Good morning! I've been doing a lot of reading this morning, and it suddenly occurred to me that I'd better start writing a report!

easyHotel (£EZH)

This is yet another IPO (surely the market must be reaching saturation now?) which commences trading on 30 Jun on AIM. I've been reading the Admission Document, and it looks potentially interesting, although I've only skimmed it so far.

The bare bones are that the company is raising £24.1m (after expenses) through the issue of new shares at 80p each. There will be 62.5m shares in total, giving a market cap of £50m at 80p per share. The existing business operates 17 easyhotels, but all bar two are owned & operated by franchisees. So the company is going to use the fresh funding to open more of its own hotels.

Stelios is converting some debt into equity as part of the deal. I need to go through the figures in more detail (a weekend job methinks), but thought I'd flag it here as a potentially interesting IPO, given the strong brand recognition, and the interesting business model - I think budget, no frills city centre hotels are a good growth area, and I already have a few shares in Safestay (LON:SSTY) - a similar sort of thing, but more of a nice hostel rather than a cheap hotel.

My main concern at the moment is that quite a lot of IPOs seem to be failing, in that they go to a price discount immediately, and it can then be a long time for them to return to, let alone exceed the float price. I remain of the view that in the vast majority of cases, people who buy into an IPO get a lousy deal, which is why the vendor is selling! Whereas in the case of easyHotel, the deal is structured to raise fresh cash, with some dilution of existing holders, which is a much better proposition than some spivvy private equity operation selling out at the top of the market, on a bonkers valuation, as we've seen with some other deals in the last year.

Small cap markets

I was benchmarking my performance last night, as I've been very disappointed with how my main share picks have done in the last few months. So it was encouraging to see that the markets overall have been poor - it somehow feels a lot less painful when you're doing badly, to discover that other people are mostly doing even worse!

My main portfolio is down about 1% this year to date (having been significantly up in Mar). However the FTSE AIM ALL SHR (FTSE:AXX) index is down far more than that, as you can see from the 12 month chart below;

| % change YTD | ||

| 31 Dec 2013 | 850.7 | n/a |

| 6 Mar 2014 (this year's high point) | 897.3 | +5.5% |

| 25 Jun 2014 | 779.7 | -8.3% |

.

So if you invest in AIM shares (which most of mine are), and your portfolio is doing better than down 8.3%, then you're beating the relevant Index!

Note that the current level is back to where we were last autumn, around Sep-Oct, which is when I recall things starting to get really frothy - arguably the point where we went into a euphoric phase that generally signals the last stage of a bull market.

So overall, I would just say don't beat yourself up too much if you're finding things tough at the moment. This is a necessary & healthy correction, and if you are in good solid companies, on reasonable valuations, then long term you should be fine. If you're in speculative, overpriced junk, then you need to re-think how you do things!

Zanaga Iron Ore (LON:ZIOC)

This is pretty much my only resource sector stock, which I regard more as a special situation, hence why I'm in it.

Today's results for calendar 2013 don't contain any surprises or new information, but for anyone not familiar with the share, in my view the narrative published today gives an excellent summary of the key points.

ZIOC shares have their own Listing, and the company owns 50% less one share of a West African iron ore project. The other party is mining giant Glencore, who have spent over $300m on just the feasibility study. Last year the market assumed that Glencore would probably ditch this project, but to everyone's amazement, they reworked it (to reduce the initial capex from $7bn to $2.6bn) and still appear to be committed to the project.

As you can see from the capex numbers, this is a huge project, with a mine life of many decades, and when fully operational will be supplying around 2% of entire global iron ore production.

The problem is that iron ore has been dropping in price, due to over-supply. However, as explained in today's report, the Zanaga project still stacks up even if the iron ore price falls as low as $80 (it is currently about $100). There are several factors to consider - Zanaga will be a very low cost producer, at $32/ton. Add another $25 shipping costs to China, and the mine still makes a decent profit with iron ore prices above $80.

Secondly, this iron ore is high grade, and low in the impurities that are doing so much environmental damage in China (the largest consumer of iron ore). Hence it will attract a significant price premium, further reinforcing the project economics.

Furthermore, if iron ore prices remain low, then high cost loss-making producers are likely to scale back or cease production, thus sowing the seeds for price rises as supply tightens.

There are no guarantees that this project will go ahead, but all the signs so far are that it will. The big question remains how is the capex funded? The company believes it can mostly be done on debt financing, and this is where having Glencore as your JV partner is of such enormous value. If Glencore want the project to go ahead, it will go ahead. The only question is what level of dilution Zanaga shareholders are likely to see? Having discussed this with the company on a number of occasions, I am hopeful that the capex can mainly be funded through debt (there are generous Govt-backed export financing packages available with some foreign contractors). Hopefully this could then leave Zanaga with a meaningful stake (but obviously less than 50% by the time it is fully funded) in a massive & highly profitable iron ore mine.

It is clearly speculative, but all investing is risk/reward. You just try to find situations where the upside case is very much bigger, and more likely, than the downside case. This share could be a pretty serious multi bagger if a number of factors come together favourably. However, it could go horribly wrong if project finance is not secured on reasonable terms, or worst of all if the project is cancelled or mothballed (which could trigger a c.75% instant share price fall). So high risk but very high potential reward. Definitely not for widows or orphans, but personally I have done a lot of research on this one, and think it looks potentially very exciting. The market cap is currently about £50m at 18.12p per share.

Downside risk is partially mitigated by cash, which stood at $24m at 31 Dec 2013, although that will have since dropped by about another $7m, so say roughly £10 m in the kitty, or about 20% of the share price. We should have further newsflow within a reasonable timescale, and the clock is ticking now, as 31 Dec 2014 is when the funding commitments to the project end. On a positive note, teams from Glencore and Zanaga are working jointly on arranging the project finance, so as things stand currently it looks as if there is a clear intention to take this project forwards into production.

Here's an interesting recent article about iron ore prices.

Synectics (LON:SNX)

There's a nasty profit warning from this CCTV company today. I think management credibility is now starting to look seriously in question here, as it's not the first time they have warned, and some of the items mentioned today smell of poor management. I think the market has been gentle with it, only marking down the price by 22% to 329p. I think it should be a good bit lower than that after today's update.

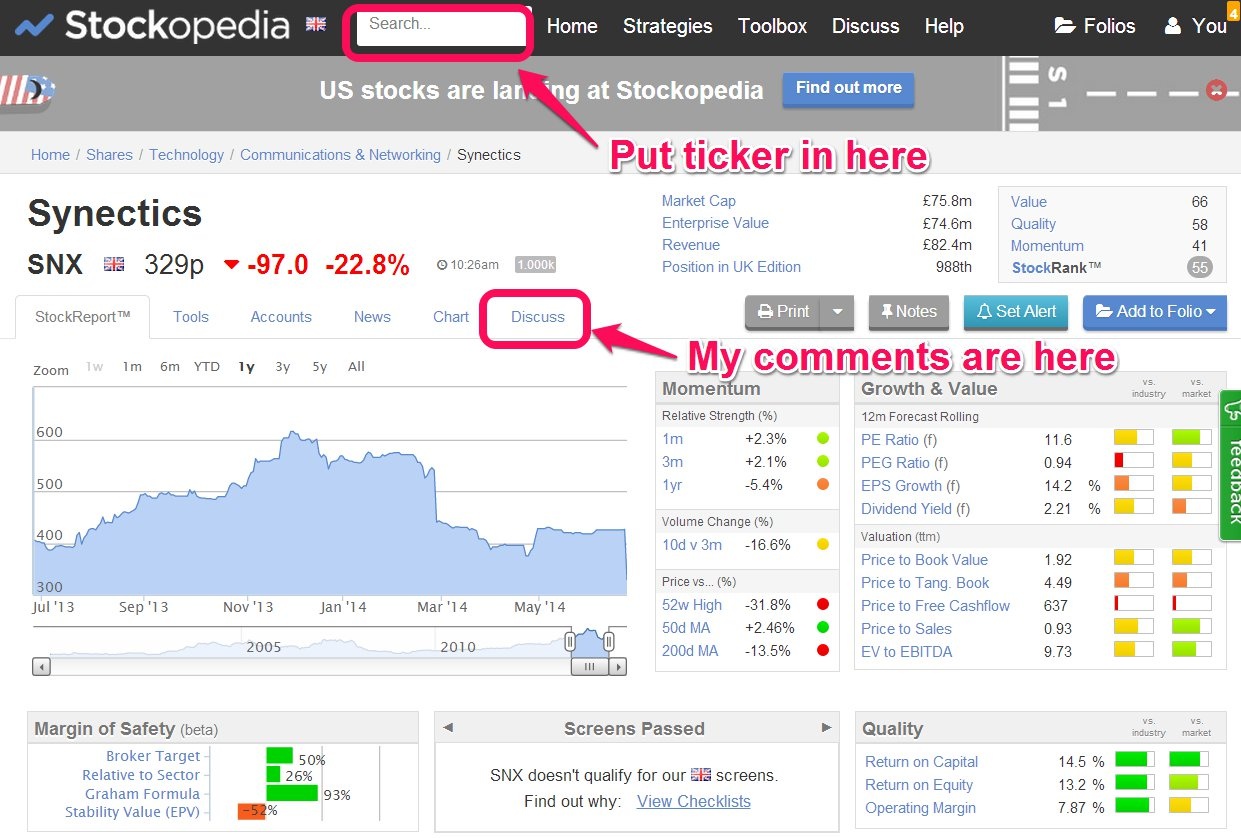

You can check the archive for my previous comments about any company (which you can do by clicking on the "Discuss" tab on any StockReport (see screen grab below):

So checking the archive for my previous comments is the first thing I do, as it refreshes my memory about the key points from last time. In my report of 30 Apr 2014, I concluded the following (with the shares at 434p);

"Overall then, it's probably not bad value now, if nothing else goes wrong. Although given the wobbly track record, I would say there might be a chance to buy more cheaply, if it warns on profit again later this year. I'll probably hold fire, just in case".

That caution turned out to be very sensible! You can sometimes just smell the potential for another profit warning, from the language and tone of statements made by companies. As Jon Moulton said in his excellent speech at the recent London Value Investor Conference, which I wrote about here, when things go wrong, they are always worse than management at first admit. Wise words, worth keeping to the front of our minds. Or "profit warnings come in threes" is the other well known (and often true) stock market saying.

The profit warning sounds a nasty one, with a loss of £2.5m for H1;

Synectics has suffered recent negative impacts that have substantially lowered its expectations of results, both for the first half year to 31 May 2014, and for the year to 30 November 2014, which are expected to be significantly below market expectations. However, trading for the second half of this year is expected to be very strong and well ahead of the record results achieved in the second half of last year (underlying PBT of £3.5 million).

So a lousy H1, and a strong H2 is expected. Hmmmm. Given the company's track record for tripping up, I wouldn't hang my hat on H2 being as strong as they expect. So often the expectation of an H2 weighted year is just a deferred profit warning. Sorry if I'm sounding like a stuck record on this point, but you see it happen so often that I rarely put any value on management assurances that H2 will be strong. Although in this case, a stronger order book does lend some support;

...substantial growth in the Group's consolidated order book, which stood at £32.9 million at 31 May 2014 (30 November 2013: £27.6 million)

The interim dividend has been passed, and a final dividend is dependent on the strong H2 anticipated. I don't like that. Companies should continue paying divis through difficult patches. If they stop paying the divi, then it undermines assurances that trading will improve, and/or suggest the cash position is likely to be inadequate.

Recent events in Iraq are blamed for stalling a big contract, although more worryingly there seem to be some internal issues about controlling costs on contracts. I don't like the sound of that, and so for the moment I'm taking this share off my watch list. I suspect there could be more problems later this year. They are moving premises, and installing new IT systems, both of which have a high propensity to cause significant problems, in my experience.

That's all for today. See you in the morning!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in ZIOC & SSTY, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.