Good morning!

AGA Rangemaster (LON:AGA)

Share price: 155p

No. shares: 69.26m

Market Cap: £107.4m

The investment case for this share looks pretty obvious at first sight - as a maker of very expensive cookers, it's bound to benefit from the economic recovery, especially as better off people have generally seen their incomes rise - just look at the remuneration reports of most Listed companies, and you'll find Directors who have been greedily filling their own pockets whilst suppressing the pay & numbers of staff they employ. Shareholders are asleep at the wheel usually, so allow this greed to continue unchecked. All of which is scandalous in my opinion, but positive if you happen to make expensive cookers, because it means your customers have got more money.

I'm sure that Aga's customers are not just company Directors, but as the rich are getting richer (arguably QE has seen to that) then demand should be improving, which it is;

Interim results - for the six months to 30 Jun 2014 are published this morning. Revenues are up 3.3% (with the UK being particularly strong at +9.7%, although that must mean other geographies were weak). The company seems to have a heavily H2-biased phasing of profitability, as they say;

Group operating profits were up 60% to £2.4 million for the half year (2013: £1.5 million). Our expectations for full year 2014 operating profit remain unchanged with performance expected to be well ahead of last year (full year 2013: £8.2 million).

Therefore a meaningful valuation would have to look at full year forecasts, rather than taking the interim figures & doubling to annualise them. So what does "well ahead" mean? They must surely be talking of £10m+ I imagine? Broker consensus seems to be for £11.1m profit this year (about 12.5p EPS).

Outlook - this is a mixed bag, with some uncertainty over market conditions, but generally positive noises are made, and new products in the pipeline could drive growth. The order book is up at the half year end, and the summary says this;

Taken overall, the indicators are encouraging that we will see a higher revenue growth rate in the second half bringing improved trading results for the year.

The company specifically mentions its operational gearing from improved sales potential - i.e. increased sales having a disproportionately good impact on profit, due to higher revenues passing through a P&L with many fixed costs. I don't see any mention of performance against market expectations, but am assuming from the tone of the narrative, and the figures, that the company is in line with market expectations of 12.5p EPS for this year.

Balance Sheet - As regulars will know, I place a great deal of emphasis on Balance Sheet strength, because financially strong companies can survive unexpected bad news. Whereas highly geared companies can end up being forced to do an equity fundraising at the worst possible time - when things are tough, or worse still can end up with the bank pulling the plug on them - although that's very rare at the moment, it's a considerable underlying risk that is ignored at your peril.

The working capital position looks reasonably good - current assets are 143% of current liabilities.

Net tangible assets are low for the size of the company, at £20.5m, so this cannot be seen as a strong Balance Sheet.

Net debt is negligible, at £2.4m.

However, the elephant in the room is the...

Pension Deficit - I've read articles about Aga which talk about how the company is performing, how the shares look good value (which they do at first glance), but don't even mention the pension deficit. This is completely irresponsible in my view - and reflects the reality that many journalists don't have the time to properly check the figures (they should make time - I do!), but instead just regurgitate PR releases, which of course will gloss over any negatives.

It doesn't help that pension scheme accounting is so peculiar, with two different ways of measuring a pension deficit - with the Balance Sheet version usually showing a far more modest deficit than the one used to calculate the recovery payments.

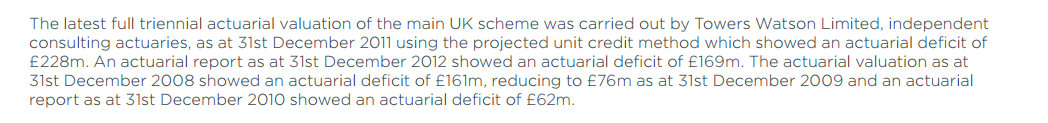

So in the case of Aga, the company reports a £46.7m pension deficit on the Balance Sheet at 30 Jun 2014 - note that this has risen from £15.6m a year ago, and £35.8m six months ago - so no sign of this deficit melting away, it's actually growing). That doesn't sound too bad, but when you look at the 2013 Annual Report, the situation is far, far worse when measured on an actuarial valuation - check out these figures:

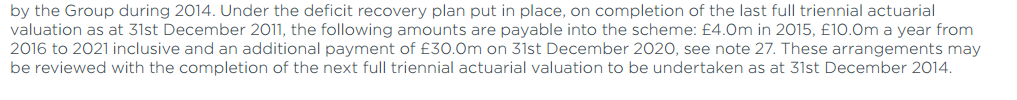

So a £228m actuarial deficit as at 31 Dec 2011 - which is the latest valuation for calculation of the recovery payments that the company has to pay, as follows;

Just to summarise that then, the company is currently obliged to make the following cash payments into the pension fund;

2015 - £4m

2016 - £ 10m

2017 - £ 10m

2018 - £ 10m

2019 - £ 10m

2020 - £ 10m + £30m

2021 - £ 10m

Total - £94m

As stated above, these payments are likely to be reviewed under the next triennial valuation, dated 31 Dec 2014, but one imagines that the revised recovery payments are likely to still be highly material to the company's cashflows.

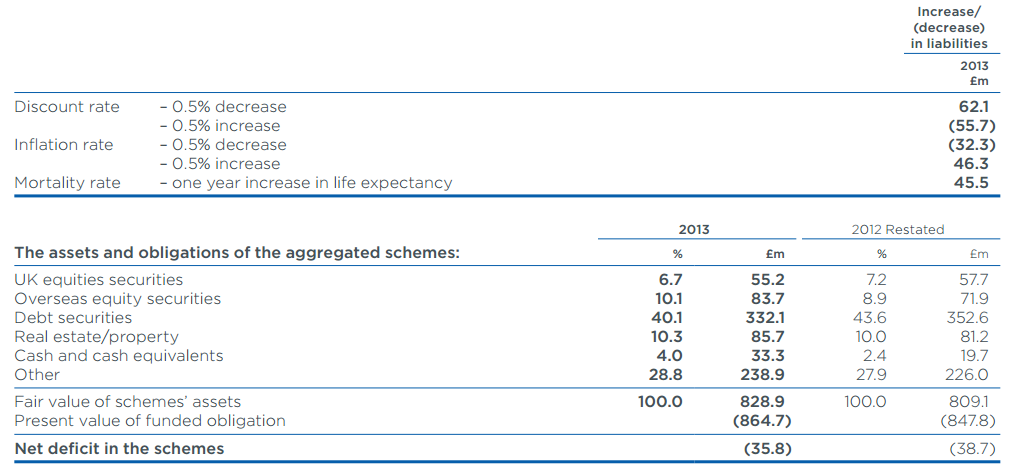

Moreover, the sheer size of the pension funds are mind-boggling for a £107m market cap company. It has assets & liabilities of over £800m each! See this table from the 2013 Annual Report;

The sensitivities look particularly alarming - if inflation rises significantly (which it might well do in an economic recovery) then liabilities would balloon. Although offsetting that would be a rise in the discount rate, which would reduce liabilities. There are lots of moving parts with pension deficits, but as Richard Oldfield says in his excellent book, "Simple but not easy" (which I highly recommend),

Disasters in every field are usually because people have assumed something that they should not have assumed.

Therefore, whilst the market may currently be sanguine about Aga's humungous pension fund, I'm not - it just presents too many risks, and if some of the variables move sharply in an unexpected direction, this size of pension fund could potentially pull the company down.

At the very least it means that shareholders may not get any dividends - since these have to be authorised by the pension fund trustees.

Dividends - There aren't any, due to the pension fund issue. Note that the company did introduce small divis (of 1.7p and 1.9p) in 2010 and 2011 respectively, but the divi was then pulled, and nothing has been paid since. That underlines the difficulty here - whilst management might want to pay divis, the company is not generating anywhere near enough cashflow to both service the pension deficit overpayments, and pay divis.

My opinion - It's entirely possible that the pension deficit might sort itself out over the next few years, who knows? On the other hand, it could continue to be a massive problem, or even get worse, we just don't know. For me, there's no way I could base an investment on making assumptions about what will happen to an >£800m pension fund. So for me this is a bargepole stock - more due to the potential risk, than the valuation.

I've got a call booked in with management for later this morning, to discuss the pension issue, so will update this article once I have more information on that. Good company by the way, it's purely the pension issue that puts me off.

Having said all of the above, I know that shrewd fund manager Hargreave Hale are keen on the stock, and hold 7.6%, so they must have satisfied themselves that the pension fund issue is not as bad as it appears. So it's entirely possible that my view on this is too risk averse. I just can't see the point in taking this risk. If the shares were on a PER of say 4, then it might be worth taking a flyer on it, but they're on a PER of about 12 times this year's earnings, none of which can be paid out in divis.

EDIT: Management were busy today, so the PR company asked me to submit my questions about the pension deficit by email, which I did. The replies received didn't tell me anything - just made general points that they will know more when the end Dec 2014 valuation has been received.

Harvey Nash (LON:HVN)

Announces the completion of a small bolt-on acquisition in Japan.

SkyePharma (LON:SKP)

I hope some readers picked up on my positive mentioning of this company after good results yesterday, as there seems to have been a delayed response today, with the shares making a convincing new 12m high today, up 31p to 280p. So presumably some big buyers must have slept on the results & decided to buy today?

I'm keen for readers to give me your views on this company, as it's not a sector I understand. However, I do like the figures, so bought some more personally this morning.

Diary Date

My next investor evening in central Brighton will be held on Tue 28 October 2014. So anyone interested in coming along, please add this date to your diaries. Tickets will be available in a few weeks' time. I set up a dedicated website for this group, here. The first two meetings were very enjoyable - friendly & relaxed, and with very good speakers. So I'll get my thinking cap on to line up another good speaker for 28 Oct too.

Enjoy the long weekend, and see you back here on Tuesday!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in SKP, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.