Good morning!

Lakehouse (LON:LAKE)

Share price: 35p

No. shares: 157.5m

Market cap: £55.1m

(at the time of writing, I hold a long position in this share)

Meeting - A friend very kindly arranged for a small group of us to meet the new Chairman and existing FD at Lakehouse (LON:LAKE) last Friday afternoon. They were very generous with their time, and over 2 hours we delved into all aspects of the business.

My feeling is that the very public board room bust-up is now water under the bridge. So I was keen to move the meeting on to talking about the future. The new Chairman, Ric Piper seems an ideal choice for a business that has experienced considerable recent upheaval. His calm, avuncular manner, and methodical approach to the numbers (being a Chartered Accountant), is just what's needed in my view. He seems to have already established an excellent rapport with the FD. A new CEO is being sought, with the role currently vacant. I like the idea of a new CEO coming into a situation where there is a strong Chairman/FD partnership already in place. This should point the new CEO in the right direction from day 1.

I came away reassured that there is no issue with the bank funding. We ran through the bank covenants, and there seems to be plenty of headroom there. So it's not a crisis situation. It's a recovery situation. That was reflected in the 1p interim divi, and guidance of a 2p final divi in due course. So the yield is close to 10% - a very nice catalyst to push up the share price.

My one reservation is that I feel there is a possibility of one last profit warning, from the "contract settlements" issue. I spotted this in the interim results statement, and mentioned it here in my report of 17 May 2016. There is some uncertainty over negotiation of the final account on some big contracts. Management explained it could go either way - a favourable outcome would be great news. An unfavourable outcome could mean another profit warning, with a perhaps 10-25% impact (my estimate) on the share price, in the short term.

The negative cashflow in H1 seems to have been a one-off, due to the unwinding of a favourable working capital profile on a big contract in Hackney that has now finished. The customer paid cash in advance of LAKE paying its sub-contractors. So the closure of that contract obviously sees that favourable situation unwind.

Seasonality automatically benefits H2 (the summer months, Apr to Sep), so in this particular case, the expected H2 weighting for profits is justified. A good example is gas maintenance contracts. The revenue is recognised monthly, in equal instalments. However the costs (mainly call-outs) occur during the winter. Therefore in the summer months (the company's H2), these contracts are highly profitable.

LAKE is likely to face continuing headwinds, because of Govt policy requiring social landlords to reduce rents by 1% p.a. for the next 5 years. That is bound to curtail discretionary maintenance spend - cuts have to be found somewhere. That said, a lot of LAKE's work is mandatory - e.g. checking of boilers & elevators has to be done every year, and cannot be delayed.

For a group that has been in turmoil over its board composition, there was a surprising amount of positive contract win news in the last interim results. So I reckon it may not be long before the market starts to see this glass half full, rather than half empty. There were also some own goals. The Chairman clarified that "performance challenges" in the presentation actually means, "we screwed up!", which made me chuckle - but also reassured me that I was talking to someone who's giving me an honest appraisal of things.

Overall, I think the market cap of c.£55m (at 35p per share) is now so pessimistic, that if things go reasonably well over the next year, I could see this share doubling without too much trouble. There again, there's a distinct possibility (maybe 50% chance, at a guess?) of one final profit warning at some point.

So it's perhaps not a share for traders, who use stop losses. More a special situation for investors who are prepared to ride out any short term price weakness, setting their sights on the bigger, longer term potential profit (and lovely divis along the way - assuming they are sustainable).

Anyway, bottom line for me, is that having met management I'm very happy to hold for the next year. I'm not "all in" yet though - am keeping my position size to medium. This means that another profit warning wouldn't hurt me too much, and would give me the flexibility to average down again on any further sharp fall in price. Mind you, that would be entirely dependent on my five tests below being passed. I only average down where I can tick five specific boxes (see below).

Falling knives generally

With falling knives, I'm continuously tweaking my approach, learning from each mistake (and success). So now, I ask five key questions after a profit warning or warnings, the answers to which determine whether I buy some (or more) shares;

1) Is this a speculative, story stock? (if it is, then I will now never buy after a profit warning)

2) Are the problems fixable in a reasonable timescale (say 1 year or under)?

3) Is the company financially sound & stable? (i.e. won't need to do a Placing)

4) Will there be another profit warning (i.e. has all the bad news come out yet?)

5) Are management doing the right things to fix the problems?

To expand on the above;

1) Once story stocks start to go wrong, missing forecasts, etc, then it's usually a slippery slope. There's nothing worse than a stale story stock - once they start falling, it's usually the beginning of the end. It's so important to remember that practically all story stocks go wrong, after a while. Even if they do succeed, it's usually years later, and several fundraisings (at increasingly low prices) afterwards, with early shareholders diluted away to almost nothing.

So once a story stock starts to go wrong, all bets are off, and I wouldn't be tempted to bottom fish.

2) This is really the crucial question. Very often good companies encounter bumps in the road. I've done well over the years from buying sound companies after some kind of temporary problem has crushed the share price.

Ideal situations are where there is perhaps one problem division within a group, but all other parts of the group are trading well. A good example of this is Avesco (LON:AVS) , when the shares were about 100p it was blindingly obvious that the rest of the group was worth maybe 300p. However, one heavily loss-making division was obscuring that. Management are sorting out the loss-making division, so a higher share price was virtually guaranteed. This type of situation can be a goldmine when you find them.

The risk is that management might present structural problems as if they are easily fixed. A good example of a company with, what I believe to be, serious (maybe terminal) structural problems is DX (Group) (LON:DX.) . Hence why I sold my DX shares, after realising that the profit warning was not going to be fixed.

3) Absolutely crucial - a falling knife situation has to be financially stable & sound. Without that, anything can happen. Although banks are being remarkably lenient right now. Sepura (LON:SEPU) is a good recent example of a huge fall in share price due to inadequate financial strength. It ran into the worst type of problem - trading difficulties, combined with inadequate funding. So now they have to raise money from a position of considerable weakness. NOT a falling knife to catch, as I said at the time.

4) Will there be another profit warning? Difficult to forecast, but if in any doubt, then I would either not catch the falling knife, or keep the position size sufficiently small that another 30% drop wouldn't hurt too much. At some point you have to take the plunge, and it's impossible to buy at the exact low point every time. So personally, I don't worry too much about being 10-20% wrong in the short term, if I'm confident there's a 100% gain to be had in the longer term, with patience.

5) I like to meet management after a profit warning, or at least have a telecon, if possible. They give away so much in body language, without realising it! How they answer questions, not just the words said, can also be very revealing.

Also I feel that management who hide away after a profit warning, possibly have something to hide. Or are just not of very good character. Whereas management who face the music, and take criticism on the chin, usually seem to get on top of the problems more quickly. They also usually restore investor confidence more quickly.

Restore (LON:RST)

Share price: 331.5p (up 0.5% today)

No. shares: 99.9m

Market cap: £331.2m

AGM statement (trading update) - this reads like an in line update:

"I am pleased to report that 2016 trading has started satisfactorily across the Group...

More detail is then given about divisions, which I won't cover here.

Net debt has reduced significantly:

Net debt has reduced significantly since 31 December 2015, principally due to the sale in March 2016 of Restore Document Management Ireland Limited, which held the Irish assets of Wincanton Records Management

Cenkos is forecasting net debt of £27.0m at end 2016, down from £60.6m at end 2015, so this is a key factor to take into account when valuing the shares - i.e. a higher PER could be tolerated, since debt has reduced.

The conclusion is:

We look forward with confidence to making further progress this year."

My opinion - I don't like "making further progress this year" comments, because it stops short of confirming that the company is trading in line with market expectations.

So I rang up one of the company's advisers, and queried this point. He indicated that the AGM statement wording is based on last year's. So I checked back, and sure enough, it follows the same layout, with almost the same wording.

I say almost because last year the company concluded:

We look forward with confidence to making further good progress this year."

This year the company concluded:

We look forward with confidence to making further progress this year."

See the difference? There's a change of emphasis, with the word "good" being removed this year.

Maybe I'm over-analysing this, but it's interesting to see a slightly more cautious tone to this year's statement.

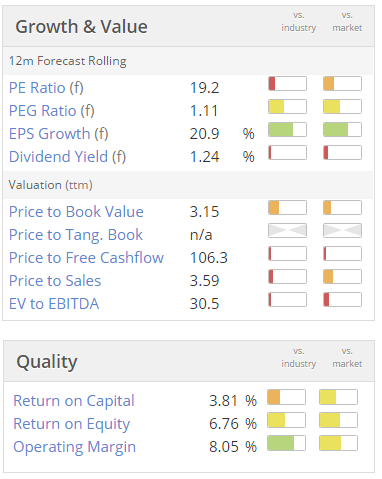

Valuation - it's looked expensive for a while, but that hasn't stopped the shares continuing to go up!

It seems a good company, but personally I would want more exciting organic growth, to induce me to pay up a PER of nearly 20.

Dods (Group) (LON:DODS)

Share price: 13.1p (up 5.0% today)

No. shares: 340.3m

Market cap: £44.6m

Results, y/e 31 Mar 2016 - I'm not familiar with this company, so don't feel I can add any meaningful analysis. So I really just wanted to flag up its results today, which look rather good. Readers may then want to take it further, and DYOR possibly?

I only half-understand what the company does. On the Stockopedia "profile" section it says:

...Its principal activity includes the curation and aggregation of information and data, as well as the provision of services through a combination of online information and digital services, training courses, conferences and events publications, and other media...

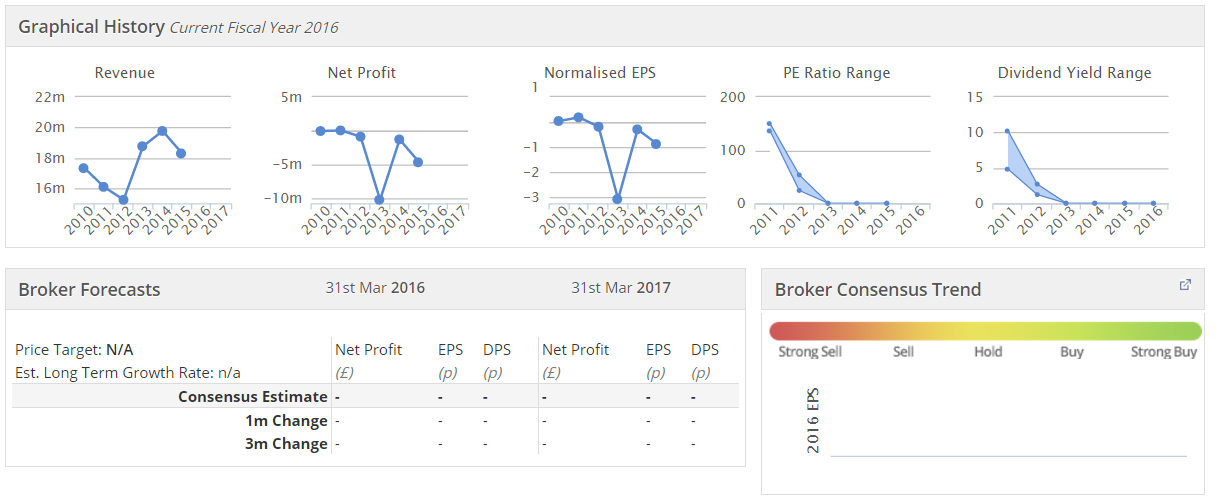

Looking at the historical graphs on Stockopedia, its performance seems to have been consistently poor, but that seems to have turned around in 2015/16:

This year, the company seems to have dramatically improved its profit margins, saying:

During the year, Dods' revenue increased 7% to £19.6m. Gross margin for the Group increased to 38% compared to 29% in the prior year. The Group achieved adjusted EBITDA of £3.0m versus £1.2m in the comparative period. Adjusted EPS for the fiscal year was 0.66p compared to 0.13p for the prior year.

The increase in adjusted EBITDA is a result of top line growth and restructuring initiatives. Initial efficiency plan results are reflected in the increase in gross margin.

This begs the question, if it was so easy to increase margins dramatically, why haven't they done so before?

Balance sheet - looks very good. There's £9.1m in cash, and no debt.

Although note 19 indicates that deferred income is £5.1m. This represents the amount by which the cash pile has been inflated by customers paying up-front for services which have not yet been delivered. Obviously the company will incur considerable costs in providing those services in future. So I feel it is always prudent to deduct deferred income from net cash, to arrive at the true, surplus cash figure - which in this case is £4.0m.

Other people may regard it differently, as we've discussed numerous times here before!

My opinion - there's been little revenue growth in recent years, but the group has suddenly become much more profitable. That needs investigating. Is it sustainable?

With a nice strong balance sheet, the company should be able to start paying divis soon.

Overall, it doesn't excite me, so I won't be investigating any further, but just thought I'd flag it here as something that might be worth a look? The shares have already risen a lot, so maybe the improved performance is already baked into the valuation now?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.