Good morning! I'll have to write this report fairly quickly this morning, as I'm heading into London for a broker/analyst lunch with Churchill China (CHH) - an interesting company that has been on my watch list for some time, but which has not fallen to an acceptable price for me to buy any (it's not been far off a couple of times).

Churchill China (LON:CHH)

Share price: 460p

No. shares: 10.93m

Market Cap: £50.3m

This is one of two Listed makers of ceramic crockery, the other being Portmeirion (LON:PMP). The main difference between the two seems to be that Churchill focus on supplying the hospitality sector, whereas Portmeirion seems more about decorative & special occasion crockery.

I compare the two companies from time to time, because I like the fundamentals & prospects at both, but always come back with the same conclusion - that Portmeirion is a higher quality business (making a significantly higher operating profit margin), yet the shares are consistently cheaper on a PER basis. Both have sound Balance Sheets & pay a reasonable dividend.

That has worked out well, as the chart below shows the share price performance of Churchill China (the dank blue line), with the comparison line (beige) being the share price of Portmeirion - which has done considerably better. So I picked the right one, in terms of performance over the last two years anyway.

Interim results - for Churchill China are published today, covering the six months to 30 Jun 2014. There is an H2 weighting to the trading year, so one has to be careful not to extrapolate % gains in profitability in H1 to the full year.

Operating profit - rose 31.9% in H1, although the figures are quite small - £1,046k last year H1, to £1,380k this year H1. The operating margin was medium at 6.6% (I prefer 10%+ operating margins), although the full year figure should be higher (it was 7.8% last full year), so will be getting close to 10% for the full year in 2014 I reckon.

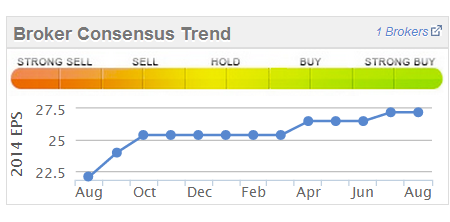

Earnings Per Share (EPS) - diluted EPS rose from 7.6p to 9.8p in H1. Full year diluted EPS was 24.9p last year, so that suggests to me the company is probably heading for maybe 28-32p EPS for the full year in 2014? Broker consensus is 27.2p EPS this year, and 29.3p next year - those look perhaps a tad too conservative to me, so I'd expect to see some modest broker upward revision of forecasts, which has been the pattern in the last 12 months, a positive sign, as this Stockopedia graphic shows;

It's nearly always best to be buying into a share where brokers are steadily revising up forecasts. Although care is needed with small caps, as in this case it's only one broker putting out forecasts.

Valuation - If we run with say 30p EPS for this year, then at 460p the shares are on a PER of 15.3, which looks about right to me.

Balance Sheet - This is superb. There are £28.4m net assets, with negligible intangibles. The working capital position is bulletproof, with current assets at 287% of current liabilities. Therefore pretty much all the net cash of £8.5m is surplus to requirements, which is about 17% of the market cap. However it depends what they do with the cash - but it could be given away in a special dividend, used for acquisitions, etc. I shall ask management today about their intentions, although I remember from last time there was talk of having a war chest for one of two potential acquisitions that are twitching away on their radar. The company has a track record of being canny in acquisitions, often buying assets dirt cheap from the Receiver.

Dividends - The interim divi has been increased 4.1% to 5.1p. This is in line with the forecast full year divis of 15.1p, which is a reasonable 3.3% divi yield. There is clearly scope to pay more, although divi cover is about twice, so one imagines they might keep the standard divi at that sort of level of cover.

Outlook - the all important outlook statement - as markets look forwards more than they look backwards! Today the company says;

Churchill delivered an excellent performance in the first half of 2014 with profits increasing by over 30%. Given the seasonality of our markets, performance in the second half of the year is the most important contributor to our annual performance. We expect our rate of growth to moderate in the second half against more difficult comparatives from the excellent trading at the end of 2013. The Board remains confident that we will deliver a strong performance for the year as a whole in line with our expectations.

That sounds OK to me, with a bit of wiggle room having been included in case H2 is softer than they expect!

My opinion - This is one of my favourite, steady companies. However I can't get excited about the current valuation, it's probably priced about right, with maybe some upside if they do something clever with the cash. It will remain on my watch list.

EDIT: I have added my thoughts from the analyst/broker lunch today in the comments section below.

Just time for some quick comments before I have to dash off for London.

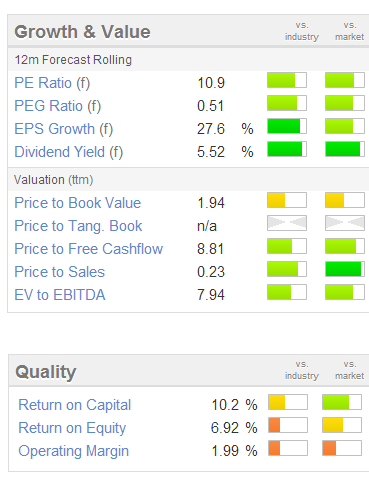

McColl's Retail (LON:MCLS) - a Q3 trading statement is issued this morning by this chain of convenience stores/ post offices. The shares have done surprisingly well since IPO in Feb 2014, and the valuation looks superficially attractive as you can see from the usual Stockopedia graphics below.

LFL sales in Q3 were down 0.5%, and YTD are up 1.2%, which is probably borderline in terms of whether it's enough to absorb cost increases?

Most importantly it says trading is in line with expectations for the full year. The dividend yield is attractive, but I'm not sure whether that is sustainable long term? The format is tired & old-fashioned, and likely to need continuous capex, so it's not a retailer I would buy into. I think something like Shoe Zone (LON:SHOE) is a far better proposition, if you want a cheap retail stock, just an opinion as always - please be sure to DYOR.

I'm interested in reader comments about McColls - have I got it wrong?

I shall report back later today or tomorrow about how the Churchill China (LON:CHH) lunch goes.

Signing off now for the day.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in PMP & SHOE, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.