Good morning! There's an interesting-sounding statement from a recent addition to my portfolio, Ubisense (LON:UBI) - the company announces a strategic partnership in Asia, and the passing of regulatory hurdles such that their product can now be sold in Japan. No financial details are given, and no revenue impact is expected until 2014, but this sentence intrigues me (see bolding below), as it seems to be pointing towards potentially significant growth perhaps?

Cambridge, UK - Ubisense Group plc ("Ubisense" or the "Company") (AIM: UBI), a market leader in real time location intelligence solutions, is pleased to announce that it has entered into an exclusive strategic partnership with one of the world's leading automotive logistics companies in Asia.

Following an engagement and trials over the last 12 months, both companies have agreed to work together to deploy an integrated automotive logistics solution to new and existing customers, built on the Ubisense Real-time Intelligence Platform. The solution will be deployed on sites at large scale Asian ports and leading automotive OEMs.

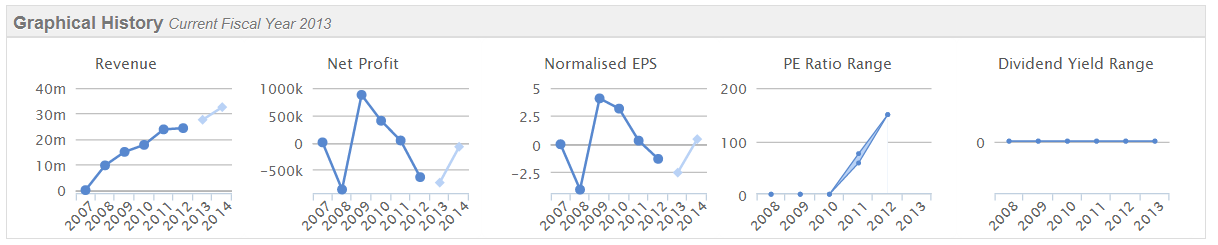

At almost £50m market cap at the current share price of 218p, Ubisense shares cannot really be valued on the historic figures. So this is very much a speculative, growth company. I would only buy into something like this in a bull market, when the market is highly receptive to growth situations, and is tending to put an optimistic valuation on growth potential. You certainly couldn't justify a £50m market cap on the historic numbers, as the Stockopedia graphical history below makes clear. However, I think it looks an interesting growth stock:

Broker forecasts show a loss of 2.53p per share in calendar 2013, and a tiny profit of 0.46p EPS in 2014. So the valuation hinges on the market believing that further growth will see a decent move into profit in 2015 and beyond. So today's announcement can only help in that regard. NB - this shares is considerably more risky than the usual things I cover. The problem with growth companies is that if they disappoint on the figures, then the share price can lurch downwards suddenly & violently. However, they also have exciting upside potentially.

I've had a quick skim of the interim results…