Good morning.

Risk Management

Before looking at individual company results, I must make some comments on portfolio risk management. A share that is very popular with retail investors, Quindell (LON:QPP) recently plunged almost 50% on a new shorters attack by a website called Gotham City Research. I won't go into the ins & outs of that here, as it's neither a small cap, nor something I can comment on at Stockopedia, because I have personally been short of the shares for some time, and indeed have been very bearish in my comments here about the company since 2012.

The reason I mention it though, is my shock and dismay at reading some bulletin board comments about how some people have said that the shorters have ruined their lives, inflincting huge financial damage on individual investors. The reason I am shocked is that anybody could be so reckless, and stupid, as to expose themselves & their families to huge financial loss on an AIM share dropping 50%.

This shows appalling lack of risk management, which is the vital first step that all investors must put in place before they even get started. You MUST have portfolio rules to manage risk in any circumstances, as follows;

1. Diversification - the simplest way of managing this is to set a maximum percentage of your portfolio that any share can reach. Personally I have a 15% rule - i.e. that I keep a running total of all my portfolio on a spreadsheet (which consolidates all positions, however held - e.g. ISA, SIPP, spread bet accounts, etc), and then ensure that no individual share can represent more than 15% of the overall portfolio. This ensures that when (because it is inevitable with small caps) something goes wrong, and your biggest holding drops by 50% on a profit warning, that you can emerge relatively unscathed. With a 15% rule, the maximum you can ever lose is 7.5% of your portfolio, if your largest share plunges by 50% in price. That's just happened to me too, but not on Quindell shares, but on SpaceAndPeople shares. It hurt me financially, but it came nowhere near causing me financial ruin. That wasn't an accident. It was because I had set a sensible rule on maximum position size. So position size is one thing, and diversifying into various sectors is another good idea. Make sure that your portfolio is not just a collection of speculative blue sky stocks for example - as they tend to drop as a group when the market gets the jitters.

2. Gearing - don't use it! Gearing is so dangerous, and is only suitable for very experienced investors, and in highly liquid shares, and even then only in moderation. However, if you must use gearing, then again set a limit, and don't breach it. I would say that 50% gearing on top of your equity (i.e. taking positions up to 150% of your equity) can be justified for relatively short periods in a bull market, and providing your portfolio is already diversified. Notice also how shorters always pick target shares where there are large numbers of leveraged mug punters holding spread bet positions. They do this because they know that if the share price can be slammed down by more than 10%, then it will trigger a domino effect as forced closures of sometimes quite large geared positions starts & rapidly escalates. You need to be the smart person buying the dip, not the mug being stopped out of your spread bets on the dip.

3. Learn from your mistakes! So instead of blaming others (e.g. shorters) for attacking a share you hold, find out why they targeted that share, and spot the warning signs for weak & over-priced shares in future. Try not to be on the other side of the trade to short sellers, because they tend to be the smartest & most experienced investors out there, and are usually (but not always) right.

4. Ditch the emotions - the market is currently awash with inexperienced, foolhardy investors, who simply don't know what they are doing. However, a long bull market is like a rising tide which lifts all boats - so bad decisions have been rewarded handsomely (the riskiest shares often go up the most in bull markets, but eventually many turn out to have been in reality worthless), which can give these foolish people big portfolios, and big egos. Yet they are almost destined to lose the lot, or most of it, because they're not taking basic measures to manage portfolio risk. So if you are treating your favourite share like supporting your favourite football team, then that means you're behaving emotionally, not rationally. Do you try to shout down any negative comment on your favourite share? Do you get abusive online towards anyone who is critical of your favourite share? If so, then it means you're a muppet, and will probably lose your money on that share.

I've been an active investor for about 18 years now, and in that time I can tell you that pretty much every speculative share that had a large fan base on the bulletin boards, turned out to be an investment disaster. So if you are part of an unsophisticated, and noisy crowd on a bulletin board, that has become obsessed with your favourite share, then you are almost certainly going to lose your money, sooner or later. You have been warned! Unsophisticated investors tend to bunch together in story stocks, and are impervious to the risks that most sophisticated investors have spotted and avoided in the accounts. So try not to become part of a fan club for any share, as this also clouds your judgment about when to sell.

Buying and selling shares should never be based on emotions, it should be based on careful analysis of the facts and figures. If you're taking investment decisions based on your emotions, then you're going to under-perform, potentially very badly, in the long run. The best investors follow Buffett's rule of being greedy when others are fearful, and fearful when others are greedy.

So I hope none of my readers ever see a 50% share price fall as anything more than an annoyance, and a small and temporary financial setback. In fact, I challenge every reader to write down on a piece of paper now, how much it would cost you if your largest shareholding (including leveraged positions) instantly dropped by 50%. Is that amount of money a loss that you could cope with comfortably? Would you be able to explain easily to your partner that you had lost that amount of money, without feeling reckless or stupid? If that potential loss figure is getting anwhere near to where it would change your life for the worse, then it means the position is too large, and it should be reduced.

I'm speaking from experience here, as I've made all the mistakes in the book in my time! Arguably it's the only way to learn. However, these mistakes are simple and easy to avoid, if you just have a couple of basic rules on portfolio management. Above all, you must set a rule on maximum position size, and stick to it. That might well save your bacon one day, in a market downturn or crash.

EDIT: Please also see the comments section below, where John Rosier makes some useful points, and has included an interesting graphic of a portfolio management tool he uses. I should also add that Stockopedia has some excellent portfolio management tools under the "Folios" tab on the black menu bar above. So it's worth monitoring your portfolio using such tools, which can help you manage risk.

EDIT 2: Here is an example of one of the Stockopedia portfolio management screens, which I set up about a year ago, but haven't updated since, so the holdings do not reflect my actual portfolio, it's just an example. You can see how Norcros was significantly over my 15% position size limit here! So that flags immediate action required to reduce that position:

Also note how under the "Events" tab within Stockopedia's "Folios" section, it will create a calendar of forthcoming results, dividends, AGMs, etc, for the shares in your portfolio! This is a really nifty feature, and it integrates with popular calendar functions such as Google Calendar, or Apple equivalents. Here is a screenshot for my test portfolio's calendar that Stockopedia has generated for me;

PuriCore (LON:PURI)

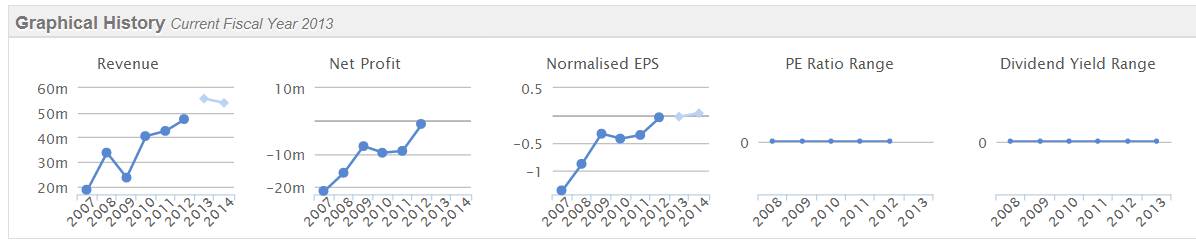

This is a potentially interesting growth company. They make machines which extend the life, and disinfect fresh food, cut flowers, and also for sterilising medical instruments. The company has looked a basket case in the past, but it caught my eye about a year ago when they restructured the Balance Sheet, got rid of all their debt, and that was then followed with some substantial Director buying later last year - usually a positive sign of good things in the pipeline.

Results for calendar 2013 are issued today, and show some progress in my opinion. Revenue is up nearly 16% to $54.8m, so it's a proper business, not a blue sky thing. EBITDA nearly doubled to $2.4m. However note that they capitalised $1.2m of development spend. There is a pre-tax loss overall of $6.5m, but that's distorted by a $5.8m exceptional write-off relating to the debt restructuring. The operating loss is $0.7m.

These figures may not look particularly exciting, but should be viewed in the context of disastrous losses in the past, so very much a recovery/turnaround type of situation. What makes it potentially interesting is that they are building recurring revenues for the fluids that their machines use, so in time perhaps this might build into a profitable business?

My only reservation is that the outlook statement is probably not upbeat enough to trigger much immediate interest. Note also that some hardware sales are not likely to repeat;

Consistent with market expectations, revenue is expected to soften in the short term as PuriCore balances declining revenue from capital equipment and grows consumables and other recurring revenue.

Therefore I think it might be a case of going back to sleep for another six months with this share.

I shall remain invested, as the big Director buying stands out here, in particular the last two Director buys were £236k and £450k. That's a meaningful vote of confidence from D.Hegglin who has personally spent over £700k buying shares since Sep 2013. I doubt he did that in the expectation of nothing much happening.

Very large Director buying has served me well in the past as a buying signal. If Directors are willing to invest meaningful amounts (i.e. well into six-figures) into a company's shares, then we should sit up and take notice.

I would say that the Balance Sheet is OK, but not strong. Current assets are 107% of current liabilities, which is not as strong as I would like, but it isn't a serious worry either. There are no long term creditors at all, so that's a positive. Net cash was $3.4m at 31 Dec 2013, although as it has been historically loss-making, a small fundraising might be required at some point.

I've just noticed that the 2013 results are stated after a $1.8m charge for inventory write-down. So as that's a one-off, the underlying trading is better than reported.

The market cap (at 42p per share) is just over £20m, which strikes me as potentially cheap, IF they succeed in driving up recurring revenues to a point where it becomes decently profitable. So this one is speculative, but there might be something exciting here, if the company executes well going forwards.

Bioventix (OFEX:BVXP)

This is small (£28m market cap at 550p per share) specialist biotechnology (antibodies) company. It has only just over a dozen employees, and makes the most astonishingly high profit margins - e.g. interims to 31 Dec 2013 issued today show £1.5m turnover and £975k pretax profit! Wow.

The company also announces it is moving up from ISDX to AIM, which is a good move in my view, and might help the shares become more liquid.

I was tremendously impressed with management here, who presented at an investor event last year. However, my main worry is that the company could be too heavily reliant on one or two key individuals. If you accept that risk however, then the company just looks like a tiny cash machine - generating pots of cash from its speciliased niche.

Basic EPS was up strongly, from 12.5p to 16.0p in H1 (vs H1 in 2012), so annualise that to a run rate of 32p EPS. That puts the shares on a PER of about 17.2, so not cheap on a PER basis, but on a PEG basis that's under 1, since the EPS growth rate is 28%. Therefore if you think that sort of growth rate is sustainable, then a premium PER is justified.

So, a very interesting company.

I've not spotted anything else of interest on the results front.

A reader asked me to look at results from Trap Oil (LON:TRAP), but I've no expertise in the resources sector, so prefer not to make a fool of myself by writing ill-informed rubbish on that!

Good discussion in the comments section below, so do please feel welcome to add your thoughts to the debate on risk management.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in PURI, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.