Good morning!

Norcros (LON:NXR)

That bathroom fittings company has scored an own goal this morning with a gloomy trading statement which goes into great detail about how revenues are down. Then almost as an after-thought the final sentence reports on profitability;

Nevertheless, given the continuing improvement in the financial performance of our UK and South African tile businesses and the expected recovery in Vado export revenues as commercial projects complete, the Board remains confident that the Group should continue to make progress in line with market expectations for the current year.

They should have reported the other way around - i.e. stressed that full year expectations on profits are unchanged, as the opening paragraph. Then give details below on divisional performance. Also, the statement focusses far too much on turnover. I'm not particularly interested in turnover, it's profitability that matters! So what if the S.African rand has depreciated - we already know about that anyway. All that matters is how it affects group profitability - which as we saw in the last set of results, is minimal - because their S.African operation has its costs in rand too, so all we're looking at is the translation into sterling of profits, which are miniscule anyway.

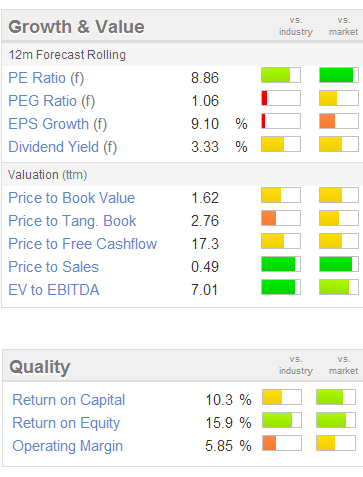

In my view if Norcros can't bring their S.African operations up to a decent level of profitability, then they should dispose of them - to my mind all the S.African operations do (and they're significant at nearly 40% of turnover) is dilute the quality of the UK business, by lowering the overall group operating margin, and other quality measures like ROCE, etc.

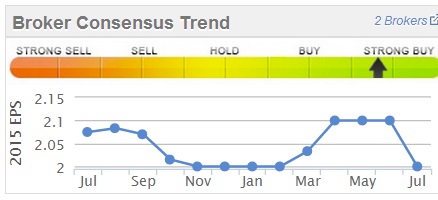

So as expectations are unchanged, the broker consensus forecast of 2p normalised EPS for this year means the shares are on a remarkably low PER of about 8.6. The dividend yield is a useful 3.3%.

To recap briefly on the Balance Sheet - it has some debt, but a roughly equal amount of freehold property, so I have no issues with that. Debt is reasonable compared with EBITDA, the key measure that banks look at. Today's RNS also mentions that bank facilities of £70m have been renewed with a syndicate of 3 banks, at a reduced interest rate, another positive that got lost in the unnecessarily gloomy tone of today's statement.

There is a large pension fund, but its deficit is relatively small on an accounting basis, but a bit scary on an actuarial basis. I've looked into this, and am comfortable because deficit recovery payments are not excessive at about £2.2m p.a., and the scheme is very mature, with most members being in their late 70s, so without wishing to sound callous, the scheme will be considerably smaller in 10 years time than it is today.

As you can see from the chart below, the shares have been constantly drifting down this year, and are now well into value territory in my opinion, so I like this share a lot at this price. DYOR as usual please, this is not a recommendation, just an opinion. The bizarre thing is that throughout the decline in share price of 2014, the company has continued to trade in line with expectations.

Here are the usual Stockopedia valuation & quality graphics;

Note that market expectations have been in a tight 2.0p to 2.1p range this year;

Flybe (LON:FLYB)

I wouldn't normally look at an airline, but this one is a special case, as it's undergoing dramatic change under new management (from Easyjet) on multiple fronts - staff numbers have been drastically reduced, uneconomic routes slashed, bases closed, and the fleet rejigged to better suit their needs. All in all it's a dramatic turnaround underway if you really dig into the detail.

Year ended 31 Mar 2014 was the year that things were stabilised, with losses eradicated and the company brought to just above breakeven. However, it's this year & next year's forecasts that interest me most. Broker consensus is for 8.1p EPS this year, and 16.0p next year, so at 120p per share now the shares look good value. If Flybe hits next year's forecast, then a PER of say 12-13 would equate to a share price of around 200p - which is the sort of share price target that I have in the back of my mind. Possibly more, if things go well.

So what does today's IMS say? I think we should second Norcros's RNS writer to Flybe, as Flybe shows how it should be done - starting the announcement with a clear & upbeat summary, as follows;

Flybe reports an encouraging start to the year, in line with management expectations, as the trading performance shows the benefits of our disciplined approach across four focus areas: capacity, revenue, costs and organisation. We also continue to prepare the business for future growth.

That's all the market needs to know - that the company is in line with market expectations, so you should put that in the first paragraph, as Flybe have done, and then that allows busy people to move on & not worry about the share price.

The rest of the detail in the statement is just music to my ears. It details all the changes that new CEO Saad Hammad has made in the business, and it all sounds very positive.

On the negative side, there is an ongoing legal issue regarding potential compensation claims for clients on late flights, although the market doesn't seem overly concerned about that. Remaining legacy issues are commented on today as follows;

Our plans to address the few remaining legacy issues in the business, especially the grounded E195 aircraft and the loss making scheduled flying business in Finland, are progressing and I look forward to providing further updates in due course.

Airlines generally are out of favour at the moment, because of a number of profit warnings in recent months. However, Flybe looks to be doing well, and the turnaround investing case looks good to me - so I shall remain long for the next 1-2 years.

There's always the risk of a spike in oil prices, plus geopolitical issues, so one has to be prepared for turbulence in the share price. Bear in mind though that following a large Placing & Open Offer of £150m at 110p per share in Feb-Mar 2014, the company is now very soundly financed. I also feel that the 110p fundraising price should provide a floor for the share price, as indeed it has done recently.

So it's exactly what I like best - namely asymmetrical risk/reward. The downside from the current share price of 120p should be no more than 10p before the Placing price level provides strong support, and with patience the upside could be 80p+ from here if the turnaround continues. There are no guarantees of course, as unexpected events can happen, but at the moment it looks good to me. It won't appeal to everyone though, each to their own.

Augean (LON:AUG)

This is a waste recycling company. I've not reported on it here before, but have looked at the figures before and not been terribly impressed.

However, it might be worthy of further research, as today's trading update signals in line with expectations performance, and that means the valuation on a PER basis is fairly reasonable;

We are seeing clear signs of the opportunities that the new strategy is opening up for the Group with positive revenue growth across all five divisions. While the first quarter was impacted by a number of one-off issues, the overall performance in the second quarter and pipeline of work in the Energy & Construction and Radioactive Waste Services divisions give me confidence in delivering the strategy announced in March. The Group continues to trade in line with market expectations for the full year.

Stockopedia shows forecasts of 3.9p EPS for this calendar year, and 4.75p for next year. So at 46p the shares are on a PER of 10-12-ish. That's not a bad starting point for some research. Note there is debt too, but that can be OK for companies that have a lot of fixed assets.

I'll do some more work on it when the interim results come out.

I'll leave it there for today, it's too hot to think straight!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in NXR and FLYB, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.