Good morning!

Today, I'm planning to look at Flowtech Fluidpower (LON:FLO), SThree (LON:STHR) and Paddy Power Betfair (LON:PPB), and anything else that seems worth covering. Paul is traveling at the moment.

When he returns to London, Paul will be meeting MySale (LON:MYSL), and I am also planning to cover their trading update from last Friday, later today.

Regards

Graham

Flowtech Fluidpower (LON:FLO)

Share price: 124,6p (-7%)

No. shares: 43m

Market cap: £54m

Trading, Acquisition, Strategy & Notice of Results

There's a disconnect between the tone of this announcement (positive) and the share price reaction (negative), because I think the profit guidance is actually a miss against market expectations.

Somewhat strangely, the company says that it is planning a 5% dividend increase, which is "in line with current market expectations" - but it doesn't say that the profit guidance is below market expectations!

Against difficult trading conditions the Group has delivered a solid performance.

Group revenue was c.19.9% up on 2015 at approximately c.£53.7 million (c.19.3% in constant currency)

The GBP devaluation looks to be culpable:

"...some margin contraction was experienced in H2 while prices were managed upwards on products sourced in Euro and USD and sold in GBP markets.

Checking last year's annual report, I see that Benelux revenue was c. €5 million, versus £30 million in UK revenues. And the underlying operating result from Benelux was less than 10% of the UK result. I'm not sure how this has changed since then, but there is a lot of GBP exposure here.

Significant investment in central and sales resources aimed at optimising cross channel opportunities, and future acquisition integration programme underpinning long term growth.

As a result of these investments and the gross margin contraction in H2, the Board expects underlying* PBT will be in the range £7.0m to £7.2m.

According to the forecasts available to me, £7.6 million was the consensus forecast here. So it's a miss.

The company also announces the acquisition of a Shropshire-based hydraulic equipment distributor for total consideration (including debt assumed) of £2.65 million. There are said to be "several acquisition and product opportunities being actively pursued".

My opinion: More important than the valuation here, for me, is whether I buy into the strategy.

Some companies have grown successfully via multiple acquisitions, but it's not a style of management which I wish to take part in for now - too many things can go wrong, and it's almost impossible to judge how much integration will cost in the end. It can take a long time before the hypothesised synergies eventually materialise.

Indeed, today's statement attributes the company's "future acquisition integration programme" as being partially responsible for the lower PBT forecast.

So I'm going to express my preference for organic growth by not getting involved here.

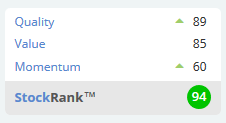

For what it's worth, the Stockrank does consider this share to be good value.

Share price: 311p (-3%)

No. shares: 128.9m

Market cap: £401m

Final Results for the year ended 30 November 2016

There are times I wish I traded more actively. Looking at the SThree (LON:STHR) chart, a STEM recruitment group which I've studied before a couple of times, I can't help the feeling that Mr. Market is far too jittery on this stock - it was marked down from 400p in July 2015 to a low of around 220p in October 2016, before recovering to the current level.

A lot of this was Brexit-related: SThree earns 49% of gross profit in Continental Europe, and is also quite sensitive to economic and legislative shifts in the banking sector.

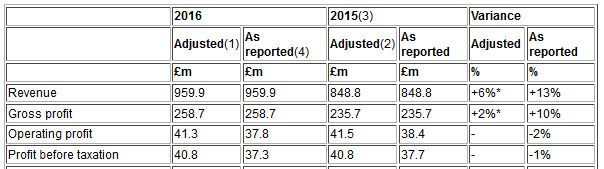

In the end, 2016 results have turned out very flat:

The increased revenue figure is due to the increased focus on Contract, rather than Permanent employees, and FX.

It's a highly detailed announcement - this can be a refreshing change after analysing smaller companies!

Outlook: Despite the high level of detail, the company admits an uncertain outlook (somewhat inevitable, given the nature of its activities and the markets in which it operates):

This has been a year of unexpected developments in several of our key

territories which are likely to impact the future trading environment.

The changed political landscape creates global macro-economic

uncertainties which make this a difficult environment in which to plan.... we will continue to adopt the prudent approach to planning

which has served us well in recent years, but remain poised to respond

quickly to opportunities when they arise.

My opinion: I still think this is a good recruitment business, and I like the strategy of focusing on contract recruitment (now two-thirds of gross profit).

Recruiters are like most brokers (stockbrokers, real estate agents, etc) - they thrive off activity and change. Contract workers are the most active in the job market, so it makes sense for recruiters to gear their business towards them.

SThree has a special model which employs contractors directly, and contracts them out to clients - this looks smart, from a legal/tax point of view.

The PE ratio is a little expensive for a recruitment business, but it seems to be offering a decent proposition, in my view. The StockRank is 98.

Share price: 8350p (-4%)

No. shares: 83.7m

Market cap: £7,030m

This is an update for Q4 and for the calendar year 2016 as a whole.

It has been an unusual quarter: customer-friendly results in politics (Trump) and sport (football) resulted in revenue reduction of £40 million.

Note that the above figure is "before the benefit from the re-cycling of winnings" - gamblers tend to bet with their winnings, sooner or later.

Think of PPB like an insurance company: occasionally, there are hurricanes and floods, and the insurance company (or its reinsurer) takes a hit. But that's necessary, to occasionally boost the demand for insurance policies (and to wipe out insurance companies which are pricing their policies too cheaply).

A few adverse results go with the territory here.

Total revenue for 2016 is up 18%, or 11% at constant currency (using pro forma results as if Paddy Power and Betfair had always been merged). That was achieved despite a flat result in Q4. Nothing to panic about here, in my view.

Photo-Me International (LON:PHTM)

Share price: 154p (-10%)

No. shares: 376.4m

Market cap: £580m

Shares were down by almost 20% at one point this morning, giving a trading opportunity as they are now down by just 10%!

The above-linked RNS has been released in response to newspaper articles saying that it may be "curtains for photobooths" - as Home Office rules no longer require photos by a machine or a professional.

These were introduced some time last year, but have only now made it into the media.

Response from PHTM:

The Company believes its latest technology represents a major growth opportunity as the most secure photo ID solutions available and that accepting photos from mobile phones for official documents is incompatible with developing security requirements.

Photo-Me's solutions have been adopted by

ANTS (Agence Nationale des Titres Sécurisés, a national agency linked to

the French Ministry of Transport and issuing secured official personal

documents) as well as by the Ministry of Foreign Affairs and Trade in

the Republic of Ireland where trials are underway for photobooth secure

online passport applications. Furthermore, it is currently in ongoing

discussions with Her Majesty's Passport Office in order to equip its

photobooths in the United Kingdom with the technology used in France.

It's a strong statement, but who can predict what government decisions might be made?

I previously spoke very positively on this company, and won't make a U-turn. I do think investors should try to quantify the risk associated with this. The UK accounted for 19% of total operating profit last year, and since then PHMT bought the UK photo division of Asda. So the UK photo segment is important to the investment case. And perhaps there is a risk that other countries might eventually follow suit with the UK Home Office, despite heightened terrorism risks.

On balance, I'd bet that governments will generally tend to err on the side of caution (better to be accused of being too strict, than too laissez-faire).

This is a difficult puzzle, and enlightened reader comments are more than welcome. I'd still have a favourable overall impression of this business, but maybe the shares should be trading cheaper now, than they are currently, to give investors a bit more upside for taking on the risk of the worst-case scenario?

Braemar Shipping Services (LON:BMS)

Share price: 249p (-15%)

No. shares: 30m

Market cap: £75m

This company has three divisions: the largest one, Shipbroking, is in line with expectations, but the other two have seen performance deteriorate.

Checking back to the company's interim results, it's obvious that we were already on track for a much weaker 2016/2017.

Demand for the company's Technical services has been greatly diminished by conditions in the offshore oil and gas industries. In H1, Technical swung from a £3 million profit to a £2 million loss, resulting in reduced headcount and restructuring costs. Further significant restructuring costs have been incurred in H2

Helpfully, the company guides us for "underlying operating profit before

interest, acquisition related costs and tax" within a £3.0 million -

£3.5 million range. And it intends to pay a 5p final dividend (down from 17p last year). The dividend had been flat for six years.

The chart shows a falling knife but with the company showing net cash (£1.7 million) and with the Shipbroking division apparently doing fine (responsible for 40% of revenues), I'd be inclined to think that this is worthy of further research.

MySale (LON:MYSL)

Share price: 125pNo. shares: 151m

Market cap: £189m

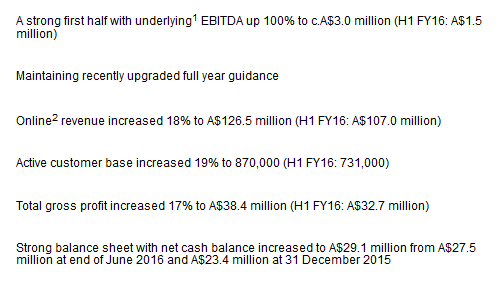

This was a very nice update ahead of the company's interim results.

What's special about this company's original and primary business model is the negative working capital requirement: customers order goods which are in-season for the customer's part of the world (and off-season in their country of origin), using MySale websites as the middleman. MySale doesn't have to hold stock, and gets paid up-front, so there are no working capital needs.

This has changed a little bit via the introduction of higher-margin own-buy inventory. I can't see any reference to own-buy inventory in this statement, but there has been a welcome improvement in gross margin all the same (270 bps).

The cash balance (A$29.1m) is worth c. £18 million, nearly 10% of the market cap. Crucially, the company appears to be more than adequately funded for future growth.

This one is a little bit too difficult for me, in terms of figuring out where it will wind up long-term. But if I wanted a relatively simple way to time my entry/exit into this share, I'd probably value it as a multiple of gross profits. Gross margin is the most important performance indicator for me, and revenues define the overall size of the business, so the product of those two numbers, versus the market cap, is the indicator which I'd be looking at.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.