Good morning!

Churchill China (LON:CHH)

I recall mentioning this maker of ceramics, mainly for the hospitality sector, fairly recently. Sure enough, checking the archive here (which can be done by putting in the ticker in the search box above, then going to the "Discuss" tab) I last did a report on 10 Jan 2014, when the company issued a positive trading update for calendar 2013.

That statement said that results would be "signifcantly ahead" of 2012, and exceed current market expectations, which at the time were 23.2p EPS. So I guessed that 2013 might come in somewhere in the 25-30p range.

As it's turned out, the results are 25.2p basic EPS, and 24.9p diluted EPS, so note there must be few share options in issue, since the two figures are very close. With the share price currently at 457p, that gives us a 2013 PER of 18.4, which looks a fairly full valuation to me. Although that may be justified, since the growth in EPS is strong at nearly 28%, and as we know the market attributes a higher P/E rating to companies that are growing earnings strongly. So using Jim Slater's PEG ratio (which is a useful tool to have in your kit), then the PEG is 0.66 - where anything below 1 is considered worth looking at, in terms of value. It's a while since I read the "The Zulu Principle", Slater's book which set out his idea of the PEG ratio, but I think it should be calculated on future growth, rather than historic. Or both? Of course it's harder to work out in advance what future growth will be, as assumptions are usually wrong.

Broker forecast for 2014 is for 25.4p EPS, so those are now likely to be too low, and I would guess that an EPS figure of nearer 30p looks more likely for 2014, if the same progression continues. That would lower the PER to 15.2, which is starting to become more attractive, although personally I feel more comfortable buying companies on a PER below about 12. So this share is currently already factoring in about two years' growth in profit at the same rate achieved in 2013. I'm not sure that is an attractive proposition, as it doesn't give any leeway for something going wrong during that time - there's no margin of safety.

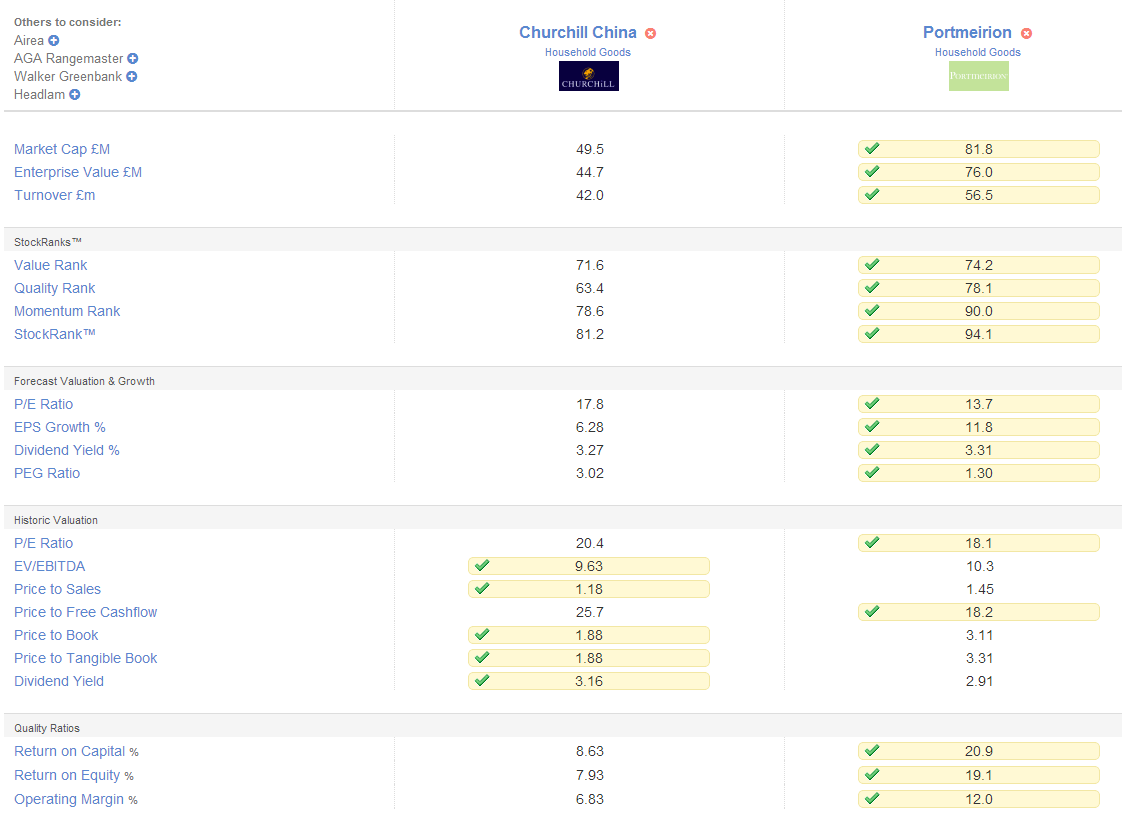

There are all sorts of wonderful features buried in Stockopedia, and one I've never used before is a tool to rank two (or more) companies on key valuation measures. It's under the "Toolbox" menu on the black band above, then "Compare stocks". So I have run that feature for Churchill China (LON:CHH) and Portmeirion (LON:PMP), the two UK ceramics companies, so here are the results:

As you can see, PMP scores better (every item that is ticked is the more favourable of the companies chosen) on pretty much all the forward valuation measures, and the quality ratios at the bottom. There are more things covered in this report, but this was the most I could fit on one screen shot.

Although I should add that, since the CHH figures will be based on broker forecasts that are now likely to be too conservative, the figures in the forecast & value section will shortly be updated. So it is worth taking a screen grab of the figures today, then revisiting in say a week's time when broker forecasts have been updated, to see how the ratios have changed. Or just update them yourself with your own estimates, which is what I do.

So basing it on their latest results for 2013, PMP grew basic EPS by 12.6%, whereas CHH grew basic EPS by 28.6%, so that would justify CHH being on a higher rating, if that more favourable growth rate is set to continue.

CHH has a strong Balance Sheet (and says so in its narrative, so I may have to consign Scott's Law to the dustbin!) with net tangible assets of £28.1m (incidentally, when I calculate NTAV I only deduct Goodwill & other Intangible Assets such as capitalised development spend or software. I don't deduct any other items like Associates, Deferred Tax, etc).

Its working capital position is very strong, with current assets of £25.5m being 288% of current liabilities of £8.9m - this actually gives me a warm glow. However, note that there are £4m of long term liabilities, including £2.9m for a pension deficit, which would need checking to the last Annual Report, to ensure it's not one of these horrible iceberg deficits (where you only see the tip on the Bal Sheet). The agreed overpayments also need to be checked, as that is real cash leaving the business that you could have received in dividends, so it's a negative in terms of valuing the share.

The initial market reaction this morning is slightly negative, with Churchill shares down 12.5p to 445p.

Note that the year end cash of £8.2m is material to the valuation, and represents 75p per share. So when you deduct that off the share price of 445p, you get an Enterprise Value (EV) of 370p. If they are on track to do 30p EPS this year, then the cash neutral PER is only 12.3, which is actually looking quite good value. Although it depends what they intend doing with the surplus cash. If they're just going to sit on it, for nil return, then it's worth nothing to shareholders. If they use it to make a canny acquisition or two, at the right price, then it could be worth more than face value - that will be my key question when I meet the Directors today, as they have kindly invited me along to a results presentation luncheon.

Haven't got time to read all the blurb with the accounts today, so have printed that off to read on the train up to London shortly. I don't know about HS2, but do know that getting a reliable 3G+ signal onto all trains should be the top priority of the Transport Department - I would like to work on the train all the way, but instead find my signal constantly dropping in & out. Also why does everyone answer their phone by saying, "I'm on the train...", it's so irritating. I deliberately try to think of something different when answering mine, or don't answer it at all, as I still think it's rather bad manners to talk on a mobile on public transport.

SWP (LON:SWP)

A reader has asked me to run my slide rule over the interims announced today from this engineering group.

The figures look good, with pre-exceptional operating profit up60% to £863k. That also excludes a bit of goodwill amortisation. The outlook says a similar result is expected for H2, so if we take the £502k Earnings result (i.e. profit after tax) and double it for the full year, then it's about £1m Earnings likely for the year ending 30 Jun 2013. The market cap is currently about £19m at 10p per share, so that's a PER of 19. It would be a bit less if you strip out goodwill amortisation, but it's not looking a bargain to me.

It has net debt of £1.7m, and the Balance Sheet looks just about OK to me, although I would have preferred no debt. The dividend was only about 0.8% yield last year, and there doesn't look to be much scope to increase that.

So overall I'm not seeing anything here that appeals on valuation grounds. If anything the price might be a little warm? However, if you expect the business to continue growing, and profits to rise significantly from those reported today, then it might stack up. The company's activities look fairly humdrum though, but might benefit from a recovering economy.

The market doesn't seem to like results from micro caps Photonstar Led (LON:PSL) (down 20%) and Mobile Streams (LON:MOS) (down 10%) today.

I quite like the recovery potential at PSL, but it will probably need to raise some cash, and the shares are illiquid (I hold a few). MOS is the one which has issues with money being locked up in Argentina I think?

I'm going to have to dash now, to get ready for my trip to London, so will sign off for today. As usual, please add your comments in the comments below, especially if you find any interesting companies that I have missed.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in PMP and PSL, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.