Good morning!

MySale (LON:MYSL)

Share price: 52p

No. shares: 150.6m

Market Cap: £78.3m

Interim results - the company had already warned on profits, so poor results were expected. That said, I'm feeling negative about the company reading these figures. It looks to me as if their business model is questionable. Growth has all but dried up, and the company remains heavily loss-making.

I do like their business model of having no inventory risk - taking excess stock on a sale or return basis from suppliers. However that is reflected in much lower margins.

The £3m Director purchase at c.80p just before Christmas appears now to have been for show, rather than on fundamentals. Either that, or he had already made a start on the Xmas booze and had £3m burning a hole in his pocket?!

On the positive side, there's plenty of cash in the kitty.

My opinion - MySale has a lot to prove, and in my view it has not yet demonstrated a viable business model. The penny is starting to drop with investors that internet retailers are just distributors to the public, through a website. They don't have any magic formula for making money, and the stretched valuations on many are accidents waiting to happen in my view - so I remain short of a number of UK online retailers.

There are many competitors popping up, and so anyone who thinks they can dominate a market online is probably deluded (the exceptions being the giants like Amazon, Ebay, etc).

The only reasonably-priced online retailer that I've found is Boohoo.Com (LON:BOO), which after a profit warning in Jan 2015 (original expectations at the IPO were far too high) is now on a fwd PER of 20.3, less if you remove the cash. That seems to me a sensible price for a decently profitable business that is growing at a reasonable pace, and is making good progress overseas, as well as in the UK. There was some interesting original research on BooHoo & its competitors, from Investors' Champion earlier this week, click here.

So why would I look at MySale, which is loss-making, and having to close in certain countries because it didn't work? That sounds to me like the business was a nice idea, but isn't working. Just because Philip Green is backing it, doesn't mean it will automatically be a success. He is a brilliant retail man, but he makes mistakes too - all entrepreneurs do - you have to try things out to see if they work. Some will, some won't. I suspect this won't.

The trouble with surplus stock, is that it's surplus because customers don't like it the first time round, when it was in shops. So just because it's cheaper now, doesn't mean it will necessarily sell on a clearance website such as MySale. I recall from working in the sector that some items just wouldn't shift even if you put them into 75% off sale.

Waterman (LON:WTM)

Share price: 67.25p

No. shares: 30.8m

Market Cap: £20.7m

Interim results for the six months to 31 Dec 2014.

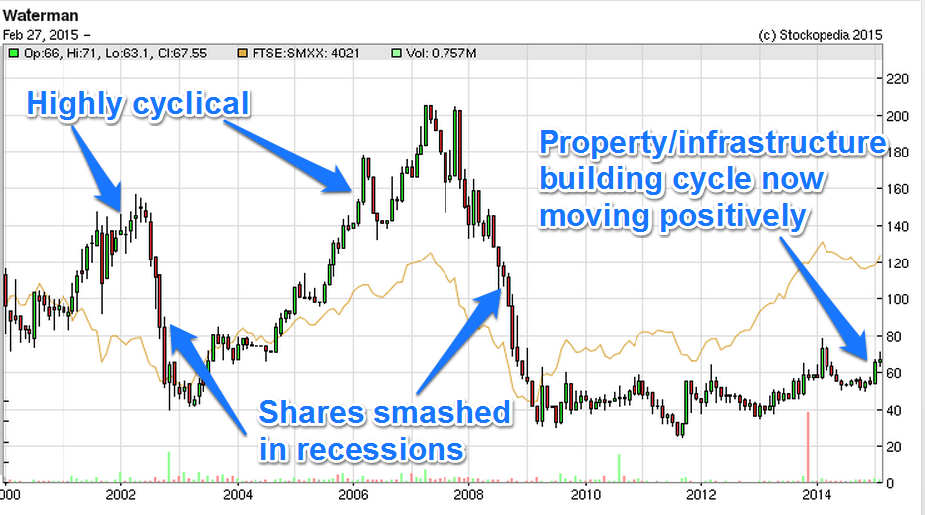

On an initial review (I'll read in more detail over the weekend), these figures look good to me. The company is cyclical, and is now seeing improved trading. It's important to note that the group has one under-performing part, which is loss-making, but that's being sorted out gradually. So there should be good upside when the restructuring has been completed.

The presentation of the figures is not what I'm used to, in that they seem to have shown three sequential half years together, which I find confusing.

Adjusted profit before tax is up 75% to £1.4m, which I'm impressed with.

Balance sheet - Waterman's balance sheet passes my simple tests, as follows;

1. The current ratio is 1.36 (I like this to be at least 1.2 usually), PASS.

2. Net Tangible Asset Value (NTAV) is positive, at £12.2m. PASS.

3. Bank debt is minimal, and at the balance sheet date the company reported net funds of £3.6m. This is validated by a low P&L interest charge. PASS.

Dividends - note that these are rising strongly, and the yield is starting to get interesting. The interim divi has been doubled to 0.8p, and the full year divis look on track against forecast of 2.0p total. That gives a respectable yield of about 3.7%. With further increases, it's not difficult to see that yield rising to say 5%+ with a bit of patience.

Broker forecasts - these look too low to me. So I think there's an opportunity here for the company to beat forecasts, and hence see a further rise in the share price, possibly?

My opinion - I like this share, and whilst the company's track record has been patchy (it's a heavily cyclical business), the cycle is now working in their favour, and hence results are improving. As we always say, and mean (!!), please do your own research. As I mentioned in a presentation the other night, investing is a team sport, so by pooling our research and analysis, I'm sure we come to better decisions most of the time.

I flagged up that this stock looked potentially interesting here on 5 Dec 2014 (at 56.5p).

Also, one of my interviewees, analyst/investor Paul Hill, gave his views on Waterman in this audiocast from 25 Jan 2015 (from 8:20 to 11:35).

Quindell (LON:QPP)

Update - the investigating accountants, PWC, were due to report by the end of Feb, although it should be noted that such a report won't be published. We'll just get a sugar-coated version of the bits that the company wants to tell us, I imagine.

Today's update is just a holding statement really, saying that it's taking longer than expected (and must be racking up a helluva bill from PWC - I used to work for them, and the charge-out rates on this type of job are usually high). Given that Quindell has a sprawling corporate structure, due to an acquisition spree under the founder, then it's bound to take time to unpick all the detail, and assess a large enough sample of live cases to form a conclusion as to what their recoverable value might be.

Disposal talks with SGH are ongoing, and some non-core subsidiaries are to be disposed of, which makes sense given that cash is tight.

I don't think anything in particular can be gleaned from today's update.

My view remains the same as it's been for several months now - that there is clearly some value for the good bits in the group, but nobody seems to know how much - opinions vary wildly! I've never been in the 0p camp, but equally can't determine what it might be worth, as we don't have any accurate information. Also if no disposals happen quickly, then it might need some kind of cash injection to resolve the chronic inability to generate positive cashflow. All fascinating, but I remain happy sitting on the sidelines with no position now.

Harvey Nash (LON:HVN)

Trading update for the year ended 31 Jan 2015, saying that results are in line with revised expectations. Also it says cashflow has been strong, with net debt having reversed round into a net cash position of £2m.

Directorspeak sounds fairly upbeat, so overall this one might be worth a look possibly?

Balance Sheet - it passes two out of three of my tests. The one it fails is the current ratio over 1.2. The last reported current ratio here was 1.06. That might seem low, but for the recruitment sector I could live with that - the reason being that there is no "Inventories" item in current assets for service businesses. Therefore a current ratio maybe as low as 0.9 is probably OK in this sector. The most important thing is that there is no long-term debt, so overall I'm happy with this balance sheet.

The main balance sheet risks are withdrawal of bank facilities, which seems unlikely with this company, and bad debt risk from a large customer going bust - so credit control is absolutely critical.

My opinion - looks quite good. Although there are plenty of smaller recruitment companies to choose from, which are all much of a muchness in terms of performance & valuation.

That's me done for the day & the week. Have a smashing weekend, and I'll be back here on Monday morning.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in BOO & WTM, and no short positions. A fund management company with which Paul is associated may also hold positions in any company mentioned here)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.