Good morning! I updated yesterday's report in the evening with some more companies (Sprue Aegis, Staffline, and Red24). So to review that enlarged report, please click here.

A quick thank you to the generous folk who have donated to my "Live below the line" charity challenge this week. To save cluttering up these reports, I'm doing video blog updates (you see Zoella, two can play at that game!!). Day 1 update is here on Youtube, if you are bored, and have 5 minutes spare!

Anyone who wishes to donate to the three charities, is welcome to do so here. Corporate donations are also welcome, so it's fine to mention your company name & website. Any amount is welcomed, don't feel obliged to match other very generous donations. We've already raised £500+Gift Aid, which is terrific, so thank you to everyone who has contributed so far!

Anyway, on to today's gruel-fuelled review of the RNS.

Ab Dynamics (LON:ABDP)

Share price: 202.5p (up 4.4% today)

No. shares: 16.8m

Market Cap: £34.0m

Interim results - for the six months to 28 Feb 2015 are out today, from this designer/manufacturer of testing equipment for car manufacturers. One interesting snippet from the blurb is that the company supplies all of the top twenty automotive manufacturers, suggesting that it has a good niche market position.

Turnover for H1 rose 12.9% to £7,559k, so it's obviously still a small business. Operating profit was healthy at £1,526k, giving a decent operating margin of 20.2%. Operating profit was up an impressive 32.9% vs H1 last year.

Note that it was an H2-weighted year last year, with 43.5% of operating profit made in H1.

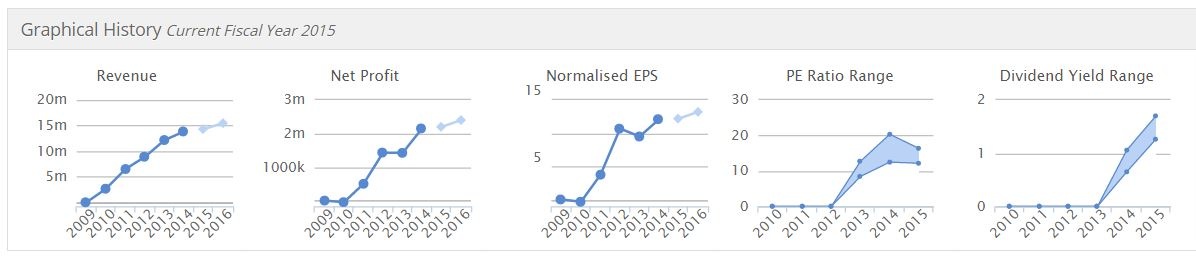

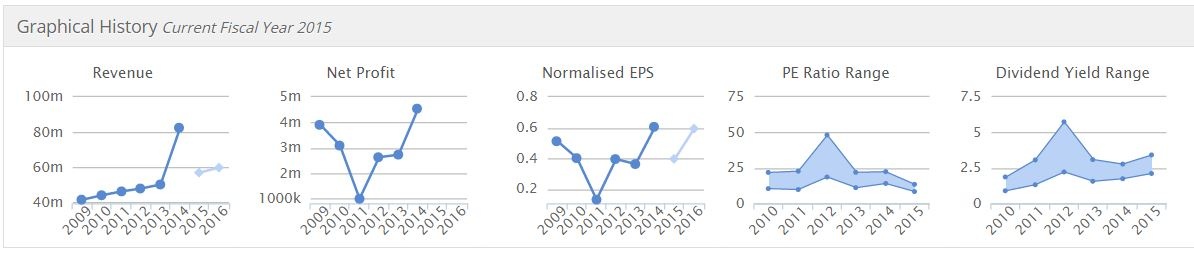

The Stockopedia historic graphs show a very nice progression, from what looks almost a start-up in 2009. I would be interested in finding out more about the company's history, and how it has grown (i.e. organically, or from acquisitions?). It has only been listed on AIM since May 2013, so there is limited history of it as a listed company. A successful listing so far too, as it was launched at 86p per share, and is now more than double that.

Balance sheet - this is very strong. There are modest fixed assets of only £1.4m, and note there are no intangible assets - which is excellent. I loathe balance sheets which are crammed with goodwill & capitalised intangible costs - since they are bogus assets in my eyes.

Looking at working capital next, the company has £13.8m in current assets (including £7.0m in cash), and only £3.7m in current liabilities. So the current ratio is fantastic, at 3.73. Put another way, I look for a current ratio of at least 1.5 for this type of business, so if we adjust the balance sheet to a current ratio of 1.5, then it would throw off £8.25m in surplus working capital. That's 24% of the market cap, in excess working capital - which could, if needed, be stripped out of the business in cash (if a modest bank facility was put in place).

Although I seem to recall that some of the surplus cash is ear-marked for building a new factory, and today's update says that will be completed in late 2016.

The bottom line is that a strong balance sheet allows investors to sleep at night. If something does go wrong, you don't have to panic over whether the bank will continue supporting the company, or if a discounted placing might be done. Companies with strong balance sheets can ride out downturns, with no shareholder dilution. They often continue paying divis in bad years too. Which is why I like strong balance sheets.

As a final point, I think you tend to find a more conservative type of management at companies with strong balance sheets. They won't blow the company up in the next recession, basically. Whereas companies that are gung-ho over growth, and allow their balance sheet to fill up with debt and goodwill, are often the first casualties in a downturn. Gear today, gone tomorrow, as the saying goes.

Outlook - the Directorspeak all sounds upbeat, and mention is made of a conditional offer for a UK Govt grant of £2.3m, which will be put towards the new factory, and new product development.

Valuation - so everything sounds rosy, but are the shares good value?

That depends. Broker consensus is for 12.2p EPS this year (up only marginally from 12.1p EPS in 2013). Since the interim results were well up on last year, then if the company repeats a strong H2, it should out-perform forecasts.

So I'm wondering if the company might achieve nearer 15p EPS this year? If I'm right, then the PER would be 13.5, which looks good value, considering the balance sheet strength thrown in for free.

If broker consensus is right, at 12.2p EPS, then the PER is less attractive at 16.6.

Dividends - a rather tight interim divi of 1.1p has been declared. A 1.5p final divi was paid last time, so the total forecast divis for this year come to 2.8p, giving a yield of only 1.4%. With ample cash in the bank, and good trading, I feel they could be a bit more adventurous and reward shareholders a bit more generously. Although bigger divis might not go down well with Govt bodies awarding grants, possibly?

My opinion - the company has delivered good growth to date, so I think the key issue would be to research the company's products, its markets, and try to determine what the future is likely to hold. The danger is that they might be delivering large, lumpy contracts, and at some point find a gap in the order book, and have to warn on profit. So visibility of sales/profits is the key issue here for potential investors, in my opinion.

However, based on the figures so far, it looks a decent little company, and worthy of further research.

Xeros Technology (LON:XSG)

Share price: 284p (down 5% today)

No. shares: 65.5m

Market Cap: £186.0m

Interim results - for the six months to 31 Jan 2015. This has been a popular jam tomorrow stock of late, with the shares soaring on positive newsflow, and the shares being tipped in various places. So it has accumulated a good speculative following.

The product is a new type of washing machine, which uses very little water, instead cleaning clothes with polymer beads, in an apparently patented process. There seems considerable interest in the technology in America, where water shortages are becoming a big issue in some areas.

As is usual for this type of speculation, the shares usually fall sharply on publication of results, as everyone gets a reality check. That's very much the case here today - turnover was only £166k for the six months, and the loss before tax was £4.8m.

It has burned through £5.3m in six months, but has a healthy £22.7m net cash left in the bank, so assuming cash burn remains static, then it will be coming back for more money from shareholders in about 24 months, so probably a Placing in late 2016, in advance of the cash running out? This won't necessarily be a problem, if the newsflow is kept bubbling away, and markets remain bullish.

My opinion - it's not a value share by any stretch of the imagination, so I'm only mentioning it here so that I have a record of things. Does a market cap of £186m really make sense for something so early stage, that is barely recording any turnover at all?

In my experience, companies like this take far longer than expected to commercialise new technologies, and multiple fund raises are required. This may succeed who knows, but the overwhelming majority of "this is going to be huge!!!" type of investments end up being a total disaster for people who get caught up in the excitement.

Perhaps this may be the exception that proves the rule, who knows? For me though, £186m market cap seems crazy for something so early stage, and it's therefore well into the realms of punting, rather than investing.

Although on the other hand, I see that Woodford Investment Mgt hold 5.9%, which given their current great popularity & strong performance, will undoubtedly reassure other investors. The signing of 61 channel partners at a recent trade show in the US, suggests that the product is generating genuine excitement too. So it's one I shall watch with interest, but for me, I would need to see much clearer evidence of commercial progress, and viability before even considering an investment.

Synety (LON:SNTY)

Share price: 94p

No. shares: 12.1m

Market Cap: £11.4m

(at the time of writing, I have a long position in this share)

Update - again, it's not a value share, but seeing as I've mentioned it before in depth, then will continue updating on it. So if you're not interested, please skip to the next section.

The story so far - (this is my synopsis, not from the company!) - Synety was delivering strong growth in KPIs late last year, the share price bottomed out around 170p, as the speculative froth from 2013 evaporated. Then the shares perked up to about 200p in early Feb 2015, on good KPIs.

Then we hit a brick wall - the company realised it needed a top-up fundraising. Not a lot, only about £2m-ish. The company (and indeed I) thought that would be a formality, and it should have been done by the broker with a few phone calls. Unfortunately not. They discovered that the market's appetite for repeat fundraisings from loss-making, tiny growth companies was little to none. Therefore what started out as a modestly discounted small fundraising unraveled into a bit of a shambles - it ended up being done at only 90p. Obviously that hammered the share price, and there was no real support after the announcement, so there wasn't great take-up from existing shareholders in the Open Offer - although top marks to the company for giving existing shareholders the option.

A lot of shareholders told the company that the heavily cash-burning, high growth strategy had to be changed - to better balance up growth with reduced overheads, thus achieving breakeven earlier.

Strategy update - thankfully the company has taken on board this issue, and responded positively. Note that Directors have been repeated big buyers of stock over the last couple of years (often at much higher prices than today), and have continued investing more of their own money into the company, which is clearly a positive.

The Board have also taken pay cuts, which is announced today, although they don't say what % the pay cuts are. I think bonuses are also (rightly) very much off the agenda for the time being too!

I won't repeat all the other detail here, but basically the company has now reduced overheads, and is concentrating on getting to breakeven more quickly, and without needing another fundraise. That's exactly what they should be doing, so it gets a thumbs up from me.

Quarterly KPIs - are published today for the last time. The company has (probably correctly) identified that giving out this information quarterly doesn't add value, it just gives shareholders more detail to fret over. So they are moving to the standard six-monthly reporting cycle that other companies use.

Today's KPIs show that there's strong growth going on. The most important measure, annualised recurring revenue (ARR) is up 19% in just the last three months. Although that's not quite as fast as the broker hoped, I think £3.75m was the target figure, as opposed to £3.61m achieved. Going in the right direction, and strongly, but not quite as strongly as hoped.

My opinion - some of us like the product, and the company, and see its potential. Others don't. That's fine, it's what makes a market.

Personally, I averaged down heavily in the 90p fundraising, and think that by getting my average cost price right down, to about 150p, I should be back in profit by say this time next year, perhaps? That wasn't done blindly, it was done on my personally being a user of the product (Cloud Call), and on crunching the numbers, which suggest to me that it should indeed reach breakeven in mid to late 2016, then move into profit.

It has to reach breakeven in 2016, and management know that. They've got the cash in the bank to do it now, and are very much aware that this was probably the last fundraising that the market will support, which I think is very much concentrating minds at the company.

Anyway, we'll see what happens. This share should of course come with a big flashing wealth warning, that it's highly speculative & loss-making, hence not suitable at all for most people! So far of course, it's been very disappointing, as you can see from the chart below. However, sentiment can change quite rapidly, so who knows what the future holds?

As regards the StockRanks, Stockopedia is unequivocal about this - giving Synety shares a big fat ZERO! As we know, shares with low stock ranks are indeed likely to underperform. However, the odd one will be a major multibagger. That's the deal with highly speculative stocks - you know that most will lose you money, but if you do find that needle in the haystack, then wealth and joy can flow.

I'm not suggesting that is a good strategy at all, by the way - for most people it's just one disaster after another, so avoiding story stocks and sticking the high StockRank shares is, I am sure, a far better investing strategy, and that's what I do most of the time, but it's nice to have a bit of fun sometimes too, with one or two more speculative shares in an otherwise thoroughly sensible portfolio.

The other thing I would point out with Synety, is that the company is actually the best it's ever been, on fundamentals, at the moment. Yet the shares are the cheapest they've ever been, with the company in its current format. So a bit of a mis-match there, perhaps?

Indigovision (LON:IND)

Share price: 260p (down 23% today)

No. shares: 7.6m

Market Cap: £19.8m

(at the time of writing, I hold a long position in this share)

Profit warning - Not another one? Unfortunately yes, this digital CCTV company has once again proved incapable of producing consistent performance. I've lost track of the number of profit warnings we've had from it over the years, interspersed with periods of good performance. I suppose that is the trouble with doing large, lumpy contracts, as they allude to today;

We already knew, from the last update, that Asia & Latin America were struggling, so no change there. However, N.America & M.East are now mentioned as under-performing too. That basically just leaves UK & Europe as the only region that is performing well.

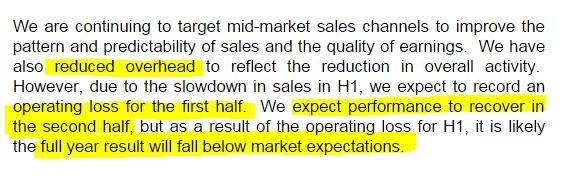

So, what's the damage? This is what the company says;

Unfortunately, it doesn't specify what size the H1 loss will be. It's being mitigated with overhead reductions, so that's encouraging. In the past the company has been swift to react to soft periods of trading, and trimmed back, so the company has a history of managing downturns well, and has not made heavy losses at any point in recent years.

In fact, as you can see from the Stockopedia graphics below, it remained profitable throughout the period since the credit crunch;

Balance sheet - thankfully the company has a very strong balance sheet, so there are no issues with solvency or dilution. At 31 Dec 2014 it had net tangible assets of $24.8m, or about £16.2m. The current ratio is extremely strong, at 2.39.

My opinion - despite the company doing loads of excellent things in the last three years, to improve products, reliability, marketing, etc, the reality is that overall it hasn't worked - with performance going backwards, and there always being some excuse for things having gone wrong.

The reason is mainly due to the company being heavily reliant on large, lumpy orders. So we keep getting patches where they are trading well, alternating with periods when they disappoint.

With an already weak share price hit hard today, the only question now is whether to sell or not? Based on current information, I wouldn't blame anyone at all for deciding that they had lost confidence in the share, and sell up. All I would say is that, in the past, selling after the profit warnings has been a very bad strategy - because the company always recovers from these bad patches.

Since it does not seem capable of delivering consistent performance, perhaps the time has come for IND to merge with a larger group (hopefully for a decent premium), which is better placed to absorb the gyrations in trading?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.