Good morning!

Norcros (LON:NXR)

Share price: 19.25p (up 6.2% today)

No. shares: 597.2m

Market Cap: £115.0m

(at the time of writing, I hold a long position in this share)

Croydex acquisition - Norcros made it clear in last week's results statement that it was on the acquisition trail, armed with a hefty bank facility, and today comes news of a deal to buy an Andover (Hampshire) based bathroom fittings company called Croydex Ltd. Please click here to recap on my article from last week which went through Norcros results for the y/e 31 Mar 2015 in some detail.

It looks a really good deal. Looking at their website, Croydex is a long-established (1919) company which designs & distributes a wide range of reasonably priced bathroom fittings and accessories. So this looks a good fit with Norcros's existing businesses.

I've had a look at Croydex's accounts at Companies House, and they look very good - nice clean accounts, a super balance sheet which includes a £2.3m long leasehold property. The company restructured (i.e. reduced costs) in 2013, and is now reaping the benefits. The Directors Report is positive, and speaks optimistically about the outlook.

Croydex reported a profit before tax of £2.1m for calendar 2014, on turnover of £19.9m.

The announcement from Norcros today refers to £2.6m profit before tax and shareholder costs, which I presume must mean Director salaries, which were £606k for the year. Croydex is currently owned by two families, the controlling one being the Browns - which reminds me of the joke about waving goodbye to the Browns, on their trip to the seaside! Rather fitting, given that one of the products that Croydex make is patented "Sit Tight" toilet seats. They look quite good actually.

I curse toilet seat makers every time I have to remove a wobbly or broken one with a hacksaw, as the bolts are all rusted tight, and aligning the hinges is so irksome! You think you've fitted it perfectly, then realise that it's at the wrong angle, and won't stay up. Anyway.

Croydex sell online though their website. and wholesale to both trade and retail buyers. It looks a nice business, and a good fit for Norcros, broadening the product range, and creating cross-selling opportunities.

The acquisition is being funded from Norcros bank facilities, with a cash cost of £20.8m initially, and a further £1.1m deferred for three years. This looks to be a retirement sale, as the majority shareholders are 64 and 66.

Forecasts - Numis have raised their EPS forecasts this morning, by 12% this year, and 14% next year. So that takes EPS to 2.3p (PER of 8.4) and EPS of 2.6p (PER of 7.4) next year. This seems an extremely pessimistic valuation to my mind, and the pressure for the shares to re-rate is only likely to increase after this sensible acquisition.

Net debt is forecast to increase to £29.7m by Mar 2016, but this is only 1.1x EBITDA, which is modest in my view.

My opinion - I like this deal. The price of Norcros has, in my opinion, been depressed by a constant seller in the market. So this overhang has also put off new buyers, and existing holders - you can sense the frustration with Norcros shareholders, and the less patient just drift away after a while, selling up when the shares refuse to re-rate.

However, in my view that's a mistake. A well-managed group, performing reasonably well (apart from UK retail) is not likely to stay on a single digit PER forever. So the overhang could be seen as an opportunity, for longer term investors to buy as much stock as we want, and then just sit back and collect in the divis while we wait to the overhang to eventually clear, and the stock to re-rate.

Numis have a target price of 30p, which I think is perfectly sensible. It won't happen overnight though, unless someone bids for Norcros. That seemed unlikely previously, but as we've seen with AGA Rangemaster (LON:AGA) and Thorntons (LON:THT) recently, it now seems that big pension deficits are not deterring takeover approaches any more. If you're an American company on a PER of 20+, where do you find more growth to justify that rating? The obvious answer is to come to the UK and buy up something on a PER of 8, and hope that the pension deficit will sort itself out in the long run.

Anyway, all good re today's announcement, as far as I'm concerned. Note that Croydex does not have a pension deficit itself. So as Norcros group grows, its legacy pension issues become a smaller part of the larger group, which is worth bearing in mind.

Anpario (LON:ANP)

Share price: 334p (up 0.5% today)

No. shares: 21.6m

Market Cap: £72.1m

AGM trading update - Chairman Richard Rose (same as Crawshaws) says that Anpario "continues to be on track to meet its profit expectations..." for calendar 2015.

The sale of the organic feed business has reduced turnover, but they are focusing on higher margin specialist feed additives.

There was £7.8m of cash at 24 Jun 2015.

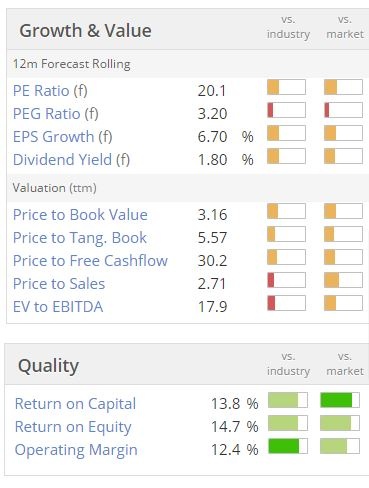

Valuation - as you can see from the Stockopedia graphics, it's on a rolling forward PER of 20.1 times, and looks expensive on every other valuation metric too:

That's fine if the company has the potential to grow its earnings & cashflows considerably in the future. I'm not averse to paying a PER of 20, for companies with a competitive advantage, and excellent growth potential.

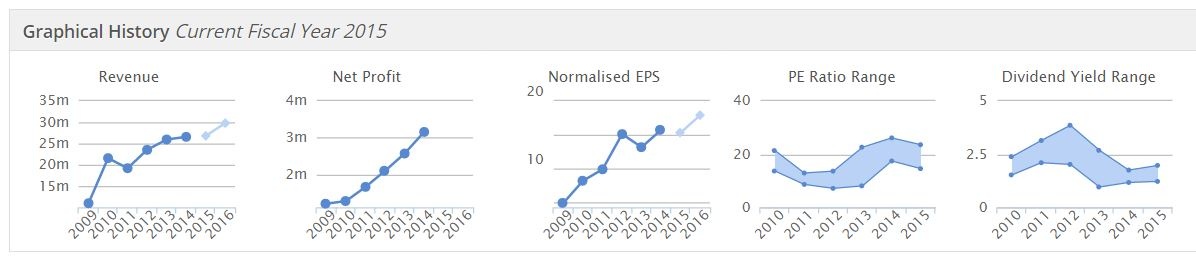

The historic graphs here look very good:

Although as you can see from the fourth graph, the PER rating range has risen a lot in recent years, so the market is now pricing in a lot more growth into the share price than before. That leaves it vulnerable to a sharp correction, if the growth in earnings disappoints at any stage.

My opinion - I'm not convinced risk:reward is necessarily attractive at this sort of valuation. There again, that's for investors to decide yourselves, by delving into the products & markets that Anpario supply. Clearly investors are feeling bullish about the company's prospects, which is why the shares are valued at 20 times forecast earnings.

It's got an excellent balance sheet too, with cash now representing nearly 11% of the market cap, so adjusting out cash would bring the PER down to about 18, which isn't quite so stretched.

Personally, I'd probably be top-slicing if I held this stock, after such a good run, and with a valuation that now looks pretty full. Equally, there's a lot to be said for just riding out the short term ups and downs, and holding for the long term, if you think the company will be a long term winner. There are merits in both strategies. Your money - your choice!

Costain (LON:COST)

Share price: 336p

No. shares: 102.0m

Market Cap: £342.7m

Trading update - a solid update today from this engineering contracting group, saying they are "on course to deliver a result for the year in line with the Board's expectations".

The order book has risen by £0.2bn to £3.7bn in the last six months. The group seems to be in a good position, as they fixed their balance sheet a little while ago with an equity fundraising, giving it a strong position as a preferred bidder.

My opinion - this looks a potentially interesting stock, although contracting businesses very often come unstuck at some point when eventually some contract(s) go wrong. It's also very low margin work, with Costain only delivering an operating margin of about 2-3%.

Overall the forward PER of 15.6 looks rich to me, given that this type of business can so easily come unstuck. I would say this type of business should probably be priced on a PER in single digits.

I suppose the shares are a bet that Costain can gain market share, and raise its margins. If they achieve higher margins, then the PER could drop considerably as profits potentially move up. I wonder how wage inflation might start to impact them, as certain technical skills are apparently already in short supply as the economy improves?

I've recorded a SCVR Extra video today to briefly review a few more company results & trading updates, as follows;

SkyePharma (LON:SKP) - in line half year trading update.

Daniel Stewart Securities (LON:DAN) - £1.2m fundraising looks contrived - designed to push up the share price?

Cohort (LON:CHRT) - good results, and strong order book. Looks priced about right.

Eckoh (LON:ECK) - good results, but very high valuation. Possible offer for Netcall.

Porta Communications (LON:PTCM) - strong trading update. More heavy Director buying - another £100k y'day.

Finally, Companies House have opened up their data, for free, hoorah! - here is the link - well worth bookmarking this if you like to look through company accounts.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in NXR, SKP, and PTCM, and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned.

Paul NEVER makes share recommendations. These reports give his personal opinions only, and readers are urged to do your own research & make your own investing decisions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.