Good morning!

I'm holding the fort here today as Paul is traveling.

Cheers,

Graham

Robinson (LON:RBN)

Share price: 115p (-14%)

No. shares: 17.7m

Market cap: £20m

A significantly weaker result (pre-exceptionals) had been well-flagged - Paul discussed the trading statement here in January.

Revenue fell by 7% to £27.5 million and operating profit almost halved to £1.4 million, thanks both to a lower gross margin and higher costs.

Perhaps the shares are down by a further 14% today because of the cautious outlook statement:

The general economic conditions suggest another challenging year ahead with continued pressure on consumer product brands and the UK retail sector. Continued investment in both personnel and equipment are leading to significant additional expenditure in 2017, justified by new business, some of which is already coming on stream. We remain on track to deliver revenue growth in 2017.

Although it is difficult for companies to do so, I much prefer when they acknowledge that they are struggling to compete within their industry, rather than blaming macro conditions.

In this case, is it true that consumer product brands generally are under pressure? Or is it more likely that Robinson's packaging solutions simply haven't quite managed to differentiate themselves from the alternatives in recent times?

"Significant additional expenditure" is a sign that the company does feel the need to change, but of course is likely to impact profitability in the short term. Revenue growth is mentioned, but there is no explicit mention of any anticipated profitability growth for 2017.

My opinion

Despite the weak outlook, I can see a potential value investment here. Net tangible assets are £15.6 million.

Paul's previous report suggested that the value of surplus land might be some £10 million. According to today's statement:

The Group is currently working with partners to find prospective tenants, develop detailed plans and sell the sites. Proceeds from the eventual sales will be used to finance the expansion of the operations and reduce debt.

So the company could potentially pay off all of its £5.6 million borrowings and swing into a healthy net cash position.

So on balance, the £20 million valuation here strikes me as reasonably attractive, if you can make the assumption that earnings will at least stabilise from the current level. In saying that, bear in mind I am always heavily biased in favour of family businesses, and those which have illustrious histories. Robinson ticks both of these boxes!

CPPGroup (LON:CPP)

Share price: 13.125p (-13%)

No. shares: 858.7m

Market cap: £113m

Investors have been very unsure about what to make of CPP's prospects, as you can see from the Stocko chart below:

The company got into some financial and regulatory trouble a few years ago but appears to be on the mend.

it provides a range of related services - credit card protection, mobile insurance and passport assistance, both through its own channel and via business partners.

Today it reports growth in policy numbers for the first time in five years (up to 4.3 million from 3.8 million).

Revenue is down 4% on a continuing basis, however, as lower-value policies outside the UK are now driving the business strategy. International revenue is now 61% of the total (up from 44%), revenue in India more than doubling.

Profitability: only at breakeven, although the company claims to have generated £8.4 million on an underlying basis.

This looks like a fair claim, as £9.1 million in impairment and settlement costs are due to severing its relationship with an insurance software provider (this was widely reported in the insurance industry last September).

My opinion

It's a rather complicated situation, and I'm not surprised the share price has been so volatile.

Following on from the historic mis-selling scandal, CPP comprises a legacy book of business in natural decline, and a new book of growing (primarily international) business.

This gave it something of an artificial boost in 2016, as revenues fell by 10% on a constant currency basis (only 4% on a reported basis). But the international diversification does hopefully reduce the company's specific country risk going forward.

It has a new CEO (appointed May 2016), who worked at CPP from 2002-2014, and appears well-placed to drive a new business strategy.

Potentially cheap against underlying earnings and the growth in international revenues.

IG Design (LON:IGR)

Share price: 300.5p (+14%)

No. shares: 62.6m

Market cap: £188m

It's not difficult to see why the shares are up here today, with the following sub-heading to the RNS:

Record revenue, delivering EPS, profit and cash generation ahead of expectations

And then, under "Financial Milestones":

- Group revenues are now expected to achieve record levels - exceeding £300m;

- Profitability expected to be ahead of current market expectations;

- Cash generation is well ahead of previously expected levels and such that the Board's target of average annual leverage at less than 2.5x EBITDA will be achieved for the year ended 31 March 2017 - two years ahead of plan.

EPS is said to be "significantly ahead of market expectations", those expectations being in a 15.8-16.1p range based on November's upgraded forecasts.

So if we add 10% on to that range (presumably a 10% beat would be significant?), we get EPS of 17.5p, putting the shares on a PE ratio of 17x.

My opinion

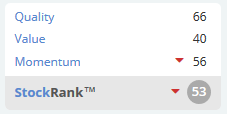

My initial review of the company chimes with the Stocko ranking: above-average quality, below-average value, so at a quantitative level it's hard to see what makes this stand out as a potential investment:

Given that the Board's target leverage has been achieved ahead of schedule, I'd expect them to be back on the acquisition trail again before too long.

So perhaps you could make an investment case based on the company's recent successful track record in acquisitions. Not one for me, though.

PV Crystalox Solar (LON:PVCS)

Share price: 21.125p (-2%)

No. shares: 160m

Market cap: £34m

Paul has previously suggested that the core operating business at PVCS may be worthless and that appears increasingly likely as the company warns today of "bleak prospects" for 2017, unless there is a recovery in market pricing.

But why would there be a recovery in pricing? There is said to be "massive over-capacity" of solar cells and wafers originating in China. What that says to me is: Chinese companies have figured out how to produce these items at much lower cost. And we should assume that this change is irreversible. If anything, we should expect pricing trends to continue lower, as technological and process improvements continue to increase supply.

Managed decline

Given that context, it sounds as though PVCS is taking the sad but necessary decisions needed to conserve shareholder value. Ingot production facilities will be closed at the two UK facilities in 2017.

Long-awaited judgement on its dispute with a customer is not expected before Q3 2017. It would not be surprising if this was delayed further, though the pay-off is likely to be highly material if PVCS is successful.

Cash-rich

Net cash rises by €16 million to €29 million (£25 million) thanks to a profitable result for the year despite the reduction in volumes, and much lower inventory levels.

Outlook

Wafer prices are said to be "well below production costs". Production has accordingly been reduced, but could be back on stream should pricing improve. As noted above, I think the base case assumption must be that this won't happen.

In the meanwhile, the company is focusing on the "niche low carbon footprint wafer market", and undertaking a Strategic Review which has been extended until the customer dispute has been settled.

It looks to me as if shareholders at the current level should do reasonably well: the market cap is mostly covered by net cash, there is a small but profitable niche activity which can still be pursued, and the award from the customer dispute could be worth "a multiple of the Group's market capitalisation" (it said that when the market cap was £22 million). Sounds like a value investment to me.

That's it from me today, have a good weekend everyone.

Best regards

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.