Good morning!

Tungsten (LON:TUNG)

Share price: 380p

No. shares: 103.5m

Market Cap: £393.3m

If I had to pick my favourite more speculative share, then this would be it. Tungsten has bought an e-invoicing company, and a small bank, and the combination will be used to finance the supply chains of large corporations & Governments. It's work in progress so far, but the idea is brilliant, and looks do-able, given that they already have many blue chip clients using the e-invoicing system. Financing their customers supply base is the next step.

There's an AGM update today, which helpfully recaps what the company has achieved this year.

Two things I note from today's update. Firstly, that current trading sounds good;

This has helped to underpin a strong start to the financial year for Tungsten Network and as a result the Group is ahead of budget for the first four months of FY15. As we have from inception, we expect this year to be a year of heavy investment and transition in the rollout of our products and services.

Secondly, when the company mentions negotiations to raise financing for their invoice discounting activities, the previously-used phrase of something like, there can be no guarantee that funds will be successfully raised, has been omitted this time. Does this mean management are more confident about raising the money needed? Possibly.

How to value it? Absolutely no idea! Seriously, it's the type of situation that is pretty much impossible to value at the moment. If it works, then the company could be worth billions. If it doesn't, then who knows? There could be a series of fundraisings, and little commercial progress made, we'll just have to wait & see. I was very impressed with the level of Director participation in a small recent Placing, they stumped up a couple of million quid, not something you see very often.

Sorry for the interlude, we've got the carpet cleaners in, and I couldn't hear myself think.

MoPowered (LON:MPOW)

Share price: 7.65p

No. shares: 15.9m

Market Cap: £1.2m

This probably deserves the award for biggest car crash IPO of the year. Not one of N+1 Singer's finest moments (ranking alongside their change of name decision perhaps?). MPOW actually floated in late 2013, with inadequate cash resources, and as it now transpires a rather flaky business plan.

I flagged up concerns over inadequate cash here in my report of 3 Jul 2014, so it doesn't come as a surprise to read today that the company is doing a rescue refinancing.

Interim results were published on Friday evening, and look awful to me. Turnover rose, but was still only £753k, and a whacking great loss before tax of £2.4m was incurred. A Placing at just 5p has been announced today, which is a crushing 75% discount to the price on Friday - which tells me that the broker probably had to call in favours from friendly contacts in order to raise the money at all. I don't think 5p will hold afterwards either, as in this type of rescue fundraising, people who took part in the Placing often can't wait to exit, even at a loss.

I don't believe that existing investors have any reason to complain about this Placing - it was obvious that the company was running out of cash, so if people didn't sell their shares, more fool them - if you hold shares in a company that is more-or-less insolvent, then you can't really complain when Directors do whatever they have to do in order to refinance it.

So, yet another story stock goes disastrously wrong!

Moss Bros (LON:MOSB)

Share price: 94p

No. shares: 100.8m

Market Cap: £94.8m

I last reviewed this menswear retail & hire business in my report of 23 May 2014, and concluded that the shares were far too expensive when they were about 121p, and that I would only start to be tempted at about half that price.

So at 94p today the shares have come off a decent amount, but still don't look cheap to me. Interim results out today are unimpressive in my opinion. Despite LFL sales being strongly up, operating profit actually fell from £2.2m to £1.9m. The company blames this on shops being closed for refits, and on a reduction in hire revenues.

Dividends - the dividend yield here looks superficially attractive, but it's important to note that the company is reducing its surplus cash by paying out divis which are not fully covered by earnings. I don't like that. Surplus cash should be distributed by special divis and/or buybacks, but should not be used to inflate the standard dividend in my view.

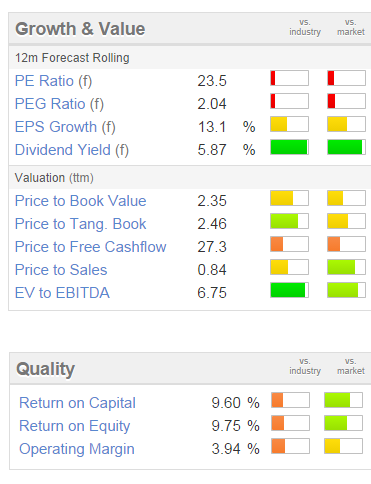

My opinion - As the Stockopedia graphics below clearly confirm, this is a fairly low quality business, whose shares are expensive. So the opposite of what we should be looking for. I'm not at all tempted to buy these shares, and think they remain significantly over-priced.

The product isn't great either - I bought a black tie outfit from Moss Bros which looked nice in the shop, but when I got it home and inspected it in a bit more detail, it looked and felt cheap & nasty.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in TUNG, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.