Good morning!

The Chancellor's Autumn Statement is due to be announced shortly, so I expect all eyes are on that.

It wasn't possible to write a report yesterday unfortunately, but I'll circle back to those announcements later this week, as we don't want gaps in the sequence.

There are a couple of equipment hire companies reporting today, so let's start with those.

VP (LON:VP.)

Share price: 749p (up 4% today)

No. shares: 40.2m

Market cap: £301.1m

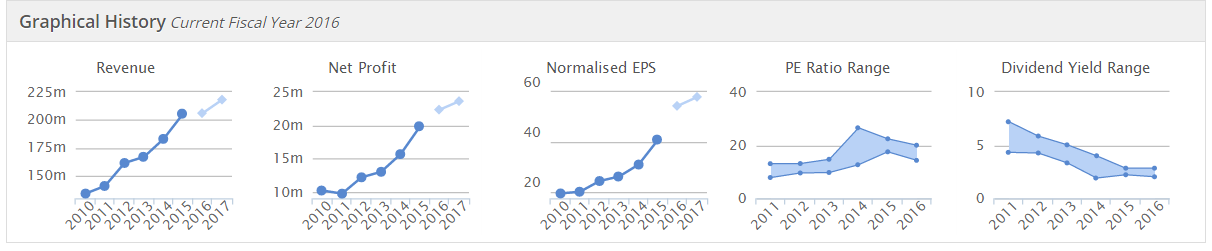

Interim results to 30 Sep 2015 - the headline figures here look solid, rather than exciting. Key numbers being;

- Revenues up 4% to £105.1m for the six months

- Profit before tax & amortisation up 6% to £17.2m (I'm happy to accept this as an accurate performance measure, as the amortisation charge is non-cash, and immaterial anyway)

- Headline EPS is also shown pre-amortisation, and rose 7% to 35.14p

Judging from last year's results, there seems to be a trading bias towards H1, and the full year broker forecast seems to confirm this, with 54.4p forecast for y/e 31 Mar 2016, assuming that forecasts are prepared on the same basis that the company reports.

This seasonality makes sense, since there's more outdoor construction & maintenance activity over the spring & summer, than over the winter.

On reading the divisional breakdown, it's clear that most parts of the business are doing better than the headline figures suggest. UK Forks and Hire Station did very well, with profits up 25% and 27% respectively. However, two smaller divisions performed poorly, in particular Airpac Bukom (impacted by the O&G sector slowdown), and TPA, where profit more than halved.

So assuming the problem divisions (which are relatively small) can be turned around (all are still profitable, so no basket cases), then there is reason for optimism perhaps. I like shares where strong performance is temporarily obscured by fixable problems at a particular division, as that can allow a decent value entry point.

Outlook - this sounds reasonably encouraging;

This period has once again demonstrated the Group's ability to deliver good results even when some of our markets are performing at less than full capacity. This continues the excellent progress delivered over previous years.

We see opportunity across all divisional segments in Vp and will continue to deploy our robust financial strength to deliver further value growth to our shareholders.The Board has every reason to believe that the Group will be in a position to deliver a very satisfactory result for the year as a whole.

I think they are trying to say that they're likely to be in line with, or maybe a bit above market expectations, but that's my interpretation. I sometimes wish companies would just tell it like it is, instead of finding carefully constructed words which give them wiggle room, but frustrate readers, who have to work out how to interpret those words.

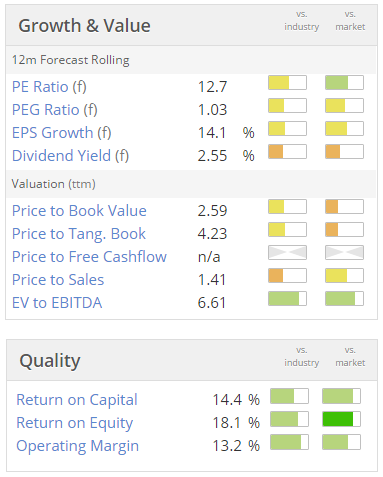

Valuation - looks reasonable on a PER basis, but quite high on a price to NTAV - which is usually about 2 times for equipment hire companies, so at 4 times, this is looking a bit warm.

There again, this company seems to sweat its assets well, so it might well deserve such a premium.

The big question is where are we in the cycle? If we're near the top, then the valuation should now be moderating, to factor in future declines in earnings. If we're not near the top of the cycle, then the valuation could still have further scope to rise.

Remember that hire companies are benefiting from ultra low interest rates, as they carry a fair bit of debt, so they should be making hay in the current environment.

I note from the cashflow statement that there were substantial share purchases by the employee trust, so the accounting treatment of that needs to be investigated.

HSS Hire (LON:HSS)

Share price: 46.8p (up 1.1% today)

No. shares: 154.8m

Market cap: £72.4m

Great caution is needed with this share, in my opinion, as it was subjected to the scourge of Private Equity, thus loaded up with debt, and floated on the Stock Market at an excessive valuation, still with way too much debt remaining, and issued a profit warning just months after the IPO. A truly appalling sequence of events, that surely must put off investors altogether from even considering taking part in any future IPOs from PE? This certainly isn't an isolated case either. I would say that PE floats would make an ideal starting point if you're looking for shares to short.

I last reported on its interim figures & profit warning here. Re-reading that article has reminded me that the company has a weak balance sheet (NTAV is negative), and too much, expensive debt. So caution is needed when the company mentioned EBITDA and EBITA, as there's a hefty interest charge to come off those numbers.

Trading update - covering the 39 weeks to 26 Sep 2015. Adjusted EBITA of £13.8m for Q1-Q3 may sound reasonable, but interest costs will eliminate most of that, so there's in reality little overall profit being generated.

Net debt - is now £210.4m . I don't see any alternative to an equity fundraising here, to reduce excessive debt, and de-risk the balance sheet. No doubt that will be done in a discounted Placing at some point, which private shareholders will be excluded from probably. That gives us little incentive to consider buying the shares now.

My opinion - I'll need to look at the latest broker notes, to ascertain whether there's a trading opportunity here, to buy the shares for a quick punt on a bounce? The general tone of today's announcement appears to suggest that conditions are stabilising, and that there might be a recovery play here, given that the shares are now down a staggering 78% from the IPO price

Although the poor balance sheet means it could only be seen as a high risk share, and certainly not a long term hold, due to the excessive debt, and inadequate equity on the balance sheet. That said, we're in a parallel universe right now, where highly indebted companies are allowed to continue trading, so who knows, everything might turn out fine in the long run?

I'm tempted to have a nibble, but have been catching too many falling knives lately, so on reflection it might be best to avoid it!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.