Good morning!

I didn't get involved in the RBG story last week but the comments have continued on Paul's thread from last Friday, visible here.

Onto today's updates:

Keywords Studios (LON:KWS)

- Share price: 826.25p (+3.3%)

- No. shares: 55.6m

- Market cap: £459m

This international service provider to the video gaming industry continues to spread its wings, developing its presence in China and Indonesia via acquisition.

In theory, I like the sound of this company. It gets

to take part in the growth of gaming worldwide without

being overly reliant on the success or failure of individual titles as game publishers might be. Instead, it relies on its relationship with those publishers.

The services it provides can be broadly broken down into localisation (text/audio translation), testing and quality control.

It has undertaken a very large of number of small acquisitions, and today marks the continuation of that trend with a further $6 million being spent on this company (in a mix of cash, deferred cash and deferred shares).

Management of the target will stick around, which is good, and it sounds like it might be decent value against $0.9 million in PBT at the target last year.

CEO comment:

"The acquisition of Red Hot further strengthens our fast growing, higher margin art services business, enhancing our unique client proposition which combines operations close to our clients, in the US and Canada, with those in lower cost locations across Asia. Following the acquisition, we believe the Keywords Art Service Line is the leading player in the outsourced market in terms of capacity and breadth of service."

I wonder if art services is a good place to be from an investor point of view - it sounds perhaps quite labour-intensive.

Red Hot has 220 artists in its employ, so this deal values the company at $27k per artist.

Granted that the salaries in its 2nd/3rd-tier Chinese cities will be lower than typical Western salaries, that still seems to be a rather low valuation per skilled employee.

So I would have a little bit of concern in terms of whether this is an attractive segment to be from the point of view of 3rd-party investors. However, it could be the case that art services are highly complementary to the rest of the services provided by KWS, so it's important to beef them up as part of the overall offering.

It's a highly-rated stock and a High Flyer according to Stockopedia's StockRank Style, and it appears to have done enough to deserve that, in terms of profitability growth. Worth looking into.

StatPro (LON:SOG)

- Share price: 124p (unch.)

- No. shares: 64.7m

- Market cap: £80m

AGM Statement and Trading Update

It's a confident statement today from the chairman of this cloud-based portfolio analytics software company, serving the asset management industry.

Stepping aside after 17 years at the helm, he includes a summary of the group's evolution and progression over that time period.

Trading is in line:

"Trading in the first quarter of the current financial year is in line with expectations.

"New sales of StatPro Revolution and StatPro Seven have progressed well and the pipeline for the remainder of the year remains solid.

Worth noting that having grown by acquisition over the years, Statpro's 2016 results suffered the stain of very large (nearly £10 million) goodwill impairments, and other "one-off" items, resulting in a net loss of £10 million.

But the impairments were non-cash, of course, and underlying trading continued to grow in a reasonable way, so the dividend was unchanged.

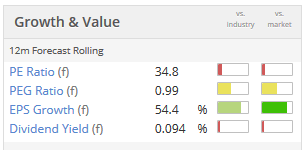

The stock is highly-rated which I guess is a consequence of having sticky customers in the asset management space, its own strong forecast sales growth, and software valuations generally at the moment.

Given it's relatively small size, I would assume that a company such as this would eventually get taken out at a decent premium by one of the giant financial software providers and suppliers to the buy-side industry. Though Statpro has been independent for so long, perhaps there are particular reasons it has not been bought out yet?

Given the current 2.3% yield and 21x forward PE ratio, it's not exactly in the "value" territory (of course, neither was KWS), but maybe it's one to keep on the watchlist.

Innovaderma (LON:IDP)

- Share price: 248.5p (+9%)

- No. shares: 12.5m

- Market cap: £31m

Launch of haircare range and entry into skincare

I mention this in passing as IDP shares are up more than 50% since I first mentioned them in these reports and momentum apparently remains strong as two separate initiatives are announced today.

Signs remain positive with five new haircare products being launched in Superdrug's top 400 stores from August, along with a brand extension to the successful Skinny Tan brand.

It's forecast to make a small profit this fiscal year on c. £7 million of revenue, up from £4 million the prior year, and has excellent gross margins, the only thing I'm not sure about is the size of the addressable market - I've seen an estimate that self-tanning is worth c. £60 million in the UK.

That's not really exciting enough for me to want to get involved. On the other hand, if it were to make progress in the US and Australia, then it could be worth considerably more than the current market cap!

Taking a break now, hoping to add another story later.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.