Good afternoon!

It's been amazingly quiet for company results this week, so I've made a diary note to take this week as holiday next year. I suppose we're in that lull, where all the decent companies have already reported their 31 Dec year end figures. So we're just getting a few companies with unusual year ends reporting now. Then we'll need to ready ourselves for the next deluge of results in May/Jun from the popular 31 Mar year end.

Ben has written another excellent article in his series of interviews with famous fund managers. This time he's met Gervais Williams of Miton Group.

Here is the list of Ben's other interviews - all of which are very interesting I think.

Ed's webinar from yesterday, looking at Stockopedia's greatly expanded international stock coverage is now on YouTube here. Do take a look, if you're interested in international investments.

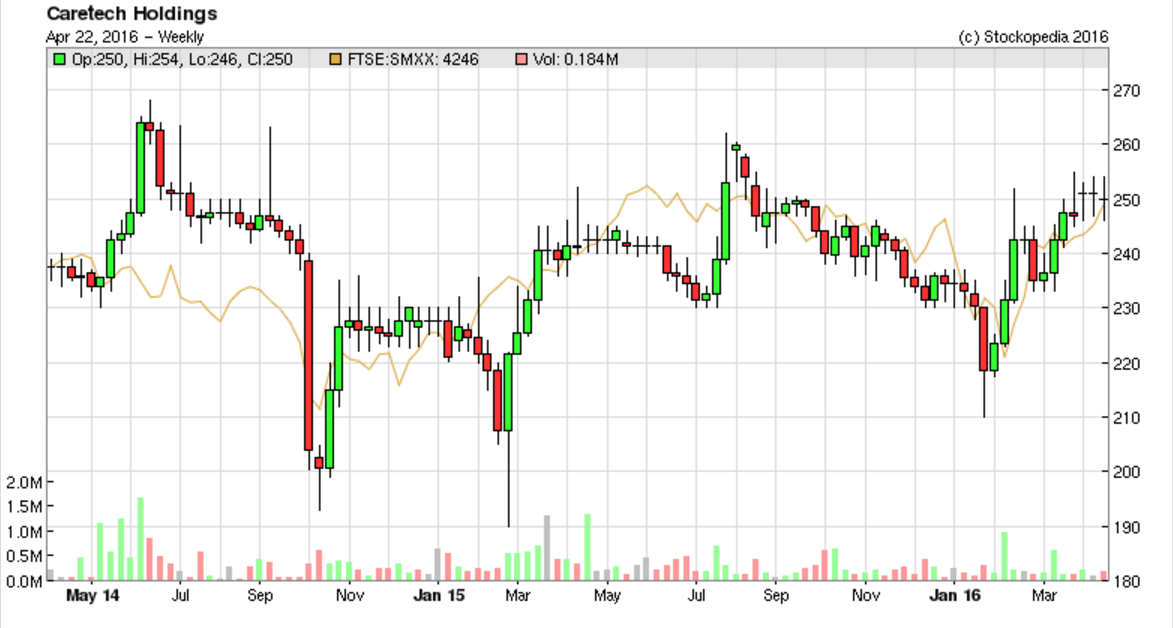

Caretech Holdings (LON:CTH)

Share price: 252.7p (up 1.1% today)

No. shares: 62.3m

Market cap: £157.4m

Trading update - for the half year to 31 Mar 2016. The company owns & operates specialist social care facilities - e.g. for children & adults with learning difficulties. The customers are therefore local authorities, and health service commissioners, out-sourcing to CareTech.

The company (or group rather) appears to be trading well:

The Board confirms that trading for the half year is in line with its expectations. This performance has been underpinned by the strategic initiatives undertaken over recent years which have delivered a stronger performance compared with the same period last year on all of the key financial metrics.

Clearly then, the success or failure of the business will depend on the willingness of local authorities to accept fee increases. This is especially important, as Living Wage will be a constant ratchet up in costs between now and 2020.

Annual fee rate negotiations with local authorities remain at an early stage and this year are against the backdrop of the Living Wage, which was introduced on 1 April 2016. The Board anticipates that a more positive outcome will be achieved than in recent years and that the Living Wage costs will be covered by fee increases.

That sounds encouraging.

Net debt - is reported at £156.6m, slightly down in the last 6 months. Whilst that might sound a lot, it's supported by freehold property with a Net Book Value (NBV) of £234.8m, as reported in the last Annual Report.

The last Annual Report shows freehold property (at cost) of £234.8m. The latest valuation of freeholds, given today, indicates a higher figure, of £282m. So the net debt seems alright, given that it's funding freehold property.

Directorspeak comments today sound encouraging:

"I am pleased to report another solid performance in the six months ended 31 March 2016, highlighting the growth trajectory that our strategy is delivering. We are pleased with the two acquisitions made during the half year, which are trading in line with our expectations. We were also pleased to announce in February the innovative and non-dilutive ground rent transaction which raised £30m to further strengthen our balance sheet.

"We have considerable headroom for further acquisitions with the ground rent monies, money from our existing bank facilities and from our strong underlying cash flow. We intend to continue to deliver our exciting growth strategy, both organically and through bolt on acquisitions."

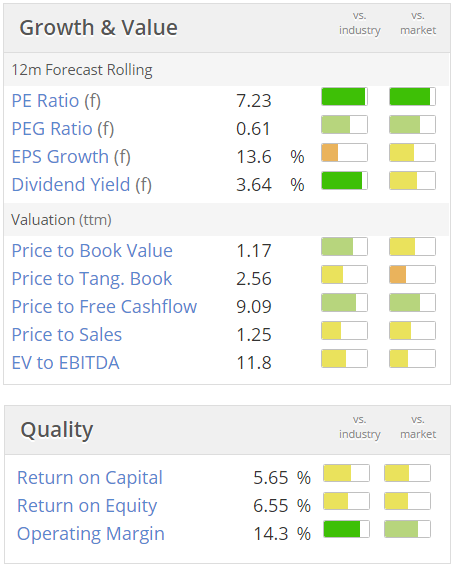

Valuation - as you can see from the Stockopedia graphics, this share appears good value on both a PER and divi yield basis (the darker green bars).

Also note that the operating margin is strong, also with a darker green bar.

It's unusual to find good value, combined with high quality. Operating margin is the most important quality measure, in my view. Some people disagree, and prefer ROE & ROCE. Each to their own.

Note that the StockRank of 87 is very good. This means that statistically, the share is more likely to out-perform, when in a portfolio of other high StockRank shares.

My opinion - I quite like it, the figures look attractive.

However, for me, the enormous fly in the ointment, is that this type of business is only one change in Govt policy away from disaster.

What happens if, in the future, Govts decide they need to cut budgets for social care even more, and fees are frozen? The rising costs of Living Wage would then rapidly erode the currently high levels of profit.

I vividly remember this very issue causing the downfall of Southern Cross Healthcare a few years ago. Costs rose, occupancy was too low, and the LAs started to refuse fee increases. So it went bust.

CareTech has a much more sound balance sheet than Southern Cross had. I like that it owns the freeholds to many sites. However, the properties are so specialised, that their valuation is dependent mainly on what profits are generated from that site. Therefore, if in future the Govt/LAs decide to squeeze its profits down by refusing fee increases, then that would not only hit profit, but would also damage the value of its freeholds.

Freehold values might then fall to alternative use value, which could be a lot lower for some sites perhaps?

Therefore, to my mind the low valuation is probably justified, considering the high inherent risks. However, if the company can maintain the status quo, in terms of good profitability, and fee increases, then the shares would be worth having.

The other risk with this type of business, dealing with vulnerable people, is of abuse of patients by staff. That has happened before in this sector, and can be very damaging, both in human, and financial terms.

Overall then, I'm quite tempted, but this is not a sector I want to invest in, so will probably give it a miss. As always though, I reserve the right to change my mind, after mulling things over.

Goldenport Holdings Inc (LON:GPRT)

De-listing - it's game over for this Greek shipping company, listed on on the main market, amazingly - despite a market cap of only just over £100k now.

The ships are now worth less than the bank loans, and the bank wants them sold & the loans paid off (at least partially).

A similar thing happened with Hellenic Carriers, a similar company, whose shares de-listed earlier this week.

My personal view is that, if a company is clearly worthless, then it makes sense to sell the shares, providing you get more than the dealing costs. We had a discussion about this at my local share club, which I am Treasurer for, here in Hove. The club held a position in doomed Fastjet (LON:FJET) which was only worth £120. The club members said, let's just write it off, we've lost our money.

I pointed out that if there were 6 £20 notes lying on the table, we wouldn't just leave them for the cleaner, we'd put them in our pocket! So on the same basis, we should sell our FJET shares. They agreed last night, and I sold them today. It's always better to retrieve something from a disaster, in my view. As opposed to just throwing the money away by letting the shares de-list, and hence usually ending up completely worthless.

In my view, there will be many more de-listings over the next year or two. So it's really important to check those micro cap holdings, and ensure that there is a clear reason for the company to remain listed.

Chapel Down (OFEX:CDGP)

Share price: 33p (down 1.5% today)

No. shares: 101.0m

Market cap: £33.3m

Results y/e 31 Dec 2015 - it's disappointing to see such a small business take so long to produce its accounts - when it should be a quick & simple job. So I would like to see financial controls improved.

This is a English south coast producer of wine & beer. I've been told that their wines are rather good, but haven't sampled them myself, maybe I should jump in the car (or catch a train, more advisedly) to visit the company's vineyards, and sample them. I wonder if ShareSoc could get them to come along to a Brighton investor evening?

The company seems to think that it's performing well, saying:

I am delighted once again to announce a good set of results for Chapel Down Group plc.

It reports £507k adjusted EBITDA, up just 6% from prior year. However, after at the PBT level, it's actually an LBT - loss before tax of £279k - a deterioration from 2014's LBT of £40k.

The main divergence is caused by a big increase in share based payments, which look excessive at £420k in 2015. How can it possibly make sense for effectively bonuses to management, through shares, to consume all the profit, and cause a £279k overall loss? That seems pretty bonkers to me. So this looks very much like a lifestyle business, rather than a company that is run for the benefit of outside shareholders.

That said, I am reliably informed that there are excellent discounts on product available to shareholders, so I'll look into that, and possibly pick up a few shares just for the perks.

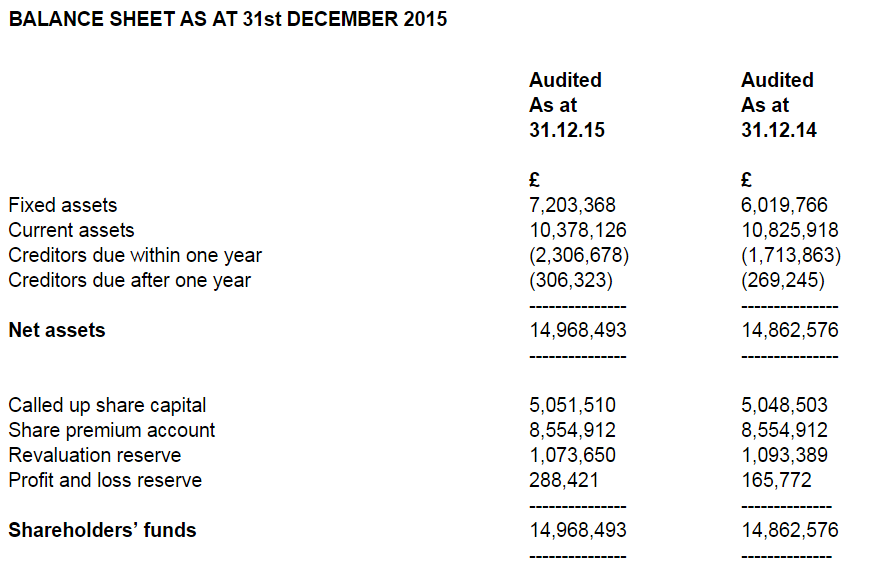

Balance sheet - is strong, but very strangely presented - only giving subtotals, and no breakdown of what is within current assets, for example. Most odd.

From the notes, I see that £5.0m is stock, and £3.1m is cash. So the balance of £2.3m must be debtors. Why am I having to calculate this manually? It should be shown on the face of the balance sheet, as everyone else does! Maybe it's an ISDX thing? Give investors half the numbers, and let them work out the others, as a brainteaser?!

Crowdfunding - I'm impressed that £1.7m has been raised in this way to build a new brewery in Ashford. There have been some remarkable successes in crowdfunding for craft beer companies, so this is quite a hot space.

Awards - the company has won 3 awards for its wines in 2015. That could be good for the brand, longer term.

Risks & uncertainties - in the past I've tended to ignore these comments from companies, but I'm starting to focus more on them. There are often some very useful pointers in this section. In this case, the EU Referendum is mentioned specifically:

The uncertainty surrounding the EU referendum has had no real impact on our business to date. We would be affected, like all agriculturally based businesses if we were not able to access EU workers for our viticulture and the expertise in winemaking available in Europe. However, maintaining and developing a strong brand with high quality people is our best defence and we will continue to invest to ensure we are well placed.

There is always a risk of a poor harvest through extreme weather events which we mitigate through maintaining the highest standards of viticulture, choosing the very best sites and utilising the latest proven advances in technology and agriculture. We source from a wide geographic area to minimise micro-climatic variations. The diversification into beer also further protects our ability to continue to grow.

Competition continues to grow in our markets of English wines and craft beers, and we continue to invest in our people, brands and distribution to ensure that the business can thrive.

Outlook - this all sounds upbeat, and I like the touch of humour, re its customers being thirsty!

We have excellent fast growing brands in two very exciting markets and a strong balance sheet. We have blue chip customers, good export potential and enthusiastic and thirsty consumers. We have more stock of our wines available and more customers wanting our beer and cider.

With the construction of our new brewery on a highly visible site in Ashford, the development of our site in Tenterden and the continuing shift in demand towards high quality drinks made with passion and care, we remain confident that the prospects for the Group are excellent.

My opinion - OK this historic figures are rubbish, and the £33.3m market cap looks over-the-top by a considerable amount, looking at the historic figures. However, as a growth business, it might have potential, who knows?

I would be interested to know how rapidly the company could scale up production, if its wines become really popular? There seems to be a time lag to age the wines, which is not helpful. 90 more acres were planted in 2015, giving 193 acres overall now, and the company also seems to buy in grapes from a "high quality group of contracted growers".

Its brand of "Curious beers" has delivered 50% sales growth, so that sounds interesting.

Overall then, I'm intrigued by this share, and might buy a small amount just for the shareholder discounts initially. I like the "buzz" about its products that comes across from the narrative with today's results. The market cap looks much too high really, but I suspect that many shareholders see it as a fun thing to own.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.