Good afternoon!

Paul has already written a Part 1 article (at this link) which covers Bioventix (LON:BVXP), DP Poland (LON:DPP) and Spaceandpeople (LON:SAL).

In this article, I'm covering YouGov (LON:YOU), Elecosoft (LON:ELCO) and K3 Business Technology (LON:KBT).

Cheers

Graham

YouGov (LON:YOU)

Share price: 263.5p (+0.4%)

No. shares: 105.1m

Market cap: £277m

Some strong percentage growth numbers here:

- Revenue growth of 24% (2016: 15%) - Constant currency growth of 8%

- Adjusted operating profit1 up by 33% to £5.7m - Constant currency growth of 14%

- Adjusted profit before tax up by 27% to £6.3m

Paul has previously analysed the discrepancy between YouGov's adjusted and statutory numbers (see here) and today's results again show a large gap.

Statutory PBT is also rising strongly, but at the lower level of £2.5 million for the six month period to January 2017 (versus the £6.3 million adjusted measure given above). And FX gains have played a big part in these results (so are unlikely to be repeated).

The gap between the numbers above arises primarily from £3.1 million of amortisation, broken down as follows:

- Consumer Panel (£1.05 million)

- Software and Development (£1.65 million)

- Customer contracts and lists (£0.3 million

- Patents and trademarks (£0.1 million)

YouGov added £1.6 million of software & development in the period, and amortised £1.65 million.

In the prior six-month period, it added £1.6 million and amortised £1.7 million.

In the period before that, it added £1.3 million and amortised £1.5 million.

If it simply expensed all of this, the statutory profit figure would barely change.

But the adjusted number would collapse, since it would start to reflect these costs!

Data products

It's a shame we have to concern ourselves with this, since the underlying business does appear to be doing really well.

Yougov's brand intelligence tracker ("BrandIndex") helped its Data Products division grow revenue by 43% (24% at constant currencies), and operating profit in this division grew by 50%. This is perhaps competing with similar products offered by Brainjuicer (LON:BJU) ? On a standalone basis, this division looks like it would be worth a premium rating.

Outlook

Upbeat comments:

Current trading is in line with the Board's expectations and we remain confident in our ability to achieve our ambitious goals and deliver shareholder value. Within Data Products and Services, our pipeline of opportunities for BrandIndex and Omnibus remains strong and the growth potential of the newer YouGov Profiles is significant.

My opinion

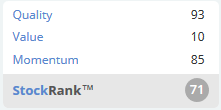

I'm not sure what the attraction is in terms of investing at the current share price, and the Stockopedia ranks suggest some caution might be required too (although the Quality and Momentum scores are very good):

It is a well-known name and is performing solidly, but how can it be worth nearly £300 million?

Elecosoft (LON:ELCO)

Share price: 42p (unch.)

No. shares: 77.1m

Market cap: £32m

My first time looking at this construction software provider (formerly known as Asta Development).

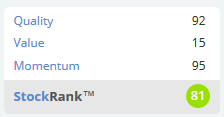

It's another highly-rated share, though I can see the potential in terms of providing standardised solutions to the construction industry worldwide. They have over 100,000 users and appear to be embedded within the industry.

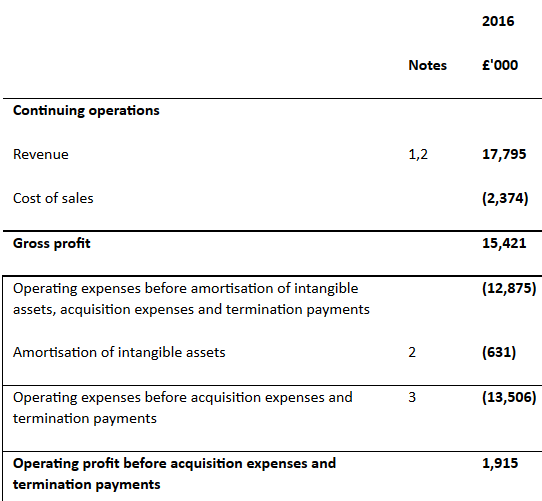

The growth rates are impressive, too. And the accounts are a straightforward demonstration of how a software company should present its activities, without any funny business, which helps to build trust.

Ok, there are a few adjustments. But operating profit emerges at £1.6 million after all expenses, not too far off the £1.9 million figure presented above. And note that the company doesn't emphasise pre-amortisation profit measurements. It capitalises about a quarter of R&D and is explicit about that.

Outlook

Nothing too specific in the outlook statement, but the Chairman is "confident" the company can meet its challenges and believes it is "fast becoming a truly international provider of market leading construction software applications".

My opinion

Potentially interesting. I haven't discovered any red flags yet!

1.7p of EPS means that the market cap is not cheap but there is real cash flow (backed up by a dividend) and it sounds like it it could be one of those few companies with genuine promise as an SaaS provider.

K3 Business Technology (LON:KBT)

Share price: 254.5p (-0.2%)

No. shares: 36m

Market cap: £92m

This company had a big profit warning in January, so investors were already braced for a tough set of results today.

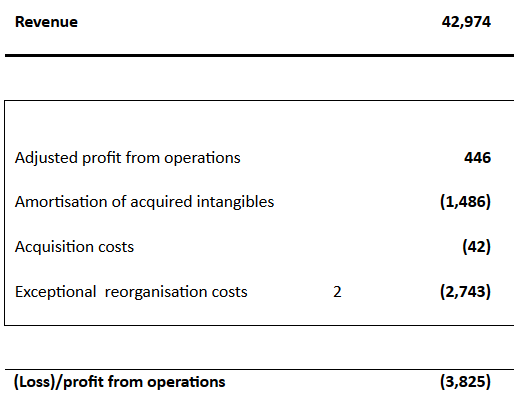

Revenues are up slightly to £43 million, but profitability takes a big hit due to "overhead investment" and the "sales slippage" in the key December period.

There is reference made "the pipeline of order prospects" which is standing at £82 million (compared to £56 million a year ago). I wonder how many of these sales are guaranteed, or are they prospective customers?

I've been taking a look at the KBT product set homepage. I consider myself reasonably up-to-date with technology, but have very little idea about what most of these descriptions mean!

So this stock will have

to go directly to my "too difficult" folder for now. Verticalising ERP solutions, providing out-of-the-box functionality, and unified omni-channel platforms - it all sounds great, but way above my pay grade.

Adjusted profits

For what it's worth, KBT claims to have earned an "adjusted profit from operations", prior to deducting the amortisation of acquired intangibles, and prior to exceptional reorganisation costs.

My opinion

Too difficult for me in terms of product at this stage and the numbers are tricky. Maybe someone smarter than me can figure out if there is an opportunity here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.