Good morning!

Lots going on today, so I'll probably be gradually updating this article all afternoon, so please feel free to refresh the page later.

A bad morning for investors in this one, my commiserations;

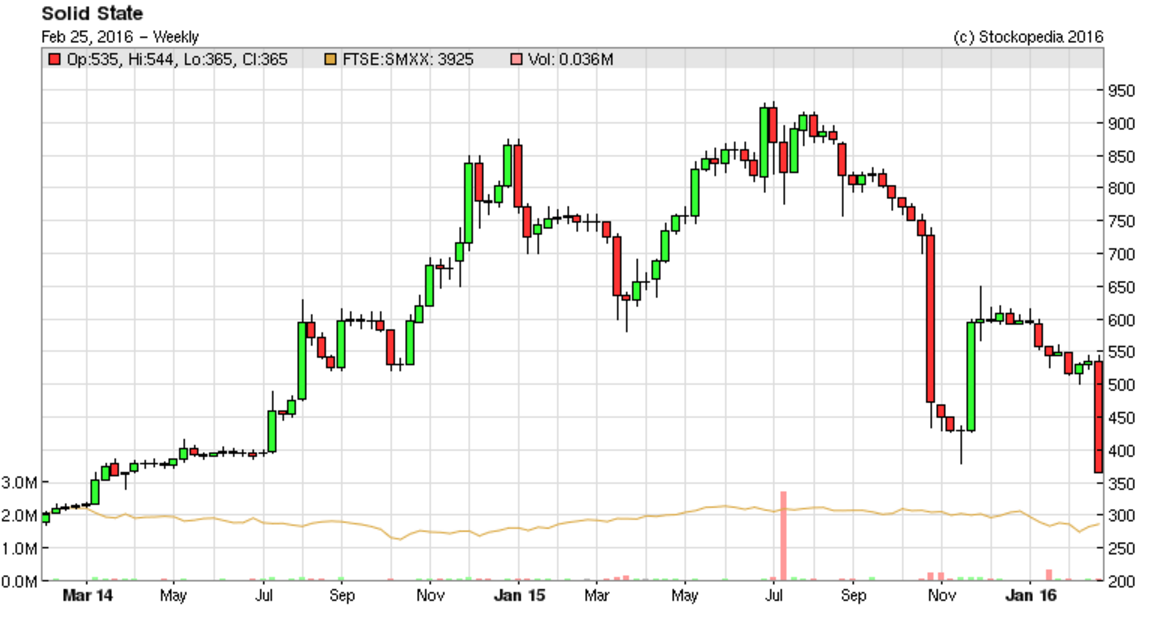

Solid State (LON:SOLI)

Share price: 367.5p (down 30% today - very volatile)

No. shares: 8.4m

Market cap: £30.9m

I last wrote about this company here on 29 Oct 2015, when it issued a profit warning for H2 (Oct 2015 to Mar 2016), blaming "contract variations and general market softening" - the contract concerned being a highly material MoJ contract for electronic tagging for offenders.

This led to a substantial reduction in broker forecast EPS, down from 56p to 36p. It seemed very strange to me that the share price rebounded from a low of about 390p on Nov 18, to around 600p in Dec 2015. The revised forecast clearly didn't support such a big rebound to 600p, as that equated to a PER of 16.7 - very high for a really ordinary company, with lumpy revenues.

MoJ Contract Update - it's bad news. The delayed contract is now cancelled;

Solid State plc (AIM: SOLI) has today been informed of a decision by the Ministry of Justice (MoJ) to terminate the MoJ's contract for Electronic Monitoring Hardware with its subsidiary Steatite Limited. Steatite Limited is to enter into discussions with the MoJ regarding the terms on which the relationship will end.

The last bit is presumably to discuss if, and what amount, of compensation the company can negotiate. That depends on factors which are only known by the company, and not us - what were the contract terms, why was it cancelled, etc. If the cancellation was due to poor quality or service, then SOLI may not be entitled to any compensation at all. Or if the company did everything they were supposed to do, but the MoJ just changed its mind about wanting the product, then compensation may be payable to SOLI. We won't know until SOLI updates us again.

In terms of valuing the company, personally I would assume no compensation, to be on the safe side.

Financial impact - the house broker has put out a note today, saying that they had already removed the MoJ contract revenues from their forecasts (to be prudent), hence forecasts are unchanged on today's news.

Is this a market over-reaction then? The EPS forecast for this year is 36.0p, and next year 36.5p, so it all depends what PER you think is appropriate.

For this type of business, personally I would not go higher than say 8-10, so I'm arriving at a share price in the 288p to 360p range.

Balance sheet - the last one looked alright overall, with only a modest amount of debt. Although the worry now is whether there will need to be any write-offs from inventories and debtors, relating to the MoJ contract, which could be material. Until this is known, it might be safest to apply a further discount to the shares, to cover any losses that might yet come out of the woodwork and may not be covered by compensation - we don't know yet.

My opinion - at the time of writing, the share price is 367p, which is slightly above what I consider to be the right price for this share, of 288-360p. Therefore it doesn't interest me as a knife-catching situation.

The reality as I see it, is that the share has been significantly over-valued for some time, and is only now coming down to a more realistic price, for what is really a very ordinary business. It's very illiquid too, so we'll have to see where the price settles in the coming weeks.

Sorry if people think I'm sticking the boot in, but I've been very consistent about this share, warning in the past on a number of occasions that it looked over-valued. A lot of last year's momentum darlings are crashing down to earth with a bump this year. That's the trouble if something goes wrong, at a company which has snowballed up to an irrationally high valuation.

Crimson Tide (LON:TIDE)

Share price: 3.5p (up 25% today)

No. shares: 445.5m

Market cap: £15.6m

Trading update - this is a new company to me, but today's update looks potentially interesting, so thought I would get some notes into the system, to refer back to in future.

It's a tiny software company, based in Tunbridge Wells. I've had a look at the company's website, and the software seems to be a mobile app, which enables employees to submit information to head office, about deliveries, jobs that have been done, need to be done, etc. Looks interesting. Also there are some impressive logos on the website, of big name companies that are existing clients. This has piqued my interest.

Today's update sounds really good;

The Company expects that Profit before Tax will be higher than market expectations and significantly higher than for the previous year. Turnover is expected to be in line with market expectations.

Trading in the early part of 2016 has been robust and has seen a number of new transactions being progressed both in relation to contract wins announced in 2015 and also new subscriber transactions for the core mpro5 service. In addition, new pilots are being rolled out in respect of potentially significant client contracts.

The Directors are confident of further growth during 2016 and beyond.

My opinion - it all sounds great until you look at the numbers. Turnover was only £673k in H1, and pre-tax profit was £60k. Sure that was 140% up on H1 last year, but £25k wasn't exactly a challenging target to beat.

It's impressive that the company can be profitable, when so small - suggesting that it's a Mom & Pop type company. Expanding would I'm sure mean taking on more overheads, so it would be a mistake to assume that increased sales on 90% margin will drop straight through to profit.

Overall, it looks potentially interesting, but to my mind the company is far too small to command a £15.6m market cap. There must be numerous other companies offering similar software products - although very impressive that TIDE has won some big name clients.

So it's one I will certainly be looking at in future, but for now I think the price is way too high.

Lavendon (LON:LVD)

Share price: 136.6p

No. shares: 169.7m

Market cap: £231.8m

(at the time of writing, I hold a long position in this share)

Results y/e 31 Dec 2015 - just a quick review of these numbers, as everything looks fine, and I'm pushed for time.

Revenue almost flat (up 1% to £248.6m)

Profit before tax up a much stronger 13% to £38.5m (I'm working from the "underlying" numbers.

EPS of 17.95p is up 15% on last year, and seems to be about 5% ahead of broker consensus of 17.1p, so a positive surprise on earnings today.

Statutory EPS is only 4.91p, so a huge difference. This is mainly writing off exceptional goodwill - a non-cash item, and "well flagged" in advance according to a broker. So no concerns there - the adjustments look fine to me.

Full year dividends - up 17% to 5.4p in total (interim + final) - giving a fairly attractive yield of 4.0%

Net debt is up 33% to £119.2m, again as expected, due to increasing size of hire fleet. This looks reasonable relative to £284.2m in fixed assets

Balance sheet overall is very good - net assets are £222.9m, take off ££45.5m goodwill, and £6.6m other intangibles, and NTAV drops out at £170.8m. Therefore the P/TBV is 1.36, which is low for an equipment hire company (nearer 2x is more normal).

Outlook - sounds alright to me;

Trading in the current financial year has been in line with our expectations and, whilst recognising the recent increased uncertainty in the economic outlook, the Board looks forward to delivering another year of progress in 2016.

Valuation - the PER is only 7.6, which looks remarkably cheap when you compare it to other hire companies, once you adjust their net debt to be comparable anyway.

So why is LVD such a bargain relative to other hire companies? I think it's because the group is so reliant on profits from Saudi Arabia, and fears that this region could collapse if the low oil price continues.

The share price here at LVD therefore already discounts a collapse in M.Eastern earnings, yet there is no sign of such a collapse happening (yet, anyway). If the market turns out to have been too cautious, then this share could re-rate higher. If M.Eastern earnings do fall heavily, then arguably it's already in the price. So risk:reward looks favourable to me.

Overall then, I like it a lot, and think it looks great value - providing the M.East earnings remain reasonably sound.

Molins (LON:MLIN)

Share price: 67p (down 14.6% today)

No. shares: 20.2m

Market cap: £13.5m

Results y/e 31 Dec 2015 - if you ignore the pension fund issues, this share looks superficially cheap. However, the "Pensionschemes" section in today's results is arguably the most important bit to read. It shows that the pension funds are gigantic, dwarfing the size of the company, and that £1.8m payments were made by the company in 2015.

However, this bit sounds scary;

The Company is also responsible for paying a statutory levy to the Pension Protection Fund. The quantum of this levy is dependent on a number of factors, including a specific method of calculating a pension deficit for this purpose and a credit assessment of the Company, the methodology for which is also specific for this purpose. The levy that will be paid in 2016 is largely linked to the Group's financial information reported in the year to 31 December 2014 and it is expected that this will result in a payment considerably in excess of the 2015 levy.

Dividends - the final divi has been cut from 3p last time, to 1.5p this time. Although a 2.5p interim divi was also paid, I suspect that might also be cut, or passed, next year.

Balance sheet - this looks superficially alright, but it really doesn't reflect the true position, because of the ridiculous rules on accounting for pension deficits.

My opinion - in an era of apparently now permanently low interest rates, pension deficits get worse, and don't melt away. For this reason, with such huge pension liabilities, relative to the size of company, I think Molins is now uninvestable. So it's going on the Bargepole List I'm afraid, as being now too high risk.

Also I have major ethical issues about anything to do with the tobacco industry, which is a large part of Molin's activities.

Ceres Power Holdings (LON:CWR) - scary figures out today, for the 6 months to 31 Dec 2015. This is a hugely cash burning company and there's only enough cash left to last about another 12 months. The company says;

The Company ends the period with £12.8m in cash and cash equivalents and short-term investments (2014: £22.7m) and we have a good expectation of raising further funding before the end of 2016, which is required in order to continue our activities and to fund the growing opportunity we see in the higher power markets, and supplements income from customers and government grants.

Too high risk. It's going on the Bargepole List.

Idox (LON:IDOX) - an upbeat-sounding trading update today. The company looks to be on a roll, so is possibly worth a closer look in my view.

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.