Good morning!

I had a rip-roaring lunch yesterday with the CEO of Research Tree. It's a website that enables private investors to access broker notes - a hot topic which we've been debating here recently. Private investors rightly complain about being blocked from receiving broker notes, under some absurd regulation, which harms our interests instead of protecting them.

Well, here's a service that helps bridge that gap. I'm impressed with the website, and have taken a free trial. There are some good providers of research on the site, including N+1 Singers, and Finncap, and many others. They're hoping to add some more big name brokers shortly. It's handy to have research all in one place, so you just put in the company name, and up comes a list of what research is available. Well worth a look, I think.

Also, we have a special discount code, which gives 20% off annual, or 10% off monthly pricing. The code is "stockopedia". For the avoidance of doubt, I am not getting any commission for mentioning this! I'm just happy to flag up anything that looks useful for investors, and I think Research Tree is a good initiative, to help level the playing field for private investors, so I hope it is a success.

Lakehouse (LON:LAKE)

Share price: 29.25p (up 24% today)

No. shares: 157.5m

Market cap: £46.1m

(I hold a long position in this share)

Board changes - the share price has reacted very positively to news that Bob Holt is joining the Board, as Executive Chairman. Googling his name, I see he seems to have been the founder of Mears (LON:MER) - which is big in providing outsourced services for social housing - so highly relevant experience for Lakehouse.

Ric Piper is stepping down from Chairman to NED.

I think there's a decent underlying business here. Although there's a nagging doubt that it might have one more profit warning in it, possibly?

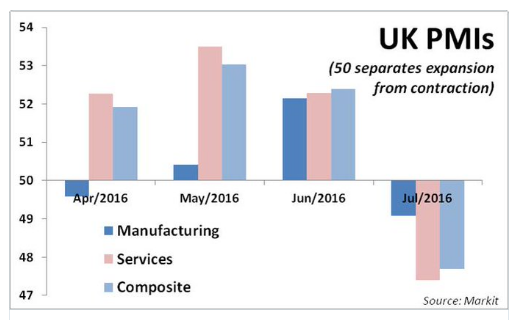

PMI data

There's been a sharp deterioration in PMI data today, which is forward-looking, hardly a surprise given the impact of Brexit, and the uncertainty that has created. So the only question remains how long & how deep this downturn will turn out to be.

Interestingly, the mid caps index has barely moved today, so it seems that the market is already pricing in a downturn.

So I think we need to be very careful which stocks we hold, and think ahead about which ones are most likely to be affected by a downturn. Probably lots of profit warnings to come this autumn, unfortunately. Although arguably the market is already pricing-in a downturn, and at some point will start to price-in a recovery. We just don't know when.

The key point I think is to pick shares with a good spread of international business, as they're the ones weathering the storm the best, e.g. Empresaria (LON:EMR) yesterday.

Inland Homes (LON:INL)

Share price: 65.75p (down 1% today)

No. shares: 201.8m

Market cap: £132.7m

Trading statement - this smaller housebuilder & brownfield developer sounds upbeat about things;

"We are confident that our underlying business is extremely robust and the demand for our high quality, lower cost homes remains strong. The appetite for our consented land is similarly unabated, while the size and quality of the land bank we are amassing has exceeded our targets.

While we have been somewhat impacted in the short term by one of our contractors going into administration, against the current supportive market environment, we look to the future with considerable optimism."

Profit is going to be marginally below market expectations (mentioned as being £15.9m), due to a contractor going bust. It's really helpful when companies quote the market consensus figure that they are relating to, as sometimes figures can vary from one financial website to another, creating confusion.

Brexit - this is pretty emphatic, and sounds positive to me;

...the business has continued to see a steady level of enquiries from potential purchasers. These fundamentals were unaffected by the uncertainty ahead of the UK Referendum on membership of the EU and purchaser appetite since the result has remained stable.

Sprue Aegis (LON:SPRP)

Share price: 183p (up 2.2% today)

No. shares: 45.9m

Market cap: £84.0m

Trading update - the share price for this smoke alarms company more than halved in Apr 2016, on a nasty profit warning. However, that would have been a good time to buy, as the shares have risen by c.50% since then - a terrific return for those brave enough to buy at the time, and indeed for existing holders who sat tight.

Today's update shows some improvement on the worst case scenario, but it's still pretty bad;

The Board expects sales for H1 2016 to be approximately £25.9 million (H1 2015: £56.5 million) and to report an operating loss* of £0.9 million (H1 2015: £9.0m operating profit*). Due to stronger than expected trading in June 2016, the operating loss* for H1 2016 is significantly lower than the Board's expectations as previously announced in the Company's final results on 26 April 2016.

The cash pile has almost halved;

Net cash at 30 June 2016 of £14.7 million (2015: £28.9 million) was adversely impacted mainly by the H1 2016 operating loss* and the £7.0m payment for buffer stock acquired in Q4 2015. Sprue remains debt free (30 June 2015: nil debt).

Outlook - it's so helpful when companies publish profit guidance - everyone should do it, even if it means giving investors a range of possible outcomes.

Subject to there being no further net adverse foreign exchange rate movements, the Board expects Sprue's sales and operating profit for the year ending 31 December 2016 to be approximately £58.0 million and £1.9 million respectively.

My opinion - I fail to see why this company is valued at £84m. That seems an awful lot for a company that's only going to make £1.9m this year. Profits are forecast to more than triple next year, giving forecast EPS of 11.2p, but even then the PER is hardly a bargain at about 16.

So it's not for me, at this valuation.

Sorry, I've run out of time, as have a meeting to go to now.

Have a smashing weekend.

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.