i.e. technology enabling buyers & sellers to connect directly, cutting out the middleman) via the internet, as are so many other sectors too. So the speculative money seems to be chasing massively over-priced hype stocks in this sector, like Purplebricks (LON:PURP) .

It sounds as if Martinco's business is robust;

"We do not envisage the Government's recent changes to the buy-to-let sector significantly impacting on our business. We are well positioned to sell investment properties if investors do decide to exit, and our research suggests that larger investors will purchase this stock. Buy-to-let investors have generally reduced gearing in their portfolios over the years since 2008 and are well positioned to absorb rising interest rates.

"We remain positive about the outlook for our core lettings business, from which 76% of our franchise royalty income is derived. I look forward to providing a further update at our full year results in April."

I don't really have enough figures to go on, so cannot form a view on the valuation of this share at the moment. I look forward to reviewing its 2015 accounts in April (why so late? Come off it, a small company like this should be issuing results in Feb, not Apr. Sloppy).

The chart looks intriguing - I like shares that have dropped a lot, but then issue upbeat results and outlook statements, as this one has. Sometimes that can be a bargain.

Animalcare (LON:ANCR)

Share price: 203p (down 1.0% today)

No. shares: 21.1m

Market cap: £42.8m

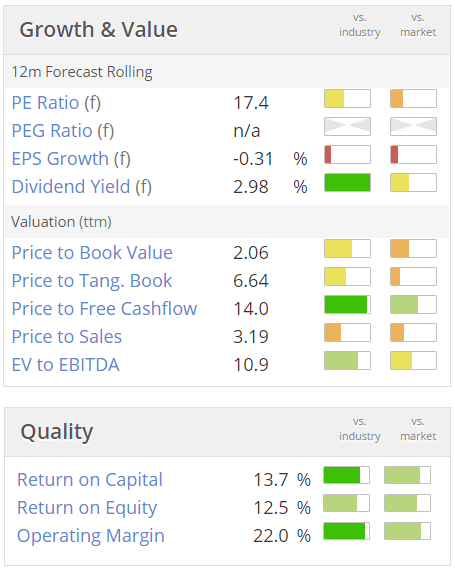

Also note that it has a high StockRank of 97.

Ed has explained in the past that a high StockRank is no guarantee of success, but picking a basket of high StockRank shares should, over time, out-perform a basket of low StockRank shares, and the performance stats validate that.

So personally I always get a warm glow when a share that appeals to me on fundamentals also has a high StockRank - it's almost like having a robot friend that is checking my work & giving me a reasonableness check. I try to keep low StockRank shares to a minimum in my portfolio, as the odds of success are lower, so selection has to be very careful, and higher conviction, to make me take the additional risk.

Trading in H1 (to 31 Dec 2015) sounds OK, if unexciting - revenue up 2.7% to £7.1m, although that rises to 5.6% if a one-off £0.2m sale in the prior year is excluded.

What concerns me is that the PER has risen from about 12 in 2014, to 17.4 today. Therefore the share price appreciation since I last looked at it in Oct 2014 has been all about expansion of the earnings multiple, rather than the business doing much in terms of growth.

This is a general problem with small caps. We used to be able to buy good companies on a PER of about 12. Now we have to pay 15-20 for similar companies. Maybe that is a function of ultra-low interest rates for an extended period? Assets become inflated in price. Remember the concept of mean reversion - what goes up will eventually come down again.

Cash - this has risen to £6.1m, and the historic figures show nice cash generation, with the company hoarding a growing cash pile. Cash represents 14.3% of the market cap, so it's fairly significant. It would be interesting to find out what the company intends doing with its cash pile - acquisitions, or a special divi perhaps? Given its stable, and high operating margin, the company doesn't need to hoard cash, and could actually run with say £4m or more of net debt. So there is scope to release about £10m in cash for other purposes, in my view - giving potential upside for investors.

New products - details are given about new products being developed, so I think this is the key area to research, if looking into this company in more detail. If it has good growth in the pipeline, then the shares might end up looking cheap in a year or two perhaps? I like the concept of cash generative companies funding their own growth, through new products, or acquisitions.

Dividends - a nice progression of well-covered divis has been paid out in recent years. The forecast yield is currently about 3%.

Outlook - sounds confident;

Following the solid trading performance in the first half, particularly across the Licensed Veterinary Medicines and Animal Welfare Product groups, the Board remains confident about the prospects and outcome for the full year.

My opinion - this is only a brief review, as usual, so more in-depth research is always necessary. On the face of it, this share looks perhaps priced about right, or possibly a little too expensive? It's difficult to justify a PER of 17 for a company with pedestrian growth, although adjusting out the cash would bring the PER down to nearer 15, not outrageously high, but hardly a bargain.

If you think the new products are set to generate significant growth in profit, then it might be worth pursuing.

It looks a good company, and has a lot of features I like - high profit margin, decent & growing divis, net cash, stable & predictable profitability, I'm just not convinced the current valuation stacks up.

Another point to consider is whether customers might squeeze its margins? Vets have traditionally been fragmented, so individual customers had little buying power. Now that groups like CVS are consolidating the sector, then maybe a more concerted effort might ensue for customers to eat into ANCR's high margins? The availability (or not) of cheaper, substitute products needs to also be a key avenue of researching this share, to determine whether its profit margins are sustainable or not.

Overall though, this one looks potentially interesting to me, and certainly worthy of deeper research. If you like the company, then the recent sell-off looks a potentially good entry point in relative terms, if not in absolute valuation terms perhaps?

Eckoh (LON:ECK)

Share price: 44p (down 3.8% today)

No. shares: 224.8m

Market cap: £98.9m

Trading update & contract wins - this RNS came out yesterday, and sounds amazingly bullish,with new contract wins, a bulging pipeline of opportunities, etc.. Which is all great, but the trouble is, it's already in the price, because the update for y/e 31 Mar 2016 is only in line, not exceeding expectations;

...the Group remains on track to deliver full year results to 31 March 2016 in line with market expectations.

Valuation - broker consensus is 1.37p EPS for this year, and they usually use adjusted earnings, so it's a full figure, and the PER drops out at 32.1 times, clearly a very rich multiple that anticipates considerable further growth in profits.

EPS forecast for 2016/17 is 1.77p EPS, so the PER then falls to a still high 24.9 times.

My opinion - this share has sold off quite a bit recently, but it still looks expensive to me. The company seems to be on a roll with contract wins, etc., but the share price already seems to factor in flawless execution.

Also, as a general point, companies tend to make a big deal about new contract wins, but they don't announce attrition, of existing contracts expiring & not being renewed, do they?! (unless they're so material that they trigger a profit warning). As the CEO of one AIM-listed company once told me - ignore contract win announcements, unless they are accompanied by an out-perform against market expectations statement, and broker earnings upgrades. Companies win & lose contracts all the time, it's part of the normal operation of a business. It's only when the aggregate triggers upgrades to estimates, that it's of any real significance.

Also with ECK look at how much is adjusted out of the P&L for share option schemes (backdoor remuneration) - £1.2m in 2014, and £0.9m in 2015 - highly material numbers in both years, which makes you wonder for whose benefit this company is run, when you compare that with the dividends paid out in those years of £0.5m and £0.7m respectively!

The share option charges were not only considerably more than total dividends paid to all shareholders in both years, but represented nearly 57% of adjusted operating profit in 2014, and nearly 28% in 2015. So this company is clearly a lucrative vehicle for management, less so for shareholders, with a paltry 1% dividend yield.

So with this share still priced to perfection, paying out-sized rewards to Directors, and a poor divi yield, the growth potential isn't exciting enough to compensate for the negatives, in my view. To my mind it would start to look more interesting at, say, about 30p per share (tops), and if the divis were increased meaningfully, along with curtailing share options.

Finally, a few brief comments on things I overlooked earlier today;

Quixant (LON:QXT) - Trading update - profit "comfortably in line with market expectations" for calendar 2015, so that's reassuring.

Completed acquisition of Densitron in Nov 2015 - pleased with progress.

Outlook - positive;

"The Company has started 2016 well, with a healthy order book. This underpins our confidence in achieving market expectations for 2016."

My opinion - PER of 25 for 2015 looks high. Drops to 15.1 times forecast 2016 earnings, so valuation rests on forecasts being achieved. Doesn't look very interesting to me.

Empresaria (LON:EMR) - trading update - for calendar 2015 - ahead of expectations, despite currency headwinds.

Adj PBT expected to be up 23% y-on-y. I make that about 10p EPS, so looks quite good value at 87p.

Net debt reduced to £7.3m. Sounds good, but the balance sheet is still quite weak.

My opinion - I see modest upside, maybe to 100p from here. The group seems to be performing well, and has a StockRank of 98. Worth a look.

Escher Group (LON:ESCH) - shares up 11.1% to 175p today, so market likes today's trading update.

Reports adjusted EBITDA nearly doubled to $4.0m in 2015 vs 2014. Real profit figures are not given, unfortunately.

Net debt reduced to $2.7m, which sounds manageable.

Licensing revenues will "continue to be uneven and difficult to forecast" - which is the Achilles Heel of this, and many other software companies.

My opinion - it's impossible to forecast accurately, hence impossible to value the shares with any degree of confidence.

4imprint (LON:FOUR) - yet another strong update from this quality company;

Consistent with the trend reported in the trading update issued on 21 October 2015, strong organic growth continued through the fourth quarter of 2015. Unaudited Group revenue for the year ended 2 January 2016 was $497.2m, 20% higher than the prior year comparative of $415.8m. Underlying** profit before tax is expected to be at least in line with market expectations.

Net cash is reported at $18.4m.

My opinion - a super company. I would be reluctant to buy now - if the USA is entering recession, then we could have already reached peak earnings?

International Greetings (LON:IGR) - (at the time of writing, I hold a long position in this share) trading update was issued on 18 Jan 2016. Strong trading over Xmas, in line with expectations for the full year.

Directorspeak - focus on cash conversion & paying increasing divis (I like it).

PER of 12.5 (based on 153p share price) looks fairly good value, after recent sharp decline in share price. I like a big fall in share price, combined with a positive trading update - so it looks like selling has been sentiment-driven, and could be a buying opportunity perhaps?

All done for today! See you in the morning.

Usual disclaimers apply.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.