Good morning,

The FTSE is up by nearly 2% this morning and the euro has surged following the first round of French presidential voting, won by the centrist and ex-banker Emmanuel Macron.

As a rule, I never react to events such as this. Some people can make a living out of reacting to political and macro events and I wish them well. For someone who is analysing individual stocks, however, it seems like a dangerous temptation to increase transaction costs and to get distracted from what matters most - the success or failure of individual companies.

It's worth keeping an eye on currencies, of course, but perhaps not a good idea to accidentally become a currency speculator!

Graham

Fishing Republic (LON:FISH)

Share price: 46.5p (+4.5%)

No. shares: 37.8m

Market cap: £17.5m

This stock has divided opinion a little bit.

Today's results suggest to me that my mildly optimistic outlook may have been justified - the company is continuing to make progress on a number of fronts. The results are in line with expectations.

Key points:

- 5 new stores in 2016 (taking total to 12), 3 new stores in Q1 2017, and another 3 soon.

- Total sales up 41% to £5.8 million.

- Like-for-like store sales grew by 16%.

- Online sales decreased, as planned. But own website sales increased to £660k.

- PBT £400k, and no exceptional items this year (pre-exceptional PBT £300k in the prior year).

Outlook sounds good:

The main fishing season, which typically begins in the second quarter of the year, has started well, helped by the recent warm weather, and the Board looks forward to reporting on further progress in due course.

Inventories: Paul has been unhappy with the high level of inventories, which increased further to £4.3 million at year-end.

Using the H1 report, I deduce that Cost of Sales was £1.8 million in H2 (this seems a lot more relevant than using a full-year number, given the store growth).

Annualising £1.8 million to £3.6 million would again leave us with the conclusion that inventories are being held for more than a year.

I agree that it's a bit unsettling, but would again counter with the argument that decent returns might still be achieved, depending on margins.

Fishing Republic's gross margin has increased in 2016 to 47.6%. Unfortunately, this has not yet translated into an improved operating margin, which sits at 7.2%.

My opinion

I don't consider this to be "uninvestable" by any means. It looks as though it may have some good potential.

The current stage of development is still very early, so it does still have a lot to prove.

I do have a few concerns about quality. For one thing, own-branded product sales increased this year but fell as a percentage of total sales to 13%. I'm not too keen on simple distributors, so it would be a lot better to see this metric on the increase.

The company attributes its improved gross margin to its improved

purchasing power, but administrative costs doubled and selling and

distribution expenses were up 24%.

Thanks to the stagnant operating margin, and the increased share count, earnings per share actually fell from 1.36p to 0.99p (adjusting for last year's exceptional costs).

There will probably be a lot of investment required to grow the online platform, and several further rounds of sales growth might be needed to generate operating leverage.

I'd have a lot more confidence in the business model if it was already generating good operating margins, but I can't rule out the possibility that it could achieve this at a larger scale in the coming years.

Goals Soccer Centres (LON:GOAL)

Share price: 107.5p (+5.4%)

No. shares: 75.2m

Market cap: £81m

This is a short announcement responding to a story reported by Sky News yesterday about Goals and Powerleague exploring a potential merger.

The preliminary discussions with Powerleague are but one of the strategic opportunities currently being assessed by the Goals Board. Furthermore, at this stage, no commercial or financial terms have been agreed and no decision on any course of action has been made by the Board. There is therefore no certainty that any transaction will proceed.

Even if the Board strongly intended to pursue a deal, it would be important for them to say this from a negotiating point of view.

But in the absence of any further information, it's safest to assume that a deal won't be going ahead, at least not without sufficient carrots for shareholders (and directors).

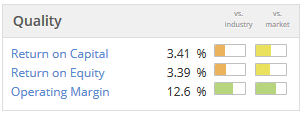

At first glance it appears that a merger would make sense, as existing arrangements have led to poor overall returns on capital:

Skimming through recent reports, this looks like a highly capital-intensive business which needs to use cheap debt to generate acceptable returns for shareholders. One way of mitigating that financial risk is to diversify across as many sites as possible, so a merger makes sense to me from that point of view (as well as providing all of the usual benefits of scale).

Jimmy Choo (LON:CHOO)

Share price: 185p (+10%)

No. shares: 378.6m

Market cap: £700m

Strategic Review including Formal Sale Process

At first, this one didn't make a lot of sense to me.

Jimmy Choo hasn't been listed for very long (October 2014), and the owners have decided to move on.

The Board of Jimmy Choo announces today that it has decided to conduct a review of the various strategic options open to the Company to maximise value for its shareholders and it is seeking offers for the Company. Jimmy Choo has discussed the strategic review process with its majority shareholder, JAB Luxury GmbH ("JAB Luxury"), and JAB Luxury has confirmed that it is supportive of the process.

Checking its website, I see that JAB "actively manages and controls most of its investments".

Media reports suggest it has decided to focus instead on its food and beverage investments, rather than luxury. It will also be selling the Switzerland-based shoe and bag designer Bally.

It's interesting how the stock exchange has only partially managed to assist the majority shareholder in Jimmy Choo's case. JAB's share of the company has been reduced to 70% thanks to the 2014 IPO, but a formal sale process is now required to dispose of the entire stake.

As for valuation, and the prospects for minority Choo shareholders: the valuation currently looks on the rich side to me, especially considering the company's £155 million in borrowings.

So if you're a long-term believer in the Choo brand, then you're probably going to continue holding it even when the valuation looks a bit rich, in the same way that I'm currently holding Burberry despite the more aggressive valuation it's now at.

The power of a good luxury name can persist for decades and holding it through thick and thin, rather than jumping in and out, is a simple way to reap the rewards.

Jimmy Choo's minority shareholders may find they no longer have the choice about how long they will be permitted to continue holding it, but I suspect the owners will hold out for an attractive offer in the current environment (which could easily be higher than the current share price).

Mporium (LON:MPM)

Share price: 13.5p (unchanged today)

No. shares: 534.5m

Market cap: £72.2m

(this section written by Paul Scott)

Results - for the year ended 31 Dec 2016. I very much dislike companies reporting their figures this late. We’re near the end of April, that’s nearly 5 months after the year end date – a ridiculously late time to be reporting. It really makes me wonder what sort of finance function the company has – clearly not a very good one, if it takes them this long to produce the figures.

This is very much a jam tomorrow share. However, a friend flagged it to me recently, saying that their product is ground-breaking, and hence he reckons it’s worth a punt.

Some key facts & figures from the 2016 results;

- Revenue up 44% to £1.8m

- Operating loss of £4.8m, slightly improved from £5.1m loss in 2015 – so clearly this is a heavily cash-burning, jam tomorrow company.

- Gross margin of 82.5% - high, so increased sales mostly drop through to profit.

- By my calculations, revenues need to rise by 322% to £7.6m to achieve breakeven – assuming no increase in administrative costs – seems a tall order.

- Losses are mitigated by receipt of R&D tax credits - £627k credited to P&L in 2016.

- Going concern emphasis of matter in audit report.

- Cash position very low at 31 Dec 2016 – only £949k.

- A further £3.05m (before costs) was raised in Mar 2016 – but this is not likely to be enough. So expect another Placing later this year.

My opinion (Paul) – it sounds like an interesting product. The company provides advertising for smartphones triggered by “micro moments” in real time – e.g. a sporting event, or a product appearing on television. mPorium then serves ads which are relevant to that micro moment.

The trouble is, at this stage, there’s really no way of determining whether this will succeed as a business idea, or not. So how can we possibly value the shares? We can’t, it’s pure guesswork at this stage. Would I make the leap of faith, and value this at £72.2m? Definitely not. Personally, I’d rather watch developments, and perhaps buy the share (maybe at a higher price) once it becomes clear that things are working. It’s nowhere near that stage yet, judging from the 2016 figures. Also I can’t see any clear guidance as to how 2017 is progressing.

In the going concern note, the company admits that more funding is going to be needed;

The Directors have prepared a cash flow forecast up to 30 April 2018 which indicates that continued product development, increased sales and marketing activity and general working capital requirements may require a further funding round if required within the next 12 months. The success of the previous funding rounds, the most recent in March 2017, and current discussions with major shareholders supports the Directors' reasonable expectation that a further funding round, if required, will succeed and mporium will have adequate resources to continue in operational existence throughout this period. Thus, they have adopted the going concern basis of accounting in preparing the annual financial statements.

I think this is a cavalier attitude. Cash-burning companies should fully fund themselves when that funding is easily available. Failure to do so, can end in disaster – as often when market conditions turn down, the funding window is slammed shut as investors instantly become cautious.

So shareholders could be diluted substantially in future, if investors lose faith in the company at a time when it needs more cash. Being heavily cash-burning is bad enough, but not planning ahead with adequate cash resources just strikes me as irresponsible & unnecessary risk-taking.

This share isn’t my cup of tea at all, but good luck to holders. If it

does work out well, then who knows, in this bull market, the valuation could go

a lot higher? Very few jam tomorrow companies actually succeed though, so why

take the risk?

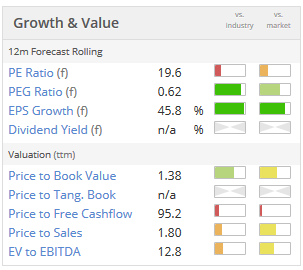

The StockRank is predictably low, at just 10 – so the Stockopedia

algorithms are warning us that this is high risk – or in the “expensive junk”

corner of the graph.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.