Good morning. Today's report is dedicated to Richard Allden, a friend from my local investment club here in Hove, who died in hospital yesterday after bravely battling illness for some time. A real gentleman, who will be missed very much.

Judges Scientific (LON:JDG)

Share price: 1505p

No. shares: 6.0m

Market Cap: £90.3m

Final results - for calendar 2014 are in line with revised expectations. Fully diluted EPS (before exceptionals) was 80.5p (broker consensus 80.2p). With the shares currently 1505p, that means the valuation is hardly a bargain at 18.8 - that looks distinctly toppy to me still, unless people are expecting a sizeable increase in future earnings?

The growth here has come from serial acquisitions, and Judges is unusual in that it doesn't seem to have made any mistakes - the acquisitions have all driven up earnings, and the business model of hoovering up small scientific instruments companies into a group has worked very well.

The trouble is that there doesn't seem to be any organic growth at the moment, so that puts into question whether the shares should be on a premium rating still? If the company can keep pulling off good acquisitions, then it does deserve a premium price perhaps? Although bundling together a lot of businesses that don't have much in the way of synergies, and putting the whole on a higher rating than you would the individual companies, is something I struggle with conceptually.

The company makes excellent margins - I am impressed with the operating profit margin of 17.3%.

Balance sheet - this is surprisingly good. For a highly acquisitive group, there is very little goodwill - only £8.7m, plus £8.7m of other intangible assets. The current ratio is very healthy at 2.22, and long-term creditors in total are reasonable at £11.5m (the largest component being bank debt of £9.7m, with the balance being deferred tax).

Overall then, it easily passes my balance sheet testing. I remember CEO David Cicurel saying that the businesses acquired generate the cash to repay their acquisition cost loans. So a very impressive business model, no doubt about that - I'm warming to this one!

Cashflow statement - I don't see anything untoward in here. The group is generating genuine cashflow, and using that for acquisitions, using a reasonable level of bank loans to initially fund the acquisitions.

Divdends - there's a good track record of paying a rapidly rising dividend, although the share price has gone up so much over the years, that the yield is low - at about 1.5% currently (based on 22p paid for 2014, at share price of 1505p). The company points out that the divi is over 4 times covered by earnings, so I take from that the point that once it stops making further acquisitions, there will be scope for considerably larger divis.

Armfield - a recap on the latest acquisition (post year end) of Armfield Ltd is given. This was acquired for £9.8m, 50% in cash, and 50% in shares priced at 2055p. This looks like another good deal, as Armfield made £1.66m EBIT in 2013, so assuming it makes a similar amount going forwards, then I reckon that would add almost 24% to Judges profits - which ties in with the broker consensus of 101.5p EPS for 2015, which would put this share on a 2015 PER of 14.8, which is looking much more reasonable.

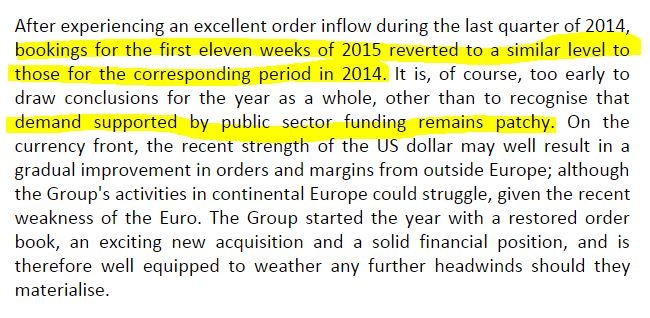

Outlook - it sounds as if things are flat against last year so far in 2015, which is probably a reasonable basis to assume to continue;

My opinion - overall, I think it looks priced about right. A PER of 15 times current year earnings, allowing for the debt, looks the right price. If the company can continue making more, similar value bolt on acquisitions, then that provides the catalyst for continued upside. So I can see the appeal of the shares, but for me I'd rather wait for a better entry price (I'm thinking c.£12 as the level that would tempt me back in).

Cenkos Securities (LON:CNKS)

Share price: 186.5p

No. shares: 58.0m

Market Cap: £108.2m

(at the time of writing, I hold a long position in CNKS)

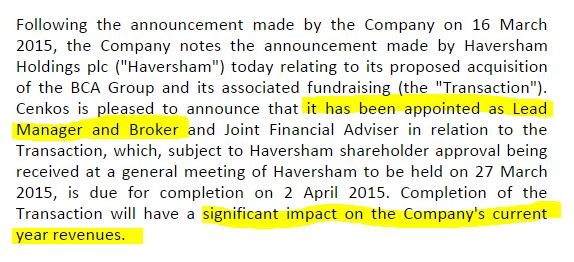

Haversham deal - announced today - note that Cenkos and Zeus capital have brokered a £1,028.5m Placing for Haversham's takeover deal for used vehicle marketplace, BCA Group, announced today. The fees are £23m, although it's not clear what proportion of that Cenkos will be getting.

Cenkos put out their own statement yesterday, saying that it was the lead manager & broker, so perhaps is in line for most of that £23m in fees? I find it astonishing that large investors are happy to pay a middleman 2.2%, but that's up to them I suppose!

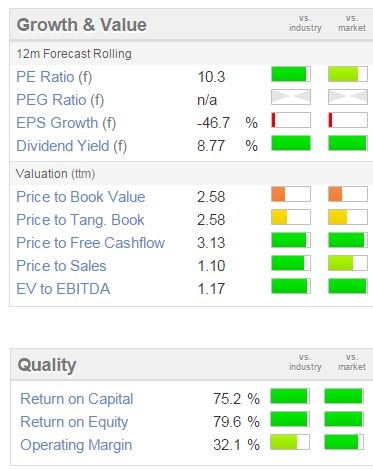

Valuation - you have to allow for the fact that brokers make hay when the sun shines, but then have lean years when markets are depressed or even normal. However, Cenkos really seems to be in a sweet spot at the moment. They have a bumper year in 2014 with the AA IPO, and it looks like 2015 is going to be another bumper year. The divis are fantastic too, a forecast yield of 8.77%! Obviously that probably won't be sustainable, but it would certainly put a nice dent in your cost price of the shares, after say 2-3 years.

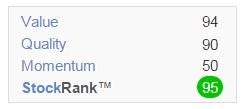

Note the very high StockRank of 95.

Also note the sea of green on the valuation & amazing quality scores too. So accepting that this is a good times stock, and that we are in good times now (which won't last forever), I think it looks very interesting at this price.

There could be good upside from here I reckon, if the good times keep rolling, for lucrative placing & IPO deals.

Robinson (LON:RBN)

Share price: 151p (down 4.4% today)

No. shares: 17.7m

Market Cap: £26.7m

Preliminary results - for calendar 2014 look a little better than I was expecting, but the "challenging" outlook statement has probably triggered the negative market reaction today.

I note the amortisation charge relating to customer relationships, which seems to be the new accounting treatment for acquisitions, as I've seen this crop up at a number of other companies. Anyway, it's one of these daft acquisition-related accounting items, so best reversed, in my opinion. Doing so gives you pre-exceptional profit of £2.9m, versus £2.3m in 2013.

Looks good, until you take into account that a large acquisition (of a Polish packaging company called Madrox), added £5.1m to revenues and £1.0m to operating profit in H2 of 2014. So the core business went backwards, from £2.3m profit to £1.9m. Not good, but hardly a disaster either.

Madrox will contribute a full year in 2015, so that should give a decent boost to the 2015 figures.

Dividends - the total divis for 2014 have been raised 11% to 5.0p, which is in line with broker forecast. That gives a yield of a reasonable, but not exciting 3.3%.

Outlook - not great, in terms of market conditions, but as mentioned above, 2015 and beyond will include a full year of Madrox's results, as opposed to half a year in 2014, since results are only consolidated from the date of acquisition;

Balance sheet - this passes my usual tests. There is some net debt, but it looks perfectly reasonable, at £4.1m.

Pension fund - very unusual to find a pension scheme in surplus, but this one is, so should not be a problem.

My opinion - overall I think this share probably looks priced about right at the moment, given the difficult market conditions, and the likelihood that food companies are likely to be placing great pressure on their supply chains to reduce prices, given the highly competitive supermarket sector.

For that reason, the fwd PER of 10.1 seems a fair price. There is also a prohibitively wide bid/offer spread, making the shares very tricky to deal. You lose about 7% instantly (including 0.5% broker commission) if you buy at the full offer price, although you can sometimes get a bit of a discount. If you get down to 5% bid/offer spread, that's still 18 months worth of divis that will be dissipated before you even breakeven, and that's assuming there are no more profit warnings.

I'd be happier buying at around 100-120p, to build in a bit of margin of safety.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.