Good morning! It's Paul here.

I'm hoping to report on up to 6 companies today, as noted in the header.

I'm moving house this week, so things are a bit chaotic (more so than usual anyway). I'm being distracted by having to do tip runs, and pack away my remaining possessions into cardboard boxes. It's ridiculous all the junk we accumulate over a few years, isn't it?

accesso Technology (LON:ACSO)

Share price: 1895p (up 1.6% today)

No. shares: 22.5m

Market cap: £426.4m

AGM trading statement - the company describes itself as - " the premier technology solutions provider to leisure, entertainment and cultural markets". It provides things like electronic queuing systems for theme parks, ticketing, and an increasing range of complementary services.

Its update today covers the first 4 months (Jan-Apr inclusive) of this financial year, ending 31 Dec 2017. The business is heavily skewed seasonally to the summer, so there's not usually much to report on at this time of year.

It sounds like things are progressing well;

"I am happy to report that the first part of the 2017 financial year has started strongly, with all parts of the business generating good momentum...

There's more detail in the announcement, which you can read if you're interested, but it all sounds positive.

The conclusion is;

It is still early in the season and, as is normal, less than 20% of the year has been traded to date. Nevertheless, the strong start gives the Board confidence in the Group's outlook, with expectations for the year remaining unchanged.

So it's an in line update.

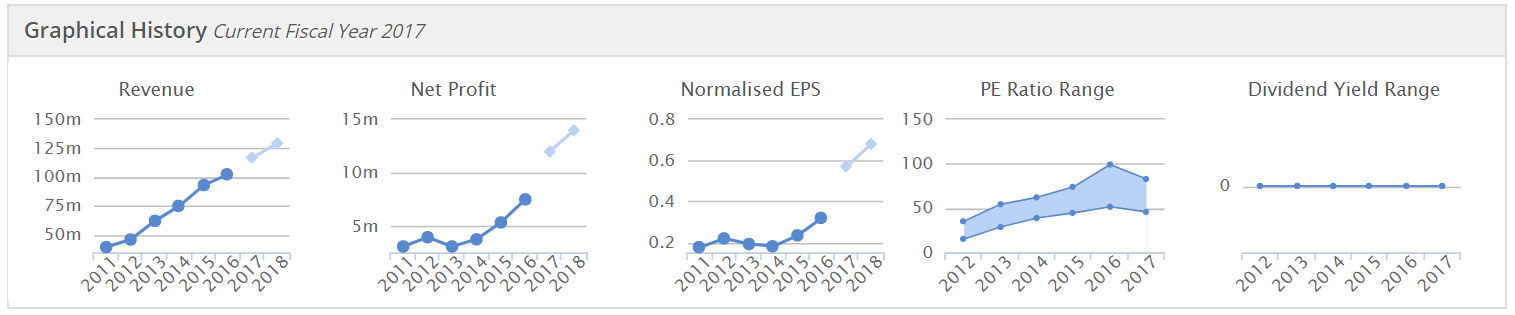

Let's have a look at the Stockopedia graphical history;

NB. The company reports in US dollars, so the figures above are in dollars/cents.

Graph 1 - a good progression in revenues, some organic, some from acquisitions.

Graph 2- steadily rising net profit, with significant forecast growth in 2017 & 2018 (the lighter coloured blobs are forecasts, darker coloured blobs are actuals)

Graph 3 - a similar story with EPS growth. Note that the company has expanded whilst issuing relatively few new shares - a very good thing. The StockReport shows 17.6m shares in issue in 2011, and the most recent figure is 22.5m. That's not bad, considering how much the company has grown over that period.

Graph 4 - this is telling us that the share started out fairly expensive, and has got increasingly more expensive! That's justified, as long as decent growth continues. Also I think the high rating here reflects that this does seem to be a unique company, dominating its niche, globally.

Graph 5 - there are no divis at the moment, as the company is reinvesting its cashflow into growth, which is fine. People don't buy this type of growth tech company for the divis. They come later (hopefully), once the company is mature.

My opinion - this is a superb company in my view. Tom Burnet has worked miracles here, and I'm sure shareholders are delighted with the company's progress. I interviewed him a year ago, here, which has a lot of interesting background info about the company. Maybe I'll see if he wants to do another interview later this year?

As with a lot of growth companies, the shares have done very well in this roaring bull market we're currently in. That's fine as long as positive newsflow keeps flowing, and the market as a whole remains buoyant. Although the general risk is that growth company shares can plummet if newsflow disappoints.

So far, so good though. Today's update sounds reassuring.

Directors must be kicking themselves for selling £16m of shares at 950p in Apr 2016, as the price has since doubled.

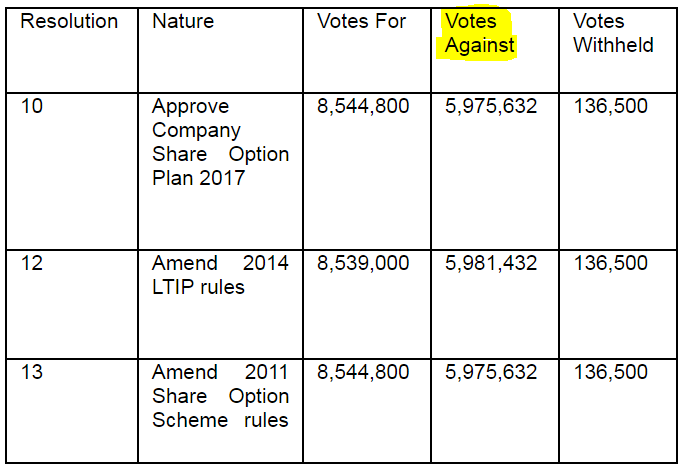

EDIT - there's been a sizeable shareholder revolt today over the company's share option schemes. This RNS shows that, whilst all resolutions were passed, there was a big vote against 3 resolutions relating to share options;

This means that management really need to go back to the drawing board, and change these share option schemes. It's very unusual to see such a close vote, as galvanising negative votes at an AGM is notoriously difficult.

Such a large negative vote also suggests to me that the company is not consulting adequately with its shareholders. To propose schemes for approval that have clearly irked a lot of shareholders, seems remiss.

Given this negative reaction, shareholders should probably scrutinise the share option schemes. It sounds like they're possibly too generous?

Grotesque executive remuneration generally (not specifically at this company) is a big issue at the moment. If re-elected, the Government has vowed to take action. I think sensible management should be restraining themselves in advance of this. Investors, and the public generally, are incensed (rightly so) about executive greed.

Johnston Press (LON:JPR)

Interestingly, there has also been a similar, sizeable "against" vote at this company's AGM today - see this announcement.

I like the comment from the company in this RNS;

The Board of the Company notes the significant proportion of the votes cast against resolutions 2 and 12. The Company will continue its ongoing dialogue with shareholders at the appropriate time in order to further understand the reasons behind the results of the votes on these resolutions (see Note 4, below).

I think Accesso need to put out a similar statement. Shareholder revolts at AGMs are not a good thing - it tends to indicate out of control Directors, over-remunerating themselves, and not adequately consulting with the owners of the business. It also shows that Directors are out of touch with public opinion, and hence probably the opinions of their own workforce too.

Indigovision (LON:IND)

Share price: 241p (up 6.6% today)

No. shares: 7.6m

Market cap: £18.3m

(at the time of writing, I hold a long position in this share)

Share buyback programme - the intriguing new StockRank Styles feature describes this company as a "Super Stock". I must admit, that wouldn't have been my first choice of words to describe this Scottish digital CCTV company.

Still, the shares have risen by about a third in the last week. I reported here last week on a much more positive-sounding trading update than we've had for a long time.

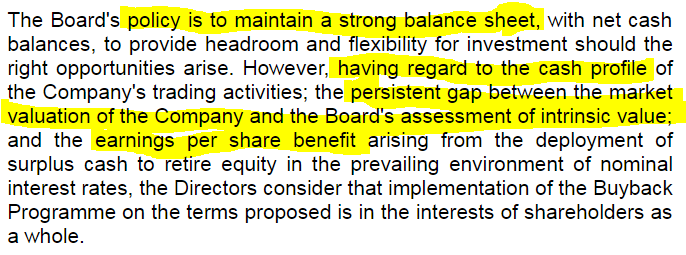

Today the company says that it intends buying back up to 375k of its own shares (c. 5% of the total). The explanation given for this makes interesting reading;

(sorry about the wonky highlighter - it's so difficult to control using a mouse - for some reason it won't let me copy/paste the text, so I had to insert it as a picture instead).

A couple of points;

- Directors must be confident about current trading, and the outlook, to be prepared to deploy up to about £900k cash (at the current share price of 241p) on doing buybacks.

- It's unusual (but pleasing) to hear the Directors specifically tell us that the company is undervalued (in their opinion).

- New Pistoia Income Fund owns 29.89% of the company, so buybacks would tip them over the 30% threshold where the Takeover Panel rules would require a mandatory takeover bid for the company. So an exemption has been secured to prevent this happening.

My opinion - dare I hope that things might be turning around here, after a long period of disappointing performance? It's starting to look possible.

Cloudcall (LON:CALL)

Share price: 96p (unchanged today)

No. shares: 20.1m

Market cap: £19.3m

(at the time of writing, I hold a long position in this share)

Result of AGM & Board Appointment - this company (formerly called Synety) describes itself as: "a leading cloud-based software business that integrates voice communications into Customer Relationship Management (CRM) platforms".

It's amazing to find a tech company that can actually describe what it does in a clear & understandable way. So that's a good start.

What's interesting here is that the company slipped out a trading update, buried in a "result of AGM" statement, yesterday. Companies often put trading updates into the main AGM announcement. However, result of AGM announcements are nearly always just a formality, saying that all resolutions were passed.

It just goes to show that investors should read all announcements from companies of interest, no matter how apparently unimportant they might appear. It's surprising how often a trading update can be buried in an apparently unimportant announcement such as this. So I always check every RNS.

The update said;

Peter Simmonds, Non-executive Chairman of CloudCall, made the following statement at the meeting:

"CloudCall delivered significant operational and strategic progress during 2016 and I am pleased to report that the Company has made a solid start to the current financial year. We continue to see strong sales momentum underpinned by product demand from both new and existing customers. This positive start to the year provides a strong platform on which to build on for the remainder of 2017.

"In addition, the Company is seeing the benefits of implementing a more focused sales strategy with key channel partners alongside a number of operational improvements.

Our strategy to leverage larger mid-market customer relationships continues to drive up customer metrics and underpins our confidence of delivery during 2017."

Bear in mind that Peter Simmonds has a terrific track record, building up dotDigital (LON:DOTD) very successfully. So his musings about CloudCall carry considerable weight, in my eyes.

My opinion - this share seems to be another serial under-performer which looks like it's sorting itself out. The company is still loss-making, but I suspect it's getting close enough to breakeven that, in a bull market, investors may begin to focus on the operationally geared potential future profits?

I'm minded to sit tight on this one, it could yet prove the bears wrong perhaps?

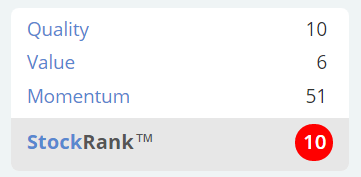

The StockRank is still very low, so caution is needed. Also, it's classified negatively as a "Momentum Trap" by the Stockopedia computers. I always think very hard before buying, or holding a share with a very low StockRank like this. It means that, statistically over a basket of shares, the odds are against me.

Topps Tiles (LON:TPT)

Share price: 97.5p (down 5.3% today)

No. shares: 192.4m

Market cap: £187.6m

Interim results - 26 weeks ended 1 Apr 2017.

Topps describes itself as "the UK's largest tile specialist", trading from 359 stores.

The word "challenging" is used 6 times in this half year results statement.

A few key numbers for H1;

- Revenue down 1.3% to £106.6m

- Like-for-like ("LFL") revenues down 1.9% - although the company points out that prior year comparatives were exceptionally good, due to Stamp Duty changes stimulating demand last year.

- Gross margin remains high, at 61.2% (prior year H1 was slightly higher, at 61.5%)

- Adjusted profit before tax remained robust at £10.1m (H1 last year was £10.3m)

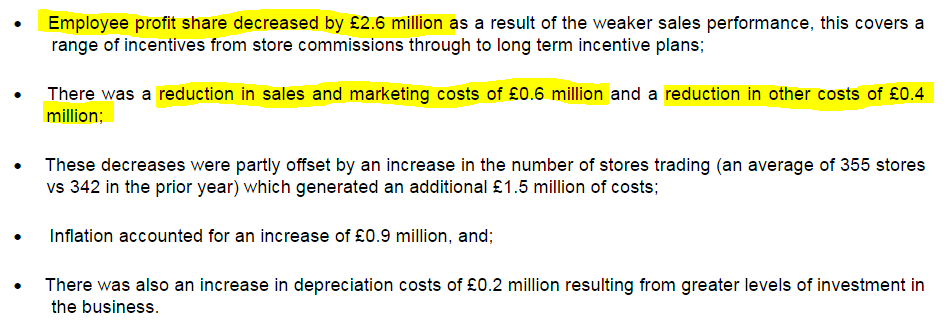

I'm quite surprised that profit only fell 2%, because normally I would have expected higher costs (such as NLW, and other), and reduced sales, to translate into a sharp fall in profits. That has not happened. Why? The reason is that costs have fallen, as explained;

In my view this is very encouraging - it shows that Topps has some flexibility in its cost structure, to help offset periods of more subdued trading.

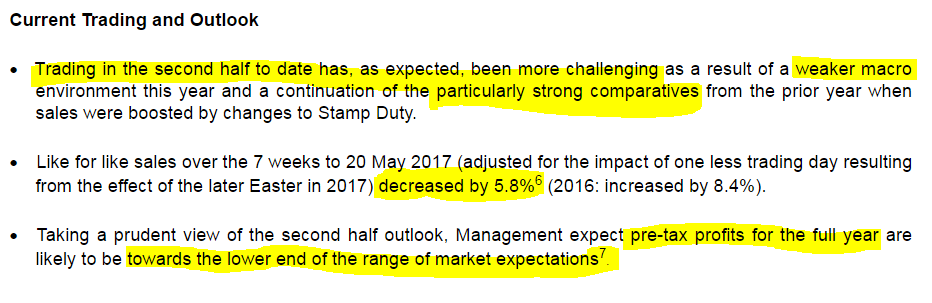

Outlook - not great, but not a disaster, probably best sums it up.

That drop in LFL sales of 5.8% in the last 7 weeks is quite a nasty fall. The company has given back most of last year's sales gains over that period.

Top marks for Topps, in that note 7 very helpfully states exactly what market expectations are. This is extremely helpful for investors, and all companies should do this please:

7 The range of market expectations for adjusted profit before tax for the year ended 30 September 2017 is £21.0m to £22.1m.

It would have been even more helpful to include the EPS numbers too, but never mind.

Stockopedia shows consensus as 8.64p EPS for this year (ending 1 Oct 2017). So if we guesstimate that might end up around 8.0-8.5p perhaps, then I make the current year PER about 11.8 - that looks about right to me.

Dividends - the interim divi has been raised 10% to 1.1p. That looks consistent with a forecast of 3.76p full year divis - for a yield of about 3.9% - not bad, for a growing divi.

Balance sheet - looks a little thin, with NTAV of only £20.0m, which doesn't seem much for the size of business.

Note there is £39.9m in bank loans, shown within creditors over 12 months. Although cash of £13.4m partially offsets that. Given the level of profits, I don't see this level of debt as being particularly burdensome. Although we should of course take it into account when deciding whether the PER is reasonable or not - the more debt, then the lower the PER should be, as a rule of thumb.

Overall then, an OK balance sheet, but I've seen better.

Cashflow - this is a decently cash generative business. Note that the net cash from operating activities has fallen from £11.0m in H1 last year, to £7.1m this year - quite a big drop. This is due to modestly unfavourable working capital movements, and higher cash outflows for interest and tax, compared with H1 last year. Those don't seem a particular concern.

The cash generated by the company is basically spent on capex, and paying divis.

My opinion - this is a good business, and it seems to be demonstrating robust profitability in more subdued conditions, which is good.

I can't really see anything much that would compel me to buy this share. It's likely to face cost headwinds, like all other labour-intensive businesses. Demand also seems soft at the moment, so it might be one to keep on my watchlist, and possibly revisit when conditions for the consumer are improving again.

The StockRank is 71, and the style is "Adventurous, Small Cap, Contrarian" - my view is similar - it's quite good, but not compelling. I can't really see what would be the catalyst for the share price to resume its upward movement?

Epwin (LON:EPWN)

Share price: 117.5p (down 0.2% today)

No. shares: 142.5m

Market cap: £167.4m

AGM trading update - this group described itself as;

"the vertically integrated manufacturer of low maintenance building products, supplying the Repair, Maintenance and Improvement ("RMI"), new build and social housing sectors"

This sounds reassuring;

"The Group continues to make progress with its strategy, focussed on operational improvement, broadening the product portfolio, selective acquisitions, cross selling and market share growth in key sectors.

Trading for the first four months of the year has been in line with expectations.

As highlighted in the final results announcement for the year ended 31 December 2016, input costs increased as a result of the weakening of sterling since June 2016 following the vote to leave the European Union and the Group is continuing its efforts to mitigate the increase in these costs."

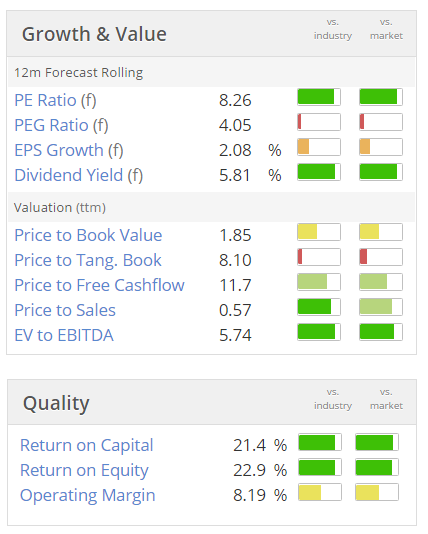

Valuation - it looks attractively priced, although this type of business would never command a premium rating, as it's low tech, and cyclical;

My opinion - I like the low PER, and high dividend yield.

Although this sector is not one that I would generally be interested in, unless the valuations were bonkers cheap - and that would be sign that something was wrong. It might be worth a look though, if you like this sector.

eg Solutions (LON:EGS)

Share price: 77p (up 17.6% today)

No. shares: 22.7m

Market cap: £17.5m

(at the time of writing, I hold a long position in this share)

AGM trading statement - this software company has been slated (rightly so) in the past for its executive greed, generally poor performance, and repeat fundraisings.

However, the newsflow seems to be becoming more positive of late. That's why I picked up a small personal shareholding in it a little while ago.

Today the Chairman said at the AGM;

"Following on from a very strong second half of the financial year 2017 which saw the Company securing several major contracts with global firms across new verticals, I am pleased to report to shareholders that the business has continued to carry this momentum into the first four months of the new financial year.

Contracted revenues for the current financial year are already in excess of the full year total achieved in the previous financial year and we have clear visibility of our full year targets.

"The business continues to gain market share by implementing our focused strategy of direct sales and distribution via our in-house resources and global partners and the Board looks forward to the future with confidence."

What does the middle bit actually mean? I think it's saying that the company is basically home & dry in terms of at least meeting last year's numbers - which were £8.2m revenues and profit after tax just above breakeven.

Consensus seems to be for £10.2m revenues this year (ending 31 Jan 2018), and a net profit of £1.44m. Maybe those figures might be exceeded if some additional decent contract wins are won over the next 8 months?

My opinion - this company has had a number of false dawns in the past, but I like the space it operates in (back office optimisation), and its customer list looks impressive - selling into large organisations.

There could be something interesting here, I'm not sure. It's worth a look though, and I'm intrigued by signs of improved trading.

All done for today.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.