Good morning! Some companies seem to constantly deliver bad news, and your heart sinks before you've even started reading their latest trading update. Whereas others just deliver a steady flow of good news, and the shares are a pleasure to own, as you wait for the re-rating. If you can find the latter still at a reasonable price, then that is the proverbial needle in the investing haystack.

Sweett (LON:CSG) is, in my opinion, just such a share. I've written about this share five times so far this year, but hesitated too long, and only bought shares in it after they had already doubled, which is always very difficult to do. I belatedly pushed the buy button on 30 Aug, at 42p, and explained why here.

Today's trading upate, in advance of its half year results to 30 Sep 2013, follows the usual pattern of out-performance. Sweett indicate that all their international operations are trading well. This is the key part of today's statement (my bolding);

As a result, the Board anticipates that the Group's results for the year ending 31 March 2014 will be slightly ahead of management's expectations. Furthermore, the full year profit before taxation will also be increased by the £1m referred to above. Our efforts to achieve the objectives of our 3 year plan of turnover growth and margin improvement remain firmly on track.

Incidentally, the £1m referred to is a one-off gain on the unwinding of a currency hedge.

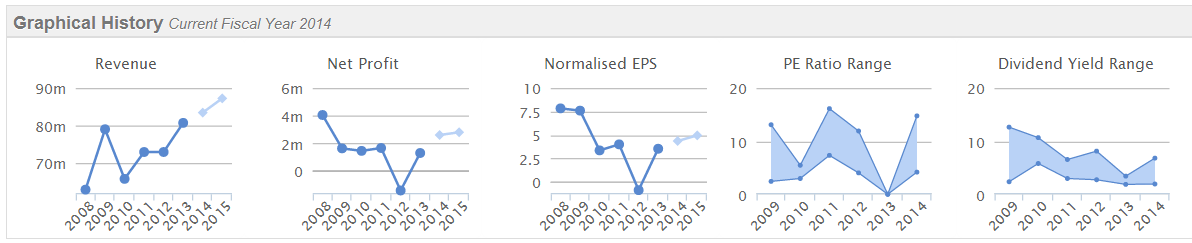

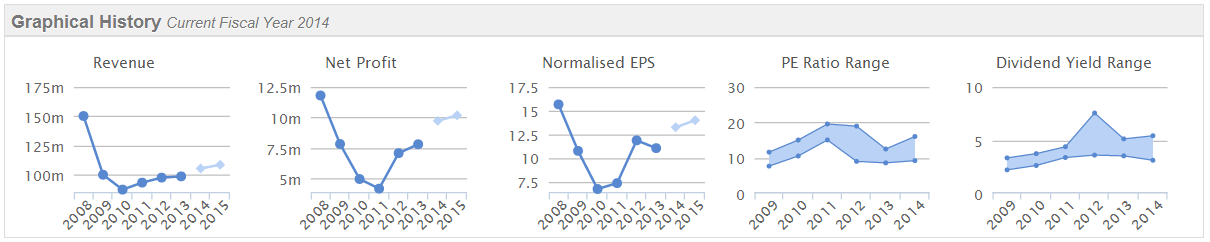

Here is the usual Stockopedia graphic that I like so much, as so much information on trends can be gleaned from these five simple performance graphs. In my opinion, access to these graphics alone is worth the annual subscription, as it saves me so much time when researching & gives me excellent insights;

So what can we tell from these graphs? That turnover is trending upwards, that profit margins are fairly slim. Apart from a bad year in 2012, the company has been fairly steadily profitable - not bad considering their markets have generally been depressed over this period (they are a construction consultancy, quantity surveyor). The PER has generally been low over this period, and it has consistently paid dividends.

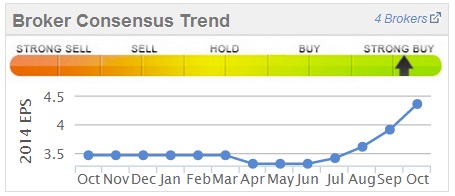

Given the steady stream of positive trading updates this year, I would not be surprised if broker forecasts lag behind reality. You can see from this graphic on the right that broker EPS forecasts have been steadily upgraded this year, another excellent sign.

So it seems to me that CSG are probably heading for around 5p EPS this year, and therefore at about 49.5p the shares look to be on a current year PER of about 10, which strikes me as a bargain, given their positive trading momentum.

Here is the usual growth & value graphic on the left, for Sweett. As you can see, it is mostly light green, indicating better value than average valuation metrics.

The dividend yield is not bad, and is likely to grow. Note that the dividend was cut in 2010, and again in 2011 and 2012, from 2.4p to only 0.5p. However, it is now on an upward trajectory again, rising to 1.0p in 2013.

I have double-checked their most recent Balance Sheet, and it's OK. There is net debt of £7.1m, which is a little higher than I would like, so keeping the dividends down in order to repay debt seems the best strategy to me.

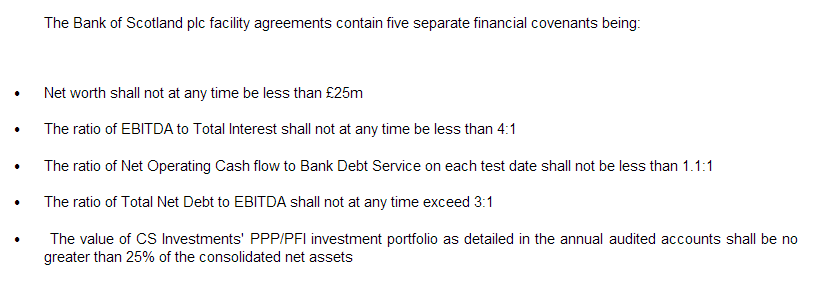

I was interested to see that they publish their Bank Covenants too, something that many companies are coy about. The recent debacle with Albemarle & Bond Holdings (LON:ABM) shows that investors really should check how much headroom there is on the Covenants, as even a potential breach can have catastrophic consequences for the share price, as ABM shareholders recently learned to their cost.

Here are CSG's Bank Covenants, as published in their last set of preliminary accounts;

On a very quick check, it looks as if there is reasonable headroom on the key ones. Also noteworth is that the Net Debt to EBITDA covenant is quite relaxed at < 3:1. I've heard that other Banks prefer a ratio of < 1.5:1, so this tells me that the banking relationship here is good, and BoS clearly have confidence in the business. Not that that matters. As I've discovered in the past, banking relationships are not worth the paper they are not written on, as it only takes a missive from Regional Office to totally change a supportive relationship into a problematic one. My experience is that if you want to have control over your business, don't borrow from Banks, or at least only borrow for specific asset financing, that can't be withdrawn.

Giving the Bank a fixed & floating charge over a businesses assets can be akin to signing its death warrant, so that's why I tend to avoid highly geared companies altogether as investments, they're just too risky. CSG is OK though overall. Current assets are 137% of current liabilities, which is fairly good (I like to see this ratio over 120%, and am happiest when it's over 150%, and ecstatic when it's over 200%!).

There is also a pension deficit, but it's only £3.2m, so not a significant problem there.

Interestingly, the company reiterates its medium term goals, which are to get turnover up to £100m and achieve a 7-8% profit margin. Based on their trading statements this year, that looks a realistic target, and I intend holding for perhaps a couple of years here, with my personal target being EPS growth to about 10p per share. That would justify a PER of about 12, so a share price upside of 120p gives me what I need - i.e. >100% upside on the current price, on reasonably realistic assumptions. As always, I would start top-slicing my position once it starts to get close to that level, if it does.

This statement today should put about 10% on the share price in my opinion, in the short term.

Also I see that WH Ireland has increased its price target for CSG from 60p to 75p, and flags further probably upgrades in Dec 2013. So all going well there, I shall sit tight.

Tracsis (LON:TRCS) is a share that I frequently cover - I like the company, but felt the shares were too expensive, with the PER around 20 at just over 200p yesterday. Their results for the year ended 31 Jul 2013 have been issued today, and the market is clearly disappointed, since the shares are currently down 20p to 183p.

I think we'll see a lot more of this negative reaction to results from highly rated small caps, because we're in a frothy market for small caps, and many investors are buying on momentum & chasing valuations too high. They are likely to then come back down to earth with a bump on results day, unless the results/outlook are very strong. It's not really a problem for me, as I don't buy highly rated stocks, but if I did then I'd probably be top-slicing in the days before results day, just to be on the safe side.

So going back to Tracsis, here are the key numbers: at the current share price of 188p, and with 25.5m shares in issue, the market cap is about £48m.

Revenue rose 25% to £10.8m (but note the very high PSR of almost 5 times). I note that £3.2m turnover has come from acquisitions, so continuing turnover is down almost 12%.

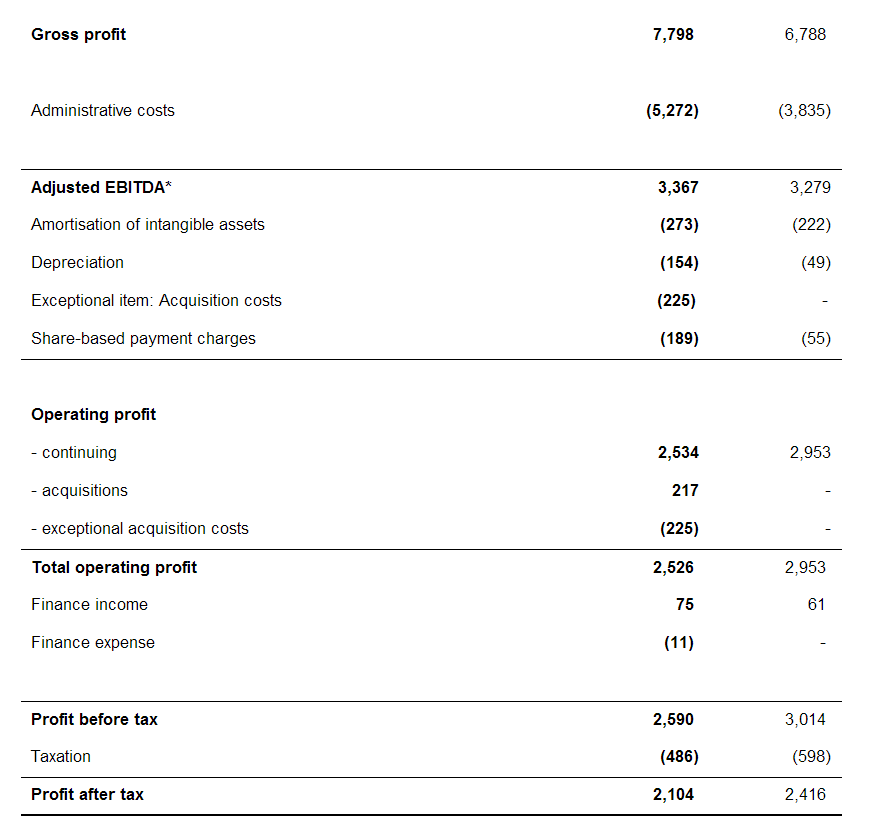

I'm not keen on the highlighting of EBITDA as a performance measure, although in fairness the figures are presented in a very clear way, with the P&L giving a line by line reconciliation between EBITDA and operating profit, as this excerpt from the P&L below shows (bolded figures are y/e 31 Jul 2013, comparative figures on the right are prior year);

So you can mix & match as you wish, as to which figures you want to include or exclude from the calculations. Diluted EPS has fallen from 9.83p to 8.15p, which is the most conservative measure. In my view, if you're going to put a racy PER multiple onto a share, then you should base that on the most conservative EPS number.

In this case I think Tracsis probably deserves a PER of about 15, to reflect its growth potential, so on 8.15p EPS that takes me to 122p per share. Add the cash on top, which is £6.6m, or 26p per share, and you get to 148p per share. So that's the kind of level where I would start to get interested. Also, I like to buy below what I think a company is worth, so for me it's probably not the sort of thing I'd want to buy unless it came down to about a quid a share.

That said, the company is excited about their framework agreement announced recently, so that could lead to some decent orders & hence growth. So a bit of a premium could be justified for that. Overall though, I think these shares have probably got a bit ahead of themselves, and could benefit from a cooling off period.

The dangers of gearing!

Going off at a tangent for a moment, It's essential for all investors to consider what the financial impact would be of a profits warning from any of your shares. This is especially true for people who trade on margin - could you absorb a (say) 30% plunge in share price on a profit warning? If you work out the cost of your biggest holding dropping 30% in a leveraged account, you'll probably get a nasty shock. It's very easy to lose sight of the underlying size of leveraged positions.

Years ago I remember having a £1000/pt bet on Tate & Lyle. They warned on profit, and the share price dropped about 150p. Thankfully I'd closed my long bet a few days earlier, but it then dawned on me that if I hadn't, then I would have instantly lost the same amount of money as a 2-bed flat was worth at the time. That would have blown a nasty hole in my portfolio. It wouldn't have been a catastrophe, as my portfolio was a few million quid at the time, but it was a big wake-up call on the dangers of gearing.

These days I don't use any gearing at all in my long term portfolio, indeed am currently about 20-30% in cash. Although I do also have a couple of smaller trading accounts, which do use gearing. So here are my...

Golden rules for Spread Betting

These are the key lessons I've learned from over 10 years of using leveraged accounts for mainly small cap shares;

1) Restrict the gearing - anything over 2 times equity is getting into very high risk territory.

2) Only gear up on solid, safe companies. Gearing should never be used on highly speculative shares, as it magnifies the risk, or only on very small positions anyway.

3) Diversification is essential. A geared account should not have more than 15-20% in any one stock.

4) Liquidity is vital - geared positions should be no bigger than about 5-10 times the normal Market Maker size, so that you can get out fast if necessary.

5) Don't take a geared position in stocks where lots of other people have geared positions, as sooner or later there will be a spike down as people are forced to close.

6) Only use gearing if you have a proven, successful investing strategy.

7) Try to use gearing counter-cyclically - i.e. increase gearing when stocks are cheap, and reduce/eliminate gearing when stocks are expensive.

8) Avoid straying into areas where you have no expertise or competitive edge. The flashing prices & colours of SB platforms are designed to lure you into punting on things where you are likely to lose.

9) Always convert the £/pt into the actual underlying value of the shares, and consider whether you would be happy buying that amount of shares.

10) Keep a daily updated spreadsheet of the underlying value of all positions, to monitor & control your gearing. You will nearly always get a nasty shock when you tot up the total underlying value of all your positions - most people massively over-gear, which is why nearly all SB accounts blow up sooner or later.

Finally, in summary, unless you have very strong self-control, and take a completely disciplined approach to investing, then don't use gearing at all! It's far too risky & most people come a cropper with geared accounts.

I see that shares in Globo (LON:GBO) are up & down like a yoyo at the moment. There are potentially several reasons for this - profit-taking after a spectacular rise, an FT article today apparently has something to do with Blackberry making their software available on all phones (which could be negative for Globo), or the realisation that the company doesn't actually generate any cash & has a rather odd-looking Balance Sheet with a surfeit of debits where you wouldn't normally expect them to be.

I've had a very interesting, and generally good natured (apart from one obnoxious idiot) discussion with Globo shareholders over on the advfn discussion board, where I aired my concerns over the Balance Sheet, poor cashflow, and capitalising of costs into intangibles. There were some excellent replies, and I must return when time permits to respond.

However, I just want to clarify something again. Evil Knievil posted some inflammatory comments on advfn, and quoted my morning reports. I want to distance myself from his comments, which have absolutely nothing to do with me. If people want to quote my articles, that's up to them, and it's not something I or Stockopedia have any control over.

I'm not short of Globo shares, and never have been, and had no prior knowledge of EK's taking a short interest in it. He's a completely independent operator, and nothing to do with me.

My comments have always been absolutely specific, about precise accounting issues. I've never published any general derogatory comments about the company, it's only the figures that interest me. So I restate my opinion that the accounting treatments look aggressive to me (perfectly legal I'm sure, but towards the aggressive end of what is permissable), and that I don't like their Balance Sheet one bit.

As with most fashionable stocks, I also detect strong confirmation bias in the bulls for the stock. Someone even claimed that my concern over debtor days being almost 6 months was because I was an old fashioned 1990s FD, and didn't understand modern business methods! I nearly fell off my chair laughing at that. Let me tell you this - tight control over your debtor book will never go out of fashion, and is an absolutely vital financial control. Any debtor book over 60 days on average is not being properly controlled, and can accumulate all manner of gunk in it. So the risks are clear. If investors choose to ignore those risks, or worse still, convince themselves that the risks are imaginary, then don't blame anyone else if & when things go wrong. Of course it might turn out fine. If Globo get on top of their debtor book & collect in the cash down to about 60 days, then I will happily admit that my concerns were wrong.

Also, to pre-empt any nonsense, we won't tolerate any personal attacks on the Stockopedia discussion threads, regardless of who it's from or to. We like to keep the discussion civil here, and from now on I'll be Moderating comments that fall outside acceptable limits. What is acceptable? The golden rule is, would you say that to the person's face? Most people are polite in person, so would not hurl abuse at anyone, so if they do so in the comments here, then it will be deleted.

Going back to results, let's take a look at interims from Bloomsbury Publishing (LON:BMY). This made it into Paul's Picks back in Jan 2013, at 116.75p, and has done very well since, rising about 45% to 170p. Of course, we've been in a roaring bull market for smaller caps during that time, so important to remember that a rising tide lifts (almost) all boats.

Just to clarify, Paul's Picks is a page where I make a note of shares that in my opinion are good solid companies, on reasonable valuations. They are ideas for further research, not recommendations - some I own, some I don't. It proves the concept nicely too, namely that you don't have to chase story stocks on crazy valuations to achieve good results. These stocks should also out-perform in a market correction. Sure they will fall too, everything does when the market sells off, but solid companies with earnings, dividends, and cash on the Balance Sheet tend to fare better in a downturn.

There has only been one clanger out of 30 stocks in the list, which is Silverdell (LON:SID). Still no news from the company or broker as to what is going on there. It's just a complete disgrace. Silverdell has reinforced my view that I should avoid companies with stretched Balance Sheets. I didn't own any personally though, so it was just on the watch list at the time the shares were suspended. The shares should come back at some point, but nobody has bothered to inform the owners of the business about what's going on.

Anyway, back to Bloomsbury Publishing. They have about 73.8m shares in issue, so at 170p that gives a market cap of £125m. Here is their historic performance:

So turnover seems to be in a gently recovering trend, and profits bounced out of their previous downtrend, and now seem pretty solid. Note also the dividend yield has been good, and has risen every year since 2007. The Balance Sheet here is good too, with net cash on it.

Looking at today's interims to 31 Aug 2013, turnover is up 13% to £49.2m, and profit before tax is up 33% to £1.1m. That seems very low, so it must be a heavily H2-weighted trading cycle here. Indeed that is the case, as stated in their outlook statement today;

Traditionally sales of trade titles peak for Christmas and sales of academic titles peak in the autumn, at the beginning of the academic year. We expect our results therefore to continue to be significantly second half weighted.

So there's not really a lot to be drawn from the interim figures. So the outlook statement is key, but unfortunately it's too vague to be of much use. They just say they are "well positioned" for H2, so no clues as to how that compares with market expectations unfortunately.

Stockopedia shows a forward PER of 12.5, which is reasonable for a company that's performing well, and has a net cash balance sheet. The forecast dividend yield isn't bad either, at 3.45%. So, even after a very strong year for the share price, these still look quite good value.

I must comment on the Balance Sheet as at 31 Aug 2013. It's wonderful! Current assets of £93.7m, and current liabilities of £34.5m, gives an astonishign surplus of working capital of £59.2m, almost half the market cap! That's a bulletproof Balance Sheet, especially as there is only £4.0m in long term creditors.

Current assets are therefore 272% of current liabilities, which is outstanding. The strength of the Bal Sheet greatly reduces risk for investors, and underpins the valuation. So I like this one. Not sure I'd be happy to buy after such a big rise in price, but I'll be keeping an eye on it & will certainly buying any major dips.

This is turning into War & Peace again today, so I'll wrap it up soon. Just a few comments on Molins (LON:MLIN) though, for some reason I've never reported on this share here before. They have issued a trading update for the period 1 July to date, being the bulk of their H2 (calendar year end).

It's a "broadly in line" statement, so slightly down then. Their Q4 order book is fine, so full year expectations are unchanged. That makes the shares look good value, as 21.2p EPS is forecast for this year, which puts them on a PER of only 8.6 (based on the current share price of 182p).

They have net cash too, and consistently pay a reasonable dividend, currently forecast to yield 3.3%.

It was getting close to the point where I was about to buy a few shares in it, but then I stumbled across the elephant in the room - their pension deficit. Bear in mind this is only a £36m market cap company, yet it has a UK pension scheme with £333.8m in assets, and £333.0m liabilities. So absolutely humungous pension scheme, relative to the size of the company. Off the scale huge.

But it's slightly in surplus under IAS19, so what's the problem? This shows how crazy pension scheme accounting is, because under the actuarial valuation it has a massive deficit, of £53m. This is the important number, because overpayments are decided based on the actuarial deficit, not the accounting surplus. So check out this;

The UK scheme was subject to a formal actuarial valuation as at 30 June 2012. This valuation is close to completion and is expected to show a deficit as at that date of approximately £53m. The level of deficit funding required is expected to increase from £1.2m per annum to £1.7m per annum (increasing by inflation) from July 2013, which is expected to equate to a deficit recovery period of 17 years.

In other words, that looks as if about half to a third of profits are going to be consumed in topping up the pension fund, for the next 17 years! That's ridiculous, and just makes it totally uninvestable as far as I'm concerned. Way too high risk.

Finally, I hope to see some of you at the London Investor Show at Olympia, London tomorrow. I'll be writing my usual morning report here, and then jumping on a train, so will be there from lunchtime.

Somehow I've been persuaded into doing a talk on small caps on the Stockopedia stand at 2pm, which I'm dreading, as I hate public speaking. It was originally just meant to be an informal thing of me waffling on about small caps, but it's somehow now morphed into a "Seminar". Anyway, I'll do my best, and if anyone wants to join me for a beer or two afterwards, that will be very welcome!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in CSG, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.