Good morning! Another exciting morning, with a lot of price volatility in some more speculative stocks.

Hornby (LON:HRN)

Share price: 73p

No. shares: 39.2m

Market Cap: £28.6m

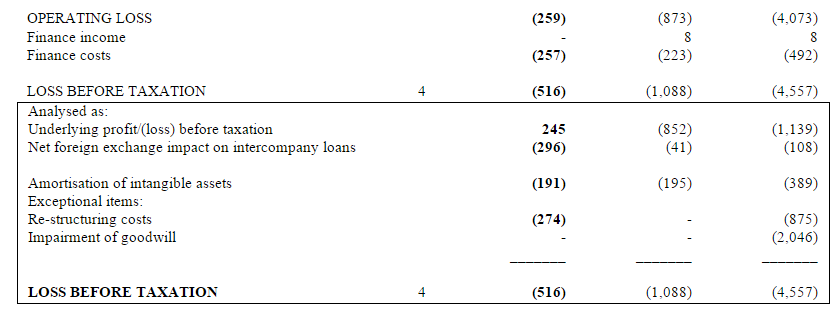

Interim results - for the six months to 30 Sep 2014 are published this morning. A modest improvement in underlying profits is reported, on turnover up 8% to £24.2m. See the excerpt below from today's results, for a reconciliation of statutory and adjusted profit. These adjustments look reasonable to me, so I'm prepared to accept the £245k underlying profit figure as representing the true performance of the business:

It's not clear what the seasonality of the business is. I note that turnover was weighted towards H2 last year, but profit was only slightly better in H2 than H1. One would expect more buoyant trading in the H2 period, as that includes Christmas & the run-up to it - this type of product must be popular as a seasonal gift, maybe not so much for children, but older customers who seem to now be the market for this kind of product - as a nostalgia for their youth thing perhaps?

Outlook - as this is a turnaround situation, the outlook statement is vital for signs of progress, so here it is;

The final results for the year as a whole depend on the success of the Christmas trading season and current indications are that it will meet the Board's expectations. As a consequence, and despite the additional costs of the ongoing investment in the future of the business, the Board currently expect to meet market expectation for the year as a whole in terms of sales and profits.

Valuation - broker consensus is for 2.8p EPS this year (to 31 Mar 2015), so the market is ascribing a PER of 26.1 times, based on the 73p share price. Clearly that is too high a valuation, were earnings to plateau at that level, so the market is effectively pricing in a future doubling of profits from this year's expected level of profit (since a PER of about 13 would be the right ballpark valuation once the turnaround is complete).

Balance Sheet - net tangible asset value is £19.3m, which I'm happy with. The current ratio is satisfactory at 1.32. However, this company has £14.8m in inventories, which is too high in my opinion. That compares with cost of sales (on the P&L) of £12.9m for the half year. So in other words, the company holds over six months worth of stock. Perhaps that is inevitable given the range of products. It is however rather inefficient, and there could be a fair bit of slow-moving stuff within that inventories figure.

I wouldn't mind particularly if the company was debt-free, but it is effectively financing this large amount of stock through bank debt. Some of that will be stocking-up for Xmas, but I note that the inventories figure was still large, at £13.2m on 31 Mar 2014, suggesting an over-stocking issue throughout the year.

Net debt is too high. The company reports £11.0m net debt as of 30 Sep 2014. For a company that's been loss-making, and is only now becoming marginally profitable, that's not a comfortable position. The expiry date for the UK facilities is Dec 2015, and this comment worries me - there could be a Placing on the cards next year perhaps?

The current UK banking facilities that expire in December 2015 together with the other Group facilities are expected to allow sufficient headroom for working capital needs over the next 12 months. This is based on a model of the Group's forecast cash flows as adjusted for current commitments and suitable sensitivities. We are now starting to develop longer term plans for next year in order to determine the associated funding requirements.

My opinion - all investments are about weighing up risk & reward, and trying to find situations which are assymetrical - i.e. where the reward is good & probability of getting it high, combined with low risk of a downside scenario playing out, and/or the downside scenario being limited to a haircut rather than a wipeout.

In this case, I don't see a favourable balance of risk/reward. There seems too much expectation of increased earnings already baked into the price for my tastes.

The company seems to be doing lots of things to improve performance, and I particularly like that they have homed in on social media as a way of testing reaction to possible new product, etc, a very sensible move that you might not have expected from a traditional company like this. However, there's also a hint of caution (bolded below) that makes me unwilling to pay the current price for this share;

During the first half of the year, the team has made material progress in organising the turnaround of the company. Operationally, we have moved our warehouse to improve logistics processes, cleared aged stock, worked with vendors in Asia to improve supply chain performance and delivered a small profit in the period. Strategically, we have started to invest in a new ERP system, set up an E-commerce team and strengthened the business with key new recruits across a range of functions. We see further operational and strategic challenges ahead of us, but we also see that demand for products is strong and we remain confident that the group can continue to improve performance over the coming months and years.

Bit of a mixed bag there. Overall, it's not for me at this price. You can find vastly more exciting growth companies for a PER of 26 times, so why buy this at that valuation?!

Snoozebox Holdings (LON:ZZZ)

Share price: 9.75p

No. shares: 211.8m

Market Cap: £20.7m

I am viewing announcements from portable hotel company Snoozebox with scepticism at the moment, as the race is on to get their share price meaningfully above 10p before 15 Dec 2014, as that's the date when a considerable number of 10p warrants expire. Holders of the warrants are only going to exercise them if the share price moves above 10p, because there would be no commerical logic to exercising them if you could buy shares in the market at a lower price. Although a large holder of warrants might still exercise them, even if they were slightly out of the money, if the market was too illiquid to secure that quantity of existing shares.

Contract win - despite my scepticism, this contract win is actually worth mentioning. It's to supply accommodation for Premier Oil, for one year, and broker Panmure Gordon believes the contract value to be c.£2.7m in 2015 - that's 29% of forecast revenues for the year. So it's a material contract win. It utilises the old v1 Snoozebox units, which is important, as it demonstrates that they have considerable value & earning capacity still, for semi-permanent sites. The new v2 units are vastly better for shorter term installations, where they can be set up in hours rather than days. These are being manufactured now, for launch in 2015.

My opinion - this contract win should underpin the figures for 2015. Results for 2014 are likely to be poor, we already know that. However, the new v2 units are a vast improvement - they are no longer made from shipping containers, they are actually bespoke trailers which are just hooked up to a HGV tractor unit, and off they go to an event. Anyone who saw the v2 unit at Mello Derby couldn't fail to have been impressed with the quality of the offering - tiny, but remarkably well appointed hotel rooms basically.

I can understand people being sceptical about Snoozebox, given it's appalling track record to date. However, dig a bit deeper, and there is a successful business in the making here, in my opinion.

Ebiquity (LON:EBQ)

Shares here have been drifting down over the last six months, as with most smaller caps, for no particular reason, just general market sentiment.

Trading update - this sounds fairly positive overall;

The Company reports that revenues to the half-year have shown strong growth with a number of significant clients confirming contracts with increased scopes of work across its divisions and geographies.

Overall in constant currency terms Ebiquity has enjoyed strong organic revenue growth particularly from the strategically important Media Value Measurement (MVM) and Market Performance Optimization (MPO) divisions.

Despite significant adverse fluctuations in the major currencies in which it trades, the Company is performing well and on track to meet market expectations for the year as a whole.

My opinion - I set out the positives & negatives about this company in my report of 16 Jul 2014, and these are still relevant, so here they are again;

Positives

- "Underlying" diluted EPS of 10.1p is up 12% on prior year, and ahead of 9.45p forecast

- Superficially cheap on fwd PER of 11.8 (based on adjusted EPS though!)

- Good "underlying" operating profit margin of 16.6%

- Expanding globally - growth potential?

- Upbeat outlook statement, refers to "high level of visibility" for this year, acquisitions performing well, confidence in year ahead.

.

Negatives

- No dividend

- "Highlighted items" are highly material (and some are questionable), at £6.7m, reducing underlying operating profit from £11.3m to only £4.6m

- Too much debt - £22.8m net debt at 30 Apr 2014 (up from £15.5m prior year)

- Horrible Balance Sheet - net tangible assets are negative £25m!

- Capitalised £796k of purchased intangibles in the year

.

Overall, the Balance Sheet looks far too stretched for my liking, although it does look quite an interesting business. If you can stomach the unpleasant Bal Sheet, then it might be one to consider doing some more research on. The company's activities sound intriguing & growth areas.

Looking at the chart, this might be a good time to buy perhaps? I like charts where the share has been going down constantly, but then a positive trading statement is issued, as that can sometimes be a turning point. There might be scope for a (say) 20% bounce in share price back up to 120p, possibly?

These shares seem illiquid, so the free float must be quite small - looking at the shareholder list, it seems to be dominated by Institutional holdings, with not many shares in private hands by the looks of it.

Signing off for the day, and the week.

Have a super weekend. My next audiocast should be published Sat afternoon, 22 Nov 2014. Here are the previous ones - these are proving popular, so I'll keep doing them, as long as willing interviewees with good insights are willing to do them!

Next week's reports - I will be on holiday in Las Vegas, so will be in an unfavourable time zone re UK markets & news. Hence I will publish reports in the evenings UK time as best I can. Coverage may be somewhat sporadic, but I'll do my best!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in ZZZ, and no short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.