Good morning!

Northbridge Industrial Services (LON:NBI)

This is an equipment hire company. An AGM trading statement has been issued this morning, which says;

As indicated at the time of our Preliminary results in April, we have enjoyed a good start to 2014, with a strong first quarter and continuing contributions from both sales and rental activities. Our cash flow remains strong which will enable net gearing to reduce further by the end of 2014. We are pleased with the Group's progress so far this year and continue to be confident in the Group's prospects. We expect results for 2014 as a whole to be in line with management's expectations.

That all seems nice and clear, with none of the weasel words that are so often present in trading statements.

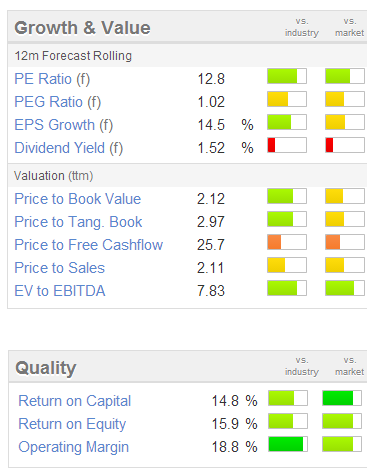

Looking at valuation, it seems reasonable to me - there are plenty of green bars in the usual Stockopedia graphics on the left.

Note that the "Quality" section at the bottom is either green or dark green, so strong ratings there. So you would expect this company to command a premium valuation.

However, the forward PER of 12.8 is actually quite modest in today's market (where PERs are generally too high, in my opinion).

The only item that disappoints me is the dividend yield, although that can be forgiven since this company is clearly concentrating on growth, having made acquisitions, and growing turnover and profits strongly over the last five years.

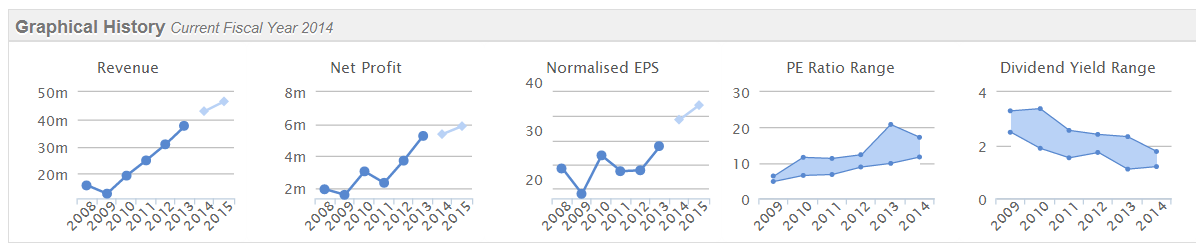

Although do note that the company seems rather too keen on issuing new shares - the number of shares in issue has grown by an average of 15.7% every year since 2008, which dilutes EPS as the company grows. You can see that from the Stockopedia graphs below, which show that profit tripled (from £2m to £6m) over the years shown, but EPS only went up about 50% (from 20p to 30p).

You often find that management are too trigger happy to issue new shares at companies where they personally only have very small shareholdings - so they are more interested in growing the size of the company, and their remuneration, than worrying about dilution for existing shareholders.

I've had a quick look at the last set of accounts, and it all looks fine - a good solid Balance Sheet, with no funnies in there, e.g. there doesn't seem to be a pension scheme, which is good news for investors.

My only worries with equipment hire companies are that the strong margins they are seeing at the moment may not prove sustainable in the long term. This is because the Banks have been restricting lending to small companies, therefore limiting competition and stifling new entrants into this capital intensive sector. So as bank lending loosens up as the economy improves, then they might find new entrants chipping away at their lucrative profit margins.

Also the cost of financing the equipment is likely to rise as bank base rates rise, although they may have interest rates fixes in place, I've not checked that level of detail.

Overall then I could see 10-20% upside on this share with a 12-month view, and maybe more longer term. That's not enough to excite me - I normally look for 50-100% upside. However I like the look of this company's figures, and it might make a good one to consider for a lower risk, long-term growth portfolio. As usual, this is not a recommendation, it's just my personal opinion based on a quick review of the numbers, so readers must do their own, more detailed research.

Note that the ridiculous 15p Bid/Offer spread on this share (455p/470p) makes it pointless progressing the idea further. Something really does need to be done about this vicious circle of lack of liquidity & wide spreads for some small caps. A good place to start would be if the the quoted market prices were the actual prices that the Market Makers are prepared to deal at (which are usually inside the quoted prices). Trouble is, there is a two tier pricing structure, whereby the MMs quote wide prices, but if you get your broker to look on the RSP (a system for smaller, automated trades) then you can often get a useful price improvement.

However, because the quoted spread is so wide, most people don't bother finding out what the real prices are on the RSP! It's like a market trader hiding all his produce under a blanket, and holding up a sign saying "bugger off!". Ridiculous! The whole system needs reform, and should just be opened up with direct market access (DMA) for everyone, via online broker platforms, with an order book for every stock, no matter how small.

Johnston Press (LON:JPR)

I can't give a view about this company under Stockopedia's editorial policy, because I currently have a short position on the shares. However, this is just a brief explanation of why the share price has dropped 71% this morning.

It's in connection with the capital refinancing plan announced on 9 May 2014. The two material elements of that plan were the issue of new bonds for £220m, and a Rights Issue of new shares priced at 3p, on the basis of 6.52 new shares for every 1 existing share held.

Bear in mind that the share price was about 18p when this plan was announced, so by pricing the new shares at just 3p, the company is effectively forcing shareholders to stump up the extra money, otherwise you'll get massively diluted. It's a distressed fundraising basically, as JPR was clearly insolvent on a Balance Sheet basis, as I've been pointing out for a long time - there's no way that the company could ever have generated enough cash to pay off the existing debt, because nearly all their cashflow was being deployed in just servicing the interest cost. That's why they have needed to do an equity fundraising, and refinance the debt too.

Rights Issues are more expensive & complicated than Open Offers, and the unpaid Rights are actually tradeable, so this morning the nil-paid Rights became tradeable. Hence existing shareholders saw the value of each share drop from about 16.75p to 4.9p this morning. However, they also have now gained a profit of 1.9p (being the 4.9p current share price, less the 3p cost of the Rights) on each of the 6.52 Rights.

That equals 12.4p profit on the Rights, less 11.9p loss (last night's close of 16.75p, less the current share price of 4.9p) on the existing share. So as you can see, it roughly balances out to being the same as last night's close, but spread over more shares at a lower price.

People can sell their Rights in the market from today for a 1.9p profit over the 3p subscription price, or they can take up their Rights at 3p, and keep the shares.

For shorters the position is just reversed. So I've seen a big profit appear on my existing short position on the shares this morning. However, I've had a big loss also appear on my short position on the nil paid rights. I will let the Rights be taken up against me, meaning that I then have an enlarged short position on the newly enlarged share capital.

Any queries, just ask in the comments section below.

Rights Issues are rare with smaller caps, as they are expensive to do. That's why simpler Open Offers are used. The key difference being that with an Open Offer you cannot trade your entitlements, it's a take it or leave it offer to buy new shares instead.

Sabien Technology (LON:SNT)

There is a profit warning today from this tiny company which makes equipment to make commercial heating systems more energy efficient. It's the type where you can read it either way - there have been some contract delays, but they say no cancellations (although I've found that delays can often become cancellations - i.e. the customer is probably not going to proceed, but just hasn't told the vendor yet!).

Therefore a loss of £0.3m is now expected for the year ended 30 Jun 2014, which looks as if H2 was around breakeven. So not a disaster, and the company has cash on the Balance Sheet, so it's not under any solvency pressure.

So if you like the company, and believe it will succeed, then this could be a buying opportunity. I was tempted to pick up a few, but missed the blip down to the sort of price (around 16p) where risk:reward would stack up for me personally.

On outlook the company says;

I am confident that Sabien's prospects for the medium and long-term remain positive and there is still a substantial market opportunity to create a profitable and valuable business moving forward.

It's not one I'm going to chase now the price is rising again, but it's on the watch list. Very small, so must be considered high risk.

Prime People (LON:PRP)

This is an interesting one - a small recruitment company, market cap about £12.4m at 100p per share (up 8% on the day at the time of writing).

Results for the year ended 31 Mar 2014 look good - fully diluted EPS is up 46% to 6.83p, and the generous dividend of 4.09p from the prior year is maintained. At first glance a PER of 14.6 looks pretty aggressive for a micro cap in a competitive sector.

However, further down the statement today the company outlines a proposed return of 15p to shareholders, with its surplus cash. So depending on how it's done, that would bring down the net cost of the shares to 85p, at which level the PER would be 12.4, which is starting to look more reasonable.

What I like in addition to this, is the mindset of management that this displays - i.e. returning surplus cash to shareholders is music to my ears. This is what companies should do, but rarely in fact do. Usually Directors will find some vanity takeover, or "investment" in some other activity to burn away surplus cash, but not in this case. It suggests a company that is being run in the interests of shareholders - something that is worryingly rare.

The answer is to be found from the shareholder list - which is dominated by four individuals, who hold 59% between them - these are probably the founders I would imagine. On checking, yes the two largest shareholders, having 45% in total, are the CEO and Chairman.

We often hear from investors who say they avoid companies where management have dominant shareholdings, and that is often wise. However in this case, dominant shareholdings of management are ensuring that surplus cash is paid out. I would need to check their remuneration, as the danger is that they're overpaying themselves, but at first sight this looks a nice situation where outside shareholders are being looked after well.

The outlook statement is moderately positive;

We are cautiously optimistic about the current year. Global economic conditions are strengthening and there are clear signs of growth in a number of recruitment sectors. The Group continues to enjoy strong client relationships which will allow it to capitalise on opportunities as they arise.

So it's another one that's going on the watch list.

Belgravium Technologies (LON:BVM)

Finally, there are two announcements today from this minnow electronics company, which specialises in making the handheld equipment used by airlines, railways, etc, to take payments from customers.

The first announcement is for a E0.5m contract win, with a European airline, which will mostly be delivered in H2 this year, so that should help firm up this year's estimates.

There is also an AGM statement, which is slightly confusingly worded;

Trading in the year to date is significantly ahead of the equivalent period last year albeit that it has commenced more slowly than expected. As in previous years the results for the year as a whole are expected to be heavily second half weighted.

So it sounds as if they are up versus last year, but expected to be up more, if I'm reading that correctly? The H2 weighting looks OK, given that mention is also made of a £1.1m contract win in April from First Great Western rail. Further reassurance is given with this comment;

The level of order enquiries is encouraging and we are confident that a good proportion of these can be converted to sales in the second half.

There has been a big increase in the cash balance to £1.9m, but that must be mainly connected with working capital movements, which I think are likely to reverse in H2. So I'm not getting overly excited about that, although it's certainly positive given that the market cap here is only about £5.5m.

I hold a tiny scrap of stock in my long term portfolio. The divis could be good here, with a doubling to 0.2p (4% yield) forecast for this year. Although that only covers the bid/offer spread, as usual the bain of life i the micro cap space.

I'll sign off now, as the RSI in my mouse hand is flaring up again, so time for a rest over lunch.

Back tomorrow morning, early start as I have to dash up to London late morning for an investor lunch.

Best Wishes, Paul.

(of the companies mentioned today, Paul has a long position in BVM, and a short position in JPR)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.