Good morning! I had a burst of energy last night, and reviewed three more company results (Porvair (LON:PRV), Accumuli (LON:ACM), and £ODX ), so here is the link for yesterday's updated report. Also, I reviewed last week's accounts from Norcros (LON:NXR), updating my report from 19 Jun 2014, for anyone interested in that company. It looks good value to me, but as always please do your own research (DYOR), that's just my personal opinion, not a recommendation.

Shoe Zone (LON:SHOE)

This is a mainly UK discount shoe retailer, which recently floated on AIM (23 May 2014). I've been having a read through the AIM Admission Document to understand the background. Interim results for the six months to 5 April 2014 have been published this morning.

It's a family controlled company, with the IPO releasing 22.5m shares at 160p to new shareholders. That leaves the Smith family with 55% remaining. No new cash was raised for the company itself, it was the family selling down part of their interest, but retaining control. So it's really a private company that happens to have a Listing - so not ideal in my opinion.

At 175p the shares are usefully ahead of the 160p IPO price. The company is based in Leicester, and has 553 stores, selling shoes for an average price of £9.77! I must visit one of their stores, as I'm clearly being profligate by paying 3-5 times that amount at Marks & Spencer!

Unfortunately there are no broker forecasts that I can find, so it's a bit difficult to value the shares on a PER basis. Today's interim results show turnover down a surprisingly large amount, from £98.9m to £82.9m for the most recent H1, which is said to be due to the "planned closure of a number of temporary stores". That's a 16% drop, so there must have been a lot of temporary stores, and I wonder how many they still have, and if more closures are likely? I would need to know the ongoing scale of the business in order to value it.

A modest profit of £3.2m was reported for H1 this year (up from a £0.5m loss in the prior year H1). So it's a low margin business by the looks of it, although it looks as if there might be an H2 bias to trading, so if the same pattern happens this year then full year profit might be heading towards £9-10m perhaps (based on a £6m profit in H2 last year).

The company made 3.7p EPS in H1, so say double that for H2, and I'm getting a very rough estimate of about 11p for full year EPS (last year it did 6.9p). That would be a PER of 15.9, which is probably about the right price.

My quick Balance Sheet review is passed, with a sound working capital position of £41.3m current assets, representing a healthy 170% of the £24.2m current liabilities. So the FD will sleep easily at night. Bear in mind also that the interim period end of 5 April is only a fortnight after all the quarterly up-front rent & service charge invoices will have been paid on March quarter day (25 Mar). So being in a £5.9m net cash position at this time of year (at or near the lowest point in the year for cash) is a solid position to be in.

Note that there is a small pension deficit of £2.5m, but that is immaterial in my opinion, and it's not an iceberg deficit either, as I've checked the admission document, and the total scheme is only about 10 times that figure, very roughly. Although having said that, payments of £300k per half year are being made into the pension scheme, according to the cashflow statement, which I'm pretty sure doesn't go through the P&L. So that is a cash outflow which would otherwise have been used to pay divis.

Overall, I quite like this share, and it will go on my watch list. Discounters will remain in demand, as such a large proportion of the population live on low incomes, and are likely to continue to do so. So it shouldn't be affected much by competition or the macro economy overall - cheap shoes will always be necessary. Competition are likely to be Primark, George at ASDA, and the other supermarkets. Shoezone also sell online.

The strength of sterling is helping UK non-food retailers at the moment, so margins will come under pressure if sterling weakens. The opportunity here is if the company out-performs, as it seems to be trading well, with the outlook statement saying;

In the 10 weeks to 14 June 2014 since the half-year, our LFL's and margins have been in line with management's expectations. Online performance remains strong and continues to be ahead of market growth projections.

(note: "LFL" means Like For Like - i.e. ongoing sales performance, with the impact of new store openings, and store closures stripped out).

Anyway, it looks quite a good business, but the shares don't scream value at me - they're priced about right probably for the time being.

Universe (LON:UNG)

It's surprising how many small caps charts are now starting to look the same - with a big rise in the autumn of 2013, peaking & flattening off in the spring of 2014, and dropping like a stone on bad news now. This is a healthy weeding out process in my opinion, with the speculative froth being washed away - last year the market was rewarding bad investors making bad decisions, so it's good to see that changing now. Any company putting out less than bullish figures will be punished, and rightly so.

Some good companies are being pulled down with the bad, so that's creating a few selective buying opportunities at attractive prices in my view.

Today's victim is Universe Group, a micro cap specialist in the EPoS and loyalty card area. Its shares have dropped 16% to 5.15p this morning, on a hesitant-sounding AGM statement. The company says that H1 has been similar to last year, so that's OK. However the H2 outlook sounds wobbly;

The outturn for the financial year will be weighted towards the second half, and remains dependent on securing certain large-scale roll-outs and while we are confident of securing them, their timing is uncertain.

So it sounds as if we're being warmed up for a potential profit warning in H2. Current market consensus forecast is for 0.8p EPS this year, so a PER of just 6.4. Although really, for a very small company with uncertain profitability, a PER of 6 is actually about the right price. In this current bull market people are paying daft multiples for very small companies.

If we allow for a profit warning in H2, then EPS might come in around say 0.4-0.5p, so the PER then would be in the 10-12 range. There is no dividend here either, so all in all it strikes me as a share that is probably best avoided. I'd rather look for something that has more reliable earnings, dividends, and easier to forecast growth.

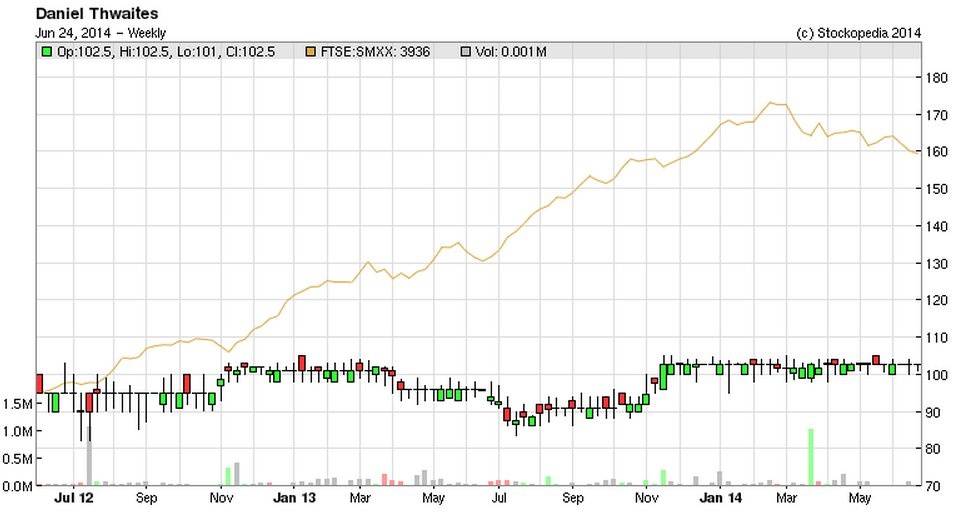

Daniel Thwaites (OFEX:THW)

This is an ISDX-Listed brewery, pubs & hotels group, based in Blackburn. It's a family company with a Listing on the tiny market below AIM. In my opinion there could be hidden value in this company. The most striking figure is the huge discount to NAV. So NAV reported today is £189.8m, with negligible intangibles on the Balance Sheet. Yet the market cap is only £61m at the present share price of 102.5p. So you effectively get a reasonable sized pubs group for less than a third of its own Balance Sheet net tangible assets. Most of the assets are freeholds.

Now of course people will start saying that Pubs are closing, and probably aren't worth anything like book value. However, in this case the company revalues 20% of the estate each year, so they are all post credit crunch now, and also interestingly the pubs that are being sold off (15 in the year reported today - under-performing "wet" pubs) are going for pretty much book value. A loss of only £0.2m was reported against those disposals.

Therefore I like that this is a deeply discounted asset play, and it seems as if the company takes good care of the assets, with plenty of pictures of nicely fitted out pubs & inns in the Annual Report.

There are some flies in the ointment though. The company has some legacy issues, including the closure of its ramshackle old brewery in Blackburn, and a failure to agree a redevelopment of the site with Sainsburys and the local council. However, a new, smaller site has been identified in the same area to modernise and downsize their operations.

Also there is a fair bit of debt (but not a problem, as supported by freeholds), and a disastrously costly interest rate swap arrangement was undertaken, making me think that management here are probably not very good. At some point though, the family might agree a sale of the business, and it's not going to happen on the cheap.

In the meantime decent divis are paid out, with a total payout each year of 4.46p, yielding about 4.4%, which is not bad going. Therefore I bought some of these for my long term portfolio, and just sit and collect the divis. The share price never seems to move at all, and it's horribly illiquid.

At some point though, maybe in a few years' time, something will happen, and the value in the company will be unlocked. This share will not appeal to many people, but as a long term value share, I think it's interesting. Note from the chart also how, because it's Listed on ISDX, this share is totally off the radar for most investors. Therefore it hasn't re-rated at all. That is a clear pricing anomaly in my view, and means that a move to 160p is implied if it had been Listed on AIM. Maybe a move to AIM is the catalyst needed to trigger a re-rating? I like it anyway, so the more patient value investors amongst you might like to have a look at it.

EDIT: I forgot to mention the pension deficit. Today's results comment as follows. Note that it's a significant drain on cashflow, but won't last forever. So again, another potential catalyst for a re-rating, when the deficit issue recedes?

The Group made contributions to the defined benefit pension scheme of GBP3.8m

(2013: GBP3.4m). Whilst this scheme was closed in August 2009, the Group is

committed to funding the deficit on the scheme which was GBP14.9m at 31 March

2014, a reduction of GBP1.5m from GBP16.4m at 31 March 2013.

Anpario (LON:ANP)

This is a natural animal feed additives company. I've raised concerns about the lofty valuation on these shares for a while now, and today's AGM trading statement sounds a bit too hesitant for a company on a forward PER of 20, in my opinion.

The Group continues to make good progress developing the business and is on track to meet market profit expectations for the year to 31 December 2014.

The Group has experienced some effect from the strengthening of the pound against the dollar, which means that sales and gross profit, in sterling, are expected to be at a similar level to those achieved in last year's strong first half performance. However, volumes are ahead of last year.

I'm surprised that sales & gross profit are only flat against last year, even allowing for the exchange rate movement. That implies pedestrian growth rates, perhaps more suitable to a stock with a PER in the low to mid teens, rather than 20. I don't know anything about the company's products or markets, so do not have a view on what the future might hold, I just go by the historic figures & broker forecasts, and on those the valuation currently seems rather rich.

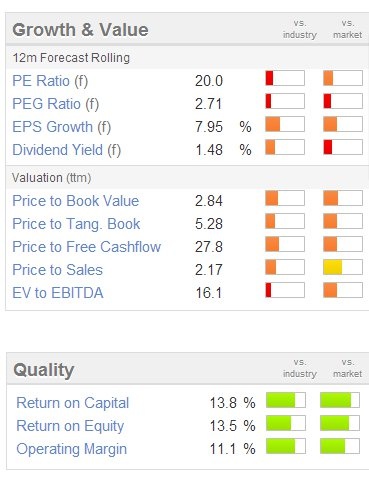

Note that Anpario scores poorly on Stockopedia's valuation measures, but quite highly on the quality measures. It's StockRank of 64 is not as high as I would have expected.

So it looks a nice company, but it's too pricey for me at 265p per share. Also, with the next interims showing flat turnover, it's difficult to see a short term catalyst for the shares to go up.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.