Good morning! For anyone who missed it, my latest podcast was published last night, being an interview with a corporate financier and accomplished private investor, Edward Roskill. Some very interesting insights & stock ideas from Edward. The file can be downloaded into iTunes using the "iTunes" button on AudioBoom, and it's very much a leisurely chat format, so best left for when time is not rushed.

Now let's have a look at today's results & trading statements, and I see that another profit warning has been issued today from CCTV company Synectics - there seems to be at least one profit warning every day at the moment, which does make you wonder about the outlook for earnings generally.

Synectics (LON:SNX)

Share price: 220p (down 29% on the day)

No. shares: 17.8m

Market Cap: £38.3m

I warned readers in my report of 29 Jul 2014 that the interim results from this CCTV security company didn't look right - in particular reported debtors were far too high (which can indicate problems to come - e.g. sales being booked aggressively to hide poor performance, and subsequently having to be reversed out when the cash can't be collected). Also I felt that creditors looked stretched, and the company had lurched from net cash into net debt, raising possible solvency issues.

If the figures don't look right, then don't invest - is my mantra these days. It's enabled me to side-step a lot of problem companies. Excessive debtors is probably the biggest red flag there is, and it's nearly always a precursor of serious trouble, in my experience. Sure enough, that has turned out to be the case here, it just took three months for the bad news to come out.

Profit warning - today sees the company's third profit warning this year, key points are below;

Synectics has been experiencing continued delays both in the award of large expected contracts and from the extension by customers of delivery periods for contracts already won. These issues are primarily affecting the Oil & Gas market sector.

Interesting to note that the problems are mainly in one sector. So time to review my portfolio again, to check whether any companies have exposure to the oil & gas sector, as capex is clearly being sharply reduced there. Thankfully it's a sector I generally avoid altogether, as it's too unpredictable.

The company also mentions a slowdown in UK public sector work, again for obvious reasons;

In addition, trading in the Group's UK security integration activities in the fourth quarter of FY 2014 is now likely to be below the Board's previous expectations. This shortfall is also mainly due to the lengthening of procurement cycles for larger projects, in this case mostly within the UK public sector.

The overall impact of this is helpfully made clear;

As a result of these negative impacts, Synectics now anticipates that underlying profit for the second half of the financial year ending 30 November 2014 will be significantly below market expectations of £5.0 million, though still positive. The Company therefore expects to incur an underlying loss for the full financial year, though smaller than that already reported for the first half. The Board will not be recommending payment of a final dividend for the year.

(Isn't it strange how people have recently started making words like "impact" into the plural? Five years ago everyone would have laughed, and assumed it was a typo, but it's suddenly become a fashion to talk about impacts, and freedoms, etc.)

Valuation - all bets are off now really, with the company being loss-making for the full year. Therefore we cannot use a PER basis to value the company.

Solvency - banks don't like having exposure to loss-making companies, so caution is needed here. The company today comments;

Although the customer-imposed delays on existing contracts have resulted in continuing high working capital requirements, the Group continues to trade within its banking facilities.

The good thing is that Listed companies don't often go bust, but they often have to raise fresh equity from shareholders if the bank gets cold feet. That can be on highly dilutive terms, if the company has nothing but bad news to report.

Restructuring - the company is taking action to cut costs, which sadly usually means people losing their jobs, and of course there are costs associated with that;

Nevertheless, the results now expected for 2014 are unacceptable and action is therefore being taken to re-align the Group's cost base with current revenue levels. This action will result in restructuring costs of an estimated £750,000 to be incurred or provided within the current financial year.

They don't say what annual cost saving will be achieved from making these cuts though, which is information that should have been provided in this update.

The CEO is retiring, and being replaced.

Outlook - this sounds mixed, and doesn't fill me with confidence at all;

From these business sector budgets, the Board's current expectations for consolidated underlying results in the year ending 30 November 2015 are for a small loss in the first half, but a return to solid profits in the second half and for the year as a whole.

That sounds a bit more encouraging - if the company is able to deliver a profit recovery in H2 2015, then the shares might be worth revisiting at that time perhaps?

Dividends - the final dividend is being passed, so one should now assume that divis are off the table for the time being.

My opinion - the company is now loss-making, has net debt (reported as £5.1m at 31 May 2014), and an uncertain outlook. Moreover, the change in CEO is, in my opinion, like to lead to the company kitchen-sinking more bad news. In particular, I would expect to see more problems emerge from that big debtor book - so maybe a £5-10m write-off of debtors, combined with a rescue fundraising, would be my guess?

Hence for me, the shares remain on my bargepole list as being too high risk, and until the outlook is clearer, and the finances improved, I consider this share uninvestable. It's not clear to me what, if any, competitive advantage the company has. It seems a bit of a me-too type of company, with unremarkable products, so I don't see read-across to other digital CCTV companies which don't have large exposure to the oil & gas sector.

EDIT: It's worth noting that the old adage about profit warnings coming in threes proved to be correct again with Synectics. As you can see from the chart above, when things started to go wrong, the best decision would have been to bail out immediately.

Flybe (LON:FLYB)

Share price: 116p

No. shares: 223.1m

Market Cap: £258.8m

The pace of change at Flybe has been remarkable in my view. The relatively new management, former Easyjet people, have pretty much rebuilt Flybe from the ground up, with a greatly strengthened Balance Sheet after a big fundraising at 110p.

New routes launched - It will be particularly interesting to see how their strategy of selling slots at Gatwick, and instead starting domestic flights from London City Airport, will work out. I think it could work very well - after all, if you work in central London, and need to go for meetings in Edinburgh, Glasgow, Dublin, Belfast, etc, then what could be easier than a 22 minute DLR journey from Bank station, straight through to London City Airport? Also being a small airport, you whizz through passport/security far more quickly than getting caught up with the tourists at Gatwick or Heathrow. It's even easier still if you work in Canary Wharf, which is a city within a city these days, as the airport is on your doorstep.

I wonder if it might be worthwhile for Flybe to rent out meeting rooms at their destination airports, so that people can actually hold their meetings at the airport, and then get the next plane back, same day?

Even Alex Salmond is excited about it!

Alex Salmond, First Minister of Scotland, said: "This is an exciting morning for Scottish aviation with new routes linking Aberdeen, Edinburgh and Inverness with the heart of London taking off for the first time.

Club Workspace - Flybe has already thought about the need to provide working & meeting space for business customers, and announce a partnership on this front today.

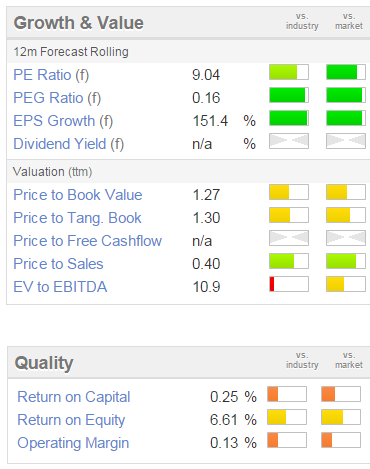

Valuation - if Flybe hits broker forecasts, then the valuation looks reasonable. Also the quality scores should improve once profitability has been restored, which should happen now, as enough costs have already been stripped out to transform the future P&L;

My opinion - I like what Flybe is doing to reinvent itself, and it seems to be working.

Lower oil prices are a significant boost to airlines profitability, and the Ebola issue does not seem to be impacting air travel, especially domestic flights like Flybe.

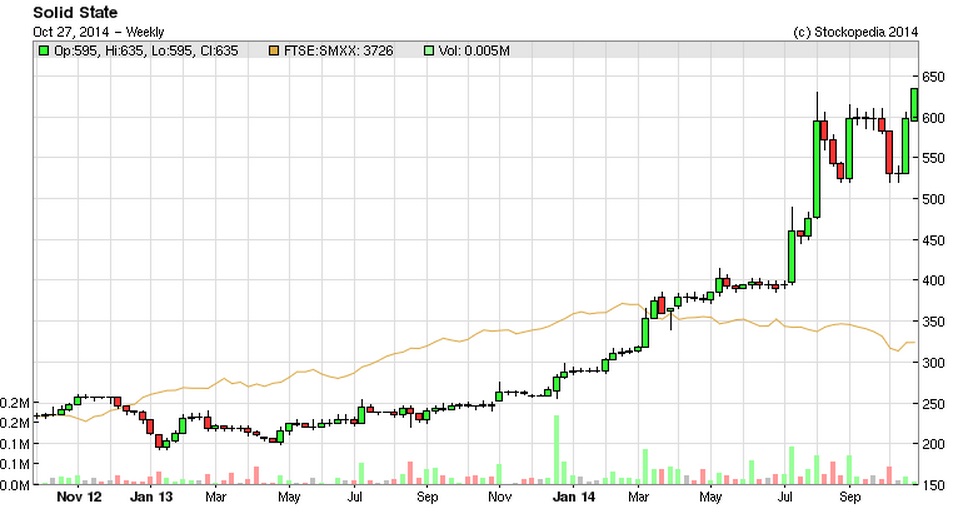

Interestingly, as you can see from the two year chart below, the 110p level where the company did a large Placing in early 2014 seems to have put in a floor for the share price at that level. Hence with the shares at 116, risk:reward looks rather encouraging, if there is only 6p potential downside, but unlimited upside, that looks an interesting dynamic to me, but as always, please DYOR.

Solid State (LON:SOLI)

Share price: 635p

No. shares: 8.3m

Market Cap: £52.7m

This company describes itself as a, "supplier of specialist industrial/ruggedised computers, electronic components, secure communications systems and battery power solutions".

Solid State is living up to its name today, with a decent trading update.

Trading update - short & sweet:

Solid State has made a good start to the year. Results for the six months will, as expected, be significantly ahead of the equivalent period in 2013 and are consistent with market expectations for the year as a whole.

So it's an in line statement.

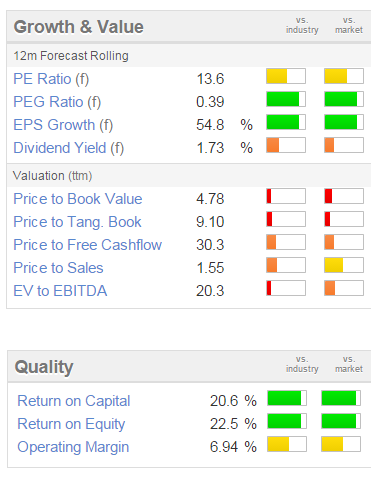

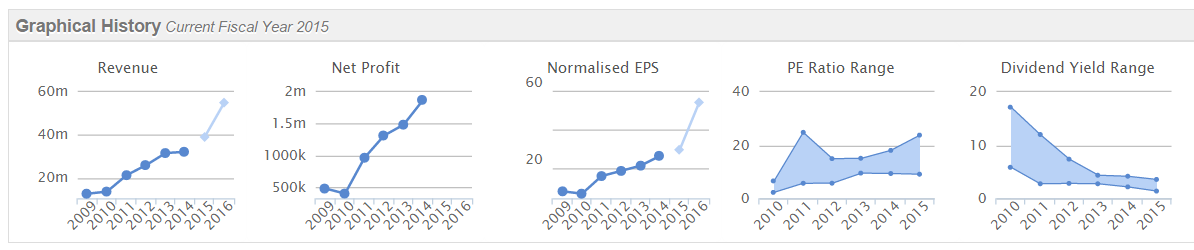

Valuation - the shares have risen a lot in the last year, and don't look to be in the bargain basement any more;

The valuation rests on a big increase in forecast turnover & profits next year, so I think the company must have made a big acquisition? Ah no, I've just looked at the RNS list, and it seems a major contract win for £34m with the MoJ was secured in Aug 2014, so that explains the big increase in forecasts. This contract is for the supply of electronic tags for criminals.

My opinion - looking at the historic graphs & forecasts above, this company seems to be on a roll. If it achieves nearly 60p in forecast EPS for next year, then the share price of 635p doesn't look a demanding valuation at all.

My main reservation is what sustainability there is for that level of profit? It's all very well winning a big contract, but if it's not repeat revenue then profits could experience a one-off boost, and then drop back again.

So more research is needed to clarify how sustainable these higher profits are, but so far, so good - the company is performing well, and hence so are their shares.

I won't comment on a number of announcements from various companies about contract wins, because if they don't affect profit expectations for the year, then they are not material, and hence should not have any impact on the share price!

Someone posted a wonderful Ben Graham quote on Twitter today, which I've dug out online, and this is very much pertinent, in that people think they ought to be buying shares because they've put out contract news. If the contract makes no difference to the outlook for profits, then it's not news at all! Companies don't mention all the little contracts that expire, do they? So most companies need a regular flow of new contract wins just to stand still.

Anyway, here is that Ben Graham quote;

“The speculative public is incorrigible. In financial

terms it cannot count beyond 3. It will buy anything,

at any price, if there seems to be some ‘action’ in

progress.”

On that bombshell, I shall sign off for the day!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in FLYB, and no short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.