Good morning!

Crawshaw (LON:CRAW)

Share price: 63.7p (up 1.9% today)

No. shares: 78.8m

Market Cap: £50.2m

AGM trading & strategic update - LFL sales growth for the 8 weeks since 23 Apr 2015 is today reported at +2.3%. That's OK, but not madly exciting. The language in today's announcement sounds a little over the top to me, given that the sales increase is only in line with the rise in average household incomes.

The integration of the Gabbotts Farm stores is "progressing very well". Although the price paid for Gabbotts was only £3.9m, for 11 shops, so about £355k for each shop. This threw into sharp relief just how expensive Crawshaws is - with 39 shops now (including the 11 Gabbotts ones) and a £50.2m market cap, that values each Crawshaws shop at just under £1.3m.

Or looking at it another way, if you take off the 11 Gabbotts shops at cost, that would value the other 28 Crawshaws shops at £1.65m each! So the stock market is valuing each Crawshaws unit at about 4.6 times what Crawshaws just paid for a competitor business.

My opinion - to my mind, Crawshaws as it stands now, is probably worth something like £10-20m. The additional £30-40m value being put on the shares is all about future expectations - the stock market is anticipating the business growing to maybe 5 times its current size, and there is also a management premium - for Richard Rose, the Chairman, and the CEO who joined Crawshaws from a senior role at Lidl.

There's no doubt it's an interesting roll-out, with high quality management, but the price is looking very toppy - investors are being asked to pay up-front for several years' growth. Bear in mind also that there's cut-throat (geddit?!) competition from the supermarkets, who are not likely to sit back and do nothing as Crawshaws increasingly eats their lunch.

Overall, I can see the appeal of the bull case, but would just raise a question mark over whether the share price is getting ahead of itself? There again, we're in a bull market, which has pockets of euphoria, so in this kind of environment growth companies do achieve high ratings. The trouble is, if unforeseen problems emerge, and/or if the stock market generally takes a bath, then shares with very rich ratings are often the biggest fallers.

So it's the sort of stock that will probably be a good bit higher in 5 years' time, but which might have some bumps in the road between now & then. There again, isn't that true of most shares?!

Naibu Global International Co (LON:NBU)

De-listing - we wave goodbye today to this appalling crock, which has brought shame on AIM and all the advisers who aided and abetted UK investors being fleeced. Let's not be under any illusions, as I've said before, the clear purpose of Naibu's UK listing was to rip off UK investors.

People connected with the company must have known or at least suspected this, because there was wave after wave of insider selling from China - large blocks of stock were repeatedly offered in private placings, at a discount to the prevailing share price. When insiders are desperately dumping a stock which is rated at a PER of 1, and valued at below its own cash pile, then you know for sure that it's a fraud.

Anyway, I warned readers here over & over again that these small, AIM-listed China stocks, are all automatic bargepoles. So hopefully none of my readers were stung on this one. It's no good trying to separate the wheat from the chaff, I think fraud is so endemic with small Chinese companies listing abroad, that it's safest to just eschew them all.

What on earth are the Chinese authorities thinking of, allowing this practice to go on unabated? Think of the damage it is doing to the country's reputation. The Chinese authorities need to act. As indeed does the LSE - facilitating the defrauding of UK investors is a serious matter, but it seems to me that the establishment (LSE, advisers, etc) are happy to continue generating fee income for themselves, and don't seem to lose sleep about all the investors who are conned by the many dodgy companies which list on AIM.

My other concern is that there are perhaps 300-400 really good companies on AIM. Yet they are being tarnished by the appallingly high prevalence of bad companies that seem to be able to list on AIM freely, rip off investors, then disappear again, with nobody being punished.

It's not good enough. Things have to change. I found the mutual back-slapping on the 20 year anniversary of AIM pretty nauseating, to be honest, given that there has been so much collateral damage at the cost of private investors who (wrongly) assume that the establishment will protect them from con-men.

Post Script - I couldn't help a chuckle at a change of Director announced today at Geong International (LON:GNG) - a nano cap Chinese AIM stock which must surely be due a de-listing pretty soon, given that it can't make sense to maintain all the costs of a listing, once your mkt cap has got down to £1.2m?

What an appropriate name for a new CFO for a China AIM Stock - Ms. Liying Wang! Let's hope she doesn't marry a Mr Kerr.

You couldn't make it up!! Well actually, since Chinese companies often do make up the figures, then maybe they're having a laugh by using made-up names too?!

IMImobile (LON:IMO)

Share price: 148p (up 8.4% today)

No. shares: 59.3m

Market Cap: £87.8m

(at the time of writing, I hold a long position in this share)

Results y/e 31 Mar 2015 - this is a software company, which has a blue chip client base. Its software facilitates clients communications with their customers on mobile devices - so it optimises emails to appear on smartphones, manages interaction with those customers, etc. So it certainly sounds like a good growth area to be involved with.

I had a half hour catch-up with management this morning on the phone, and things seem to be going well - they sound upbeat about life. Management quality is one of the things I like about this company, and they also have large personal shareholdings, so plenty of skin in the game - again, a plus point from my point of view.

Results today look good.

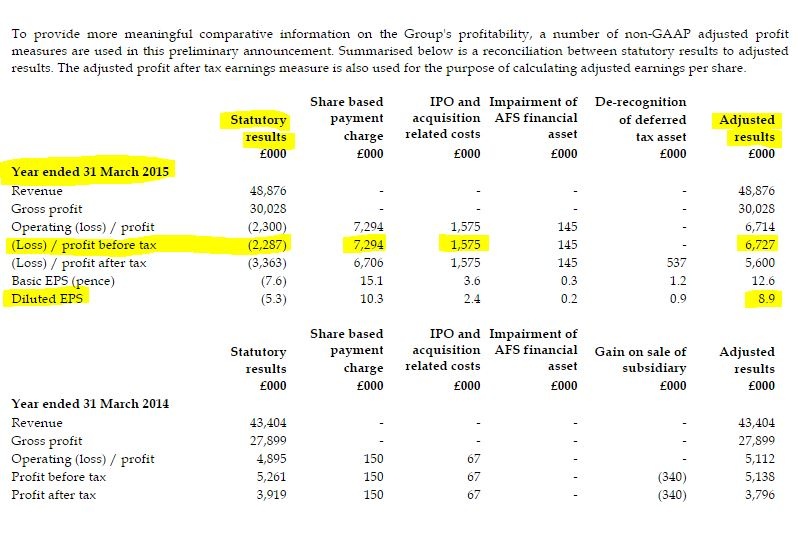

Key numbers - revenue is up 13% to £48.9m, and adjusted profit before tax is up 31% to £6.7m. That's all great, but if you look on the P&L itself, it shows a loss of £2.3m, so what's going on?!

The company helpfully provides a reconciliation between reported profits, and adjusted profits, in note 6 to the accounts today, which I have copied below, with my highlighting of the key points:

The biggest item by far is a whopping £7.3m share based payment charge. I quizzed the CEO about this today, asking is this not excessive? He explained that this was an incentive scheme for management & staff, which was set up pre-IPO, designed to lock in key people for four years. It was disclosed in the listing particulars.

I think this charge should be seen as a one-off. I asked if there will be any more share options issued, and the answer is that no significant amounts are likely, except to lock in key management of any newly acquired businesses in future.

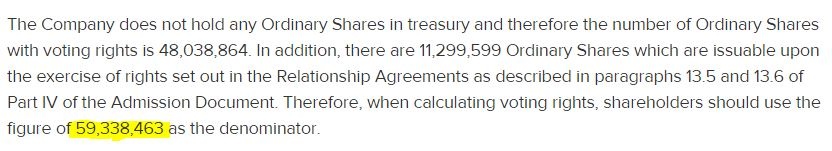

Share capital - caution is needed here, as there is an unusual shareholding structure. I won't go into the detail, but as you can see from the company's website, although the number of shares in issue is 48.0m, the de facto number of shares will at some point rise to 59.3m, therefore the 59.3m, figure should be used in all calculations.

I have used this 59.3m number of shares figure in the market cap valuation at the top of this section, and I've also raised a green ticket at Stockopedia, so that they can flag it to their data provider, Thomson Reuters. Note that at the moment, Stockopedia is using 48.0m shares in issue, as that is the figure TR give them, so you will need to manually adjust the figures on the StockReport until this figure is updated by TR. They are usually very quick at correcting things when I find glitches in their data! (I should charge TR a consultancy fee for helping to clean their data!!).

Balance Sheet - noteworthy is the cash pile, of £14.6m, with no debt, so the company has a cash pile of nearly 17% of its own market cap - a very healthy buffer.

Debtors look a bit high, but this is due to there being a degree of "pass through" revenue included. IMO's customers are mainly blue chips, so I am relaxed that the debtors should be collected in alright.

Note the large "Non-controlling interest" shown on the Balance Sheet. I need to do a bit more digging on this - it possibly relates to Indian JVs? A non-controlling interest, or minority interest, is where a subsidiary company is owned above 50%, but below 100%. So its full numbers are consolidated into the group accounts, as if it were 100% owned, but the element that is not owned by the group is then shown as a single number, on both the P&L and the Balance Sheet.

These are material amounts here, so I need to go back to management and ask them about that, so I fully understand it. Normally EPS figures should adjust for minority interests, but I'll double check that.

Acquisitions - this is an acquisitive group, so expect more bolt-on acquisitions in future. Mgt said today that they are pleased with their Oct 2014 acquisition, TXTLocal, which is trading well. Interestingly, they have realised genuine synergies from that acquisition, through e.g. applying group buying power to network bandwidth, so there is a good justification for making acquisitions in this sector, and that it's a fragmented space, so there are plenty of potential targets.

My opinion - I only have a "placeholder" shareholding here - i.e. where I've bought a small initial stake, and then take my time to do more research, and then either increase the position, if I like it more, or ditch it if I don't. This is because, in my view, it takes time to properly understand a company, and also for recent floats I like to see a track record as a listed company build up, before committing more funds.

I've also got a couple of broker notes on the company to go through in more detail, so for the moment I'm just going to say that, based on today's good results, and the positive outlook - e.g. from new contract wins, and further acquisitions being likely using the cash pile, then this share looks potentially interesting - worthy of further research anyway, before forming a more informed decision.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.