Good morning! Final results for the year to 31 Jul 2013 are issued this morning by Getech (LON:GTC), and impressive they are. Unfortunately I sold my shares in this a few weeks ago, as it was becoming increasingly difficult to value. That is no longer the case, with a cracking set of numbers released this morning.

Getech is a small company (£23.7m market cap at 80p per share) that provides magnetic & gravity data, globally, to oil exploration companies. So my understanding is that they have bought up & enhanced data collected historically. This is then licensed to mainly large oil companies.

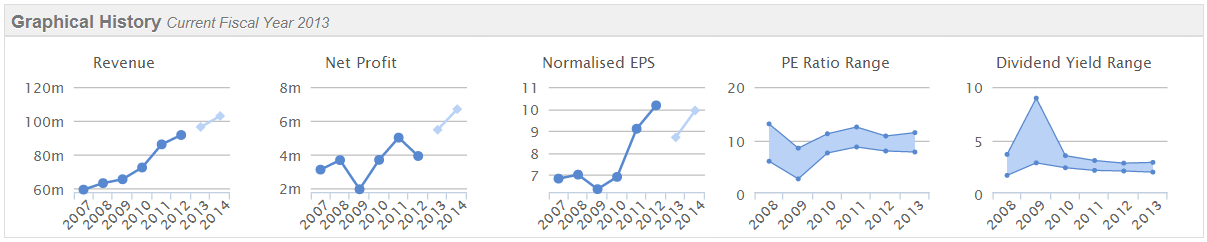

Revenue is up 24% to £8.0m, and profit before tax up a remarkable 80% to £2.2m. This company has good operational gearing - i.e. it generates high gross profit margins of 68.5%, therefore this is a good demonstration of how profits are highly geared to increases in turnover where high margins exist. Profit up 80% on turnover up 24% speaks for itself!

Finding a high growth company, with strong operational gearing, at a reasonable price, is the holy grail of investing. If the company has a large addressable market, and strong competitive advantages, then you've probably got a major multi-bagger on your hands. That was how I got started in investing, when I originally spotted IndigoVision in 2004, with a big market opportunity, world-leading products, selling at high margins. I loaded up about 80% of my portfolio into it, and it 30-bagged, making me a ridiculous amount of money.

Finding a high growth company, with strong operational gearing, at a reasonable price, is the holy grail of investing. If the company has a large addressable market, and strong competitive advantages, then you've probably got a major multi-bagger on your hands. That was how I got started in investing, when I originally spotted IndigoVision in 2004, with a big market opportunity, world-leading products, selling at high margins. I loaded up about 80% of my portfolio into it, and it 30-bagged, making me a ridiculous amount of money.

If I'd sold in 2007, then it would have been my best investment ever, but unfortunately I didn't. The crucial lesson learned being not to fall in love with a stock - it's essential to top-slice on the way up, and sell completely once something is fully valued, no matter how fond you have become of it. Sitting in an over-priced stock that has done very well for you historically, gives a very false sense of security. It's frightening how quickly those big profits can disappear once something goes wrong.

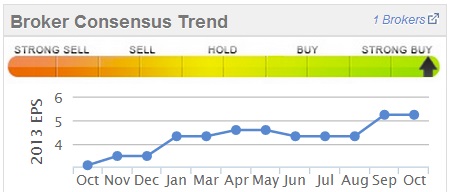

I've rambled off the point, so back to Getech. Broker consensus is shown as 5.23p for EPS, and they've come in ahead of that at 5.57p, or 5.3p on a diluted basis (indicating the presence of some share options, although not an excessive amount). So at 80p the shares are on a PER of 14.4 times normal EPS, or 15.1 times diluted EPS. That's not expensive if strong growth can be maintained - which is the key question. Whilst the outlook sounds positive, it's light on detail, so I would want to do more research and understand the future prospects here before buying back in.

It looks a very clean set of accounts - I can't see any "funnies" in there. So there is only £616k in intangible assets on the Balance Sheet, and it doesn't look as if any costs were capitalised throughout the year, other than £190k in property, plat & equipment, which is consistent with the narrative which mentions a revamp of their Leeds offices, to create a more professional environment.

The final dividend has been doubled to 1.6p, giving 2p for the full year, for a rapidly growing yield of 2.5%. Not bad. The Balance Sheet sails through my usual tests, with current assets (including £4.2m in net cash) being a very healthy 194% of current liabilities, and only £126k in non-current liabilities.

Steadily increasing EPS forecasts throughout the last year have once again proved to be a good indicator of outperformance, as even the revised forecasts were beaten - as is often the case, broker forecasts tend to lag behind both in a downturn (when they are too optimistic), and in a recovery (when they are too pessimistic).

I see the pre-opening price for Getech has already risen about 5p to 83p Bid/87p Offer. It's difficult to see a great deal of upside on that, maybe it could crack a quid a share today, who knows? There's not enough upside in that to pull me back in, so I shall watch from the sidelines with interest.

I wondered if the collapse in price of Globo (LON:GBO) yesterday might have been due to Institutional holders being stuck at home for the day, given that many trains were cancelled? You would expect the Institutions to support the share price, given that they've just pumped in £24m in fresh cash in a Placing at 71p per share, so last night's precipitious fall to 53p was pretty dramatic.

The stock is subject to a raid by short sellers, and once again to clarify, I have nothing whatsoever to do with this, and am not shorting this stock, and never have done. I've been bearish on it here for the last 9 months, as you can see from the archive. Also, as mentioned before, I want to clearly distance myself from the comments being made by the short sellers. My reports here have explained my views on the company, so what other people say (or quote me) is out of my control, and up to them.

So if it does get messy, I don't want to be dragged into the drama. The company's clarification statement is due out this Thursday, but I think they made a PR gaffe by pre-announcing a forthcoming statement. Why is it taking 4 days to put together information that should be at their fingertips? It would have been better to just issue the clarification information without delay.

A fascinating situation anyway, where again I'm happy to watch from the sidelines.

Next I've been looking at interim results to 30 Sep 2013 from Adept Telecom (LON:ADT). Unfortunately, I can't come to a firm conclusion on this one, perhaps readers could comment below? At 149p the market cap is around £32m.

The issue here is whether to use conventional earnings, which are 3.2p basic EPS, and 2.85p diluted EPS (remember these are only 6 month figures), so if we crudely double them to approximate to full year figures (since I wouldn't expect there to be any particular seasonal bias with a telecoms business), then we're around the 6p level. So at 149p that puts the shares on a very high PER of almost 25 times.

The company instead tries to steer investors to adjusted EPS, which is much higher, due to ignoring £910k in amortisation of intangible assets. Checking the Balance Sheet, this is NOT goodwill amortisation (which is fine to ignore, as it's non-cash). Also, intangibles dominate the Balance Sheet, being £16m, out of total net assets of £10.2m, so net tangible assets are negative to the tune of £5.8m. That pretty much rules it out for me. Also current assets are only 69% of current liabilities, with another £4.2m of long term borrowings.

It's cash generative, so I'm not saying there is any risk of it going bust, but the Bal Sheet doesn't give enough of a safety margin for my personal tastes.

So adjusted EPS is reported at 7.47p, or 6.66p diluted, for H1. Doubling that for the full year, and you're in the 13-15p ballpark. That's where the valuation starts to stack up, as the PER drops to about 10-12.

So adjusted EPS is reported at 7.47p, or 6.66p diluted, for H1. Doubling that for the full year, and you're in the 13-15p ballpark. That's where the valuation starts to stack up, as the PER drops to about 10-12.

It's therefore a straightforward decision on whether you accept the adjustment to EPS, or not. I don't know the ins & outs of the company well enough to form a view, so will pass on it, mainly because I don't like their Balance Sheet.

On a more positive note, it's worth pointing out that the interim dividend has been doubled to 1.5p. Last year they paid both an interim and final dividend of 0.75p each time, totalling 1.5p. So by doubling the interim dividend to 1.5p, the assumption in that the final divi will also be 1.5p, which should give 3p total dividends, for a yield of 2.0%. Not an amazing yield, but on a rapid growth trajectory.

Profit warning of the day comes from PR group Next Fifteen Communications (LON:NFC). Their shares have dropped 21% to 72p, on a negative trading update, which says that;

...as a result of audit adjustments that relate to issues in its Bite agency, its profits for the 2013 financial year will fall materially short of market expectations. Revenues meanwhile will be in line with expectations.

The FD of 14 years standing has fallen on his sword, which must have been very unpleasant for him, but the buck has to stop somewhere, and on finance & audit matters, the buck stops with the FD.

I would want to find out how serious the issues are first, before considering buying into these shares. The company's track record is of being profitable, although obviously as the light blue dots below are forecasts, then they will be reduced.

Broker forecasts had already been reduced this year, and I last reported on this company on 23 April 2013 and was not impressed. I've just had another look at their Balance Sheet, and have rejected it as a possible investment due to having inadequate net tangible assets, rather more debt than I would like, and a lot of stray liabilities kicking around for deferred consideration. Looks a bit messy to me, so I'll steer clear of this one.

That's me all done for this morning, see you from 8.a.m. tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.