Good morning!

McColl's Retail (LON:MCLS)

- Share price: 206.4p (-0.8%)

- No. of shares: 115 million

- Market cap: £238 million

Interim Results for 26 weeks to May 2017

I took my eye off the McColl's share price for a while, and it's been roaring ahead, up nearly 60% versus the low last July.

It's a national chain of "neighbourhood retailers" - 1,292 convenience stores and 358 newsagents.

Performance appears to be perking up. Life-for-like sales fell last year by 1.9%, but are stable for the latest H1 period, and up 1.4% in Q2. Good weather played a role in this (and it's refreshing to hear weather used as a positive excuse for once!)

Gross margin improved last year, and improves a bit more to 25.4%, due to a higher mix of convenience stores (selling more fresh food and groceries) rather than newsagents.

The company has got a lot bigger thanks to taking over 298 sites from the Co-op. These new stores are all trading now and early performance is in line with expectations.

However, profitability has not improved much despite the increased size, higher sales and improved gross margins.

Even if you add back exceptional costs and store pre-opening costs, you only get a PBT of £8.1 million, down from last year's £8.2 million H1 result.

In addition to the pre-opening costs, the CEO says earnings were "held back by continuing cost pressures due to legislative wage inflation". That's a big issue for the sector and one that is likely to continue to hurt for the foreseeable future, in my view.

Outlook statement is balanced. Interim dividend is unchanged.

My opinion

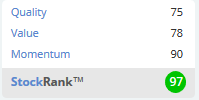

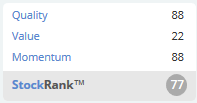

As you can see from the graphic above, McColl's doesn't have a bad rating!

Indeed, on the financial metrics, it's looking very good - cheap, consistently profitable, and growing.

When you think in terms of competitive advantage, however, it's hard to come up with too many except for sheer scale. It has arguably reached a size where it can negotiate increasingly favourable deals with wholesalers, and indeed it is currently in the process of tendering out those major contracts again.

There is also the small matter of £135 million in total borrowings, resulting in £110 million of net debt, or nearly half the market cap.

So there is an element of financial risk here. I don't think it's distressed by any means, and wouldn't mind including this within a balanced portfolio, but the market cap is not as cheap as it first appears.

SThree (LON:STHR)

- Share price: 291.75p (+2.4%)

- No. of shares: 128.7 million

- Market cap: £375 million

Interim Results for the half year ended 31 May

Continuing the recruitment theme we've been pursuing lately, SThree gives us its latest interim report.

It has a heavy weighting in Continental Europe (about half of gross profits) but apart from that the geographical exposure is pretty good, with the balance split between the USA, UK and APAC/Middle East.

UK profits are down 16%, so the relatively small exposure to the UK has been a real blessing this year!

Generally, speaking, it has a lot of control over which countries it invests in, and can respond wherever the local job market is the strongest.

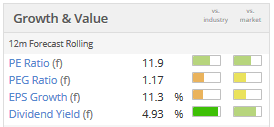

That advantage, along with its scale, helps to explain why it's consistently higher-rated against its recruitment industry peers. The current PE ratio is 12x.

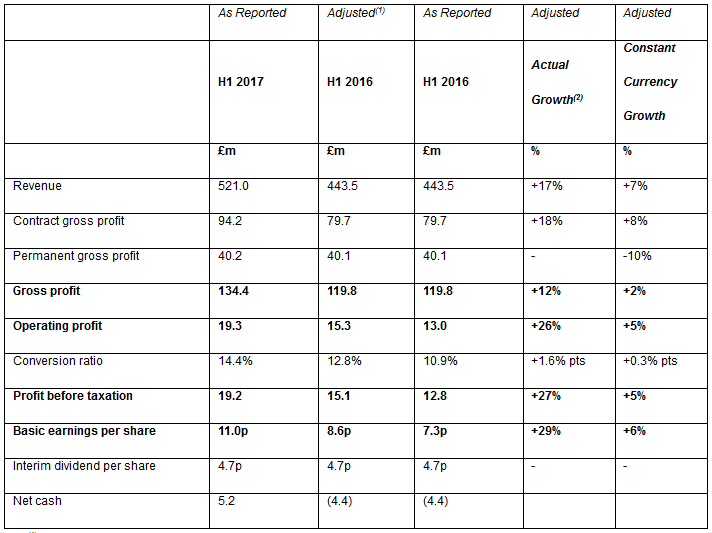

Unfortunately, the presentation of today's financial highlights is a bit too hectic for my liking. I know they are doing their best to be informative, but this chart is too much for me!

Probably the numbers at the far right are the most relevant in terms of underlying performance: stripping out £2.3 million in restructuring costs but also all the currency gains.

SThree generally keeps its numbers quite clean, in my view, so I would give them the benefit of the doubt in terms of those restructuring costs.

The numbers are pretty reasonable then, and what we've come to expect: more Contract work, less Permanent work, and a small increase in overall profitability at the underlying level.

It's not that Permanent work is being abandoned, but SThree is being a lot more selective about which Perm work its take on. The following makes the strategy clear enough:

We expect to invest in Permanent selectively in the remainder of 2017, where there is clear evidence of improving candidate and client confidence, but our primary focus will be on improving consultant yields.

Outlook statement doesn't make any extraordinary promises:

"Looking ahead to our seasonally more important second half, the continued momentum of our Contract business and improved Permanent yields give us a solid base from which to grow in a macro-economic environment which remains uncertain."

My opinion: I'd love to see the share price keep falling, as I think this is a good business and I'd be interested to pick up a few shares around the 240p mark. Even at the current level it seems ok. There is no big debt pile, no funny business, just a simple company that's geographically diversified and cranks out profits.

Dialight (LON:DIA)

- Share price: 1001p (+1.1%)

- No. of shares: 32.5 million

- Market cap: £325 million

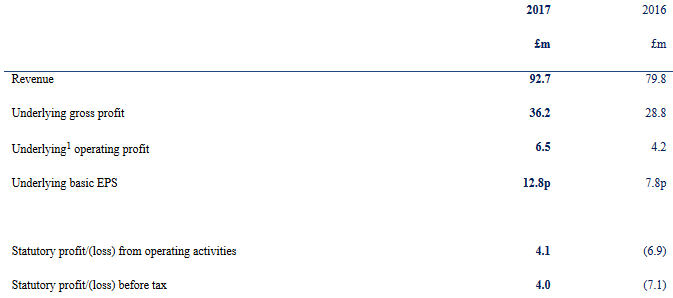

The industrial LED lighting company moves back into statutory profit:

The US exposure has been a big driver in returns as the constant currency revenue growth is just 3%.

European revenues were down 25%, and the explanation doesn't really make much sense to me. The company says the region represents a "significant lighting opportunity where we are rebuilding our capabilities".

On the positive side, manufacturing has been outsourced with just a few more product lines to be transferred by the end of the year.

Overall, things appear to be in line with plans for the year as a whole.

We remain excited by the Group's prospects and remain confident of delivering continued growth and shareholder value. Our expectations for the second half of 2017 remain unchanged.

My opinion

There is little fundamental value to be had here n valuation grounds, as Stockopedia makes clear enough.

So it really depends on whether you think the company's products are special or the prospects are so good that it justifies a premium rating. I've had a look through the company website and the customer reviews which it provides do of course provide a very rosy picture. And they seem like highly desirable clients (the ExCeL centre in London, for example).

But I can't ignore the fact that the constant-currency growth rate was only 3%. If GBP were to have strengthened, then growth could just as easily have moved in the opposite direction! So I'm afraid I don't see what the argument is for putting it on the current market cap.

Hi, it's Paul here! I have about 40 mins to kill at Glasgow airport, after a very pleasant short break here. So thought I'd put the time to good use, and mention a couple more companies reporting today.

Tungsten (LON:TUNG)

Share price: 62.75p (down 3.8% today)

No. shares: 126.1m

Market cap: £79.1m

Results for year ended 30 Apr 2017 - this company calls itself;

global e-invoicing, purchase order services, analytics and financing company

The results today really don't look good at all.

Revenue is up 21% to £31.3m, but that is only 12% at constant currency.

Yet it still generated a thumping loss at the EBITDA level, of £11.8m. This was a £4.4m improvement on the previous year, but it's still awful.

The company claims that it is on track to reach EBITDA breakeven in 2017. So if it achieves that, then clearly the picture would look a lot better for the shares.

The balance sheet looks OK for now, but I think investors should watch the cash position carefully. Things could get messy if it needs to raise more cash.

My opinion - I think this is a stale story stock. I got suckered into the original hype, along with lots of other people. The reality has come nowhere near what was originally planned. It seems to me that the company is struggling to become a viable business, and is well short of that at the moment. So why get involved?

Quixant (LON:QXT)

This might be worth a look, as today's update sounds really good.

"I am delighted with the Group's strong performance in the first half of the year. As a result we are very confident of achieving market expectations for the full year."

I'd expect to see broker EPS forecast increases after that sort of update.

More detail is given;

Trading in the first six months of the year has been stronger than previously anticipated and we expect to report revenue for the first half of approximately $56m, with both the core gaming division and Densitron performing well.

We have seen elevated demand from key customers in the core gaming division in the first half of the year which has boosted revenue in the period. As a result, we currently anticipate that, unlike previous years, the Company's full year results will be first half weighted.

Sounds good. Although the share has risen a lot in the last 12 months, and doesn't look cheap. That said, a strong update like this probably means the premium rating is justified.

My flight's just been called, so a couple of ultra-quick comments on other things I've looked at today;

Mission Marketing (LON:TMMG) - a good update today. Trouble is, this stock is so illiquid, it's almost impossible to buy in any decent size. Plus you get clobbered for a nasty bid/offer spread. Would be interesting if it was more liquid.

Earthport (LON:EPO) - the ultimate jam tomorrow company. It's been burning cash for donkey's years. Why people keep giving it the benefit of the doubt, I have no idea. There are a lot of optimists out there, clearly. Still loss-making.

Right, got to dash.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.